Chinese Stocks Rebound After Dip: US Talks And Economic Data Drive Market

Table of Contents

Positive Developments in US-China Trade Talks Fuel Market Optimism

Recent developments in US-China trade negotiations have played a pivotal role in boosting investor confidence and fueling the rally in Chinese stocks. While tensions remain, a thawing of relations, even incrementally, has significantly eased concerns about further trade restrictions impacting Chinese companies. This positive shift in sentiment has injected much-needed stability into the market.

- Specific examples of positive developments: Reports suggest a renewed focus on dialogue and potential agreements on specific trade issues. While details remain scarce, the mere indication of constructive talks has been enough to sway investor perception.

- Sectors positively impacted: The technology and manufacturing sectors, particularly those heavily reliant on US-China trade, have seen a considerable uplift. Easing trade tensions reduces uncertainty and allows these companies to focus on growth.

- Analyst opinions: Many analysts believe that continued progress in US-China trade talks is crucial for sustained growth in the Chinese stock market. The perception of reduced risk is a key driver of investment.

Strong Economic Data Bolsters Chinese Stock Market Recovery

Beyond the diplomatic improvements, robust economic data has significantly contributed to the recovery of Chinese stocks. Key economic indicators have exceeded expectations, painting a picture of continued economic strength and resilience.

- Specific economic indicators: GDP growth figures have shown strong expansion, surpassing forecasts. Industrial production and retail sales also demonstrated healthy growth, suggesting a vibrant domestic market. For instance, recent data showed X% growth in GDP, Y% increase in industrial production, and Z% rise in retail sales.

- Data implications: This positive data reinforces confidence in the Chinese economy's potential for future growth. It suggests that the underlying fundamentals remain strong, despite global economic headwinds.

- Government policies: Government initiatives supporting economic growth, such as infrastructure spending and investments in technology, further bolster investor confidence. These policies are perceived as actively mitigating potential economic risks.

Investor Sentiment and Market Volatility: A Cautious Outlook

While the recent rebound is encouraging, it's crucial to acknowledge the inherent volatility within the Chinese stock market. Investor sentiment can shift rapidly based on various factors, leading to market fluctuations.

- Influencing factors: Positive developments in US-China trade talks and robust economic data are major positive factors. However, geopolitical risks, regulatory uncertainties, and potential global economic slowdowns remain significant concerns influencing investor sentiment.

- Short-term vs. long-term strategies: Short-term investors might capitalize on market fluctuations, while long-term investors might see this as a strategic entry point, provided they are comfortable with inherent risk.

- Potential risks: A resurgence of COVID-19, global economic slowdowns, and unexpected regulatory changes could negatively impact the market. Careful risk assessment is crucial before investment.

Key Sectors Driving the Chinese Stock Market Rebound

Several sectors within the Chinese economy have been key drivers of the recent stock market rebound. These sectors reflect the broader economic trends and investor preferences.

- High-performing sectors: The technology sector has shown particularly strong gains, fueled by government support and increasing domestic demand. The energy and consumer goods sectors also performed well, reflecting robust economic activity.

- Growth drivers: Technological innovation, increased consumer spending, and government investment are among the key drivers for these sectors' growth.

- Future outlook: The outlook for these sectors remains largely positive, though investors should remain aware of potential challenges and risks specific to each industry.

Conclusion: Navigating the Future of Chinese Stocks

The recent rebound in Chinese stocks is largely driven by improved US-China relations and positive economic data. However, the market remains susceptible to volatility. While opportunities exist, investors must carefully consider the potential risks. Thorough research and a well-defined investment strategy are crucial for success in this dynamic market. Stay informed about the latest developments in the Chinese stock market to make well-informed decisions about your investments in Chinese stocks. Monitor key economic indicators and US-China relations for further insights. Understanding these factors will be vital for navigating the complexities and opportunities presented by Chinese stocks.

Featured Posts

-

Ford Urges Carney To Champion Highway 401 Tunnel Project

May 07, 2025

Ford Urges Carney To Champion Highway 401 Tunnel Project

May 07, 2025 -

March 7th Y And R Recap Diane Claire And Kyles Storylines

May 07, 2025

March 7th Y And R Recap Diane Claire And Kyles Storylines

May 07, 2025 -

Las Vegas Welcomes The John Wick Experience

May 07, 2025

Las Vegas Welcomes The John Wick Experience

May 07, 2025 -

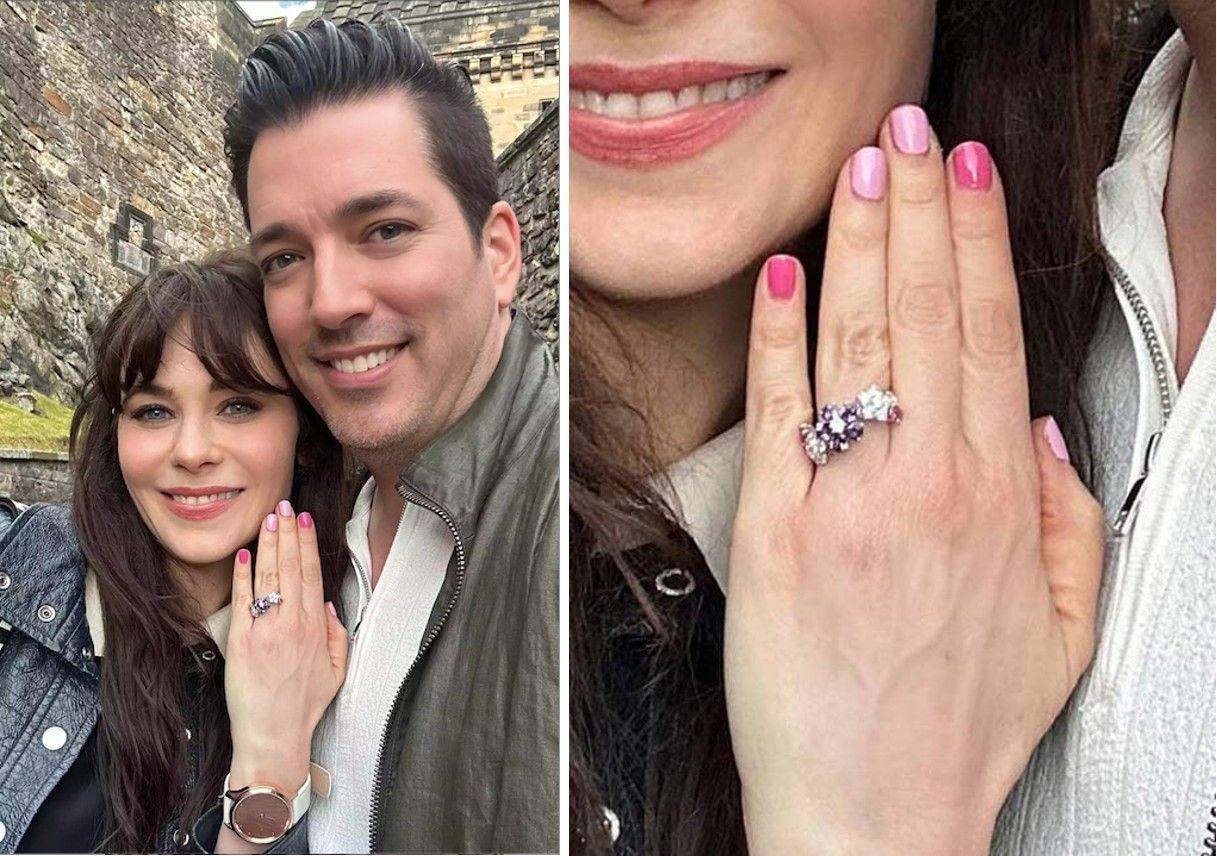

The Perfect Pair Rihannas Engagement Ring And Red Heels

May 07, 2025

The Perfect Pair Rihannas Engagement Ring And Red Heels

May 07, 2025 -

George Pickens Trade Speculation Heats Up During Nfl Draft

May 07, 2025

George Pickens Trade Speculation Heats Up During Nfl Draft

May 07, 2025