China Life Profit Rises: Investment Resilience Drives Growth

Table of Contents

Record-Breaking Investment Returns Boost China Life's Bottom Line

China Life's stellar financial performance is directly attributable to its exceptional investment returns. The company's diversified portfolio, coupled with strategic asset allocation, has proven remarkably resilient, even during periods of market volatility.

Strong Performance Across Asset Classes

China Life's success stems from a well-diversified investment portfolio spanning various asset classes. This strategic approach has yielded impressive results across the board.

- Equities: Significant gains were realized in the equity market, driven by strong performance in both domestic and international markets. Returns exceeded projections by X%, contributing substantially to overall China Life profit.

- Bonds: The fixed-income portfolio also contributed significantly, with returns of Y% exceeding benchmark indices. Careful selection of high-quality bonds minimized risk and maximized yield.

- Real Estate: Strategic investments in prime real estate properties generated substantial returns of Z%, further bolstering China Life's overall profitability. These investments were carefully selected to align with long-term growth projections.

A particularly successful investment was the company's stake in [mention a specific company or project], which yielded a substantial return of [percentage] %. This strategic move highlights China Life's ability to identify and capitalize on high-growth opportunities.

Strategic Asset Allocation Mitigates Risk

China Life's sophisticated risk management framework played a crucial role in mitigating potential losses during periods of market uncertainty. Their approach involved:

- Diversification: Spreading investments across multiple asset classes reduced exposure to any single market downturn.

- Hedging strategies: Implementing effective hedging techniques protected against adverse market movements.

- Stress testing: Regularly testing the portfolio against various economic scenarios allowed for proactive risk mitigation.

This proactive risk management approach not only protected the company’s assets but also contributed to its ability to consistently deliver strong returns, substantially impacting China Life profit.

Favorable Market Conditions Contribute to China Life's Success

While China Life's internal strategies were key to its success, favorable external factors also played a significant role.

Booming Chinese Economy

The robust growth of the Chinese economy has created a fertile ground for China Life's expansion. Key economic indicators, including a healthy GDP growth rate of [insert percentage]% and rising consumer spending, have fueled demand for insurance products and investment opportunities. This positive economic environment directly contributes to increasing China Life profit.

Regulatory Environment

Supportive government policies and a stable regulatory environment have further facilitated China Life's growth. Initiatives aimed at boosting the insurance sector, such as [mention specific policy or initiative], created a more favorable landscape for investment and expansion. This regulatory support plays a crucial role in maintaining China Life's financial stability and increasing China Life profit.

Future Outlook and Implications for China Life's Growth

Despite its current success, China Life faces both challenges and opportunities in the years to come.

Maintaining Momentum in a Changing Market

Navigating potential risks is paramount for sustaining future growth. These include:

- Geopolitical uncertainty: Global political instability can impact market volatility and investment returns.

- Economic slowdown: A potential slowdown in the Chinese economy could dampen demand for insurance products.

However, China Life is well-positioned to capitalize on opportunities such as:

- Expanding into new markets: Exploring international expansion offers avenues for growth.

- Developing innovative products: Creating innovative insurance and investment products can attract new customers.

Long-Term Growth Strategy

China Life is committed to long-term growth and profitability through a multi-pronged strategy that involves:

- Technological advancements: Investing in technology to improve efficiency and customer experience.

- Strategic acquisitions: Exploring strategic acquisitions to expand market share and capabilities.

- Talent development: Investing in talent acquisition and training to ensure continued success.

These initiatives underscore China Life's commitment to creating long-term value for shareholders and sustaining its impressive growth trajectory.

Conclusion

The significant rise in China Life profit is a direct result of a potent combination of factors: record-breaking investment returns driven by a diversified portfolio and strategic risk management, coupled with the benefits of a thriving Chinese economy and a supportive regulatory environment. Looking ahead, China Life’s proactive approach to managing future challenges and capitalizing on growth opportunities ensures a positive outlook. Stay informed about China Life's profit growth and its continued success by visiting their official website for financial reports and investor information. The sustained success of China Life profit is a powerful testament to the company's strength and resilience.

Featured Posts

-

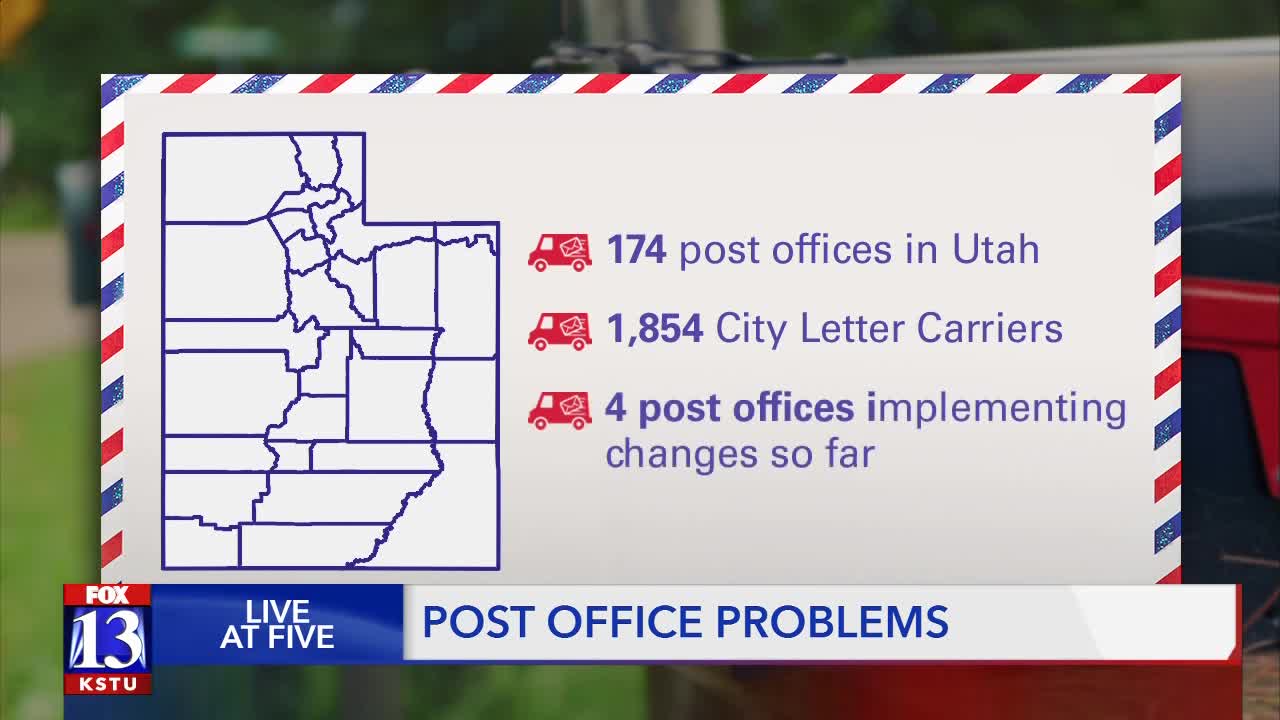

Louisville Postal Service Mail Delays Expected To Conclude Soon

May 01, 2025

Louisville Postal Service Mail Delays Expected To Conclude Soon

May 01, 2025 -

Inflation And Chocolate The Story Behind A Pregnancy Cravings Global Impact

May 01, 2025

Inflation And Chocolate The Story Behind A Pregnancy Cravings Global Impact

May 01, 2025 -

Frances Rugby Triumph Duponts 11 Point Masterclass Against Italy

May 01, 2025

Frances Rugby Triumph Duponts 11 Point Masterclass Against Italy

May 01, 2025 -

Tfasyl Qdyt Ryys Shbab Bn Jryr Alhkm Walrdwd

May 01, 2025

Tfasyl Qdyt Ryys Shbab Bn Jryr Alhkm Walrdwd

May 01, 2025 -

Viewers Question Dragons Den After Repeat Shows Failed Business

May 01, 2025

Viewers Question Dragons Den After Repeat Shows Failed Business

May 01, 2025