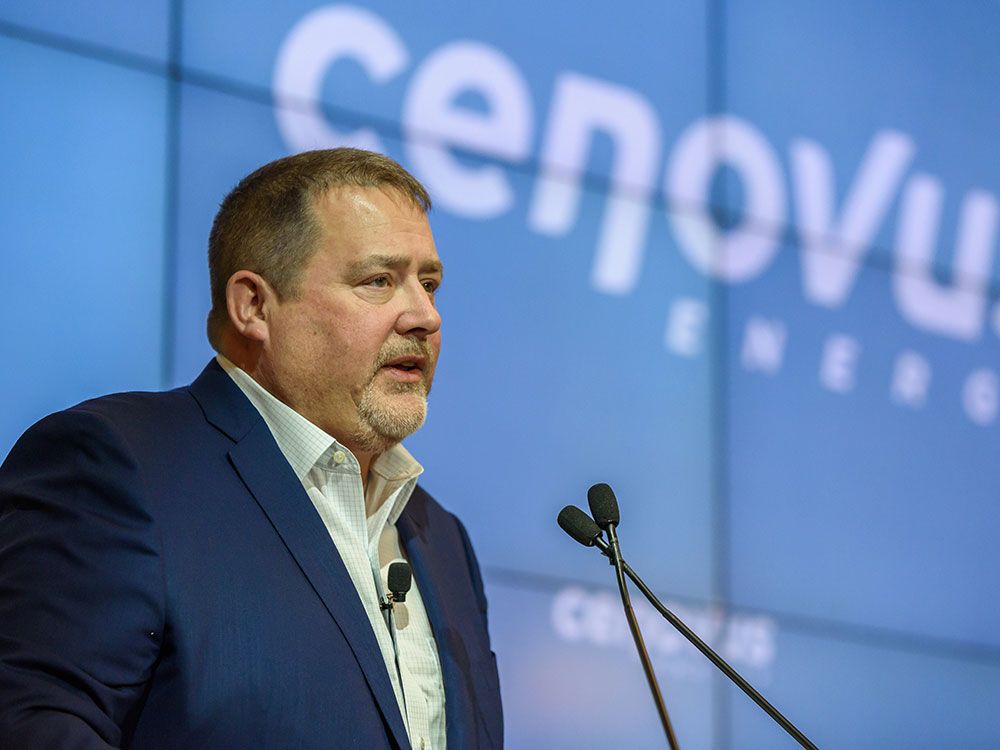

Cenovus CEO: MEG Bid Unlikely Amid Focus On Organic Growth

Table of Contents

Cenovus's Commitment to Organic Growth Strategy

Cenovus Energy has clearly articulated its commitment to a strategy prioritizing organic growth over acquisitions. This approach focuses on maximizing the value of its existing assets and operations rather than pursuing large-scale mergers or acquisitions. This strategic direction reflects a long-term vision for sustainable growth and enhanced shareholder value.

- Increased oil production through existing assets: Cenovus plans to significantly boost its oil production by optimizing its current infrastructure and leveraging technological advancements to improve extraction efficiency. This includes investing in enhanced oil recovery techniques.

- Operational efficiency improvements: The company is aggressively pursuing cost reductions and process improvements across its operations to enhance profitability and free up capital for reinvestment. This involves streamlining workflows and adopting cutting-edge technologies.

- Investment in sustainable energy initiatives: Cenovus recognizes the growing importance of sustainability and is allocating resources to explore and develop renewable energy projects, aligning with the global shift towards cleaner energy sources. This diversification strategy positions the company for long-term success in a changing energy landscape.

- Debt reduction: Cenovus is focused on strengthening its balance sheet by actively reducing its debt levels. This financial prudence provides flexibility to pursue organic growth opportunities and withstand market volatility.

This holistic strategy aligns perfectly with Cenovus's long-term goals of maximizing shareholder value through sustainable and profitable growth in the oil and gas sector.

Analysis of MEG Energy as a Potential Acquisition Target

MEG Energy, a significant player in the Canadian oil sands, has often been viewed as a potential acquisition target for larger energy companies. Its substantial asset base and production capabilities make it an attractive prospect.

- MEG Energy's asset base and production capabilities: MEG Energy possesses a valuable portfolio of oil sands assets, including significant reserves and established production facilities.

- MEG Energy's market capitalization and valuation: MEG Energy's market capitalization and current valuation are key factors considered in any potential acquisition.

- Potential synergies between Cenovus and MEG Energy: While synergies might exist, Cenovus's focus on organic growth suggests that the perceived benefits of a merger wouldn't outweigh the potential drawbacks and disruption.

- Potential challenges or risks associated with an acquisition: An acquisition of MEG Energy would involve significant financial commitment, regulatory hurdles, and integration challenges, factors that might hinder Cenovus's organic growth strategy.

The CEO's Statement and its Market Implications

Cenovus's CEO has explicitly stated that a bid for MEG Energy is highly unlikely at this time, emphasizing the company's dedication to its organic growth strategy. This statement has had noticeable implications in the market.

- Impact on Cenovus's stock price: The market reacted positively to the clarification, viewing the focus on organic growth as a responsible and potentially more profitable path.

- Impact on MEG Energy's stock price: MEG Energy's stock price experienced a temporary dip following the statement, reflecting the diminished probability of a takeover.

- Reactions from analysts and investors: Many analysts and investors have applauded Cenovus’s decision, believing that organic growth offers a more sustainable and less risky path to long-term success.

- Implications for future M&A activity in the energy sector: The CEO’s statement sends a signal that even for major players, organic growth is taking precedence over large-scale acquisitions in the energy sector.

Alternative Strategies for Growth at Cenovus

Instead of acquisitions, Cenovus is exploring several alternative avenues to fuel its growth.

- Further investment in existing projects: Cenovus plans to continue investing in its current projects to enhance their productivity and lifespan.

- Exploration of new opportunities in the energy sector: The company remains open to exploring new opportunities within the energy sector, focusing on areas aligned with its strategic priorities and sustainable growth objectives.

- Strategic partnerships and joint ventures: Cenovus is actively seeking strategic partnerships and joint ventures that can leverage complementary expertise and resources to accelerate growth.

- Technological innovation and efficiency improvements: Investing in technological advancements is paramount, allowing for increased efficiency and reduced operational costs.

Conclusion: Cenovus Prioritizes Organic Growth Over MEG Bid

In conclusion, Cenovus Energy's CEO has made it clear that a bid for MEG Energy is currently not on the table. The company's unwavering commitment to organic growth, focusing on enhancing existing assets, operational efficiency, and sustainable energy initiatives, drives this decision. This strategy, while potentially slower than a large acquisition, is viewed by Cenovus as a more sustainable and less risky approach to maximizing shareholder value. The market's response suggests a favorable reception of this strategy. To stay informed about Cenovus Energy's progress and its continued focus on its organic growth strategy, keep an eye on company updates and financial news. Learn more about Cenovus's long-term plans and its future acquisitions, or lack thereof, by following their official channels.

Featured Posts

-

Legal Implications Of Selling Banned Chemicals On E Bay Section 230 Scrutinized

May 26, 2025

Legal Implications Of Selling Banned Chemicals On E Bay Section 230 Scrutinized

May 26, 2025 -

Severe Storms Bring Flood Advisory For Miami Valley Residents

May 26, 2025

Severe Storms Bring Flood Advisory For Miami Valley Residents

May 26, 2025 -

Find The Saint On Itv 4 A Viewers Guide

May 26, 2025

Find The Saint On Itv 4 A Viewers Guide

May 26, 2025 -

Box Office Surprise 20 Year Old Romance Film Reclaims Its Popularity

May 26, 2025

Box Office Surprise 20 Year Old Romance Film Reclaims Its Popularity

May 26, 2025 -

Jeu De Management Cycliste Rtbf Preparez Vous Pour Le Tour De France

May 26, 2025

Jeu De Management Cycliste Rtbf Preparez Vous Pour Le Tour De France

May 26, 2025