Changes To HMRC Tax Codes And Their Impact On Savings

Table of Contents

Common HMRC Tax Code Changes and Their Implications

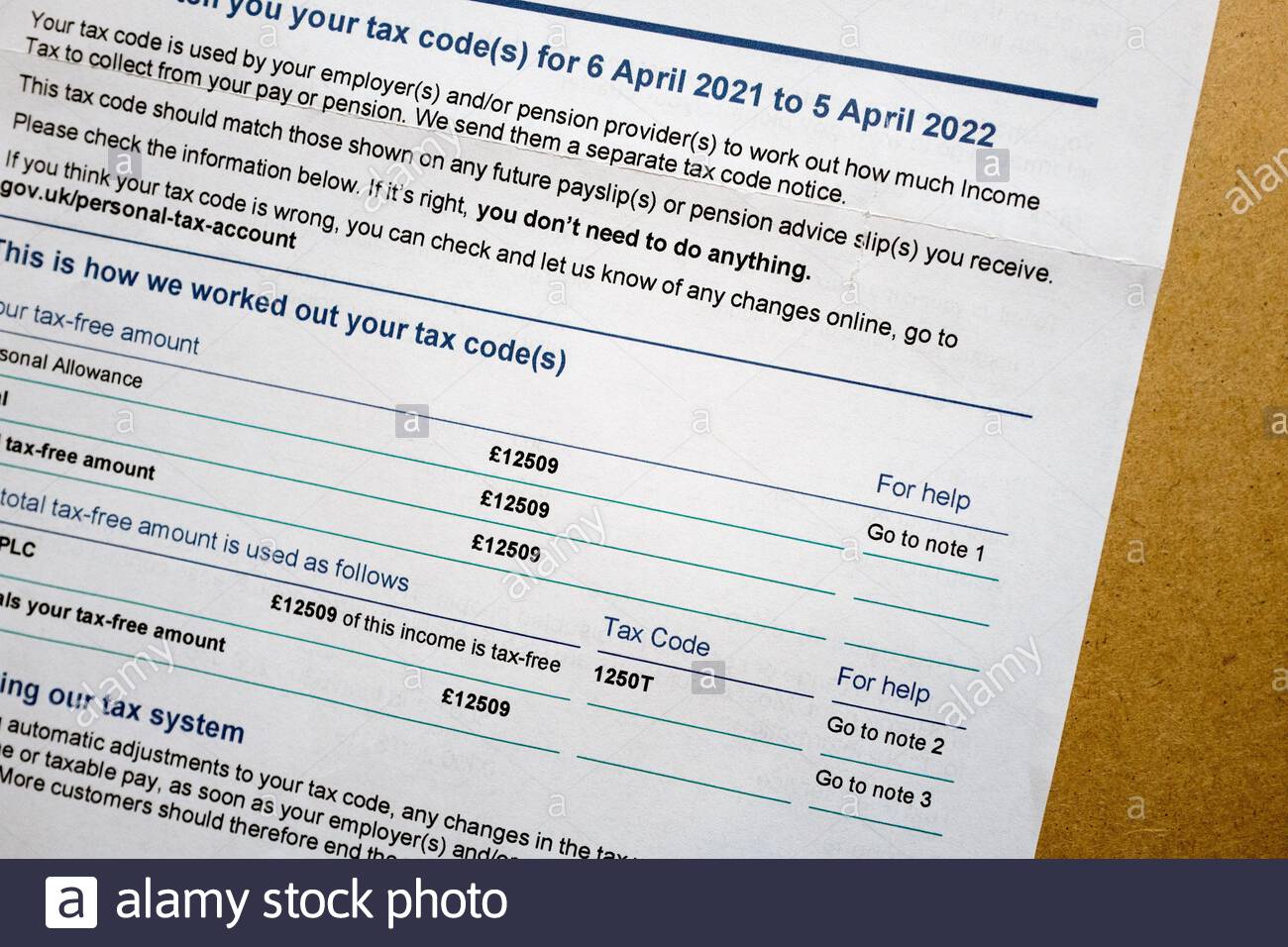

HMRC tax codes are alphanumeric codes assigned to individuals, determining the amount of income tax deducted from their earnings. Understanding changes to these codes is vital for managing your finances effectively.

Understanding BR Codes and their Effect on Your Take-Home Pay

A BR (Basic Rate) tax code, such as 1257L, indicates that your income tax is calculated at the basic rate (currently 20%). However, variations exist. A change to a BR code might signify:

- Change in Employment Status: Moving from part-time to full-time employment or vice-versa can necessitate a tax code adjustment.

- Adjustments for Previous Tax Years: If HMRC identifies an underpayment or overpayment in a previous tax year, your current tax code might be adjusted to rectify this.

- Tax Relief Changes: Changes in tax reliefs, such as marriage allowance, can affect your tax code.

Examples of BR Code Changes and Financial Consequences:

- Switching from a lower tax code to a BR code could mean a higher tax deduction, reducing your net pay.

- Conversely, moving from a higher tax code to a BR code might result in a smaller tax deduction and increased net income.

For more detailed information on BR codes and their variations, visit the official HMRC website.

Impact of Emergency Tax Codes

Receiving an emergency tax code (e.g., K100) signifies that HMRC is using a temporary code until your correct tax code can be determined. This often results in higher tax deductions because the system assumes a higher income. Reasons for an emergency tax code include:

- Starting a new job without providing your previous tax details.

- Changes to employment circumstances that haven't been reported to HMRC.

Steps to Take if You Receive an Emergency Tax Code:

- Contact your employer to verify your tax code information.

- Check your HMRC online account to confirm the correct tax code.

- Contact HMRC directly if discrepancies persist.

Emergency tax codes can lead to significant overpayment of tax; therefore, prompt action is essential to claim a refund.

Changes Due to Pension Contributions and Tax Relief

Pension contributions are a powerful tool to reduce your overall tax liability. Higher contributions generally result in a lower tax code, reflecting the tax relief you're entitled to.

Tax Benefits of Pension Contributions:

- Reduced income tax liability in the current tax year.

- Potential tax-free growth of your pension investments.

- Tax-free withdrawals in retirement (subject to limits).

Changes in your pension contributions will trigger an adjustment in your tax code, reflecting the increased or decreased tax relief. Ensure you inform HMRC and your pension provider of any changes.

Checking Your HMRC Tax Code and Understanding Your Payslip

Regularly checking your tax code and understanding your payslip is crucial for effective financial management.

Accessing Your Tax Code Online

The simplest method is through your HMRC online account:

- Visit the GOV.UK website.

- Log in using your Government Gateway credentials.

- Navigate to your tax details. Your tax code will be clearly displayed.

Alternatively, you can contact HMRC via phone or post.

Deciphering Your Payslip

Your payslip provides a detailed breakdown of your earnings and deductions. Key terms include:

- Gross Pay: Your total earnings before any deductions.

- Tax Deducted: The amount of income tax deducted from your gross pay.

- Net Pay: Your take-home pay after all deductions (including tax, National Insurance contributions, etc.).

Carefully review your payslip for any discrepancies in tax calculations. Any errors should be promptly reported to your employer and HMRC.

Strategies to Maximize Savings Despite HMRC Tax Code Changes

Proactive financial planning helps you maximize your savings even with fluctuating tax codes.

Tax-Efficient Savings and Investment Options

Consider tax-efficient investment vehicles to minimize your tax liability:

- ISAs (Individual Savings Accounts): Offer tax-free growth and withdrawals on your savings and investments, up to an annual limit.

- Pensions: Provide tax relief on contributions and tax-free growth, making them an excellent long-term savings option.

Choosing the right investment strategy depends on your risk tolerance, financial goals, and tax situation.

Planning for Tax Liabilities

Accurate record-keeping is essential for avoiding penalties:

- Maintain detailed records of all income and expenses.

- Understand your tax obligations and plan accordingly.

- Seek professional financial advice for complex tax situations.

Conclusion: Managing Your Finances Effectively with Updated HMRC Tax Codes

Staying informed about HMRC tax code changes is vital for effective financial planning. Understanding your tax code, regularly reviewing your payslip, and utilizing tax-efficient savings options can significantly impact your savings and overall financial well-being. Regularly check your HMRC online account, understand your payslip deductions, and seek professional financial advice when needed. Stay informed about changes to your HMRC tax code to effectively manage your savings and maximize your financial well-being. Visit the HMRC website for further information.

Featured Posts

-

Home Office Riesenie Pre Buducnost Alebo Docasne Nudzove Opatrene

May 20, 2025

Home Office Riesenie Pre Buducnost Alebo Docasne Nudzove Opatrene

May 20, 2025 -

Manchester Uniteds 62 5m Bid For Arsenal And Chelsea Target

May 20, 2025

Manchester Uniteds 62 5m Bid For Arsenal And Chelsea Target

May 20, 2025 -

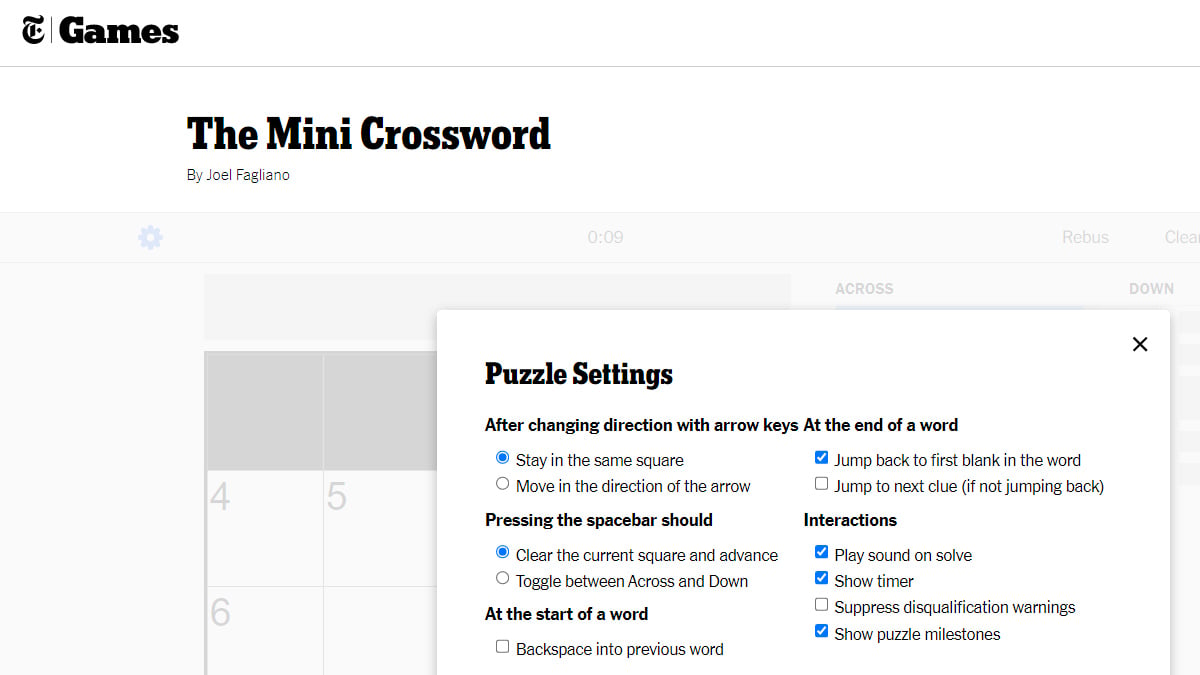

Nyt Mini Crossword Answers For March 8 2024

May 20, 2025

Nyt Mini Crossword Answers For March 8 2024

May 20, 2025 -

Richard Mille Rm 72 01 Charles Leclercs New Racing Chronograph

May 20, 2025

Richard Mille Rm 72 01 Charles Leclercs New Racing Chronograph

May 20, 2025 -

Friisin Avauskokoonpano Kamaran Ja Pukin Vaihdon Vaikutukset

May 20, 2025

Friisin Avauskokoonpano Kamaran Ja Pukin Vaihdon Vaikutukset

May 20, 2025