CFP Board CEO Announces Retirement For Early 2026

Table of Contents

Details of the Retirement Announcement

The official announcement regarding the CFP Board CEO's retirement was made on [Insert Date of Announcement Here]. [Insert CEO's Name Here], who served as CEO for [Number] years, will be stepping down in early 2026. While specifics regarding the succession plan are still emerging, the CFP Board has indicated that a search for a successor is underway and a transition plan is being developed to ensure a smooth handover of responsibilities.

- Announcement Date: [Insert Date of Announcement Here]

- Retiring CEO: [Insert CEO's Name Here]

- Tenure: [Number] years

- Official Statement: [Insert a quote from the official CFP Board statement, if available. Otherwise, summarize the key points of the statement.]

- Succession Plan: A search for a new CEO is underway. Details regarding the timeline and process will be released as they become available.

Impact on CFP Professionals

The retirement of the CFP Board CEO will undoubtedly have a ripple effect across the financial planning profession. The CEO plays a crucial role in shaping the organization's strategic direction, influencing the standards for CFP certification, and advocating for the profession. Changes in leadership could potentially lead to shifts in several key areas:

- Certification Requirements: While it's unlikely that major changes to the existing CFP certification requirements will be implemented immediately, the new CEO may introduce adjustments over time to reflect evolving industry trends and consumer needs.

- Professional Development: The emphasis on continuing education and professional development programs for CFP professionals could shift based on the priorities of the incoming CEO. New initiatives or a refocusing of existing programs are possibilities.

- Regulatory Focus: The CFP Board's regulatory role in maintaining ethical standards and ensuring consumer protection is paramount. The new leadership might adjust the focus of regulatory efforts.

- Advocacy Efforts: The CFP Board actively advocates for the profession at the state and federal levels. A change in leadership could potentially influence the organization’s advocacy strategy and priorities.

Implications for Consumers Seeking Financial Advice

The CFP Board plays a vital role in protecting consumers by setting and upholding high standards for financial advisors. The CEO's retirement doesn't diminish the importance of choosing a Certified Financial Planner™. Consumers seeking financial advice can still rely on the rigorous CFP certification process to identify qualified professionals.

- CFP Certification Standards: The CFP certification process and standards remain robust and continue to ensure that CFP professionals meet the highest ethical and competency requirements.

- Verifying CFP Credentials: Consumers should always verify the credentials of any financial advisor claiming to be a CFP professional by checking the CFP Board's website.

- Finding a Qualified CFP Professional: The CFP Board's website provides resources to help consumers locate CFP professionals in their area.

- Consumer Protections: The CFP Board's commitment to consumer protection is expected to continue under new leadership. The transition shouldn’t impact the overall level of consumer safeguards.

Speculation and Future Outlook for the CFP Board

The upcoming leadership change presents both challenges and opportunities for the CFP Board. The financial planning industry is constantly evolving, facing new technological advancements, regulatory changes, and shifting consumer expectations. The new CEO will likely face these headwinds. Potential areas of focus for the next CEO could include:

- Technology Integration: Adapting to and incorporating new financial technology into the CFP certification process and the profession at large.

- Expanding Accessibility: Broadening access to financial planning services for underserved populations.

- Addressing Industry Challenges: Tackling issues such as fee transparency, fiduciary duty, and the ever-changing regulatory landscape.

- Promoting the CFP Mark: Continuing to enhance the reputation and recognition of the CFP certification as the gold standard in financial planning.

Conclusion

The retirement of the CFP Board CEO marks a significant moment for the financial planning profession. While change can bring uncertainty, it also presents opportunities for growth and innovation. The CFP Board's commitment to upholding high standards for CFP professionals and protecting consumers remains unwavering. It is crucial for both CFP professionals and consumers to stay informed about upcoming developments at the CFP Board. To find a qualified CFP professional for your financial planning needs, visit the CFP Board website and utilize their resources to locate a CFP® professional in your area. Stay updated on CFP Board updates and ensure you are working with a certified financial planner for optimal financial guidance.

Featured Posts

-

Exclusive Report U S Army To Significantly Expand Drone Operations

May 03, 2025

Exclusive Report U S Army To Significantly Expand Drone Operations

May 03, 2025 -

Une Rencontre Bouleversante Emmanuel Macron Et Les Victimes De L Armee Israelienne

May 03, 2025

Une Rencontre Bouleversante Emmanuel Macron Et Les Victimes De L Armee Israelienne

May 03, 2025 -

A Place In The Sun Your Checklist For Buying Abroad

May 03, 2025

A Place In The Sun Your Checklist For Buying Abroad

May 03, 2025 -

1

May 03, 2025

1

May 03, 2025 -

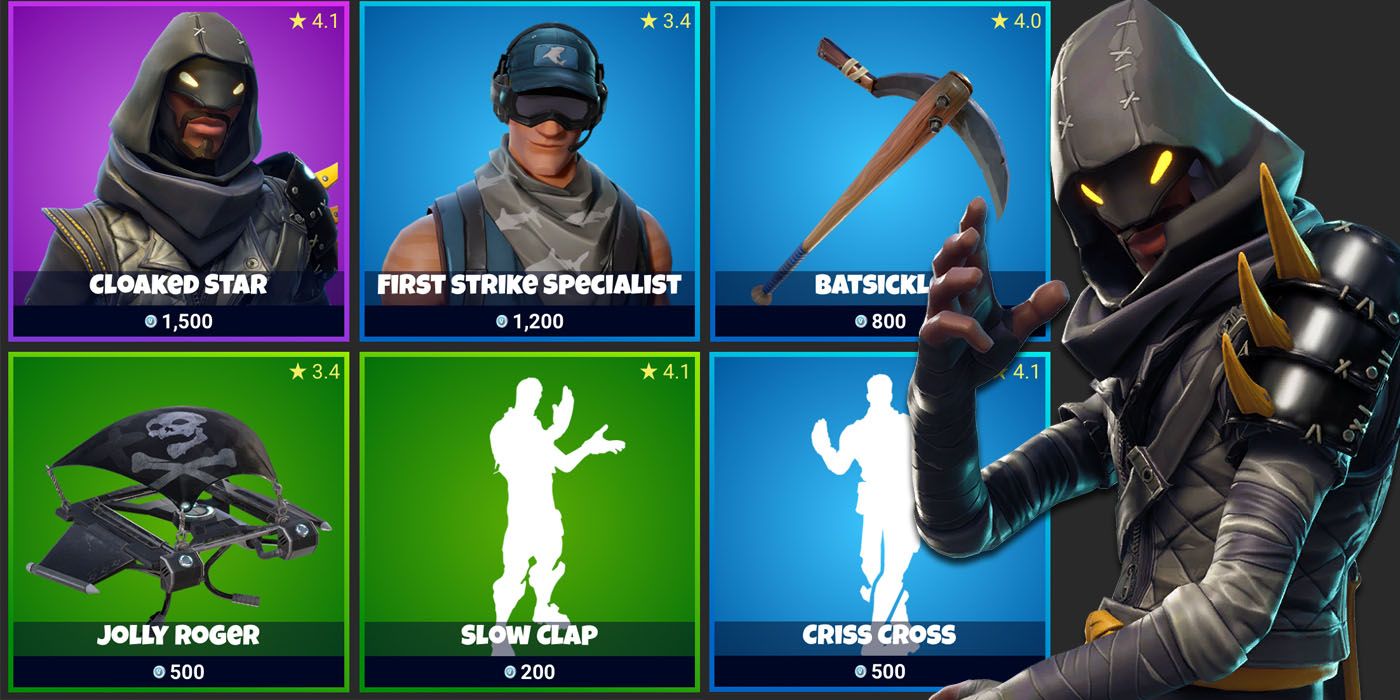

Fortnite Item Shop Update Sparks Player Anger And Frustration

May 03, 2025

Fortnite Item Shop Update Sparks Player Anger And Frustration

May 03, 2025