China's Export Dependence: Vulnerability To Tariff Hikes

Table of Contents

The Extent of China's Export Dependence

China's economy has historically exhibited a high degree of reliance on exports. For years, a substantial percentage of its GDP has been directly attributable to the sale of goods to international markets. This dependence is not merely a matter of aggregate figures; it reflects a deeply ingrained structural feature of the Chinese economy. The contribution of exports to China's economic growth is undeniable, driving investment, employment, and technological advancement in numerous sectors.

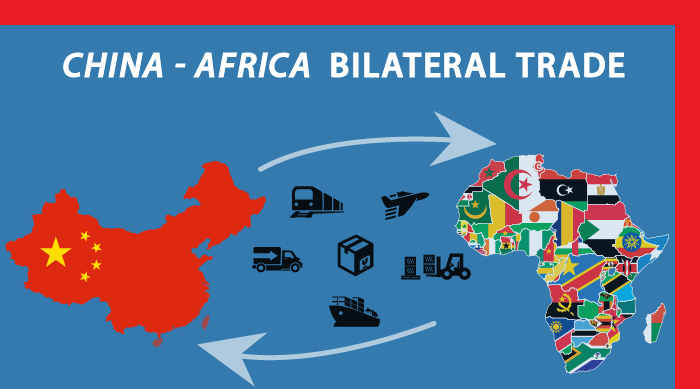

Key export sectors include electronics, textiles, machinery, and toys, among many others. China's dominance in global manufacturing is evident in its significant share of global exports in numerous product categories.

- Quantifying China's Export Share: China holds a substantial share of global exports in electronics (over 30%), textiles, and machinery, making it a dominant player in the global trade landscape. Specific figures vary by year and product category, but the overall trend remains consistent.

- Critical Trading Partners: The United States and the European Union have historically been crucial trading partners for China, absorbing significant quantities of its exports. Any disruption in these relationships carries substantial implications.

- Foreign Demand as a Driver: The growth of China's export-oriented industries has been heavily reliant on the sustained demand for its products in foreign markets. This reliance on external demand leaves the nation susceptible to fluctuations in global economic activity.

Vulnerability to Tariff Hikes

Tariffs imposed by other countries directly impact the competitiveness of Chinese goods in foreign markets. By increasing the price of Chinese products, tariffs make them less attractive to consumers in importing nations. This can lead to a decline in export volume and revenue. Moreover, prolonged trade disputes or escalating trade wars can severely damage the long-term prospects of China's export-oriented industries.

- Historical Examples: Past instances of tariff increases, such as those experienced during the US-China trade war, demonstrably reduced the volume of Chinese exports to certain markets. These episodes highlight the real-world consequences of trade friction.

- Retaliatory Tariffs: The imposition of tariffs often triggers retaliatory measures from other countries, creating a cycle of escalating trade tensions. This tit-for-tat approach amplifies the negative impact on overall global trade and the specific Chinese export sector affected.

- Sectoral Vulnerability: Certain export sectors are inherently more vulnerable to tariffs than others. For instance, labor-intensive industries might face greater challenges in maintaining competitiveness when faced with increased import costs.

Economic Consequences of Reduced Exports

A significant reduction in Chinese exports would have profound economic consequences. The most immediate impact would likely be job losses in export-oriented industries, potentially leading to widespread unemployment. This, in turn, could negatively impact domestic consumption and overall economic stability.

- Ripple Effects: The economic consequences of reduced exports extend beyond the immediate export sectors. Related industries like logistics, transportation, and ancillary services would also experience reduced activity and potential job losses.

- Capital Flight: Uncertainty caused by reduced export revenue could lead to capital flight as investors seek safer investment options elsewhere, further dampening economic growth and investment.

- Government Response: The Chinese government has various mechanisms to address economic shocks, such as fiscal stimulus packages and monetary policy adjustments. However, the effectiveness of these measures in mitigating the fallout from a significant decline in exports remains to be seen.

Strategies to Reduce Export Dependence

To mitigate the risks associated with its export dependence, China must actively pursue strategies to diversify its economic activities and reduce its reliance on external demand. This necessitates a multi-pronged approach that includes bolstering domestic consumption, fostering technological innovation, and diversifying export markets.

- Boosting Domestic Demand: Government policies aimed at increasing disposable income and encouraging domestic consumption are crucial. This would reduce the reliance on exports as a primary engine of economic growth.

- Technological Innovation: Investing heavily in research and development and promoting technological upgrading are paramount for enhancing the competitiveness of Chinese industries and reducing dependence on low-value-added manufacturing.

- Export Market Diversification: Reducing reliance on specific trading partners through active engagement in new markets and exploring new trade relationships is crucial to mitigate risks associated with geopolitical instability and trade disputes.

Conclusion

China's significant reliance on exports presents a substantial vulnerability to global trade tensions and tariff hikes. The potential consequences of reduced export revenue are far-reaching, impacting employment, economic growth, and social stability. Reducing this dependence through fostering domestic consumption growth, driving technological advancement, and diversifying export markets is crucial for China's long-term economic resilience and stability. Understanding the complexities of China's export dependence and its vulnerabilities is essential for investors, policymakers, and businesses navigating the evolving global trade landscape. Learn more about the implications of China's export dependence and its potential vulnerabilities to better understand this critical aspect of the global economy.

Featured Posts

-

Joint Effort South Sudan And Us To Manage Deportees Return

Apr 22, 2025

Joint Effort South Sudan And Us To Manage Deportees Return

Apr 22, 2025 -

Pope Francis A Life Remembered Following Death At 88

Apr 22, 2025

Pope Francis A Life Remembered Following Death At 88

Apr 22, 2025 -

Top Chinese Indonesian Officials Strengthen Security Cooperation

Apr 22, 2025

Top Chinese Indonesian Officials Strengthen Security Cooperation

Apr 22, 2025 -

Pope Francis 1936 2024 A Papal Legacy Of Service And Compassion

Apr 22, 2025

Pope Francis 1936 2024 A Papal Legacy Of Service And Compassion

Apr 22, 2025 -

Strained Ties Analyzing The Breakdown In U S China Relations

Apr 22, 2025

Strained Ties Analyzing The Breakdown In U S China Relations

Apr 22, 2025