CoreWeave (CRWV) Stock Decline Thursday: Analysis Of The Price Fall

Table of Contents

Market Sentiment and Broad Tech Sell-Off

Thursday's decline in CoreWeave (CRWV) stock price wasn't an isolated incident; it reflected a broader negative market sentiment, particularly within the technology sector. A significant tech sell-off impacted many companies, and CRWV unfortunately wasn't immune. Several factors contributed to this overall negativity.

- Market Indices Performance: The major market indices, including the Nasdaq Composite and the S&P 500, experienced declines on Thursday, indicating a general downturn in investor confidence.

- Negative Tech News: Reports of slowing growth in certain tech segments, coupled with concerns about rising interest rates and potential future economic slowdown, fueled the sell-off. Specific negative news stories impacting the broader tech landscape likely amplified the pressure on CRWV.

- Correlation Analysis: The CRWV decline's correlation with the overall market trend suggests a significant influence from the broader tech sell-off, though company-specific factors likely played a role as well. Analyzing the correlation between CRWV and other tech stocks would be a key step in future investigation. This correlation highlights the interconnectedness of the tech market.

Lack of Recent Positive Catalysts for CoreWeave (CRWV)

The absence of recent positive news or announcements from CoreWeave itself contributed to the stock's vulnerability. Without positive catalysts to counter the negative market sentiment, CRWV’s stock price was more susceptible to downward pressure.

- Missed Earnings Expectations: While not confirmed at this time, the possibility of missed earnings expectations or slower-than-anticipated revenue growth could have negatively influenced investor sentiment. The lack of positive updates on key performance indicators left investors cautious.

- Project Delays: Potential delays in major project rollouts or partnerships could also have contributed to the decline. Investors often react negatively to uncertainty regarding a company’s growth trajectory.

- Impact on Investor Confidence: The lack of positive catalysts eroded investor confidence, making them more inclined to sell their shares, exacerbating the decline in CRWV stock price. Sustained positive news flow is crucial for maintaining investor confidence and stock price stability.

Analyst Downgrades and Price Target Reductions

Adding to the pressure, several analysts issued downgrades or lowered their price targets for CoreWeave stock. These actions significantly influenced market perception and contributed to the sell-off.

- Analyst Rating Changes: Specific analysts' reports and rating changes (mention specific analysts and their changes if available) played a considerable role in shaping investor sentiment. The public announcements and the rationale behind these changes would need to be further examined.

- Influence on Market Perception: Analyst opinions carry significant weight in the market. Negative revisions can create a self-fulfilling prophecy, leading to further selling pressure.

- Relationship to Stock Price Fall: The timing of analyst downgrades and price target reductions in relation to the Thursday decline suggests a clear correlation between these actions and the stock price fall. This needs further analysis to fully understand the impact.

Speculative Trading and Volatility

The inherent volatility of the technology sector, coupled with speculative trading, likely exacerbated the CoreWeave (CRWV) stock price decline.

- Short-Selling: Short-selling, where investors bet against a stock's price, can amplify downward price movements. This may have contributed to the sharp decline observed.

- Algorithmic Trading: High-frequency algorithmic trading can contribute to increased market volatility, potentially magnifying the impact of negative news and contributing to a rapid price drop.

- Volatility Compared to Peers: The volatility of CRWV stock needs comparison to similar companies in the cloud computing and AI infrastructure sectors to gauge its sensitivity to market fluctuations. Determining CRWV’s relative volatility can provide insight into the impact of speculative trading.

Conclusion: Navigating the CoreWeave (CRWV) Stock Decline and Future Outlook

The sharp decline in CoreWeave (CRWV) stock price on Thursday resulted from a confluence of factors: negative market sentiment impacting the broader tech sector, a lack of recent positive catalysts from CoreWeave itself, negative analyst revisions, and the amplification effects of speculative trading and market volatility. The future outlook for CRWV remains uncertain. While the company operates in a high-growth sector with significant potential, the recent decline highlights the risks associated with investing in tech stocks. It's crucial for investors to conduct thorough due diligence and consider their risk tolerance before making any investment decisions related to CRWV. Stay informed about CoreWeave (CRWV) stock and the broader market trends to make well-informed investment decisions. Continue monitoring the CRWV stock price and related news for further analysis.

Featured Posts

-

Tesla Ceo Musk Stepping Back From Politics Focusing On Company

May 22, 2025

Tesla Ceo Musk Stepping Back From Politics Focusing On Company

May 22, 2025 -

Dutch Central Bank To Investigate Abn Amro Bonus Practices

May 22, 2025

Dutch Central Bank To Investigate Abn Amro Bonus Practices

May 22, 2025 -

Ispovest Vanje Mijatovic O Razvodu Potpuna Istina

May 22, 2025

Ispovest Vanje Mijatovic O Razvodu Potpuna Istina

May 22, 2025 -

Authorities Search For Two Loose Cows In Lancaster County Park

May 22, 2025

Authorities Search For Two Loose Cows In Lancaster County Park

May 22, 2025 -

Cubs Game Lady And The Tramp Style Hot Dog Shared By Fans

May 22, 2025

Cubs Game Lady And The Tramp Style Hot Dog Shared By Fans

May 22, 2025

Latest Posts

-

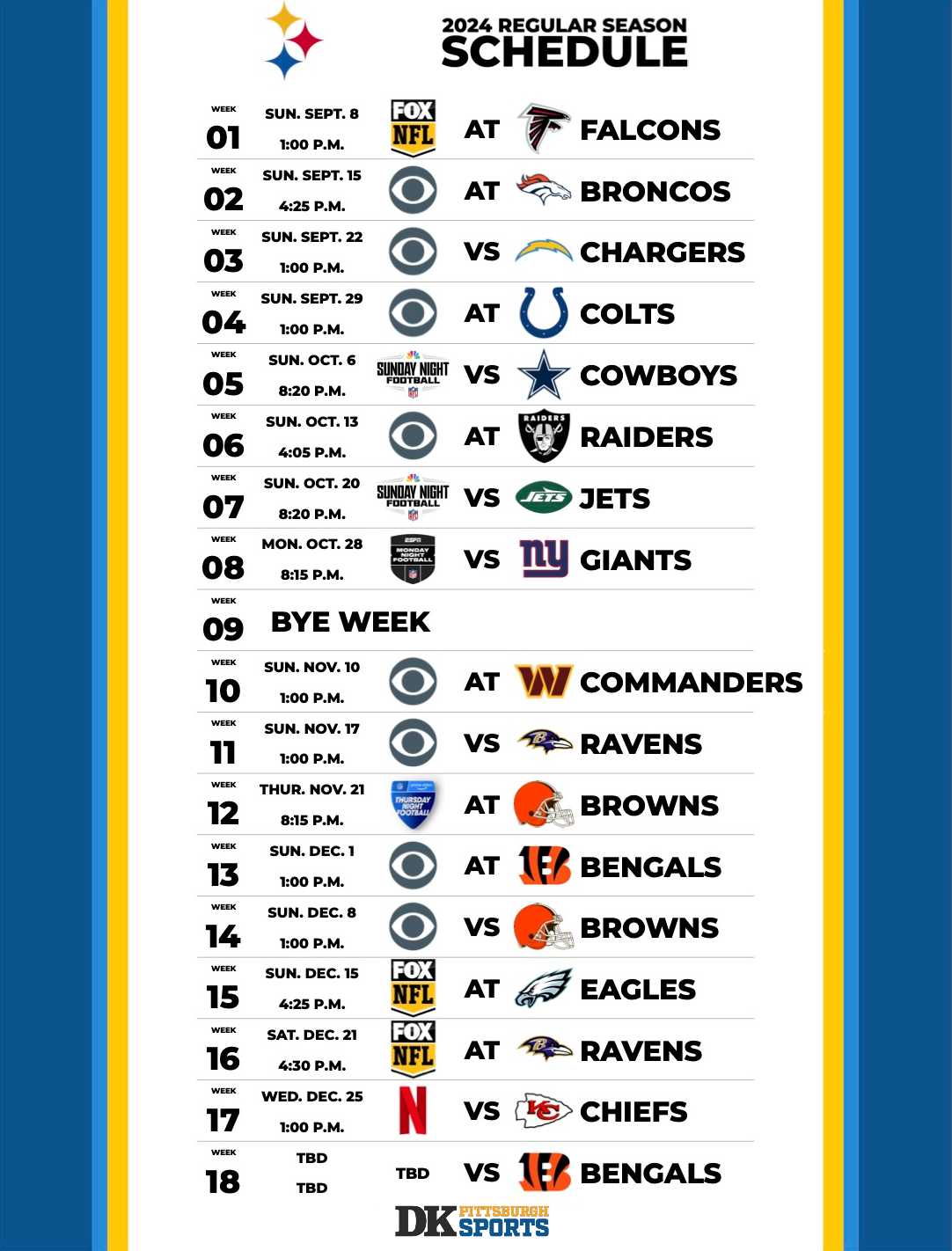

Decoding The Steelers 2024 Schedule What The Takeaways Mean

May 22, 2025

Decoding The Steelers 2024 Schedule What The Takeaways Mean

May 22, 2025 -

Pittsburgh Steelers Schedule A Deep Dive Into The Takeaways

May 22, 2025

Pittsburgh Steelers Schedule A Deep Dive Into The Takeaways

May 22, 2025 -

Analyzing The Steelers 2024 Schedule Important Takeaways For Fans

May 22, 2025

Analyzing The Steelers 2024 Schedule Important Takeaways For Fans

May 22, 2025 -

George Pickens Trade Rumors Insider Reveals Steelers Rationale

May 22, 2025

George Pickens Trade Rumors Insider Reveals Steelers Rationale

May 22, 2025 -

Steelers Schedule Release Key Takeaways And Analysis

May 22, 2025

Steelers Schedule Release Key Takeaways And Analysis

May 22, 2025