Conquering Lack Of Funds: Steps To Financial Independence

Table of Contents

Creating a Realistic Budget and Tracking Expenses

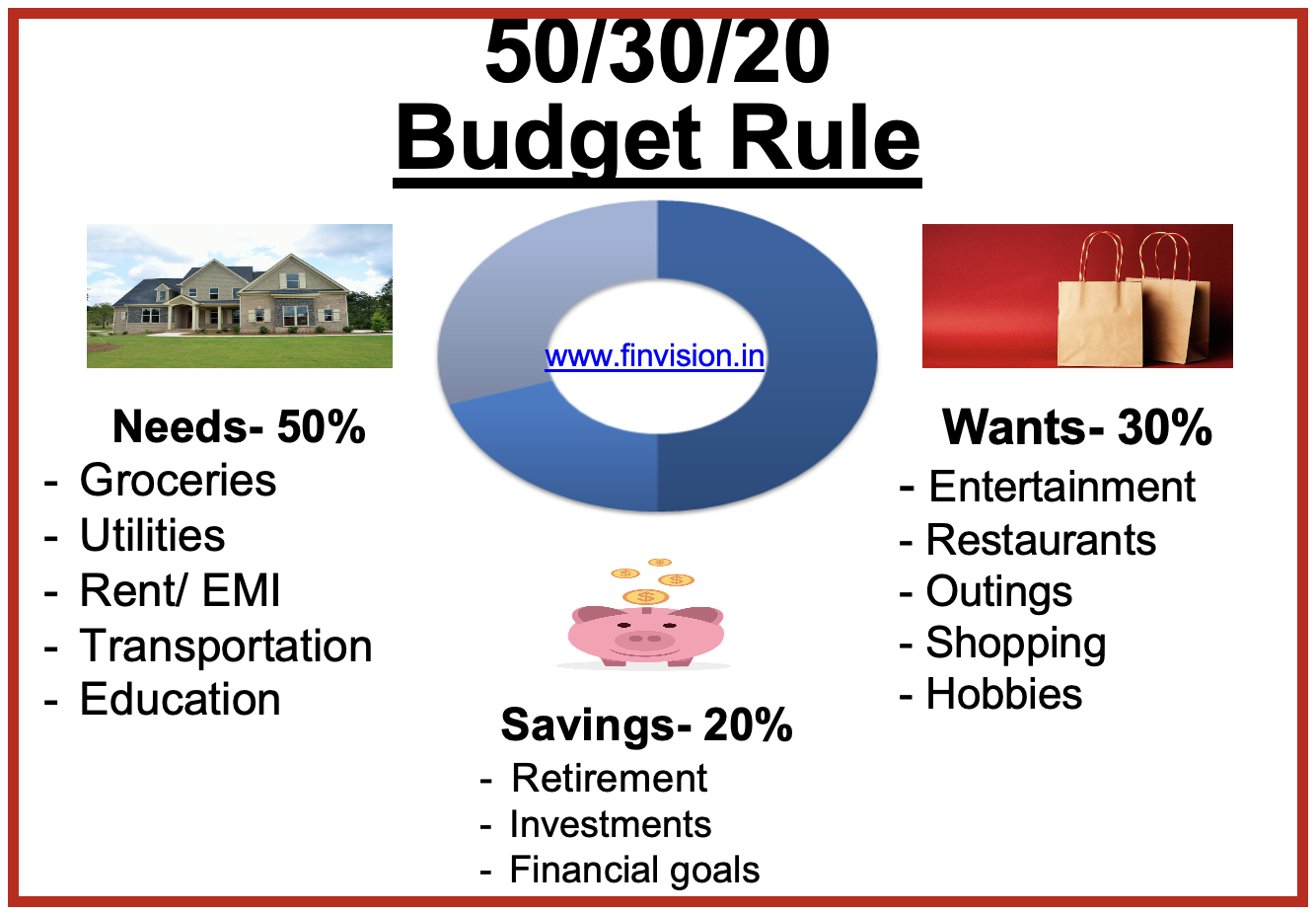

Effective budgeting is the cornerstone of financial independence. Before you can even think about investing or paying down debt, you need to understand where your money is going. Meticulous expense tracking is crucial for identifying areas where you can cut back and redirect funds towards your financial goals. This involves a clear understanding of your income and meticulously documenting your expenses.

Keywords: Budgeting, Expense Tracking, Financial Planning, Budget Apps, Savings Goals

Here are some key steps to effective budgeting:

- Use budgeting apps or spreadsheets: Numerous apps (Mint, YNAB, Personal Capital) and spreadsheet templates are available to simplify expense tracking. Choose a method that suits your preferences and tech skills.

- Categorize expenses: Group expenses into categories like housing, transportation, food, entertainment, etc. This allows you to easily spot areas of overspending.

- Set realistic savings goals: Align your savings goals with your financial aspirations. Whether it's a down payment on a house, paying off debt, or early retirement, having clear goals keeps you motivated.

- Regularly review and adjust your budget: Your financial situation changes. Regularly reviewing your budget (monthly is ideal) ensures it remains relevant and effective. Adjust it as needed to accommodate changes in income or expenses. Flexibility is key to long-term success in money management.

Eliminating and Managing Debt

Debt can significantly hinder your progress towards financial independence. High-interest debt, particularly credit card debt, can quickly spiral out of control. Addressing your debt is a crucial step in gaining control of your finances.

Keywords: Debt Management, Debt Consolidation, Debt Reduction, Credit Card Debt, Loan Repayment

Here's how to tackle your debt effectively:

- List your debts and interest rates: Create a list of all your debts (credit cards, loans, etc.), including their balances and interest rates. This provides a clear picture of your debt burden.

- Prioritize high-interest debts: The snowball method (paying off the smallest debt first for motivation) or the avalanche method (paying off the highest-interest debt first to save money) can be effective strategies.

- Explore debt consolidation options: Debt consolidation loans or balance transfer credit cards can help simplify repayments and potentially lower interest rates. However, be cautious of fees and ensure the new terms are truly beneficial.

- Consider professional financial advice: If you feel overwhelmed by debt, seeking guidance from a certified financial planner can provide a structured plan and personalized solutions for debt reduction.

Building a Strong Savings Foundation

A strong savings foundation is critical for navigating unexpected expenses and achieving long-term financial goals. An emergency fund acts as a safety net, preventing you from going into debt during unforeseen circumstances.

Keywords: Savings, Emergency Fund, Savings Goals, Investment, High-Yield Savings Accounts

Key elements of building a solid savings foundation:

- Automate savings transfers: Set up automatic transfers from your checking account to your savings account each pay period. This ensures consistent contributions without requiring constant manual effort. This is a crucial element of effective money management.

- Explore high-yield savings accounts: Maximize your returns by choosing savings accounts with competitive interest rates.

- Set SMART savings goals: Use the SMART framework (Specific, Measurable, Achievable, Relevant, Time-bound) to define your savings goals, making them more concrete and achievable.

- Diversify savings: Don't keep all your savings in one place. Diversify your savings across different accounts to manage risk and ensure access to funds when needed.

Investing for Long-Term Growth

Investing your savings is crucial for long-term wealth building. While it involves risk, it’s a vital step in achieving financial independence.

Keywords: Investing, Investment Strategies, Stock Market, Retirement Planning, Portfolio Diversification

Here's how to approach investing:

- Research investment options: Understand the different types of investments (stocks, bonds, mutual funds, ETFs) and their risk levels. Start with education and understand your risk tolerance.

- Seek professional financial advice: A financial advisor can create a personalized investment strategy aligned with your financial goals and risk tolerance.

- Start investing early: Take advantage of the power of compounding – the ability of your investments to generate returns on both your initial investment and accumulated earnings.

- Regularly review and rebalance your portfolio: Monitor your investments and adjust your portfolio as needed to maintain your desired asset allocation and risk level. This ensures your portfolio remains aligned with your long-term goals.

Increasing Income Streams

Diversifying your income can significantly accelerate your progress toward financial independence. Exploring additional income streams allows you to boost your savings and accelerate debt repayment.

Keywords: Side Hustle, Passive Income, Income Generation, Freelancing, Part-Time Jobs

Here are some ways to increase your income:

- Identify monetizable skills: Determine your skills and talents that you can leverage to generate additional income.

- Explore online freelance platforms: Numerous online platforms connect freelancers with clients seeking various services.

- Consider starting a small business: If you have entrepreneurial aspirations, starting a small business can create a significant income stream.

- Evaluate time commitment: Assess the time commitment required for each potential income stream to ensure it aligns with your lifestyle and existing commitments.

Conclusion

Conquering a lack of funds requires a multi-faceted approach involving careful budgeting, debt management, consistent saving, strategic investing, and potentially increasing income streams. By implementing these strategies, you can steadily build towards financial independence and a more secure future. Financial freedom is a journey, not a destination, requiring commitment and consistent effort.

Call to Action: Start conquering your lack of funds today! Take control of your finances and embark on your journey towards financial independence. Begin by creating a realistic budget and start saving. Don't wait any longer to secure your financial future. Start building your path to financial freedom now!

Featured Posts

-

China Us Trade Soars Exporters Rush To Meet Trade Truce Deadline

May 22, 2025

China Us Trade Soars Exporters Rush To Meet Trade Truce Deadline

May 22, 2025 -

Home Depot Misses Expectations But Reiterates Tariff Impact Assessment

May 22, 2025

Home Depot Misses Expectations But Reiterates Tariff Impact Assessment

May 22, 2025 -

Half Dome Awarded Prestigious Abn Group Victoria Project

May 22, 2025

Half Dome Awarded Prestigious Abn Group Victoria Project

May 22, 2025 -

Ascii Jp Ntt Multi Interconnect At Be X

May 22, 2025

Ascii Jp Ntt Multi Interconnect At Be X

May 22, 2025 -

Liga Natiunilor Georgia Zdrobeste Armenia Cu 6 1

May 22, 2025

Liga Natiunilor Georgia Zdrobeste Armenia Cu 6 1

May 22, 2025