Cenovus Rejects MEG Bid Rumors, Emphasizes Organic Growth Strategy

Table of Contents

Cenovus's Stance on the MEG Bid: A Detailed Analysis

Official Statement and Rationale

Cenovus Energy issued an official statement categorically rejecting the speculated merger bid from MEG Energy. While the exact details of the alleged bid remain undisclosed, Cenovus cited a lack of strategic alignment and a belief that its current organic growth strategy offers superior long-term value creation as the primary reasons for the rejection.

- Key Quote: "[Insert actual quote from Cenovus's official press release or statement regarding the rejection of the MEG bid, if available. Otherwise, paraphrase the official statement accurately.]"

- Financial Considerations: Cenovus likely weighed the potential financial benefits of a merger against the projected returns from its internal expansion plans. The company likely determined that the proposed merger undervalued its current assets and future growth potential.

- Strategic Alignment: A crucial factor influencing Cenovus's decision was the perceived lack of strategic synergy between the two companies. Different operational focuses or conflicting long-term visions likely contributed to the rejection.

Market Reaction to the Rejected Bid

The news of Cenovus rejecting the MEG bid sent ripples through the stock market. Initial reactions were mixed, with some analysts predicting a short-term dip in Cenovus's stock price, while others remained optimistic about the company's future based on its organic growth strategy.

- Stock Price Movement: [Insert data on the stock price movements of both CVE and MEG following the announcement. Include charts and graphs if possible. Examples: "CVE stock experienced a minor dip of X% immediately following the announcement, but recovered to Y% within Z days." "MEG stock showed a [increase/decrease] of X%."]

- Analyst Opinions: [Include summaries of expert opinions and predictions from reputable financial news sources. Examples: "Analysts at [Financial Institution] believe Cenovus made a sound strategic decision..." "Others, however, express concern about..." ]

- Future Performance Predictions: The long-term implications for both companies remain to be seen. The success of Cenovus's organic growth strategy will be a key determinant of its future stock performance.

Alternative Acquisition Targets (Speculation)

While Cenovus has explicitly stated its commitment to organic growth, market speculation inevitably continues. Based on industry analysis, several other companies have been mentioned as potential acquisition targets for Cenovus in the future.

- Potential Targets: [List potential acquisition targets, citing relevant industry news or analyst reports. Be clear that this section is speculative.]

- Rationale: [Explain the rationale behind the speculation for each potential target. Example: "Company X's strong presence in [geographic region/energy sector] could complement Cenovus's existing operations."]

- Implications: [Discuss the potential implications of such acquisitions for Cenovus's strategic direction and financial performance.]

Cenovus's Organic Growth Strategy: A Closer Look

Key Pillars of the Organic Growth Plan

Cenovus's organic growth strategy hinges on several key initiatives designed to increase production, improve efficiency, and expand into new markets.

- Production Increase: Cenovus plans to significantly increase its oil and natural gas production through investments in existing assets and exploration of new reserves. [Specify projected production increases with quantifiable data.]

- Operational Efficiency Improvements: The company is investing in advanced technologies and implementing streamlined processes to optimize its operations and reduce costs. [Provide specific examples, such as automation initiatives or process optimization projects.]

- Market Expansion: Cenovus aims to broaden its market reach by exploring new opportunities in different geographic regions or energy sectors. [Specify target markets and planned expansion strategies.]

- Technological Advancements: Investment in carbon capture, utilization and storage (CCUS) technology and other environmentally conscious technologies will play a role in their organic growth strategy.

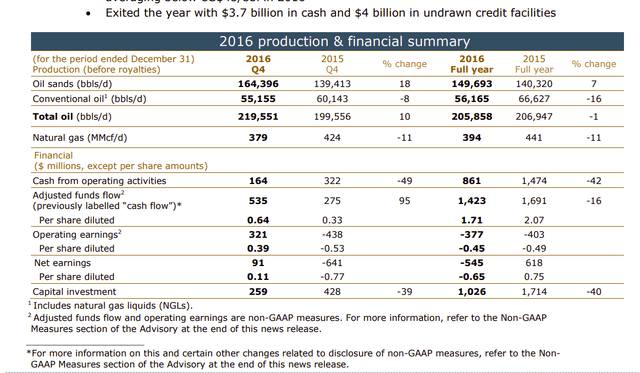

Financial Projections and Investment Strategy

Cenovus's organic growth strategy is underpinned by a robust financial plan. The company has outlined specific financial projections and investment strategies to support its ambitious goals.

- Revenue Growth: Cenovus projects [Insert projected revenue growth percentage or figures].

- Profit Projections: [Insert projected profit margins or net income figures].

- Capital Expenditure: The company plans to invest [Insert amount] in capital expenditures over the next [Timeframe] to support its expansion plans.

- Funding Sources: Cenovus will finance its growth initiatives through a combination of [List funding sources, e.g., retained earnings, debt financing, equity issuance].

Environmental, Social, and Governance (ESG) Considerations

Cenovus's organic growth strategy is deeply intertwined with its commitment to environmental, social, and governance (ESG) principles.

- Emission Reduction Targets: Cenovus has set ambitious targets to reduce its greenhouse gas emissions. [Specify targets and timelines.]

- Social Responsibility Initiatives: The company is committed to supporting local communities and fostering a diverse and inclusive workplace. [Provide specific examples of initiatives.]

- Governance Practices: Cenovus maintains high standards of corporate governance to ensure transparency and accountability. [Mention specific governance policies or certifications.]

Conclusion: Cenovus's Future: Organic Growth Over Mergers and Acquisitions

Cenovus Energy's decisive rejection of the MEG bid underscores its unwavering commitment to its organic growth strategy. By focusing on internal expansion, operational efficiency improvements, and strategic investments, Cenovus aims to unlock significant long-term value. The company's detailed financial projections and commitment to ESG principles further solidify its confidence in this approach. This focus on organic growth, rather than mergers and acquisitions, positions Cenovus for sustainable, long-term success in the dynamic energy sector.

Stay updated on Cenovus Energy's organic growth journey by visiting [link to Cenovus website] and learn more about their strategic initiatives and commitment to creating long-term shareholder value through Cenovus Energy growth and the Cenovus organic growth strategy.

Featured Posts

-

Find The Saint On Itv 4 A Viewers Guide

May 26, 2025

Find The Saint On Itv 4 A Viewers Guide

May 26, 2025 -

Zize En Spectacle Humoriste Transformiste Marseillais A Graveson 4 Avril

May 26, 2025

Zize En Spectacle Humoriste Transformiste Marseillais A Graveson 4 Avril

May 26, 2025 -

Hells Angels A Critical Analysis

May 26, 2025

Hells Angels A Critical Analysis

May 26, 2025 -

Lamentamos El Fallecimiento De Eddie Jordan Ultima Hora

May 26, 2025

Lamentamos El Fallecimiento De Eddie Jordan Ultima Hora

May 26, 2025 -

Hsv Aufstiegssaison Die Stimmung Zwischen Hafengeburtstag Und Kaiser Konzert

May 26, 2025

Hsv Aufstiegssaison Die Stimmung Zwischen Hafengeburtstag Und Kaiser Konzert

May 26, 2025