Check Today's Personal Loan Interest Rates & Apply Now

Table of Contents

Understanding Personal Loan Interest Rates

Personal loan interest rates represent the cost of borrowing money. They are expressed as an Annual Percentage Rate (APR), which includes the interest rate plus any associated fees. Understanding APR is vital, as it provides a complete picture of the loan's cost. Personal loans can have either fixed or variable interest rates. A fixed interest rate remains constant throughout the loan term, providing predictable monthly payments. Variable interest rates, on the other hand, fluctuate with market conditions, leading to potentially changing monthly payments.

- Factors influencing interest rates:

- Credit score: A higher credit score significantly impacts the interest rate you'll receive. Lenders view a high score as an indicator of lower risk.

- Loan amount: Larger loan amounts often come with slightly higher interest rates.

- Loan term: Shorter loan terms typically result in higher monthly payments but lower overall interest paid. Longer terms mean lower monthly payments but higher total interest.

- Lender type: Different lenders (banks, credit unions, online lenders) have varying interest rate structures.

- Income: Your income demonstrates your ability to repay the loan, influencing the lender's risk assessment.

- Debt-to-income ratio (DTI): This ratio shows your debt compared to your income. A lower DTI indicates a greater capacity to repay, leading to potentially lower interest rates.

- Calculating monthly payments: Numerous online calculators can estimate your monthly payment based on the loan amount, interest rate, and loan term. This allows you to budget effectively before applying.

- Impact of credit score: A higher credit score (700 or above) significantly improves your chances of securing a lower personal loan interest rate.

How to Find the Best Personal Loan Interest Rates Today

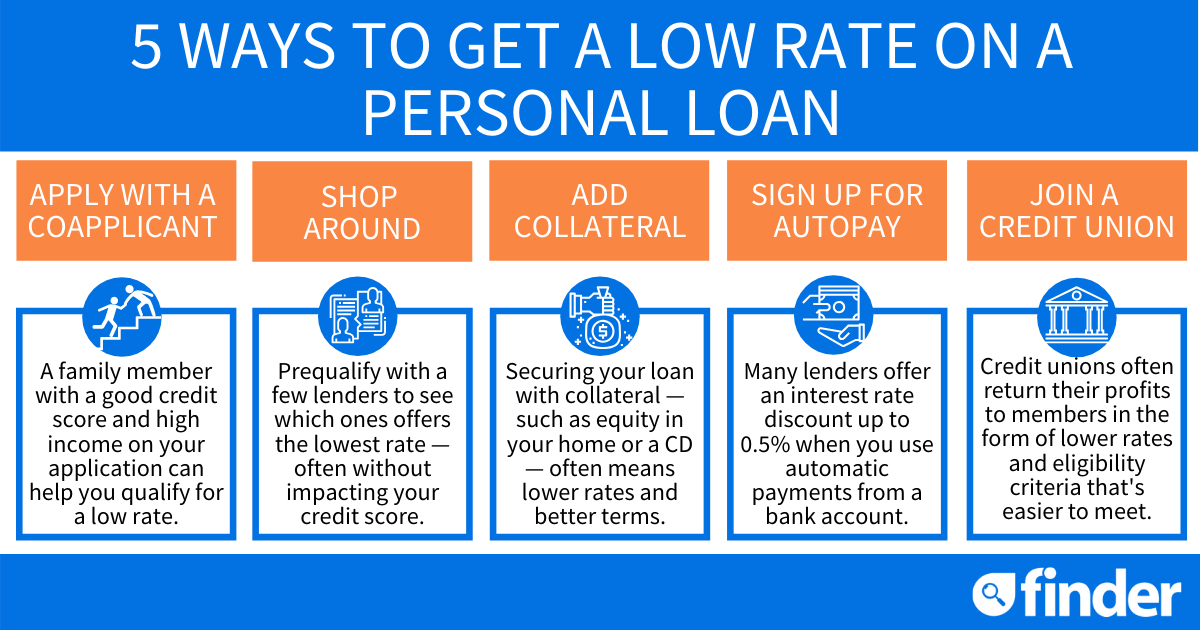

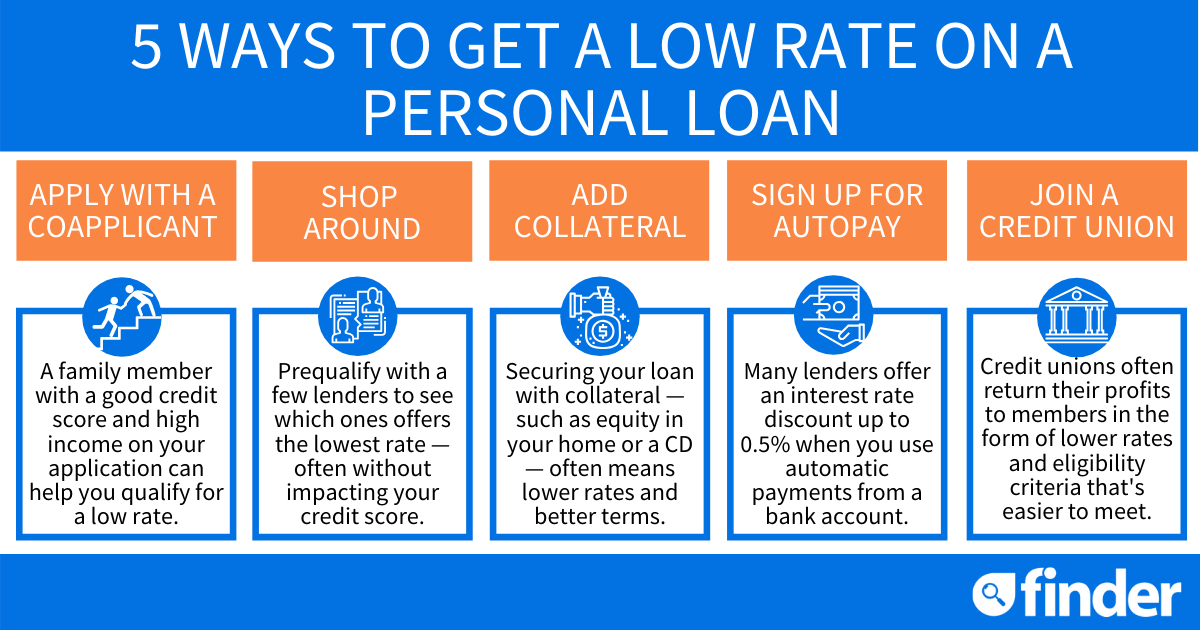

Finding the best personal loan interest rates requires diligent comparison shopping. Don't settle for the first offer you receive. Utilize online comparison tools and visit lender websites directly to gather multiple quotes.

- Reputable online comparison websites: Many websites specialize in comparing personal loan offers from various lenders. Research and choose reputable platforms.

- Steps to compare interest rates:

- Focus on the APR, not just the stated interest rate.

- Carefully examine any fees associated with the loan (origination fees, prepayment penalties).

- Compare repayment terms to find a plan that suits your budget.

- Checking lender reviews and ratings: Before committing, read reviews from other borrowers to gauge a lender's reputation and customer service.

- Negotiating a lower interest rate: Once you have a few offers, don't hesitate to contact lenders and negotiate for a lower interest rate, especially if you have a strong credit history and other attractive financial attributes.

Factors Affecting Your Personal Loan Interest Rate

Lenders utilize a range of factors to assess your creditworthiness and determine your personal loan interest rate. Understanding these factors can help you prepare and potentially secure a better rate.

- Credit score impact: Your credit score is the most significant factor. Aim for a score of 700 or higher for the best rates.

- Debt-to-income ratio: Keep your DTI ratio low (ideally below 36%) by managing your existing debt effectively.

- Loan amount impact: Larger loan amounts typically carry slightly higher interest rates due to increased risk for the lender.

- Loan term impact: Choosing a shorter loan term will usually result in a lower overall interest paid, but higher monthly payments.

- Strategies to improve credit score: Pay bills on time, keep credit utilization low, and monitor your credit report regularly.

- Calculating debt-to-income ratio: Divide your total monthly debt payments by your gross monthly income.

- Managing debt to qualify for better rates: Prioritize paying down high-interest debt to improve your DTI ratio.

The Application Process for a Personal Loan

Applying for a personal loan is typically a straightforward process, especially when done online. Most lenders offer online application portals for convenience.

- Required documents: Generally, you'll need proof of income (pay stubs, tax returns), identification (driver's license, passport), and proof of address (utility bill).

- Online application process: Complete the online application form, providing accurate information. You may need to upload supporting documents.

- Expected processing time: The processing time varies between lenders, but it can often range from a few days to a couple of weeks.

- What to do if your application is rejected: If rejected, check your credit report for errors, address any outstanding debts, and consider reapplying after improving your financial situation.

Conclusion

Checking today's personal loan interest rates is paramount to securing the best possible deal. By comparing offers from multiple lenders, understanding the factors influencing interest rates, and following the application process steps outlined above, you can make an informed decision and acquire a low interest personal loan that meets your needs. Don't delay, check today's rates and secure your low-interest personal loan! Find the best personal loan interest rates today and apply now! Apply for your personal loan with the lowest interest rate possible!

Featured Posts

-

Kanye West And Bianca Censori Exclusive Report On Fears And Concerns

May 28, 2025

Kanye West And Bianca Censori Exclusive Report On Fears And Concerns

May 28, 2025 -

Prakiraan Cuaca Jawa Barat Besok 7 5 Antisipasi Hujan Lebat

May 28, 2025

Prakiraan Cuaca Jawa Barat Besok 7 5 Antisipasi Hujan Lebat

May 28, 2025 -

Leeds United News Second Summer Signing Close Kalvin Phillips Transfer News

May 28, 2025

Leeds United News Second Summer Signing Close Kalvin Phillips Transfer News

May 28, 2025 -

Marlins Edge Athletics With Kyle Stowers Walk Off Grand Slam

May 28, 2025

Marlins Edge Athletics With Kyle Stowers Walk Off Grand Slam

May 28, 2025 -

Nl West Powerhouse Showdown Padres Dodgers Lead Burnes Sidelined

May 28, 2025

Nl West Powerhouse Showdown Padres Dodgers Lead Burnes Sidelined

May 28, 2025