China Tariffs: Analysts Predict Trump's 30% Duty Extension To 2025

Table of Contents

Projected Timeline and Impact of Extended China Tariffs

The 2025 Prediction and its Basis

Several leading economic analysts predict a continuation of the 30% China tariffs until at least 2025. This prediction is based on several factors. Firstly, ongoing trade tensions between the US and China haven't fully resolved, with disputes over intellectual property, technology transfer, and market access remaining significant hurdles. Secondly, domestic political considerations in the US play a crucial role. Protectionist sentiments remain strong among certain sectors, making a complete removal of tariffs politically challenging. Finally, the perceived need for continued protectionist measures to safeguard American industries contributes to the prediction of extended China tariffs.

- Specific examples of impacted industries: Technology (semiconductors, smartphones), manufacturing (textiles, machinery), and agriculture (soybeans, pork).

- Potential economic consequences: Increased inflation, reduced consumer spending, slower economic growth, and potential job losses in tariff-sensitive sectors.

- Geopolitical ramifications: Strained US-China relations, potential for retaliatory tariffs from China, and increased uncertainty in the global trading system. The China tariffs extension could further complicate international trade negotiations and agreements. The tariff deadline extension significantly impacts long-term planning for businesses. The trade war impact is predicted to continue unless a substantial trade deal is reached.

Industries Most Affected by Extended China Tariffs

Technology Sector Challenges

The technology sector faces significant challenges from extended China tariffs. Specific components and finished products, crucial for US tech companies, are directly affected. This includes semiconductors, smartphones, and various electronic components. The implications for supply chains are profound, potentially leading to:

- Examples of specific Chinese tech products facing tariffs: Certain types of computer memory, specialized microchips, and components used in smartphones.

- Potential for shifting supply chains away from China: This will entail substantial investments and logistical challenges, potentially impacting the cost and speed of product development and delivery.

- Increased costs for consumers: The added tariffs are likely to be passed on to consumers, increasing the price of many electronic devices and potentially impacting innovation due to slower market growth. The impact of technology tariffs on US competitiveness is a major concern. China tech trade remains heavily intertwined with US businesses. The supply chain disruption could create long-term instability.

Manufacturing and Agriculture's Continued Struggle

US manufacturers and agricultural producers continue to struggle under the weight of China tariffs. The extended timeline exacerbates existing difficulties. This leads to:

- Specific examples of impacted agricultural products and manufactured goods: Soybeans, pork, and various manufactured goods, including furniture and clothing, face significant price increases and reduced market access in China.

- Potential for job losses: Industries directly impacted by China tariffs face the potential for significant job losses, particularly in regions heavily reliant on trade with China.

- Effect on competitiveness: Higher production costs, caused by the tariffs, reduce the competitiveness of US manufacturers and agricultural producers in both domestic and international markets. The ongoing manufacturing tariffs and agricultural tariffs are severely impacting these vital sectors. The US-China trade war has lasting consequences for businesses and the economy.

Potential Economic Consequences of Prolonged China Tariffs

Inflationary Pressures and Consumer Costs

The extended China tariffs will undoubtedly exert inflationary pressure on the US economy. Increased import costs, resulting from the tariffs, will translate directly into higher prices for consumers across a range of goods. This includes:

- Examples of goods with increased prices: Electronics, clothing, furniture, and food items, all depending on imported components or finished goods from China.

- Potential for decreased consumer spending: Higher prices could lead to decreased consumer spending, impacting overall economic growth.

- Broader economic consequences of reduced consumer confidence: Uncertainty about future prices can significantly impact consumer confidence, slowing down economic activity. The China tariff impact on consumers is expected to be substantial and persistent. The impact of inflation and increased consumer prices from high import costs cannot be ignored.

Geopolitical Implications and International Trade Relations

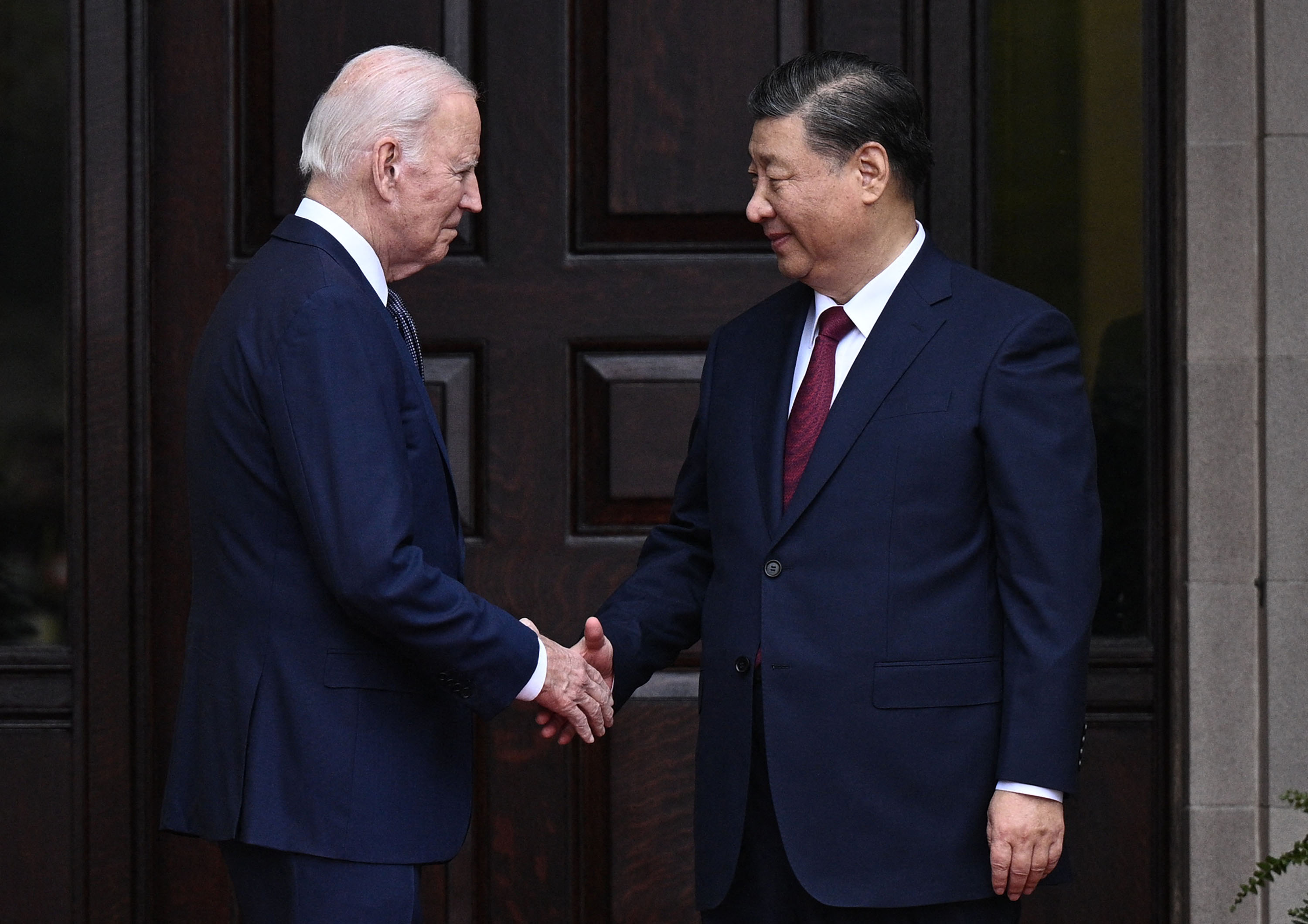

The prolonged China tariffs have significant geopolitical implications. The continued trade tensions risk:

- Potential for retaliatory tariffs from China: China may impose retaliatory tariffs on US goods, further escalating the trade conflict and harming both economies.

- Implications for multilateral trade agreements: The prolonged trade war could undermine confidence in multilateral trade agreements and the rules-based international trading system.

- Impact on global supply chains: The uncertainty caused by the tariffs disrupts global supply chains, potentially leading to shortages and increased costs for businesses worldwide. The geopolitics of the US-China relations are heavily influenced by international trade and existing trade agreements.

Conclusion

The prediction of extended China tariffs until 2025 paints a complex picture with significant implications for the US and global economies. Understanding the potential impact across various sectors, from technology to agriculture, is critical for businesses and consumers alike. The prolonged uncertainty surrounding these China tariffs necessitates proactive strategies to mitigate risks and adapt to the evolving trade landscape. Staying informed about developments concerning China tariffs and their potential extensions is vital for navigating the future of international trade. Therefore, continued monitoring of economic forecasts and policy changes related to China tariffs is highly recommended.

Featured Posts

-

High Rated Netflix Romance Dramas Reign Ends True Crime Takes Over

May 18, 2025

High Rated Netflix Romance Dramas Reign Ends True Crime Takes Over

May 18, 2025 -

Xi Jinping Meeting Trump Says He Ll Go To China

May 18, 2025

Xi Jinping Meeting Trump Says He Ll Go To China

May 18, 2025 -

Gop Tax Megaplan Stalled Conservatives Push For Medicaid And Clean Energy Revisions

May 18, 2025

Gop Tax Megaplan Stalled Conservatives Push For Medicaid And Clean Energy Revisions

May 18, 2025 -

Taylor Swift Blake Lively And The It Ends With Us Controversy An Exclusive Look

May 18, 2025

Taylor Swift Blake Lively And The It Ends With Us Controversy An Exclusive Look

May 18, 2025 -

Ai Coding Assistance Chat Gpts Enhanced Capabilities

May 18, 2025

Ai Coding Assistance Chat Gpts Enhanced Capabilities

May 18, 2025

Latest Posts

-

Economic Development Commission Secures 800 K For Florida Space Coast

May 18, 2025

Economic Development Commission Secures 800 K For Florida Space Coast

May 18, 2025 -

Florida Space Coast Edc Receives Major Funding Boost 800 K Grant

May 18, 2025

Florida Space Coast Edc Receives Major Funding Boost 800 K Grant

May 18, 2025 -

800 000 Grant Awarded To Florida Space Coast Economic Development Commission

May 18, 2025

800 000 Grant Awarded To Florida Space Coast Economic Development Commission

May 18, 2025 -

Florida Space Coast Economic Development Commission Awarded 800 K Grant

May 18, 2025

Florida Space Coast Economic Development Commission Awarded 800 K Grant

May 18, 2025 -

Check Bbc Three Hd For Easy A Full Episode Listings

May 18, 2025

Check Bbc Three Hd For Easy A Full Episode Listings

May 18, 2025