China's Trade War Resilience: Fact Or Fiction? A Look Behind The Curtain

Table of Contents

The Apparent Resilience: Economic Indicators and Government Policies

China's apparent resilience to the trade war is often highlighted by positive economic growth figures and proactive government policies. Let's examine these claims.

Positive Economic Growth Figures

Despite the trade friction, China has continued to report positive economic growth. However, a nuanced analysis is necessary.

- GDP Growth: While GDP growth has slowed compared to previous years, it has remained positive, showcasing a degree of economic stability. This stability is partially attributed to robust domestic consumption.

- Industrial Production: Industrial production, a key indicator of manufacturing activity, has also shown resilience, although certain sectors have been more significantly impacted than others.

- Government Stimulus: The Chinese government has implemented various stimulus packages to offset the negative effects of the trade war, including infrastructure spending and tax cuts, contributing to the seemingly positive economic indicators. This targeted intervention has played a significant role in maintaining a semblance of economic stability. However, the long-term sustainability of such stimulus measures remains a point of debate among economists.

This apparent resilience of the Chinese economy, fueled by government intervention and domestic demand, highlights a significant aspect of China's response to the trade war. However, a deeper dive reveals a more complex picture.

Shifting Trade Partners and Diversification

China's response to the trade war has also involved a significant diversification of its trade partners. This strategic shift aims to reduce over-reliance on the US market and create new avenues for growth.

- Increased Trade with the EU and ASEAN: China has actively cultivated stronger trade relationships with the European Union and the Association of Southeast Asian Nations (ASEAN), significantly increasing trade volumes in various sectors.

- Belt and Road Initiative (BRI): The BRI plays a crucial role in China's trade diversification strategy, connecting China to markets across Asia, Africa, and Europe through infrastructure development and increased connectivity. This initiative provides alternative trade routes and reduces dependence on established maritime trade lanes dominated by Western powers.

- Focus on African Markets: China has also intensified its engagement with African nations, fostering economic ties and securing access to raw materials crucial for its manufacturing sector. This geographic diversification acts as a buffer against trade disruptions originating from specific regions.

China's trade diversification strategy, evident in its engagement with new trade partners and the expansion of the BRI, demonstrates a proactive approach to mitigating the impact of trade tensions. However, the long-term success of this strategy is dependent on factors beyond China’s control.

Challenges and Underlying Vulnerabilities

While the positive economic indicators and policy responses paint a picture of resilience, it is essential to acknowledge China's underlying vulnerabilities.

Technological Dependence and Supply Chain Disruptions

China's dependence on foreign technology, particularly in key sectors like semiconductors and rare earth minerals, represents a significant vulnerability exacerbated by the trade war.

- Semiconductor Dependence: China's reliance on imported semiconductors makes it susceptible to trade restrictions and sanctions imposed by other nations. This dependence hinders its technological advancement and poses a threat to its manufacturing sector.

- Rare Earth Mineral Supply: China, while a major producer of rare earth minerals, still relies on foreign technologies and expertise for advanced processing and applications. Trade restrictions on these materials can hamper various industries, including electronics and defense.

- Supply Chain Disruptions: The trade war has disrupted global supply chains, affecting Chinese manufacturers who rely on imported components and intermediate goods. This has led to increased costs and production delays.

The impact of sanctions and export controls on China's technological capabilities and supply chain stability highlights a significant challenge to its long-term economic resilience.

Internal Economic Pressures

Internal economic pressures, such as rising debt levels, property market instability, and demographic challenges, further complicate the assessment of China's trade war resilience.

- Rising Debt Levels: High levels of corporate and government debt create vulnerability to economic shocks. Trade tensions can exacerbate these existing financial risks.

- Property Market Instability: The Chinese property market is a significant part of the economy, and its instability poses a systemic risk. Trade conflicts can intensify the risks associated with this sector.

- Demographic Challenges: China's aging population and declining birth rate create long-term economic challenges that could be amplified by external pressures such as trade wars.

These internal economic pressures, when combined with external trade tensions, pose a significant threat to China's long-term economic growth and overall resilience.

Assessing the Narrative: Fact vs. Fiction

Assessing China's trade war resilience requires a nuanced perspective. While the government's proactive policies and trade diversification efforts have mitigated some of the negative impacts, underlying vulnerabilities related to technological dependence, supply chain disruptions, and internal economic pressures persist. The narrative of unwavering resilience is therefore an oversimplification. China's response has been impressive in many respects, showcasing adaptability and strategic planning. However, the long-term effects of the trade tensions and the underlying vulnerabilities remain significant considerations. The claim of complete resilience, therefore, is partially fictional.

Conclusion

China's experience with the trade war reveals a complex interplay of apparent resilience and underlying vulnerabilities. While economic growth has been maintained through government intervention and trade diversification, the technological and internal economic challenges remain considerable. The narrative of complete and unwavering China's trade war resilience is thus an oversimplification; the reality is more nuanced. To gain a deeper understanding of the complexities surrounding China's trade war resilience, continue researching the topic and follow reputable economic analyses from sources like the World Bank, IMF, and respected financial news outlets. A complete understanding of this dynamic situation requires ongoing monitoring and careful consideration of all contributing factors.

Featured Posts

-

Teaching Union Accuses Farage Of Far Right Ties He Rejects Claims

May 03, 2025

Teaching Union Accuses Farage Of Far Right Ties He Rejects Claims

May 03, 2025 -

Position De Netanyahou Macron Commet Une Erreur Majeure Sur L Etat Palestinien

May 03, 2025

Position De Netanyahou Macron Commet Une Erreur Majeure Sur L Etat Palestinien

May 03, 2025 -

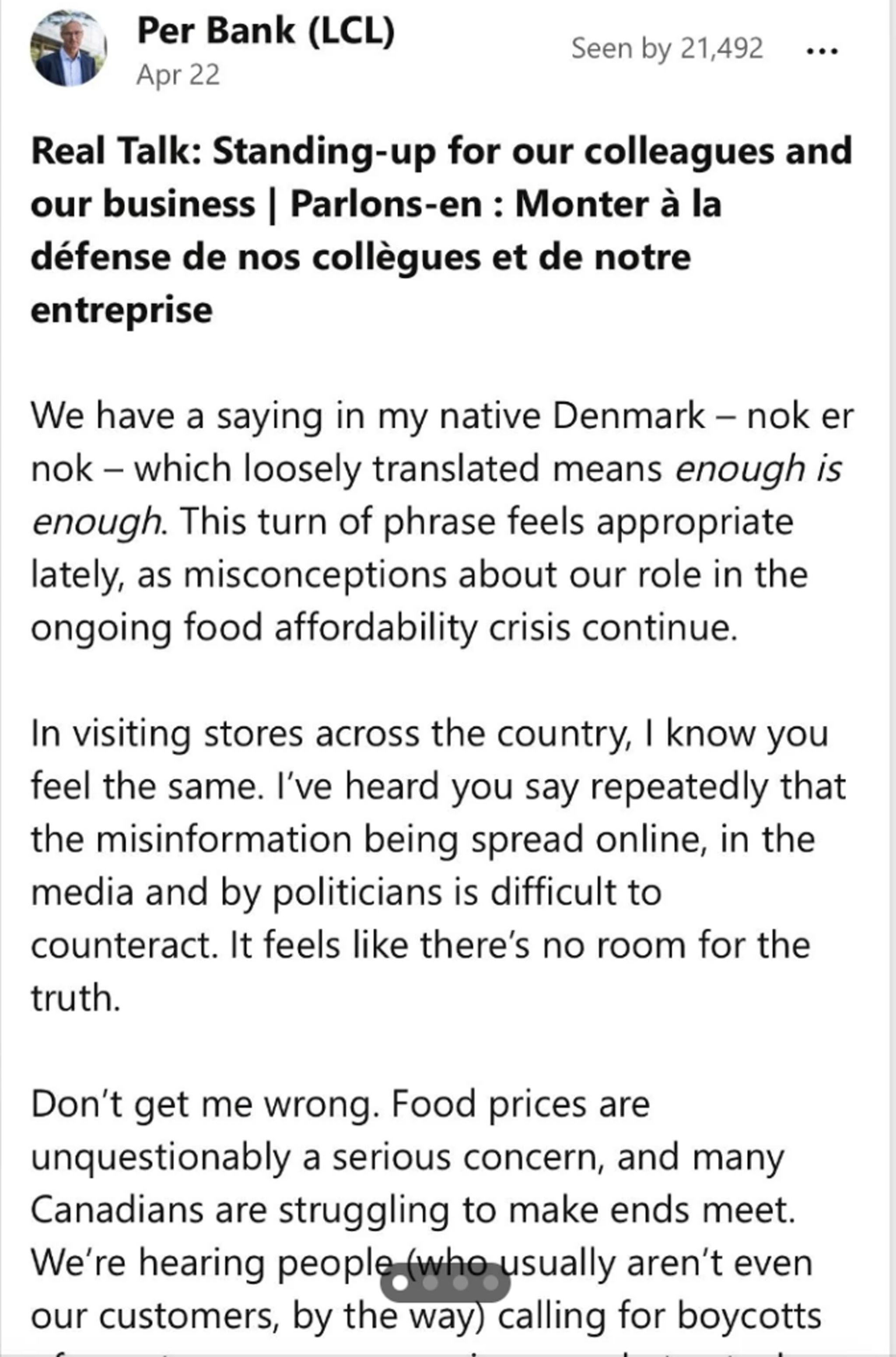

Loblaw Adds More Canadian Products But Ceo Questions Longevity Of Buy Canadian Movement

May 03, 2025

Loblaw Adds More Canadian Products But Ceo Questions Longevity Of Buy Canadian Movement

May 03, 2025 -

The Fortnite Music Update A Player Perspective

May 03, 2025

The Fortnite Music Update A Player Perspective

May 03, 2025 -

Post Tragedy Analysis A Review Of Alec Baldwins Film Rust

May 03, 2025

Post Tragedy Analysis A Review Of Alec Baldwins Film Rust

May 03, 2025