Chart Of The Week: Bitcoin's Potential 10x Price Surge

Table of Contents

Analyzing Bitcoin's Historical Price Movements & Growth Cycles

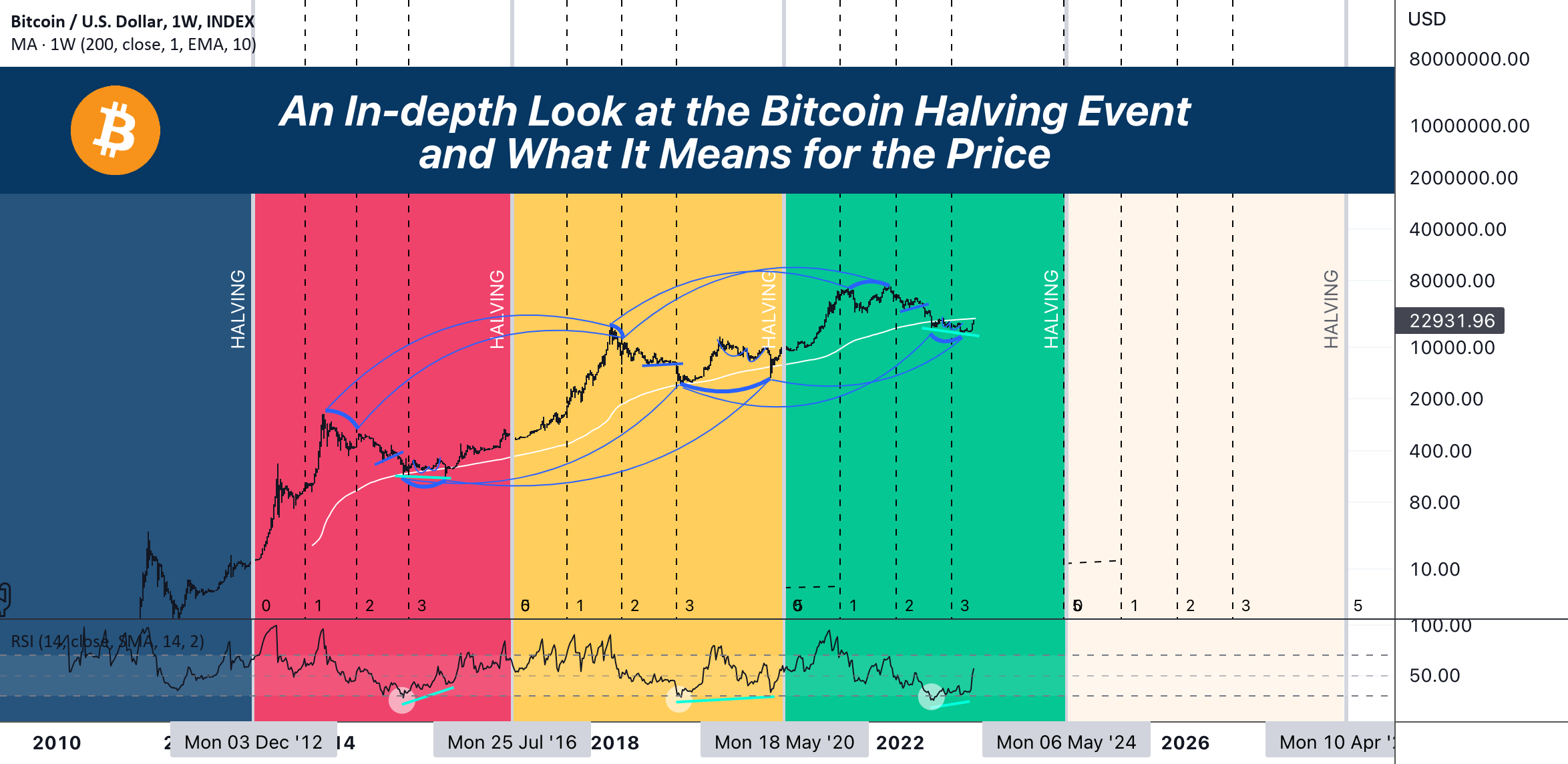

Bitcoin's price has historically followed cyclical patterns, with periods of explosive growth followed by significant corrections. Understanding these cycles is crucial to evaluating the potential for a 10x surge.

Past Halving Events and Subsequent Price Increases

Bitcoin's halving events, which occur approximately every four years, significantly reduce the rate of new Bitcoin creation. This reduction in supply has historically been correlated with subsequent price increases.

- 2012 Halving: Followed by a substantial price increase over the next year.

- 2016 Halving: Led to a significant bull market culminating in the 2017 peak.

- 2020 Halving: Showed a similar, albeit more prolonged, upward trend.

[Insert Chart showcasing Bitcoin price action following each halving event]

The correlation between halving events and price appreciation isn't guaranteed, but the historical data suggests a strong link between reduced supply and increased demand, driving price increases. The upcoming halving event further fuels the speculation around Bitcoin's potential 10x price surge. Analyzing past Bitcoin halving events is key to understanding Bitcoin price history and predicting future price cycles.

Technical Analysis: Identifying Key Support and Resistance Levels

Technical analysis provides valuable insights into potential price movements. By studying chart patterns, indicators, and support/resistance levels, analysts can identify potential price targets.

[Insert Chart illustrating key support and resistance levels on a Bitcoin price chart]

Currently, certain technical indicators suggest a potential breakout from a period of consolidation, hinting at the possibility of a significant price increase. Identifying key support and resistance levels using technical analysis is crucial for both traders and investors aiming to understand Bitcoin chart patterns.

On-Chain Metrics Suggesting Growing Adoption and Demand

On-chain data, reflecting the activity on the Bitcoin network, provides valuable insights into adoption and demand. Key metrics include:

- Active Addresses: The number of unique addresses interacting with the network. A rise suggests increased user activity and adoption.

- Transaction Volume: The total value of Bitcoin transacted on the network. Higher volume indicates increased demand and usage.

- Mining Difficulty: A measure of the computational power securing the Bitcoin network. Increased difficulty suggests a healthy and competitive mining landscape.

[Insert Chart visualizing relevant on-chain metrics]

The increasing values of these on-chain metrics suggest growing adoption and network activity, which can be interpreted as positive indicators for Bitcoin's price. Analyzing on-chain analysis is crucial for assessing Bitcoin adoption rates and understanding the overall health of the Bitcoin network.

Factors Driving Bitcoin's Potential 10x Price Surge

Beyond historical trends and technical analysis, several fundamental factors contribute to the potential for a 10x price surge in Bitcoin.

Increasing Institutional Investment and Adoption

Institutional investors, including major corporations like MicroStrategy and Tesla, have significantly increased their Bitcoin holdings. This influx of capital adds legitimacy and further boosts demand. The anticipated approval of Bitcoin ETFs could further accelerate institutional adoption, potentially triggering a large-scale price increase. This institutional adoption is a key driver in understanding Bitcoin's potential growth.

Growing Global Adoption and Mainstream Acceptance

Bitcoin's adoption is expanding beyond early adopters and crypto enthusiasts. Payment processors and financial institutions are increasingly integrating Bitcoin, making it more accessible to the mainstream. This growing acceptance contributes to increased demand and a higher valuation. The growth of global payments using Bitcoin is a significant indicator of mainstream acceptance and potential future growth.

Macroeconomic Factors and Safe-Haven Demand

In times of economic uncertainty, inflation, and geopolitical instability, Bitcoin's role as a potential hedge against inflation and a store of value becomes increasingly significant. Investors are increasingly seeking alternative assets, and Bitcoin is seen by some as a safe-haven asset. This demand driven by macroeconomic factors contributes to Bitcoin's potential growth. Bitcoin's position as a potential hedge against inflation is a key factor driving its value.

Potential Risks and Challenges to a 10x Price Surge

While the potential for a 10x price surge is enticing, it's crucial to acknowledge the inherent risks and challenges.

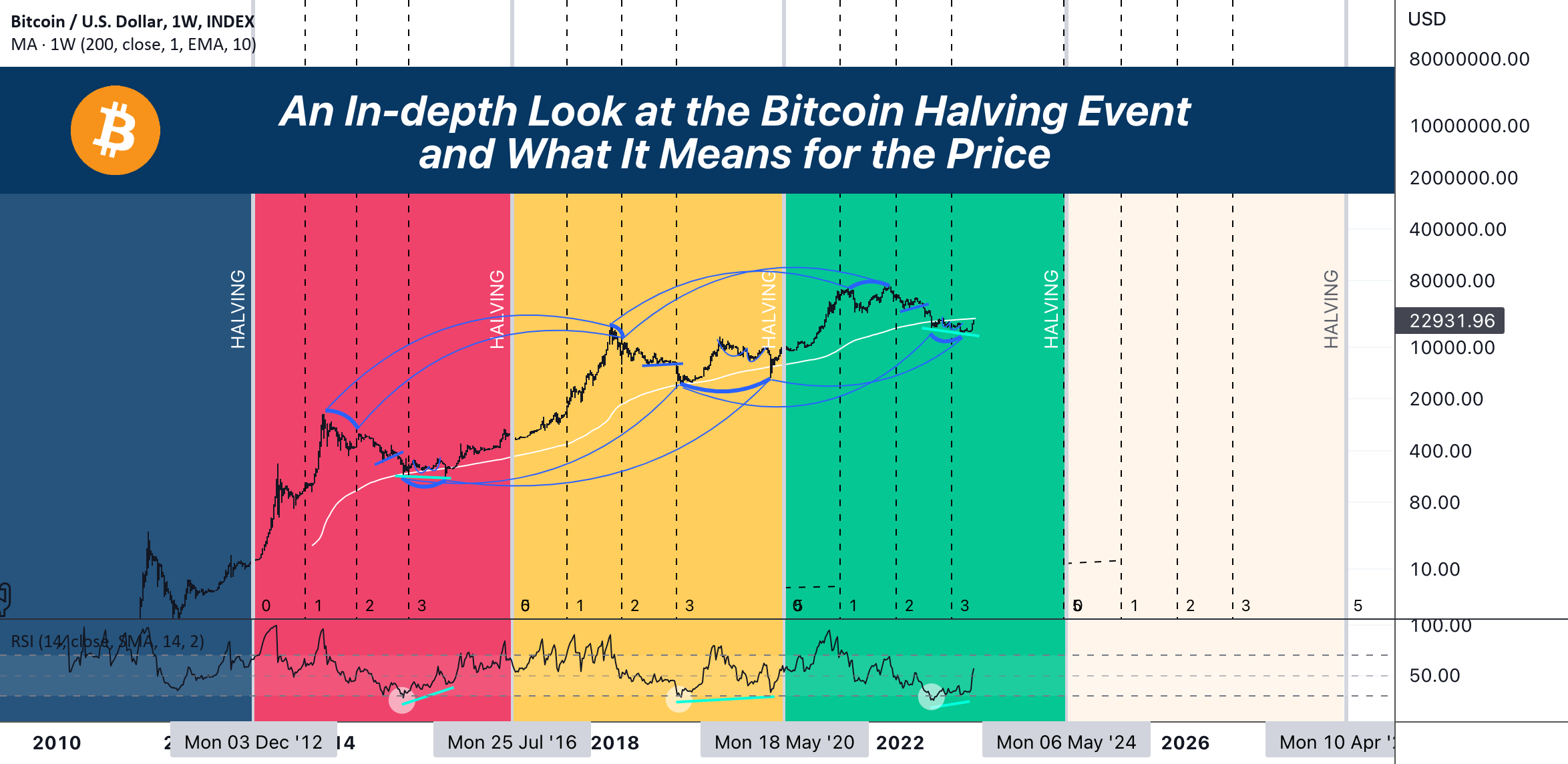

Regulatory Uncertainty and Government Intervention

Regulatory uncertainty remains a significant factor. Varying regulatory approaches across different countries can impact Bitcoin's price and adoption. Government intervention, whether supportive or restrictive, can significantly influence Bitcoin's trajectory. Understanding Bitcoin regulation is critical for navigating its volatile nature.

Market Volatility and Price Corrections

The cryptocurrency market is inherently volatile. Significant price corrections are a common occurrence, and investors need to be prepared for such fluctuations. Effective risk management strategies are essential for navigating the market's volatility. Managing risk effectively in the face of Bitcoin's volatility is paramount.

Competition from other Cryptocurrencies

Bitcoin faces competition from other cryptocurrencies, often referred to as altcoins. While Bitcoin remains the dominant cryptocurrency by market capitalization, competition can impact its price and market share. Understanding the competitive landscape is crucial for assessing Bitcoin's future prospects.

Conclusion

The potential for a Bitcoin's potential 10x price surge is a compelling proposition, fueled by historical price cycles, technical analysis, growing institutional adoption, and increasing mainstream acceptance. However, it's vital to remember that the cryptocurrency market is volatile and subject to regulatory risks and competition. While the bullish indicators are noteworthy, a balanced perspective acknowledging the inherent risks is crucial. Stay tuned for further analysis of Bitcoin's potential 10x price surge and make informed decisions about your cryptocurrency investments. Learn more about Bitcoin’s potential and how to navigate its volatility.

Featured Posts

-

Grbovic O Prelaznoj Vladi Svi Predlozi Su Na Stolu

May 08, 2025

Grbovic O Prelaznoj Vladi Svi Predlozi Su Na Stolu

May 08, 2025 -

Inter Milans Historic Champions League Final Victory Over Barcelona

May 08, 2025

Inter Milans Historic Champions League Final Victory Over Barcelona

May 08, 2025 -

The Us Tariff Impact On Gms Canadian Operations An Expert View

May 08, 2025

The Us Tariff Impact On Gms Canadian Operations An Expert View

May 08, 2025 -

Rusya Merkez Bankasi Ndan Kripto Para Uyarisi Yatirimcilar Icin Riskler Neler

May 08, 2025

Rusya Merkez Bankasi Ndan Kripto Para Uyarisi Yatirimcilar Icin Riskler Neler

May 08, 2025 -

New Trailer For The Long Walk A Chilling Adaptation That Shocked Stephen King

May 08, 2025

New Trailer For The Long Walk A Chilling Adaptation That Shocked Stephen King

May 08, 2025

Latest Posts

-

Updated Batman Costume And New 1 Comic Book Dc Comics Announcement

May 08, 2025

Updated Batman Costume And New 1 Comic Book Dc Comics Announcement

May 08, 2025 -

The Best War Movie Saving Private Ryans Legacy Challenged

May 08, 2025

The Best War Movie Saving Private Ryans Legacy Challenged

May 08, 2025 -

Batmans New Beginning Dc Comics Unveils 1 Issue And Updated Suit

May 08, 2025

Batmans New Beginning Dc Comics Unveils 1 Issue And Updated Suit

May 08, 2025 -

Pierce County Homes Transformation From Historic House To Public Park

May 08, 2025

Pierce County Homes Transformation From Historic House To Public Park

May 08, 2025 -

Demolition Makes Way For New Park In Pierce County

May 08, 2025

Demolition Makes Way For New Park In Pierce County

May 08, 2025