Carney And Trump: Canadian Dollar's Reaction To Potential Deal

Table of Contents

Historical Context: Past Trade Deals and CAD Performance

The North American Free Trade Agreement (NAFTA) and its successor, the United States-Mexico-Canada Agreement (USMCA), have profoundly shaped the Canadian economy and, consequently, the CAD's performance. Analyzing past trade deal impacts on CAD volatility offers valuable insights for future predictions.

- Impact of NAFTA ratification/implementation on CAD: The initial implementation of NAFTA led to a period of relative stability and, in some periods, appreciation of the CAD, reflecting increased trade and economic growth. However, this wasn't a consistently upward trend, influenced by other global economic factors.

- CAD movements during renegotiations of NAFTA (leading to USMCA): The renegotiation period under the Trump administration witnessed considerable CAD fluctuations, driven by uncertainty and market sentiment regarding the potential outcomes of the trade talks. Periods of perceived risk led to depreciation, while positive developments fostered appreciation.

- Analysis of economic data correlating trade agreements and CAD value: Empirical economic data clearly demonstrates a correlation between the stability and expansion of US-Canada trade and a generally stronger CAD. Periods of uncertainty or trade disputes typically result in a weaker CAD. Analyzing economic indicators like exports, imports, and GDP growth alongside CAD exchange rates reveals this correlation.

Analyzing Trump's Trade Policies and their Impact on the CAD

President Trump's protectionist trade policies introduced a significant element of unpredictability into the US-Canada trade relationship and heavily influenced the CAD exchange rate. His administration's actions, ranging from the imposition of tariffs to threats of withdrawal from trade agreements, created market volatility.

- Specific examples of Trump's trade actions affecting Canada: The imposition of tariffs on Canadian lumber and steel, and the constant threats regarding NAFTA renegotiations, generated significant uncertainty and negatively impacted the CAD.

- Analysis of market reactions to these actions (e.g., tariff announcements): Announcements of new tariffs or trade restrictions often caused immediate depreciation of the CAD, reflecting investor concerns about reduced trade and economic growth.

- Expert opinions on the long-term implications of Trump's policies on the CAD: While the immediate impact was often negative, the long-term effects are complex and debated. Some argue that a more protectionist environment could lead to decreased trade and a weaker CAD, while others suggest that focusing on bilateral agreements might offer a more stable economic outlook.

The Role of the Bank of Canada (Under Poloz)

The Bank of Canada, under Governor Poloz's leadership during the NAFTA renegotiations, played a crucial role in managing the Canadian economy and influencing the CAD through monetary policy. Its actions and communication strategies aimed to mitigate the effects of trade uncertainty.

- How the Bank of Canada might respond to positive/negative trade news: Positive trade news might lead to increased interest rates (to combat inflation), potentially strengthening the CAD. Negative news might result in interest rate cuts to stimulate the economy, potentially weakening the CAD.

- Analysis of past interventions to stabilize the CAD: The Bank of Canada's interventions were often subtle, focusing on managing interest rates and communicating clearly to the markets to influence expectations and manage volatility. Direct interventions in the currency market are less common.

- Discussion on the independence of the Bank of Canada in the face of political pressure: The Bank of Canada maintains its independence in setting monetary policy. While it considers the government's economic objectives, it operates autonomously to ensure price stability and economic growth.

Predicting Future Movements: Factors Influencing the CAD

Predicting future CAD movements following a potential new US-Canada trade agreement requires considering a range of interconnected factors, both positive and negative.

- Impact of a favorable trade deal on Canadian exports and the CAD: A comprehensive and mutually beneficial agreement would likely boost Canadian exports and strengthen the CAD, reflecting improved investor confidence and economic growth.

- Potential risks and challenges associated with a new agreement: Any new agreement will contain unresolved issues and potential points of friction that could impact the CAD negatively. Careful evaluation of these risks is necessary.

- How investor sentiment will affect the CAD: Investor confidence and market sentiment are crucial determinants of the CAD's value. Positive perceptions of a new trade deal will attract investments and strengthen the CAD. Conversely, negative sentiment will weaken it.

Conclusion

The Canadian dollar's relationship with US-Canada trade agreements is complex and multifaceted. While past experiences offer valuable insights, predicting future CAD movements requires careful consideration of numerous factors including the specifics of any new agreement, the Bank of Canada's monetary policy, and prevailing global economic conditions and investor sentiment. The interplay between political decisions and economic indicators significantly impacts the Canadian Dollar.

Call to Action: Stay informed about the latest developments in US-Canada trade relations to effectively navigate the fluctuating Canadian dollar. Understand the interplay between political decisions and economic indicators to make informed decisions regarding your investments and exposure to the Canadian Dollar. Monitoring key economic indicators and market sentiment is crucial for managing your risk and capitalizing on opportunities presented by the volatile but potentially rewarding Canadian Dollar market.

Featured Posts

-

Langer Dan Een Jaar Wachten Op Tbs Een Alarmerende Trend

May 02, 2025

Langer Dan Een Jaar Wachten Op Tbs Een Alarmerende Trend

May 02, 2025 -

La Risposta Dell Ue Alle Provocazioni Di Medvedev E Il Timore Nucleare

May 02, 2025

La Risposta Dell Ue Alle Provocazioni Di Medvedev E Il Timore Nucleare

May 02, 2025 -

Australias Opposition Promises 9 Billion Budget Improvement

May 02, 2025

Australias Opposition Promises 9 Billion Budget Improvement

May 02, 2025 -

Brtanwy Parlymnt Myn Kshmyr Ke Msyle Pr Mbahthh Ka Mtalbh

May 02, 2025

Brtanwy Parlymnt Myn Kshmyr Ke Msyle Pr Mbahthh Ka Mtalbh

May 02, 2025 -

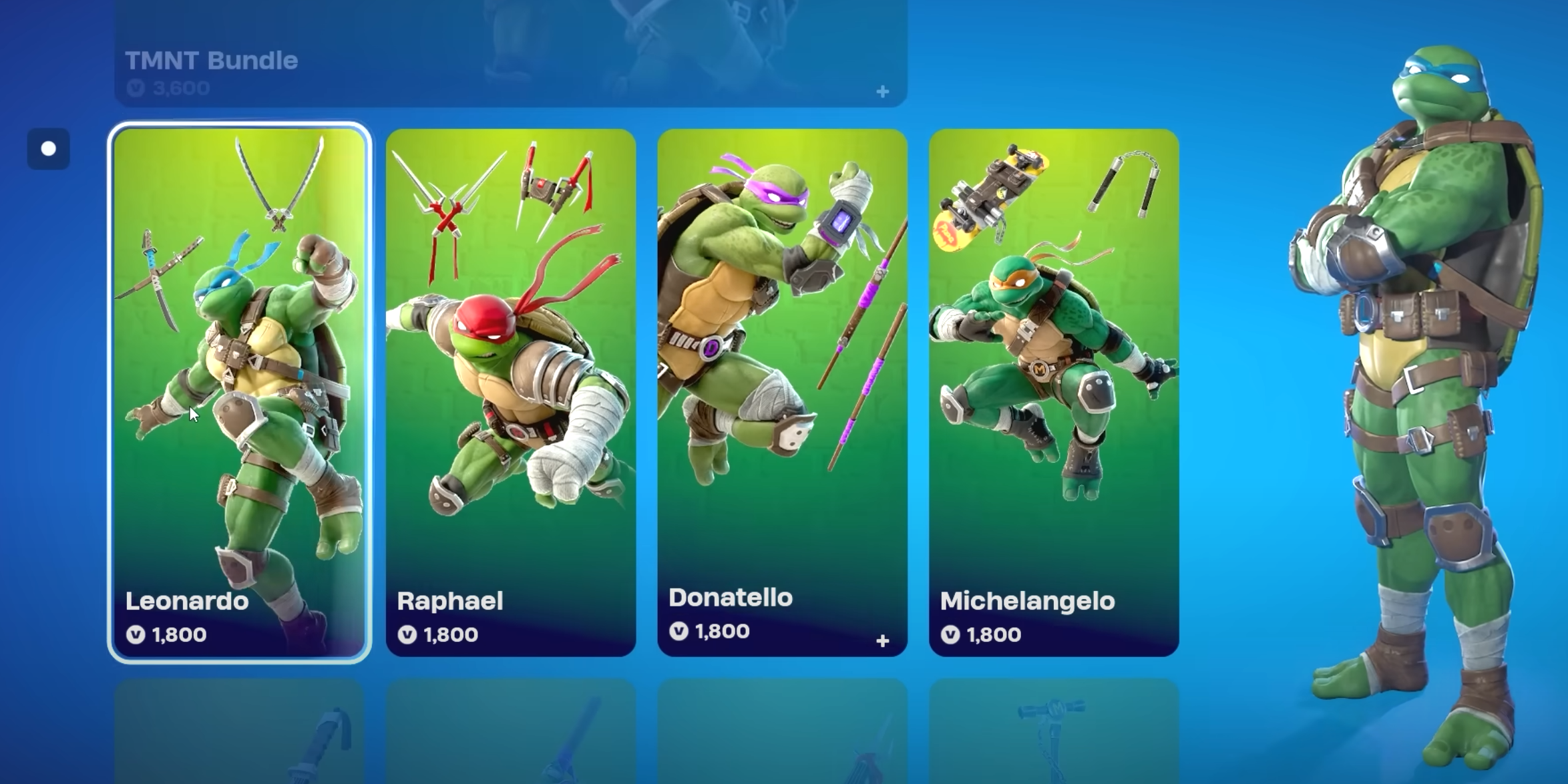

Every Teenage Mutant Ninja Turtles Skin In Fortnite A Comprehensive Guide

May 02, 2025

Every Teenage Mutant Ninja Turtles Skin In Fortnite A Comprehensive Guide

May 02, 2025