Canadian Real Estate: Posthaste Signals Of A Price Correction

Table of Contents

Rising Interest Rates and Their Impact

The Bank of Canada's aggressive approach to interest rate hikes has profoundly impacted the Canadian real estate market. These increases in interest rates Canada have dramatically raised borrowing costs, making mortgages significantly more expensive and consequently reducing affordability for many prospective homebuyers. This decreased demand is a crucial factor driving the potential for a price correction in the Canadian housing market. The impact extends beyond first-time homebuyers; even those with established finances are feeling the pinch of higher mortgage rates.

- Increased mortgage payments strain household budgets: Higher interest rates translate directly into larger monthly mortgage payments, reducing disposable income and potentially impacting other financial commitments.

- Fewer buyers enter the market, reducing competition: The increased cost of borrowing discourages many potential buyers from entering the market, leading to less competition among bidders and a potential shift in market dynamics.

- Higher borrowing costs impact investor activity: Real estate investors, often reliant on financing, are also affected by higher borrowing costs, potentially reducing their activity and influencing overall market demand.

- Potential for increased foreclosures in the future: As mortgage payments become more burdensome, the risk of foreclosures increases, potentially adding more inventory to the market and further impacting prices. This is a crucial factor to monitor within the context of real estate trends Canada.

Inventory Levels and Market Supply

While housing inventory remains relatively low compared to historical averages in many parts of Canada, a gradual increase in new listings is noticeable in certain cities. This growing market supply, although still modest, is starting to tilt the balance of power from sellers to buyers. The days of intense bidding wars and offers significantly above asking price are becoming less frequent, paving the way for more negotiation and potentially lower sale prices. This increased supply is particularly significant when considering the overall real estate inventory Canada.

- Gradual increase in new listings in certain regions: While not universal, an uptick in new listings is evident in some areas, easing the pressure of extremely limited supply.

- Longer days on market for some properties: Properties are staying on the market for longer periods, indicating reduced buyer urgency and a less competitive environment.

- Less pressure on buyers to make quick offers: Buyers are finding they have more time to consider offers and negotiate terms, leading to potentially lower purchase prices.

- Potential for price negotiations becoming more common: The shift in market power is creating opportunities for buyers to negotiate prices, reflecting a move away from the seller's market that has characterized recent years.

Regional Variations in Market Trends

It's crucial to remember that the Canadian real estate market isn't uniform. Regional variations in market trends are significant. While some areas like Vancouver real estate or Toronto real estate, historically considered hot markets, might be experiencing more substantial slowdowns and potential price corrections, other regions, such as Calgary real estate or Montreal real estate, may remain relatively stable. These regional differences are influenced by various factors, including local economic conditions, employment rates and population growth. Understanding these nuances is critical for anyone seeking to invest in or sell property in the Canadian housing market.

- Hot markets showing signs of cooling faster: Areas that experienced rapid price growth in recent years are showing signs of cooling more quickly due to the interest rate hikes.

- More affordable areas less affected by interest rate hikes: Regions with more affordable housing may be less severely impacted by the interest rate increases.

- Regional economic factors influencing market performance: Local economic conditions, such as employment rates and industry diversification, play a significant role in shaping regional housing market performance.

Shifting Buyer Sentiment and Consumer Confidence

A crucial indicator of a potential price correction is the shift in buyer sentiment and overall consumer confidence in the Canadian housing market. Surveys and market analyses reveal a decrease in optimism regarding future price growth, significantly impacting demand. Fewer potential buyers are willing to pay over the asking price, further contributing to a potential plateau or even a decline in prices. This reduced confidence is a key factor impacting real estate outlook Canada.

- Surveys indicating reduced buyer confidence: Various surveys and reports are showing a decline in buyer confidence in the Canadian housing market.

- Increased uncertainty about future economic conditions: Concerns about inflation, potential recession, and overall economic uncertainty are influencing buyer decisions.

- Fewer buyers willing to pay over asking price: The days of bidding wars and significant premiums above asking price are diminishing, reflecting a cooling market.

Conclusion

While a catastrophic collapse of the Canadian real estate market seems improbable, the confluence of several key factors – rising interest rates Canada, increasing inventory, regional variations, and shifting buyer sentiment – strongly suggests a potential price correction is underway. This correction isn't expected to be uniform across the country; some regions will undoubtedly experience more significant adjustments than others. The interplay of these factors significantly influences real estate market Canada and should be carefully considered.

Understanding these posthaste signals of a potential price correction in the Canadian real estate market is crucial for both buyers and sellers. Stay informed about the latest Canadian real estate trends and market updates to make informed decisions. Monitor key indicators such as interest rate changes, inventory levels, and buyer sentiment to successfully navigate this dynamic and evolving market. Proactive monitoring of the Canadian housing market will be key to making smart investments in the future.

Featured Posts

-

Toenemend Autobezit Stimuleert Occasionverkoop Bij Abn Amro

May 22, 2025

Toenemend Autobezit Stimuleert Occasionverkoop Bij Abn Amro

May 22, 2025 -

Dong Nai Kien Nghi Tuyen Duong 4 Lan Xe Moi Xuyen Rung Ma Da Den Binh Phuoc

May 22, 2025

Dong Nai Kien Nghi Tuyen Duong 4 Lan Xe Moi Xuyen Rung Ma Da Den Binh Phuoc

May 22, 2025 -

Two Loose Cows In Lancaster County Park Location And Updates

May 22, 2025

Two Loose Cows In Lancaster County Park Location And Updates

May 22, 2025 -

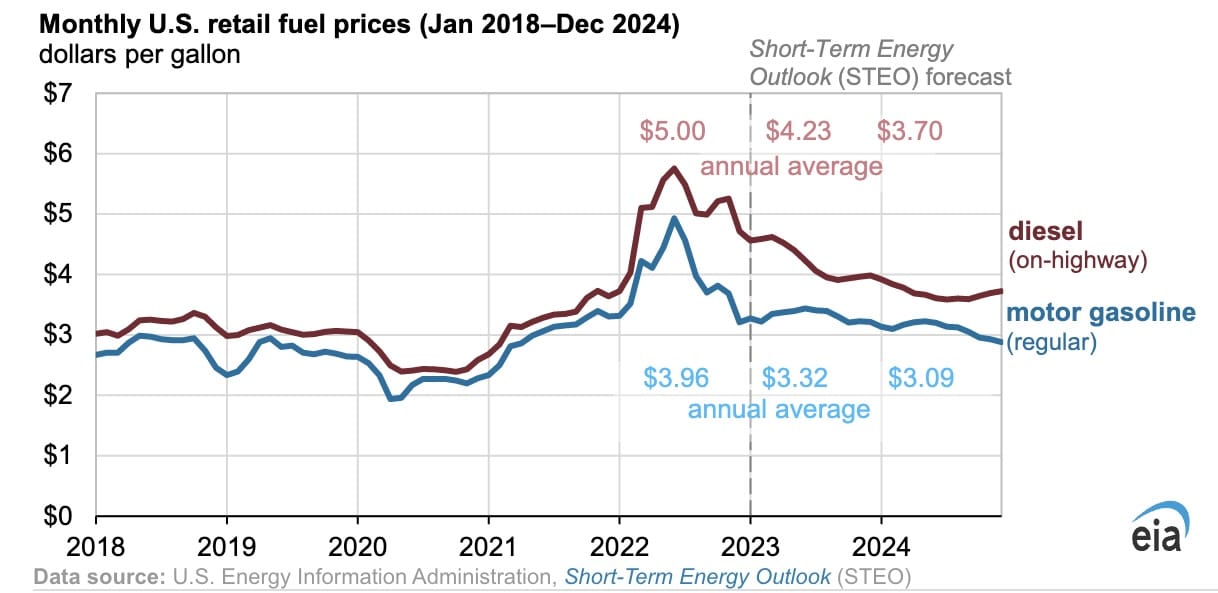

Gas Prices Surge Nearly 20 Cent Increase Per Gallon

May 22, 2025

Gas Prices Surge Nearly 20 Cent Increase Per Gallon

May 22, 2025 -

Lower Gas Prices In The Toledo Area A Detailed Look

May 22, 2025

Lower Gas Prices In The Toledo Area A Detailed Look

May 22, 2025