Cantor Fitzgerald In Talks For $3 Billion Crypto SPAC With Tether And SoftBank

Table of Contents

Cantor Fitzgerald's Role and Expertise

Cantor Fitzgerald, a prominent player in global financial markets with a rich history, brings significant expertise to this ambitious undertaking. Its deep experience in trading, investment banking, and navigating complex financial transactions makes it uniquely positioned to lead this crypto SPAC. Their extensive network and proven track record in managing high-value deals are key assets. Cantor Fitzgerald's strengths in this context include:

- Extensive network of investors and contacts: Access to a vast pool of potential investors and strategic partners is crucial for the success of a SPAC.

- Experience in structuring and executing complex financial transactions: The complexities of navigating both the traditional financial and cryptocurrency regulatory environments require a high level of expertise.

- Deep understanding of regulatory environments: Successfully navigating the regulatory hurdles involved in merging traditional finance with the crypto world is paramount.

- Proven track record in successfully managing high-value deals: Cantor Fitzgerald's history demonstrates its ability to handle transactions of this scale and complexity.

These factors solidify Cantor Fitzgerald's position as a crucial driver in this groundbreaking $3 billion crypto SPAC. Their transaction expertise and established presence in financial markets are invaluable assets in this venture.

Tether's Involvement and Implications

Tether, a leading stablecoin in the cryptocurrency market, plays a significant role in this ambitious project. Its inclusion brings both opportunities and challenges. The involvement of a stablecoin like Tether could drastically alter the perception and acceptance of cryptocurrencies within mainstream financial circles. Potential benefits and risks for Tether include:

- Increased legitimacy and mainstream acceptance: Association with established financial players like Cantor Fitzgerald and SoftBank could significantly bolster Tether's reputation.

- Access to traditional financial markets and funding: This collaboration opens doors to capital and resources previously unavailable to solely crypto-based entities.

- Potential exposure to greater regulatory scrutiny: Increased integration with traditional finance may result in enhanced regulatory oversight.

- Opportunities for expansion and further adoption: The deal could significantly accelerate Tether's adoption and integration into broader financial systems.

Tether's involvement in this $3 billion SPAC is a bold step, demonstrating its ambition to become a central player in the evolving cryptocurrency landscape.

SoftBank's Strategic Investment and its Significance

SoftBank, a renowned technology investor with a growing presence in the crypto space, adds significant weight to this endeavor. Its strategic investment speaks volumes about the potential of this crypto SPAC. The rationale behind SoftBank's participation likely stems from several key factors:

- Diversification into the growing cryptocurrency market: SoftBank seeks to expand its portfolio into the high-growth potential sector of cryptocurrencies.

- Access to innovative cryptocurrency projects and technologies: The SPAC provides a pipeline to promising projects and cutting-edge technologies within the crypto ecosystem.

- Potential for high returns on investment: The cryptocurrency market's volatility presents both risks and substantial opportunities for high returns.

- Strengthening its position in the fintech sector: This investment reinforces SoftBank's presence within the burgeoning fintech industry, leveraging its existing network and expertise.

SoftBank's strategic investment underscores the increasing confidence major players have in the future of the cryptocurrency market.

Potential Targets and Future of the SPAC

The potential targets for this $3 billion crypto SPAC remain speculative, but considering Cantor Fitzgerald's and SoftBank's investment strategies, likely targets could include promising blockchain projects, crypto infrastructure companies, or innovative DeFi platforms. This deal could significantly impact the future of crypto adoption and investment by:

- Accelerating mainstream adoption of cryptocurrencies: The partnership between established financial institutions and crypto projects can bridge the trust gap between traditional and digital finance.

- Driving further investment into the cryptocurrency sector: The large sum involved signals a growing confidence in the crypto market's potential.

- Navigating the regulatory landscape: The deal's success will heavily depend on how effectively it addresses the evolving regulatory landscape for cryptocurrencies.

The challenges lie in navigating regulatory hurdles and managing the inherent volatility of the cryptocurrency market. However, the opportunities are immense, with the potential to accelerate the integration of cryptocurrencies into mainstream finance.

Conclusion: The Cantor Fitzgerald, Tether, and SoftBank Crypto SPAC – A Transformative Deal?

This unprecedented $3 billion crypto SPAC, orchestrated by Cantor Fitzgerald with the participation of Tether and SoftBank, represents a monumental step towards bridging the gap between traditional finance and the cryptocurrency world. The implications for both the cryptocurrency market and the broader financial industry are significant. This massive investment highlights the growing maturity and mainstream acceptance of cryptocurrencies. To stay informed about the developments and potential impact of this Cantor Fitzgerald crypto SPAC on the future of finance, stay tuned for further updates [link to relevant news source].

Featured Posts

-

Cassidy Hutchinsons Fall Memoir Insights From A Key Jan 6 Witness

Apr 24, 2025

Cassidy Hutchinsons Fall Memoir Insights From A Key Jan 6 Witness

Apr 24, 2025 -

Abrego Garcia Judge Orders End To Stonewalling By Us Lawyers

Apr 24, 2025

Abrego Garcia Judge Orders End To Stonewalling By Us Lawyers

Apr 24, 2025 -

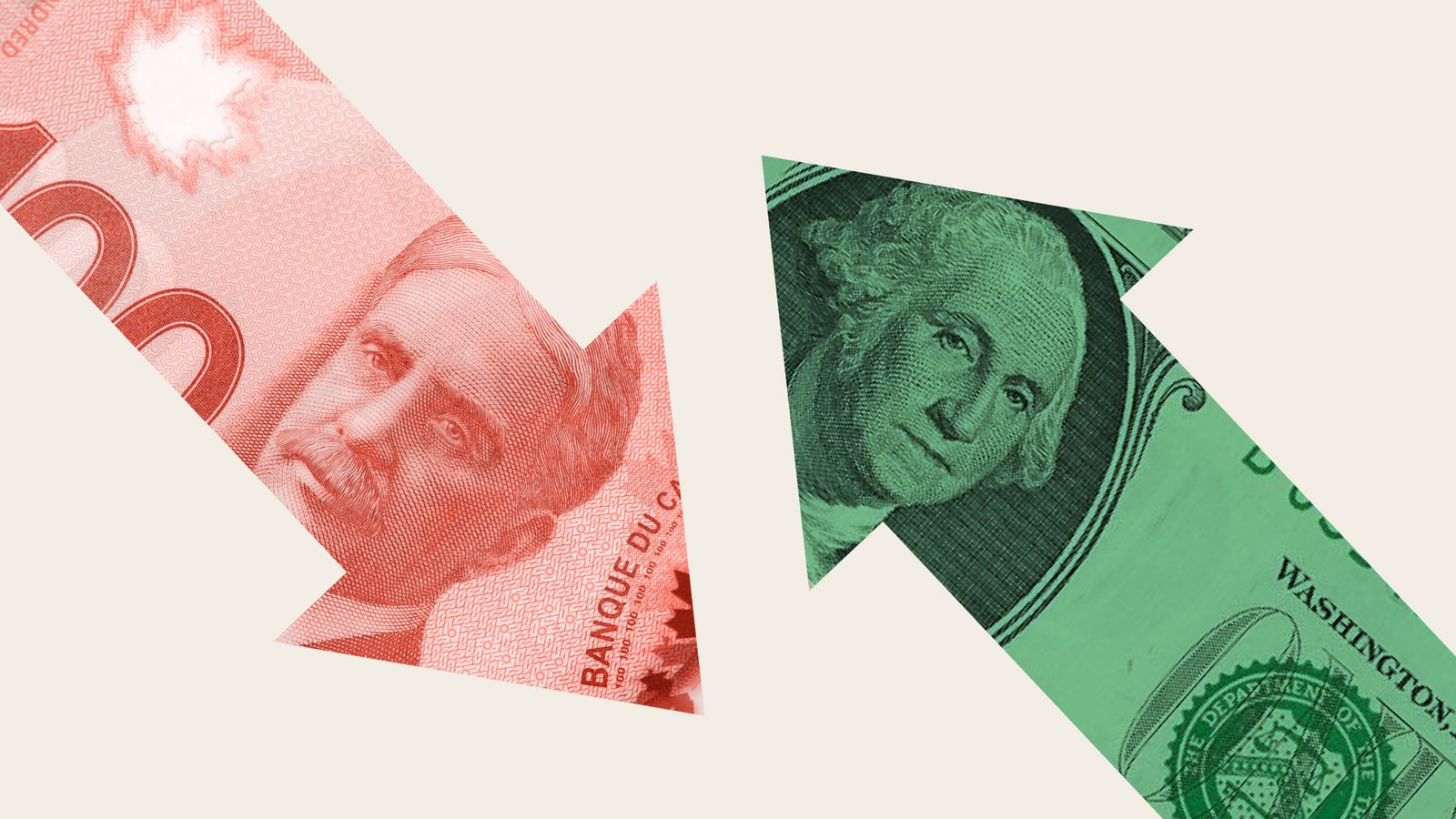

Canadian Dollar Plunges Despite Us Dollar Gains

Apr 24, 2025

Canadian Dollar Plunges Despite Us Dollar Gains

Apr 24, 2025 -

The Bold And The Beautiful April 3rd Recap Liams Health Crisis Following A Fight With Bill

Apr 24, 2025

The Bold And The Beautiful April 3rd Recap Liams Health Crisis Following A Fight With Bill

Apr 24, 2025 -

Us Market Slump Vs Emerging Market Growth A 2023 Performance Comparison

Apr 24, 2025

Us Market Slump Vs Emerging Market Growth A 2023 Performance Comparison

Apr 24, 2025