Client Outflows Drive Schroders Asset Decline In First Quarter

Table of Contents

The Extent of Schroders' Asset Reduction

Schroders experienced a considerable reduction in its AUM during the first quarter. The precise figure, representing a significant drop in investment management performance, needs to be inserted here (e.g., "a decrease of X% representing a loss of £Y billion"). This represents a substantial shift compared to previous quarters and years. (Insert data comparing Q1 decline to previous quarters/years, e.g., "This is a sharper decline than the X% seen in Q4 of the previous year and significantly higher than the average quarterly decline of Y% over the past five years"). The impact was felt across various investment strategies, with some funds experiencing more pronounced outflows than others.

- Specific figures of AUM loss: (Insert precise figures of AUM loss in monetary value and percentage terms)

- Year-over-year comparison of AUM: (Insert comparative data showing AUM changes year-on-year)

- Mention any specific investment strategies or funds significantly impacted: (Specify which investment strategies or funds experienced the most significant outflows and quantify the impact)

Analyzing the Root Cause: Client Outflows

The primary driver of Schroders' asset reduction was significant client outflows, or investor redemptions. Several factors contributed to this trend:

- Market factors contributing to outflows: The challenging macroeconomic environment, characterized by high inflation and aggressive interest rate hikes by central banks globally, significantly impacted investor sentiment. Increased market volatility led to investors seeking safer havens for their investments.

- Performance of specific Schroders funds and their impact on client decisions: While overall market conditions played a role, the underperformance of some Schroders funds relative to benchmarks also contributed to client decisions to redeem their investments. (Mention specific funds and their performance if publically available).

- Competitive pressures from other asset managers: Intense competition within the asset management industry, with some competitors offering potentially more attractive investment strategies or lower fees, also played a role.

- Changes in investor risk appetite: A shift in investor risk appetite towards more conservative investment strategies, away from higher-risk assets managed by Schroders, contributed to the outflow.

Schroders' Response to the Decline

In response to the decline, Schroders has implemented several strategic initiatives:

- Specific cost-cutting initiatives undertaken by Schroders: (Detail any cost-cutting measures, such as staff reductions, operational efficiencies, or reduced discretionary spending).

- Details of any new investment strategies or products launched: (Describe any new investment products or strategies launched to attract new clients or retain existing ones).

- Overview of communication efforts to reassure investors: (Summarize Schroders' communication strategies to address investor concerns and rebuild confidence).

- Any restructuring or changes in management: (Mention any changes in management structure or internal restructuring undertaken as a response to the asset decline).

Impact on Schroders' Financial Performance

The significant asset decline has undeniably impacted Schroders' financial performance.

- Impact on revenue and profit margins: (Quantify the impact on revenue and profit margins due to the reduction in AUM. Refer to official financial reports if available).

- Potential impact on future dividend payments: (Discuss the potential consequences for dividend payments to shareholders).

- Changes in the company's financial outlook: (Summarize any changes in the company's financial outlook and future projections as a result of the asset decline).

Conclusion: Understanding the Implications of Schroders' Asset Decline

Schroders' first-quarter results reveal a substantial AUM decline—a decrease of (insert percentage and monetary value)—primarily driven by significant client outflows. These outflows were influenced by a confluence of factors including challenging market conditions, the underperformance of some funds, competitive pressures, and shifting investor risk appetite. In response, Schroders has initiated cost-cutting measures, launched new products, and actively engaged with investors. The long-term implications of this decline remain to be seen, but it underscores the ongoing challenges facing asset managers in a volatile market environment. Understanding the causes of Schroders' asset decline is crucial for informed investment decisions. Stay tuned for further updates on Schroders' performance and the ongoing impact of client outflows on asset management firms.

Featured Posts

-

The Countrys Hottest New Business Locations A Geographic Overview

May 03, 2025

The Countrys Hottest New Business Locations A Geographic Overview

May 03, 2025 -

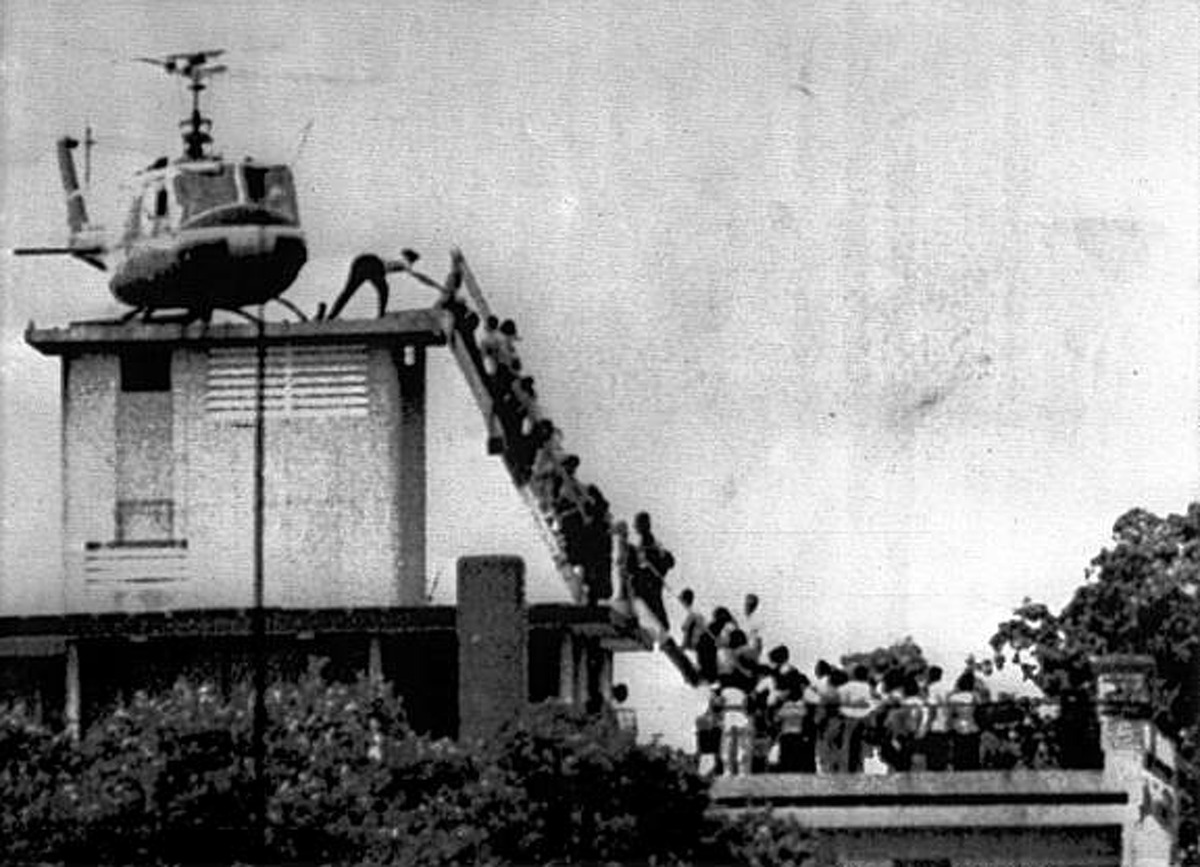

Us Officers Defy Orders Saving Lives During The Fall Of Saigon

May 03, 2025

Us Officers Defy Orders Saving Lives During The Fall Of Saigon

May 03, 2025 -

Israeli Raid On Gaza Humanitarian Ships Arab Media Perspective

May 03, 2025

Israeli Raid On Gaza Humanitarian Ships Arab Media Perspective

May 03, 2025 -

Exclusive Tesla Board Launches Search For New Ceo

May 03, 2025

Exclusive Tesla Board Launches Search For New Ceo

May 03, 2025 -

Drone Attack On Ship Near Maltese Waters Freedom Flotilla Coalitions Account

May 03, 2025

Drone Attack On Ship Near Maltese Waters Freedom Flotilla Coalitions Account

May 03, 2025