Copper Market Outlook: China's Stance On US Trade Negotiations

Table of Contents

China's Role as a Major Copper Consumer

China's insatiable appetite for copper is a defining feature of the global copper market. This massive consumption stems from two primary sources: its ambitious infrastructure projects and government policies.

Massive Copper Consumption in Construction and Infrastructure

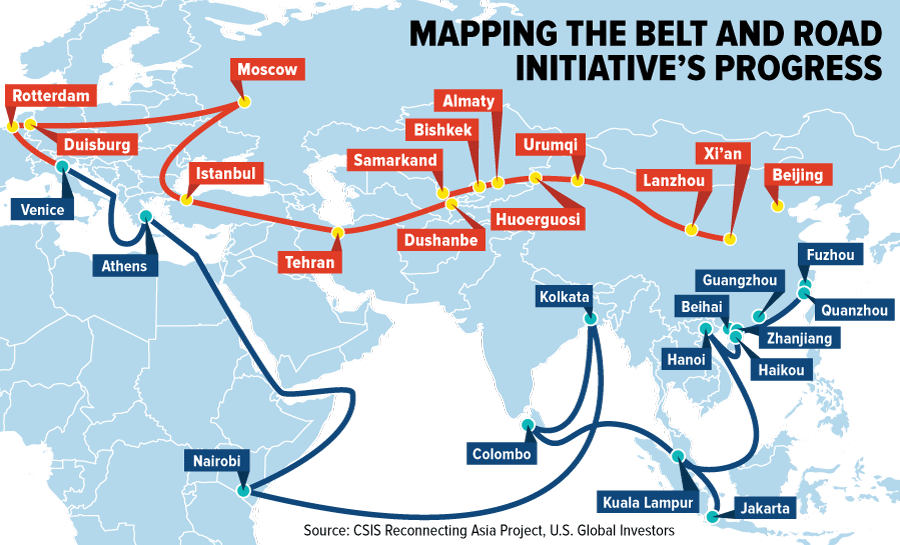

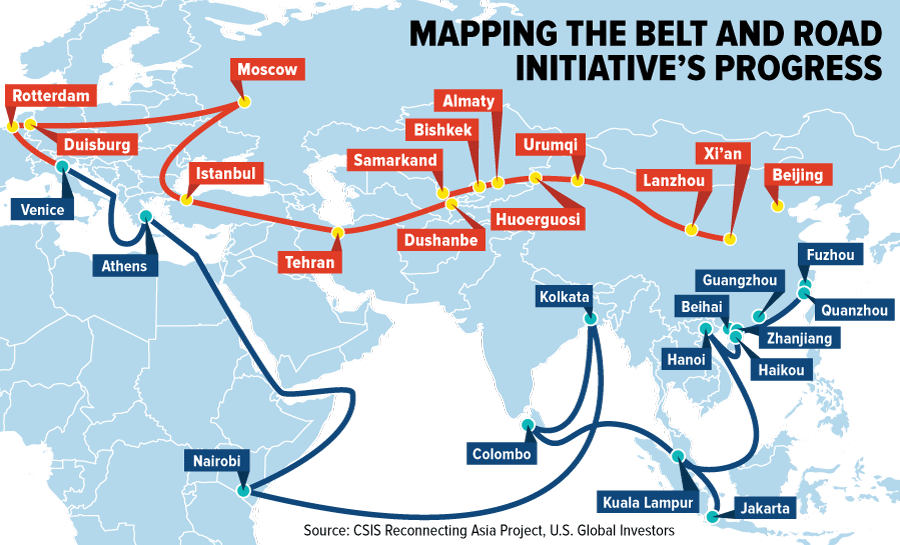

- China's infrastructure boom: The Belt and Road Initiative, a massive global infrastructure development strategy, fuels immense copper demand. The construction of roads, railways, ports, and energy grids requires vast quantities of copper wiring, plumbing, and other construction materials.

- Rapid urbanization: China's ongoing urbanization process, with millions migrating from rural areas to cities, necessitates the construction of new housing, commercial buildings, and supporting infrastructure, further driving up copper demand.

- Electrical infrastructure: The expansion of China's electrical grid and the integration of renewable energy sources requires significant copper investments. Every new power plant, transmission line, and smart grid installation translates into higher copper consumption.

These factors contribute significantly to China's position as the world's largest copper consumer, making its economic policies a critical driver of global copper prices. The sheer scale of Chinese infrastructure projects dwarfs those in other countries, creating a constant, significant pull on global copper supplies.

Impact of Government Policies on Copper Demand

Chinese government policies play a crucial role in shaping copper demand.

- Stimulus packages: Government stimulus packages aimed at boosting economic growth often translate into increased infrastructure spending, directly impacting copper demand. When the Chinese government invests in large-scale projects, the ripple effect is felt globally in the copper market.

- Green energy initiatives: China's commitment to renewable energy sources, including solar and wind power, significantly boosts copper demand. These projects require vast quantities of copper for wiring, transformers, and other components.

- Policy shifts: Changes in government policy, even minor adjustments to infrastructure spending or environmental regulations, can trigger fluctuations in copper demand and prices. Keeping a close eye on Chinese government pronouncements is essential for understanding shifts in the copper market outlook.

US-China Trade Tensions and Their Effect on Copper

The ongoing trade tensions between the US and China have had a significant and often unpredictable impact on the copper market.

Tariffs and Trade Wars

- Import and export tariffs: Tariffs imposed by either the US or China on copper imports and exports directly impact pricing and disrupt established supply chains. Companies may need to find alternative sources of copper or adjust their pricing strategies to account for the added costs.

- Supply chain disruptions: Trade disputes can create uncertainty and lead to disruptions in the copper supply chain, impacting availability and potentially driving up prices. Companies are forced to navigate complex trade regulations and potential delays.

- Alternative sourcing strategies: To circumvent tariffs, companies may seek alternative copper sources, potentially shifting their reliance away from Chinese suppliers or vice versa, depending on the specific trade policies in place.

The fluctuating nature of trade relations introduces an element of unpredictability to copper market projections.

Geopolitical Uncertainty and Investment

- Investor confidence: Geopolitical uncertainty surrounding US-China trade relations can significantly impact investor confidence in the copper market. Volatile trade relations lead to uncertainty about future copper prices and may discourage investment.

- Copper futures prices: The uncertainty created by trade wars often translates into volatility in copper futures prices, making it difficult for companies and investors to plan long-term strategies. Hedge funds and other investors carefully watch for signs of trade escalation or de-escalation.

Analyzing Copper Supply and its Global Distribution

Understanding the global distribution of copper production and its relationship with China and the US is crucial for accurate market forecasting.

Major Copper Producing Countries and their Relationship with China and the US

- Chile and Peru: Chile and Peru are major copper producers, and their trade relationships with China and the US significantly influence global copper supply. Any disruption to these relationships can have major ramifications.

- Supply chain bottlenecks: Potential supply chain bottlenecks can arise from geopolitical instability in copper-producing regions or from disruptions caused by trade disputes. These bottlenecks can contribute to shortages and price increases.

The interconnectedness of global copper production and consumption highlights the importance of understanding international relations in analyzing market trends.

Future Copper Supply and Demand Projections

- Market forecasts: Numerous analysts and organizations provide forecasts for future copper supply and demand. These forecasts often incorporate factors like economic growth projections, technological advancements, and government policies.

- Supply-demand balance: The future balance between copper supply and demand is a critical factor in determining future copper prices. A projected shortage could lead to price increases, while a surplus could drive prices down.

Conclusion:

The copper market outlook remains inextricably linked to the complex interplay between the US and China. China's enormous copper consumption, combined with the impact of trade negotiations and global geopolitical factors, creates significant volatility in copper prices and supply chains. Monitoring government policies in both countries, along with global economic indicators, is crucial for navigating the complexities of this dynamic market. Understanding China's stance on US trade negotiations is therefore essential for anyone involved in the copper market, whether as a producer, consumer, or investor. Stay informed on the latest developments to make informed decisions regarding the copper market outlook, and analyze the impact of all influential factors on the future of copper prices.

Featured Posts

-

Bbc Line Of Duty Stars St Patricks Day Reunion A Boozy Celebration

May 06, 2025

Bbc Line Of Duty Stars St Patricks Day Reunion A Boozy Celebration

May 06, 2025 -

Tracee Ellis Rosss Runway Return After 30 Years A Marni Moment

May 06, 2025

Tracee Ellis Rosss Runway Return After 30 Years A Marni Moment

May 06, 2025 -

Cumhurbaskani Erdogan In Azerbaycan Ziyareti Aliyev Ile Oenemli Goeruesmeler

May 06, 2025

Cumhurbaskani Erdogan In Azerbaycan Ziyareti Aliyev Ile Oenemli Goeruesmeler

May 06, 2025 -

High Stock Market Valuations A Bof A Analysis For Investors

May 06, 2025

High Stock Market Valuations A Bof A Analysis For Investors

May 06, 2025 -

Gypsy Rose Blanchard Shows Off Postpartum Weight Loss

May 06, 2025

Gypsy Rose Blanchard Shows Off Postpartum Weight Loss

May 06, 2025