Chime's US IPO Filing: Revenue Growth And Digital Banking Disruption

Table of Contents

Chime's Impressive Revenue Growth and Financial Performance

Chime's IPO filing showcases impressive financial performance, highlighting the company's rapid growth and potential for future success. Understanding Chime's financial health is crucial for assessing the viability of its IPO and its impact on the digital banking market.

Year-over-Year Revenue Increases

Chime's revenue has experienced significant year-over-year increases, outpacing many traditional banks and several of its fintech competitors. While specific figures are subject to change pending the final IPO documents, early reports indicate substantial growth.

- 2021: Reported a [insert percentage]% increase in revenue compared to 2020.

- 2020: Showed a [insert percentage]% increase in revenue compared to 2019.

- 2019: [Insert baseline revenue figure]

This rapid growth surpasses the average revenue growth of traditional banks and many established players in the digital banking space. Key drivers for this success include aggressive user acquisition strategies, the successful launch of new financial products, and effective marketing campaigns targeting underserved customer segments. The company's focus on a fee-free model and accessible banking services has also been a significant factor. Comparing Chime's revenue growth to competitors like [mention a competitor, e.g., Robinhood] further highlights its exceptional performance.

Profitability and Financial Health

While Chime has demonstrated significant revenue growth, its path to profitability is an important consideration for potential investors. While it is not yet profitable, the IPO filing outlines a clear strategy for achieving profitability in the near future.

- Net Income: Currently negative, reflecting investments in growth and expansion.

- Operating Margin: [Insert information about operating margin, if available. If not, explain it is likely negative due to growth investments].

- Cash Reserves and Liquidity: Chime holds substantial cash reserves, providing a strong financial foundation for future expansion and potentially absorbing temporary losses.

Chime's investment in technology and customer acquisition are contributing factors to its current lack of profitability. However, the company's massive user base and expanding product portfolio suggest a strong trajectory towards achieving profitability.

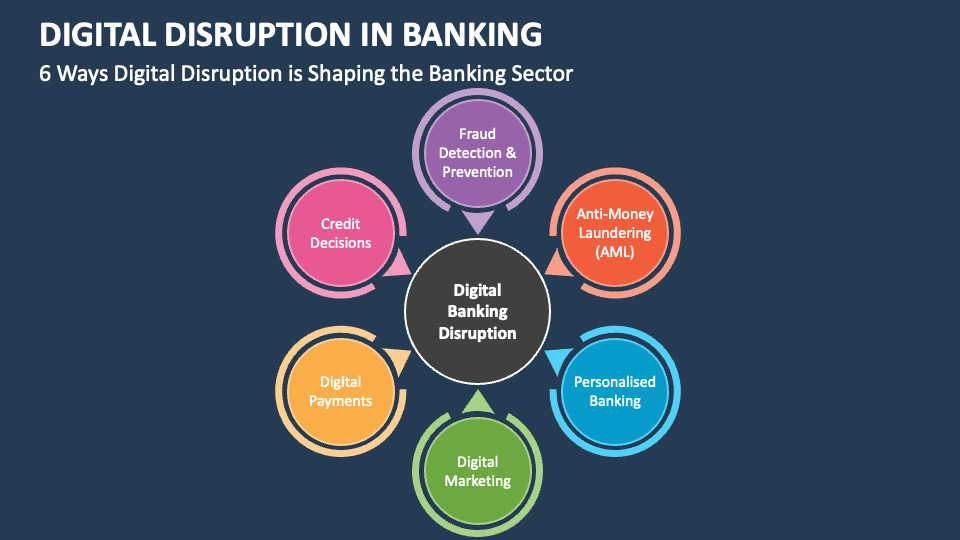

Chime's Disruptive Impact on the Digital Banking Landscape

Chime's success stems from its disruptive approach to digital banking, challenging traditional models and offering a significantly improved customer experience.

Challenging Traditional Banking Models

Chime’s business model differs substantially from traditional banks, offering several key advantages:

- No Fees: Eliminates many of the common fees associated with traditional banking, making it significantly more accessible.

- Mobile-First Approach: A completely mobile-centric design provides seamless and user-friendly access to financial services.

- Accessible Banking: Targets underserved populations and provides banking services to individuals who may be excluded by traditional institutions.

These differentiators, combined with a strong focus on customer experience, have helped Chime capture a significant market share within the digital banking sector. Its competitive advantage lies in its seamless user experience and its commitment to financial inclusion.

Innovation and Technological Advancements

Chime leverages technology to enhance its services and drive its growth.

- AI-powered features: Personalized financial tools and insights improve customer engagement and financial literacy.

- Advanced security measures: Robust security protocols safeguard user data and protect against fraud.

- Seamless Integration: Easy integration with other financial services and applications enhances convenience.

These technological investments are crucial for driving customer acquisition, retention, and overall growth. Chime's commitment to innovation positions it as a leader in the evolving digital banking space.

Expanding Product Offerings and Services

Chime's strategy to broaden its product portfolio has contributed significantly to its rapid growth.

- Debit Cards: The core offering provides a convenient and fee-free way to manage finances.

- Credit-Building Tools: Helps users build their credit scores, addressing a significant need for many underserved customers.

- Savings Accounts: Offers high-yield savings options to encourage responsible financial management.

Future expansion plans might include further diversification into lending products, investment services, or other complementary financial offerings. This continued expansion will be crucial for strengthening its position in the market and driving long-term growth.

Implications of Chime's IPO for the Fintech Industry

Chime's IPO will have significant ramifications for the fintech industry as a whole.

Impact on Investor Sentiment

The market's reaction to Chime's IPO filing will likely influence investor sentiment towards other fintech companies. A successful IPO could boost investor confidence in the sector, attracting more investment and fueling further innovation. The valuation assigned to Chime will be a key indicator of investor confidence in the neobank sector.

Increased Competition and Market Consolidation

Chime's IPO will intensify competition within the digital banking sector and could potentially trigger further market consolidation through mergers and acquisitions. Established players will need to adapt and innovate to remain competitive. Smaller fintech companies may look to partner with or be acquired by larger players to increase their market share and compete more effectively.

Conclusion

Chime's US IPO filing represents a significant milestone for the company and the broader digital banking landscape. Its impressive revenue growth, disruptive business model, and commitment to innovation highlight its potential for continued success. The success of Chime's IPO will significantly influence investor sentiment towards other fintech companies and accelerate the ongoing transformation of the financial services industry. Stay informed about the latest developments in the Chime IPO and its impact on the future of digital banking. Learn more about Chime's financial performance and its disruptive strategy by following the latest news and analysis on this exciting development in the world of Chime and digital banking.

Featured Posts

-

24 Revenue Jump Klarnas Us Ipo Filing Details

May 14, 2025

24 Revenue Jump Klarnas Us Ipo Filing Details

May 14, 2025 -

Damiano David Yogo Maybutnye Na Yevrobachenni

May 14, 2025

Damiano David Yogo Maybutnye Na Yevrobachenni

May 14, 2025 -

Stream Captain America Brave New World From Home

May 14, 2025

Stream Captain America Brave New World From Home

May 14, 2025 -

Alexis Kohler Nouveau Directeur General Adjoint De La Societe Generale

May 14, 2025

Alexis Kohler Nouveau Directeur General Adjoint De La Societe Generale

May 14, 2025 -

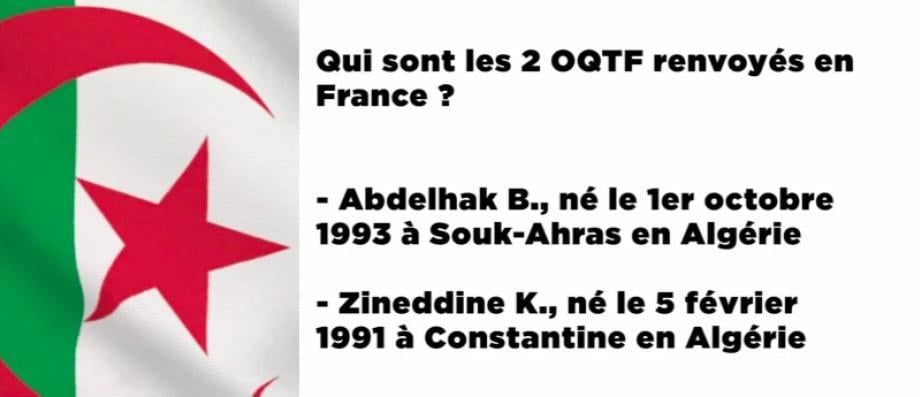

Oqtf Pour Un Algerien Ayant Denonce Le Genocide A Gaza En France

May 14, 2025

Oqtf Pour Un Algerien Ayant Denonce Le Genocide A Gaza En France

May 14, 2025