Colgate's $200 Million Tariff Hit: Impact On Sales And Profitability

Table of Contents

Direct Impact on Colgate's Sales

The imposition of tariffs directly impacted Colgate's sales through two primary channels: reduced consumer demand and supply chain disruptions.

Reduced Consumer Demand

Tariffs led to increased prices of Colgate products, impacting consumer affordability and demand. This price sensitivity resulted in a decrease in sales volume, particularly in markets heavily affected by the tariffs. While precise sales figures for specific regions aren't always publicly available due to competitive reasons, analysts have noted a clear correlation between tariff increases and decreased sales of Colgate products.

- Price increase leads to decreased affordability for consumers: Higher prices make Colgate products less competitive compared to cheaper alternatives.

- Consumers switch to cheaper alternatives: Consumers, facing increased costs, often opt for lower-priced brands or store brands, directly impacting Colgate's market share.

- Reduced market share in affected regions: The impact of Colgate Tariffs was particularly noticeable in regions where tariffs were highest, leading to a significant reduction in Colgate's market share.

Supply Chain Disruptions

The tariffs also significantly disrupted Colgate's supply chain. Increased import costs for raw materials like packaging and ingredients directly increased Colgate's production costs. Furthermore, tariff-related complexities led to delays in production and distribution.

- Increased cost of raw materials like packaging and ingredients: Tariffs on imported materials increased the cost of goods sold, squeezing profit margins.

- Delays in shipment and import processes: Navigating the complexities of tariffs and customs regulations caused delays and increased logistical hurdles.

- Increased logistical costs: The additional time and resources required to manage tariff-related complexities added to overall logistical costs.

Impact on Colgate's Profitability

The combined impact of reduced sales and supply chain disruptions severely affected Colgate's profitability.

Reduced Profit Margins

Increased costs and decreased sales directly impacted Colgate's profit margins. The reported $200 million loss is a significant blow to the company's bottom line, affecting its overall profitability and shareholder value. Colgate responded with various strategies to mitigate these losses, including price adjustments in some markets and implementation of cost-cutting measures across the organization.

- Decreased revenue due to lower sales volume: Reduced demand directly translated to lower revenue, significantly impacting profitability.

- Increased expenses due to tariff costs and supply chain disruptions: Higher input costs and logistical challenges added to expenses, further squeezing profits.

- Reduced overall profitability and impact on shareholder value: The combined effect of decreased revenue and increased costs resulted in a substantial reduction in overall profitability, negatively affecting shareholder returns.

Long-Term Financial Implications

The impact of these Colgate Tariffs extends beyond the immediate financial loss. The long-term financial health of Colgate could be affected in several ways.

- Potential for reduced investment in R&D: Reduced profitability might lead to decreased investment in research and development, potentially hindering future innovation and growth.

- Impact on future growth prospects: The disruptions caused by the tariffs could negatively affect Colgate's future growth prospects, particularly in markets heavily impacted by trade policies.

- Need for diversified sourcing and manufacturing strategies: The experience highlights the need for Colgate to diversify its sourcing and manufacturing strategies to reduce reliance on single regions and mitigate future tariff-related risks.

Colgate's Response and Mitigation Strategies

Colgate responded to the tariff challenges with a multifaceted approach. This included price adjustments in specific markets to partially offset increased costs, various cost-cutting initiatives to improve efficiency and reduce expenses, and exploration of alternative sourcing options to reduce reliance on tariff-affected regions. They also engaged in advocacy and lobbying efforts to influence trade policies.

- Price adjustments in specific markets: Colgate strategically adjusted prices in certain markets to maintain profitability while acknowledging consumer price sensitivity.

- Cost optimization initiatives: The company implemented various cost-cutting measures across its operations to improve efficiency and reduce overall costs.

- Exploration of alternative sourcing options: Colgate actively sought alternative sourcing options for raw materials and manufacturing to mitigate future tariff-related risks.

- Advocacy and lobbying efforts to influence trade policies: Colgate engaged in lobbying activities to influence trade policies and advocate for fairer trade practices.

Conclusion

The impact of tariffs on Colgate, highlighted by the $200 million loss due to Colgate Tariffs, clearly demonstrates the vulnerability of global brands to trade policies. The company's response, encompassing price adjustments, cost-cutting, and supply chain diversification, showcases the necessary resilience required in navigating such economic challenges. Understanding the impact of these tariffs is crucial for investors and businesses operating globally. Further research into the long-term effects and the broader implications of trade wars on consumer goods companies is essential. Learn more about the impact of tariffs on global businesses and how to mitigate future risks.

Featured Posts

-

Resumption Of Construction Worlds Tallest Abandoned Skyscraper

Apr 26, 2025

Resumption Of Construction Worlds Tallest Abandoned Skyscraper

Apr 26, 2025 -

Should You Return To A Company That Laid You Off A Practical Guide

Apr 26, 2025

Should You Return To A Company That Laid You Off A Practical Guide

Apr 26, 2025 -

How California Became The Worlds Fourth Largest Economy

Apr 26, 2025

How California Became The Worlds Fourth Largest Economy

Apr 26, 2025 -

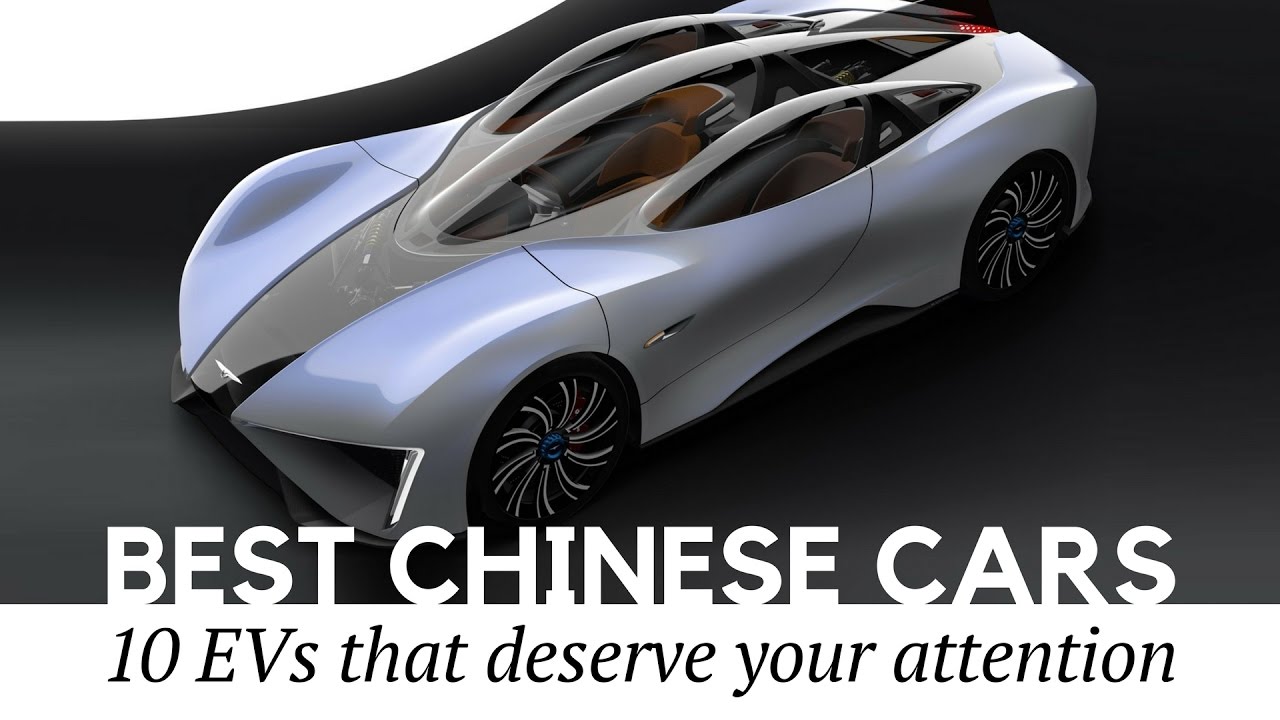

A Comprehensive Analysis The Future Of Chinese Made Vehicles

Apr 26, 2025

A Comprehensive Analysis The Future Of Chinese Made Vehicles

Apr 26, 2025 -

Trump Supporter Ray Epps Defamation Lawsuit Against Fox News Jan 6th Falsehoods Alleged

Apr 26, 2025

Trump Supporter Ray Epps Defamation Lawsuit Against Fox News Jan 6th Falsehoods Alleged

Apr 26, 2025