China's Canola Supply Chain: Adapting To The Canada Trade Shift

Table of Contents

The Impact of the Canada-China Canola Trade Dispute

The Canada-China canola trade dispute, beginning in 2019, significantly impacted China's access to a major source of high-quality canola. China, historically a significant importer of Canadian canola, faced increasing import restrictions from Canada, allegedly due to phytosanitary concerns. These restrictions drastically reduced the volume of Canadian canola entering the Chinese market.

The impact was substantial. Before the dispute, Canada supplied roughly a third of China’s canola imports. The resulting loss of this significant supply source led to:

- Price Increases: The reduced supply triggered a sharp increase in canola prices within China, impacting consumers and food processing industries.

- Market Volatility: The uncertainty surrounding canola imports created volatility in the market, making it difficult for Chinese buyers to secure consistent supplies at predictable prices.

- Specific Examples of Import Restrictions: These included increased inspections, delays at customs, and outright bans on specific Canadian canola shipments.

- Timeline of Key Events: The dispute unfolded over several years, with escalating tensions and intermittent attempts at resolution. (Specific dates and details of key events should be included here, referencing reputable news sources and official reports).

- Economic Consequences: Both Canadian and Chinese stakeholders suffered economically. Canadian farmers faced reduced export revenue, while Chinese processors and consumers faced higher costs and supply chain disruptions.

Alternative Canola Suppliers for China

Faced with reduced Canadian canola imports, China sought alternative suppliers. Key alternative sources include:

- Australia: Australia quickly emerged as a major supplier, though logistical challenges and differences in canola variety presented hurdles.

- Ukraine: Ukraine, before the 2022 conflict, was a significant canola exporter, but the war significantly disrupted its ability to supply the global market.

- Russia: Russia also offers canola, but geopolitical considerations and quality concerns played a significant role.

The following table compares key canola-producing countries:

| Country | Export Capacity (Metric Tons) | Average Price (USD/Ton) | Quality | Geopolitical Risks | Logistical Challenges |

|---|---|---|---|---|---|

| Australia | [Insert Data] | [Insert Data] | [High/Medium/Low] | Low | Medium |

| Ukraine | [Insert Data] | [Insert Data] | [High/Medium/Low] | High | High |

| Russia | [Insert Data] | [Insert Data] | [High/Medium/Low] | High | Medium |

| Canada | [Insert Data] | [Insert Data] | High | Low | Low |

- Transportation Costs and Infrastructure Limitations: Shipping canola from alternative sources often incurred higher transportation costs, impacting overall price competitiveness. China's port infrastructure also faced challenges in managing increased volumes from diverse sources.

- Geopolitical Risks: Reliance on specific countries carries geopolitical risks. Political instability or trade disputes with alternative suppliers could again disrupt China’s canola supply.

Strategies for Adapting China's Canola Supply Chain

China adopted several strategies to mitigate the impact of reduced Canadian canola imports:

- Domestic Canola Production Expansion: The Chinese government invested heavily in expanding domestic canola production, aiming for greater self-sufficiency. This involved:

- Government policies incentivizing canola cultivation through subsidies and land allocation.

- Investments in canola research and development to improve yields and quality.

- Strategic Stockpiling: The government implemented strategies to stockpile canola to ensure sufficient reserves during periods of supply disruption.

- Diversification Strategies: China actively diversified its import sources, reducing reliance on any single supplier. This involved forging new trade relationships and exploring alternative oilseed options.

- Risk Management Techniques: Chinese importers improved their risk management capabilities by using hedging strategies and diversifying contracts.

Long-Term Implications for the Global Canola Market

The Canada-China canola trade shift had far-reaching consequences for the global canola market:

-

Changing Dynamics of Supply and Demand: The shift altered the global balance of supply and demand, impacting prices and trade flows.

-

Future of Canada-China Trade Relations: The future of canola trade between Canada and China remains uncertain, dependent on political relations and the resolution of outstanding phytosanitary concerns.

-

Shifts in Global Production and Trade Patterns: The dispute accelerated the diversification of global canola production and trade, leading to shifts in market share amongst various suppliers.

-

Forecasts for Future Canola Prices and Production: (Include predictions and analysis from reputable sources on future canola production and pricing based on current market trends and potential future disruptions).

-

Potential for New Trade Agreements: New trade agreements could reshape global canola trade patterns in the future.

-

Long-term Implications for Sustainability and Environmental Factors: The shift in canola production and sourcing also has long-term environmental implications, influencing global sustainability efforts in the agricultural sector.

Looking Ahead: Reshaping China's Canola Supply Chain

The Canada-China canola trade dispute exposed vulnerabilities in China's canola supply chain, forcing adaptation and diversification. The impact on China's food security and its global trade relationships is significant. China's future canola import strategy likely involves continued investment in domestic production, strategic stockpiling, and maintaining diversified supply sources. To fully understand and navigate the evolving landscape of China’s canola imports, further research, open discussion, and international collaboration are vital. We need to analyze the long-term implications for adapting canola supply chains and the global canola trade to ensure food security and stable market conditions.

Featured Posts

-

Analysis Factors Behind Elon Musks Net Worth Drop Below 300 Billion

May 10, 2025

Analysis Factors Behind Elon Musks Net Worth Drop Below 300 Billion

May 10, 2025 -

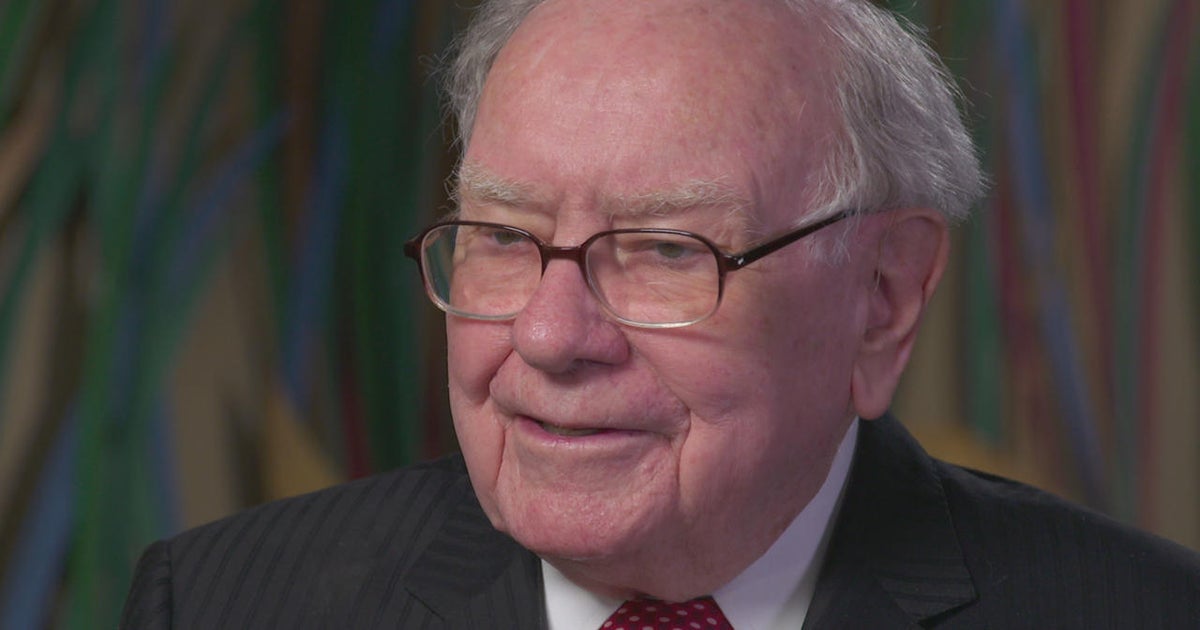

Analyzing The Succession A Canadian Billionaire And Berkshire Hathaways Future

May 10, 2025

Analyzing The Succession A Canadian Billionaire And Berkshire Hathaways Future

May 10, 2025 -

Bilel Latreche Boxeur De Dijon Devant La Justice Pour Violences Conjugales

May 10, 2025

Bilel Latreche Boxeur De Dijon Devant La Justice Pour Violences Conjugales

May 10, 2025 -

Discover The Perfect Venue Olly Murs At A Magnificent Castle Near Manchester Music Festival

May 10, 2025

Discover The Perfect Venue Olly Murs At A Magnificent Castle Near Manchester Music Festival

May 10, 2025 -

Chuyen Gioi Thanh Cong Lynk Lee Ngay Cang Xinh Dep Duoc Ban Trai Het Long Ung Ho

May 10, 2025

Chuyen Gioi Thanh Cong Lynk Lee Ngay Cang Xinh Dep Duoc Ban Trai Het Long Ung Ho

May 10, 2025