China's Steel Industry Slowdown: A Deep Dive Into Iron Ore Market Dynamics

Table of Contents

China's steel industry, once a juggernaut of global economic growth, is experiencing a significant slowdown. This shift has profound implications, sending ripples throughout the global economy and significantly impacting the iron ore market. Understanding the dynamics of China's steel industry slowdown is crucial for investors, businesses involved in steel and iron ore production and trade, and policymakers alike. This article will delve into the key factors driving this slowdown, analyzing its effects on domestic steel prices, iron ore demand, and the broader geopolitical landscape. We will explore the intricate relationship between China's steel production and iron ore market fluctuations, offering insights into potential future trends.

The Decline in Chinese Steel Production

Factors Contributing to the Slowdown:

The slowdown in China's steel production is a multifaceted issue stemming from a confluence of factors:

-

Reduced Infrastructure Spending: The Chinese government's emphasis on sustainable development has led to a decrease in large-scale infrastructure projects, traditionally major consumers of steel. This shift in policy has directly impacted steel demand. According to the National Bureau of Statistics of China, infrastructure investment growth slowed considerably in 2022 and early 2023.

-

Government Policies Aimed at Curbing Emissions: China's commitment to reducing carbon emissions has resulted in stricter environmental regulations on steel production. These regulations, aimed at curbing pollution from steel mills, have limited production capacity and increased operating costs. The "carbon neutrality" goal has driven significant changes in the industry's operational practices.

-

Weakening Global Demand: Global economic headwinds and reduced demand from key export markets have further dampened Chinese steel production. The slowdown in global construction and manufacturing activities has impacted steel exports.

-

Real Estate Market Downturn: The crisis in China's real estate sector, a significant consumer of steel, has significantly impacted demand. The downturn has resulted in reduced construction activity and a subsequent fall in steel consumption. Reports from agencies such as S&P Global Ratings highlight the severity of this impact.

Impact on Domestic Steel Prices:

The decreased production has inevitably led to fluctuations in domestic steel prices in China. The correlation is clear: reduced output coupled with softening demand has resulted in price volatility. Steel mills are facing reduced profitability, forcing them to adjust their operations and potentially leading to consolidation within the industry. Charts illustrating price trends from sources like the Metal Bulletin would clearly show this volatility.

Ripple Effects on Iron Ore Demand

The China-Iron Ore Relationship:

China's steel production is inextricably linked to its iron ore consumption. China is the world's largest importer of iron ore, heavily reliant on Australia and Brazil for supply. The decline in Chinese steel production has directly translated into a reduction in iron ore demand, impacting these major exporting nations.

Price Fluctuations in the Iron Ore Market:

The decreased demand from China has created significant price fluctuations in the iron ore market. Major iron ore producers like BHP Billiton and Vale have experienced reduced revenue and profit margins. The price volatility has created uncertainty and instability within the market, impacting investment decisions and trade strategies. Graphs showing the price of iron ore over the past few years would clearly illustrate this impact.

Global Implications of China's Steel Slowdown

Impact on Global Steel Markets:

China's reduced steel production has created a ripple effect in global steel markets. While this may present opportunities for other steel-producing nations to increase their market share, it also leads to increased competition and potential price pressures. The shift in the balance of global steel production will likely trigger adjustments in trade patterns and supply chains.

Geopolitical Considerations:

The slowdown in China's steel industry has broader geopolitical implications. It influences international trade relations, resource security, and the dynamics of global commodity markets. The impact on trade agreements and relationships between China and its major trading partners needs further consideration.

Conclusion: Understanding the Future of China's Steel Industry and Iron Ore Market

China's steel industry slowdown and its impact on iron ore market dynamics are complex issues with far-reaching consequences. The interplay of government policies, global economic conditions, and the domestic real estate market will continue to shape the future of this crucial sector. Monitoring these developments is crucial for informed decision-making by all stakeholders. The future likely holds continued volatility in both the steel and iron ore markets, requiring careful analysis and adaptable strategies.

Stay informed about the ongoing dynamics of China's steel industry slowdown and its impact on global iron ore markets by subscribing to our newsletter!

Featured Posts

-

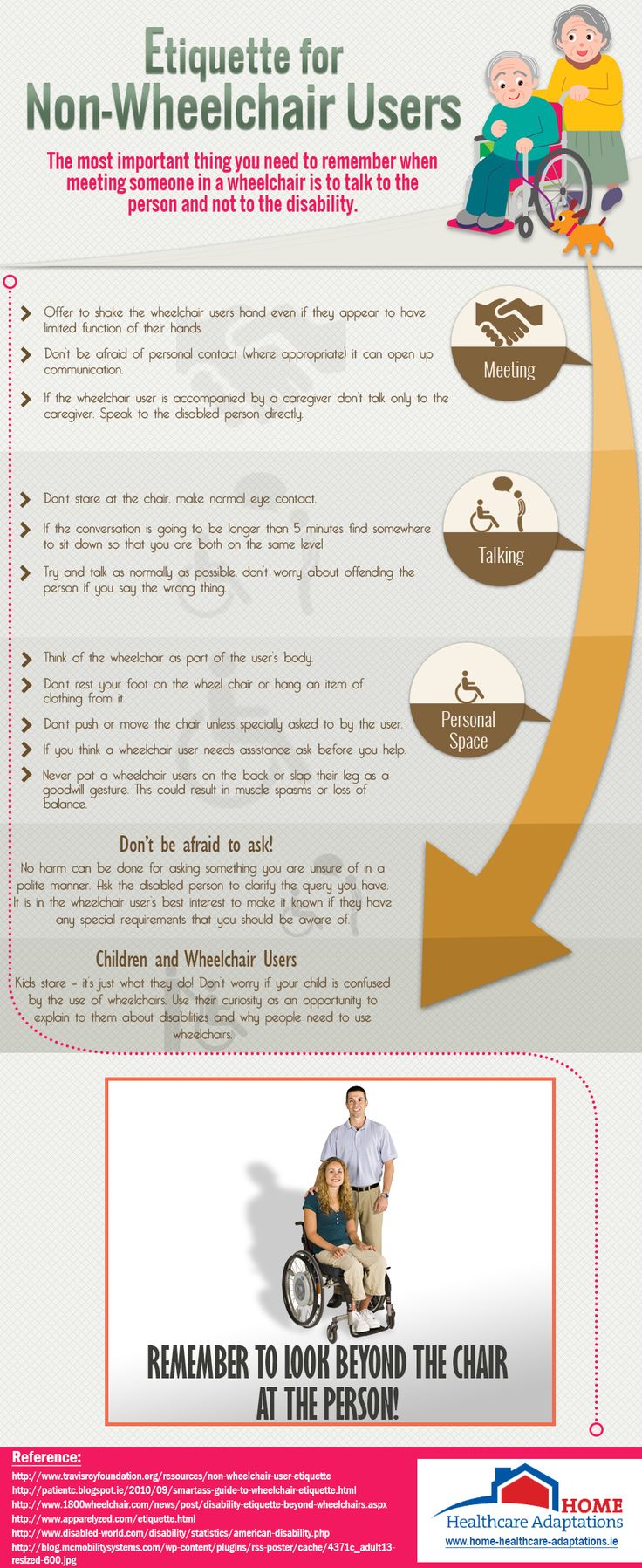

Elizabeth Line Accessibility Navigating Gaps For Wheelchair Users

May 09, 2025

Elizabeth Line Accessibility Navigating Gaps For Wheelchair Users

May 09, 2025 -

Understanding Elon Musks Wealth A Comprehensive Look At His Business Ventures

May 09, 2025

Understanding Elon Musks Wealth A Comprehensive Look At His Business Ventures

May 09, 2025 -

Bayern Munichs Champions League Defeat Against Inter Milan

May 09, 2025

Bayern Munichs Champions League Defeat Against Inter Milan

May 09, 2025 -

Activision Blizzard Acquisition Ftcs Appeal Against Merger Approval

May 09, 2025

Activision Blizzard Acquisition Ftcs Appeal Against Merger Approval

May 09, 2025 -

Stock Market News Sensex And Nifty Close Higher Despite Ultra Tech Fall

May 09, 2025

Stock Market News Sensex And Nifty Close Higher Despite Ultra Tech Fall

May 09, 2025

Latest Posts

-

Is Wynne And Joanna All At Sea Worth Reading A Critical Review

May 09, 2025

Is Wynne And Joanna All At Sea Worth Reading A Critical Review

May 09, 2025 -

Wynne Evans Go Compare Future Uncertain After Strictly Scandal

May 09, 2025

Wynne Evans Go Compare Future Uncertain After Strictly Scandal

May 09, 2025 -

Singer Wynne Evanss Cosy Date Following Bbc Meeting Delay

May 09, 2025

Singer Wynne Evanss Cosy Date Following Bbc Meeting Delay

May 09, 2025 -

Wynne And Joanna All At Sea A Detailed Analysis

May 09, 2025

Wynne And Joanna All At Sea A Detailed Analysis

May 09, 2025 -

Go Compare Advert Star Wynne Evans Removed Following Strictly Incident

May 09, 2025

Go Compare Advert Star Wynne Evans Removed Following Strictly Incident

May 09, 2025