CoreWeave (CRWV) Stock Performance: Explaining Tuesday's Decrease

Table of Contents

Market-Wide Factors Influencing CRWV Stock Performance

Tuesday's broader market sentiment played a significant role in CoreWeave's (CRWV) stock performance. The tech sector, in which CRWV operates, experienced a general sell-off, impacting many cloud computing stocks. This negative market trend wasn't isolated to CRWV; it reflected a broader concern among investors.

- Major Indices: The Dow Jones Industrial Average, the S&P 500, and the Nasdaq Composite all experienced declines on Tuesday, indicating a general market downturn. These declines influenced the performance of individual stocks, including CRWV.

- Interest Rate Hikes: The anticipation or announcement of further interest rate hikes by central banks often creates market volatility. Higher interest rates can impact investor sentiment and lead to a decrease in valuations for growth stocks like CoreWeave. You can find more information on this from reputable financial news sources such as the Wall Street Journal or Bloomberg. [Link to relevant WSJ or Bloomberg article].

- Geopolitical Uncertainty: Unforeseen geopolitical events can also contribute to market instability. Any significant global developments on Tuesday could have contributed to the overall negative sentiment.

CoreWeave-Specific News and Developments

Beyond the general market downturn, specific news or developments concerning CoreWeave might have added to Tuesday's stock price decrease. Analyzing company-specific factors is crucial for a complete understanding of CRWV's performance.

- Earnings Reports and Analyst Reviews: The release of quarterly earnings reports or any significant analyst downgrades around Tuesday could have affected investor confidence. Negative earnings reports or less optimistic future projections often lead to a drop in stock prices.

- Competitive Landscape: Increased competition within the cloud computing industry could also impact CoreWeave's stock price. Announcements from competitors or shifts in market share could trigger negative investor sentiment.

- Financial Health Concerns: Any concerns regarding CoreWeave's financial health, such as increased debt or slower-than-expected revenue growth, could also contribute to a decline in its stock price. Reviewing their financial statements is vital in assessing these factors. [Link to CoreWeave investor relations page]

Technical Analysis of CRWV Stock Chart

Examining the technical aspects of the CRWV stock chart on Tuesday provides further insights into the price movement. While we cannot offer financial advice, we can look at several key factors.

- Trading Volume: A significantly higher trading volume on Tuesday, compared to previous days, suggests increased investor activity. This high volume could have amplified the price decrease.

- Price Movements and Chart Patterns: Analyzing the CRWV stock chart for specific patterns like support and resistance levels can help understand why the price dropped. A break below a significant support level could signal a further decline.

- Technical Indicators (Disclaimer): While we will not provide specific interpretations of technical indicators, their use in conjunction with price action can provide additional context to price movements. (Always remember that technical analysis is not a foolproof prediction tool).

Impact of Short-Selling and Institutional Investors

Short-selling and institutional investor activity can significantly impact a stock's price. Analyzing these aspects adds another layer to our understanding of CRWV’s drop.

- Short Interest: A high level of short interest (the percentage of shares shorted) suggests a bearish sentiment among some investors. An increase in short-selling activity around Tuesday could have exacerbated the decline. Data on short interest can often be found on financial data websites. [Link to relevant financial data website]

- Institutional Investor Holdings: Changes in the holdings of large institutional investors (mutual funds, hedge funds, etc.) can influence a stock's price. A reduction in holdings by these significant investors could contribute to a stock price decrease.

Conclusion: Looking Ahead for CoreWeave (CRWV) Investors

CoreWeave's (CRWV) stock price decrease on Tuesday was likely a result of a combination of market-wide factors, such as a broader tech sector sell-off and potentially interest rate concerns, and company-specific factors which require further individual investigation. While the analysis here offers potential explanations, it's crucial to remember that investing involves risk. This information shouldn't be taken as financial advice.

To make informed investment decisions, stay updated on CRWV by regularly monitoring its performance, reviewing financial news, and conducting thorough due diligence. Continue to research CRWV stock price trends and related news to understand future performance. Remember to always seek professional financial advice before making any investment decisions. Stay updated on CRWV and monitor CoreWeave stock performance to make well-informed choices.

Featured Posts

-

Loire Atlantique Quiz De Culture Generale

May 22, 2025

Loire Atlantique Quiz De Culture Generale

May 22, 2025 -

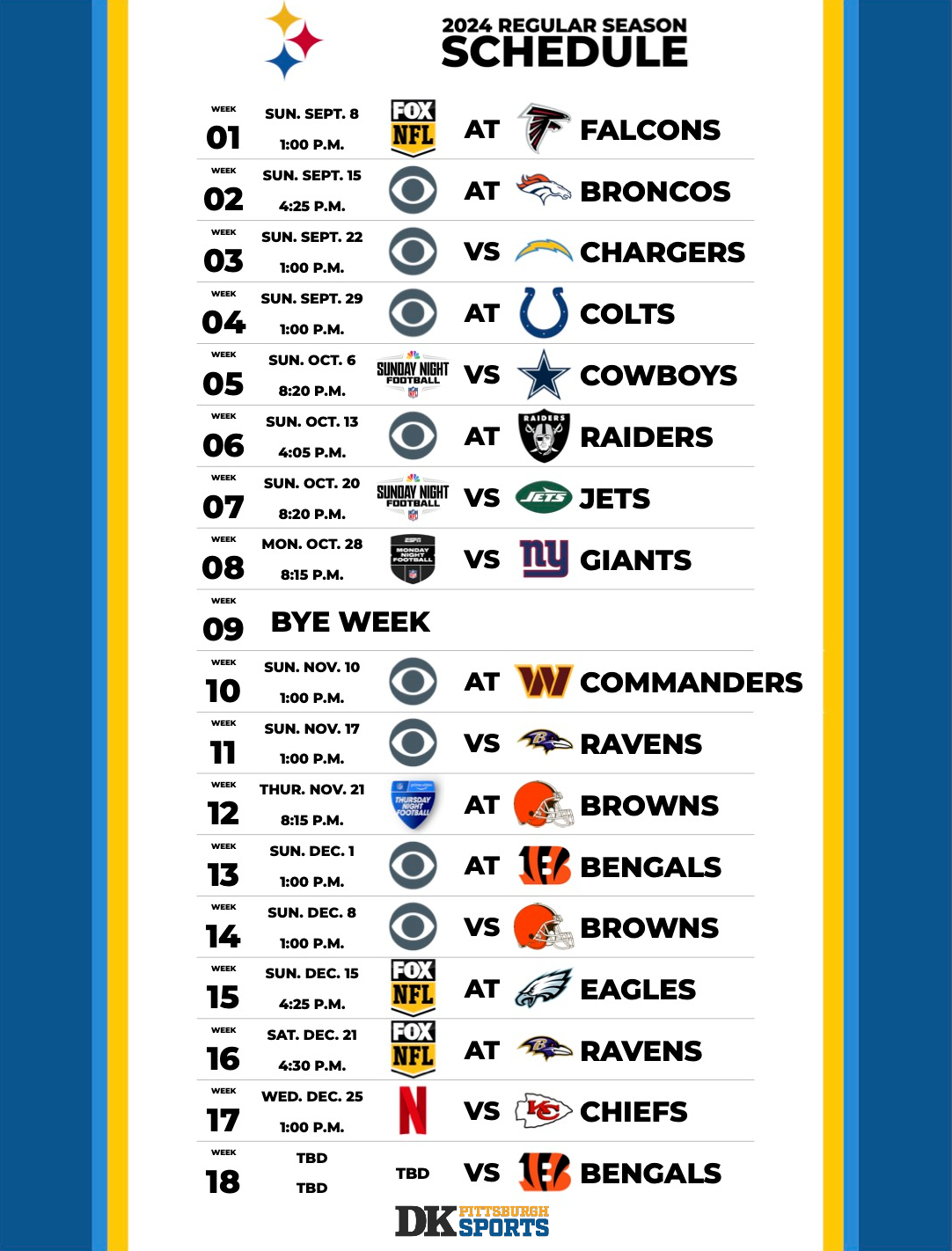

Projected Pittsburgh Steelers 2025 Schedule A Season Preview

May 22, 2025

Projected Pittsburgh Steelers 2025 Schedule A Season Preview

May 22, 2025 -

Liverpools Luck Arne Slot And Luis Enrique Offer Insights On Alisson And The Reds

May 22, 2025

Liverpools Luck Arne Slot And Luis Enrique Offer Insights On Alisson And The Reds

May 22, 2025 -

Bp Chief Executives Pay Falls By 31 Percent

May 22, 2025

Bp Chief Executives Pay Falls By 31 Percent

May 22, 2025 -

Death Of Adam Ramey Dropout Kings Vocalist At 32 A Heartbreaking Announcement

May 22, 2025

Death Of Adam Ramey Dropout Kings Vocalist At 32 A Heartbreaking Announcement

May 22, 2025