CoreWeave (CRWV) Stock Performance: Explaining Tuesday's Gains

Table of Contents

Market Sentiment and Overall Tech Sector Performance

Tuesday's gains in CoreWeave (CRWV) stock weren't isolated; they coincided with a broader positive trend in the technology sector. Understanding the overall market sentiment is crucial to interpreting CRWV's performance.

-

Positive Tech Indices: The Nasdaq Composite, a key indicator of the technology sector's health, experienced a notable increase on Tuesday. This positive market movement likely provided a tailwind for CRWV stock, boosting investor confidence across the board. Other tech-heavy indices also showed positive momentum, creating a favorable environment for cloud computing stocks like CoreWeave.

-

Cloud Computing Industry Momentum: The cloud computing industry itself is experiencing a period of robust growth, fueled by increasing demand for data storage, processing power, and AI solutions. Positive news regarding major players in the industry often spills over to smaller, faster-growing companies like CoreWeave, benefiting their stock prices. Several reports highlighted increased adoption of cloud services across various sectors, bolstering investor optimism.

-

Market Commentary and Analyst Reports: Preliminary market commentary from leading financial news outlets pointed to increased investor appetite for growth stocks, especially within the cloud computing and AI sectors. While specific analyst reports targeting CoreWeave might not have been the sole catalyst, the broader positive sentiment contributed to the overall upward trend.

Company-Specific News and Announcements

While no major press releases were issued by CoreWeave (CRWV) on Tuesday itself, the period leading up to the stock surge might hold clues. Examining recent company developments is crucial for a complete picture.

-

Potential for Upcoming Announcements: Speculation around upcoming partnerships, contract wins, or product launches can significantly influence a company's stock price. The market might have anticipated positive news, driving preemptive buying and fueling the price increase. Investors often react positively to the expectation of future growth.

-

Strong Q[Quarter] Earnings (if applicable): If CoreWeave had recently reported strong quarterly earnings or provided an optimistic outlook for future performance, this could have significantly boosted investor confidence, leading to the Tuesday price jump. This positive sentiment could have been fueled by investor anticipation of further growth.

-

Strategic Partnerships and Acquisitions: Past partnerships or acquisitions, even if announced prior to Tuesday, could have been reassessed by investors, leading to renewed interest and a subsequent rise in stock price. Positive collaborations often result in stronger investor confidence.

Analyst Ratings and Price Target Adjustments

The actions of influential investment firms and their analysts can significantly sway investor sentiment and impact a stock's price. Let's examine analyst activity around Tuesday's CoreWeave (CRWV) stock surge.

-

Positive Analyst Upgrades: If any major investment banks upgraded their ratings for CRWV stock around this time, it would likely have contributed to the price increase. A "buy" rating from a well-respected analyst can trigger a wave of buying activity.

-

Increased Price Targets: Adjustments to price targets, particularly upward revisions, signal increased confidence in the company's future performance and can attract more investment. A higher price target suggests that analysts believe the stock is undervalued at its current price.

-

Analyst Commentary and Reports: Beyond ratings and targets, the tone and substance of analyst commentary can influence investor perception. Positive remarks about CoreWeave's business model, growth prospects, or competitive advantages could have fueled the price surge.

Short Squeeze Potential

One factor to consider is the possibility of a short squeeze. A short squeeze occurs when a heavily shorted stock experiences a rapid price increase, forcing short-sellers to buy shares to cover their positions, further driving up the price.

-

Short Interest Data: Analyzing short interest data for CRWV before and after Tuesday's surge would help determine if a short squeeze played a role. A high level of short interest preceding the price increase would support this theory.

-

Short Covering: If a significant number of short-sellers decided to cover their positions on Tuesday, it could have added to the buying pressure and amplified the price increase. This would be evident in increased trading volume.

-

Market Dynamics: The broader market conditions, including the overall positive sentiment in the tech sector, would have influenced the extent to which a short squeeze could have contributed to CRWV's gains.

Competitor Activity and Industry Trends

The performance of CoreWeave's competitors can indirectly impact its stock price. Positive or negative news about competitors could influence investor perception of CRWV's position within the market.

-

Competitor Performance: If CoreWeave's major competitors experienced setbacks or underperformed, this could have made CoreWeave appear more attractive to investors.

-

Industry News: Positive developments in the broader cloud computing industry, even if not directly related to CoreWeave, can benefit the entire sector, including CRWV.

-

Competitive Advantage: Any news highlighting CoreWeave's unique competitive advantages, such as innovative technology or strategic partnerships, could have attracted investment and driven up the stock price.

Conclusion

This analysis explored various potential factors behind CoreWeave (CRWV) stock's significant gains on Tuesday. A combination of positive market sentiment, potentially positive anticipation of future company news, analyst ratings, a possible short squeeze, and the broader competitive landscape likely contributed to the positive performance. Pinpointing the single most significant driver is difficult, but the interplay of these factors provides a more comprehensive understanding of the stock's movement.

Call to Action: Understanding the dynamics impacting CoreWeave (CRWV) stock requires ongoing monitoring of market trends, company announcements, analyst opinions, and competitor activity. Stay informed on future developments of CoreWeave stock and other related cloud computing investments to make informed decisions. Continue to research CoreWeave (CRWV) stock and its performance to make the best investment choices for your portfolio. Remember that this analysis is for informational purposes only and not financial advice. Always conduct thorough research and consider consulting a financial advisor before making any investment decisions.

Featured Posts

-

Leaked Texts Fuel Blake Lively Taylor Swift Feud Blackmail Allegations Emerge

May 22, 2025

Leaked Texts Fuel Blake Lively Taylor Swift Feud Blackmail Allegations Emerge

May 22, 2025 -

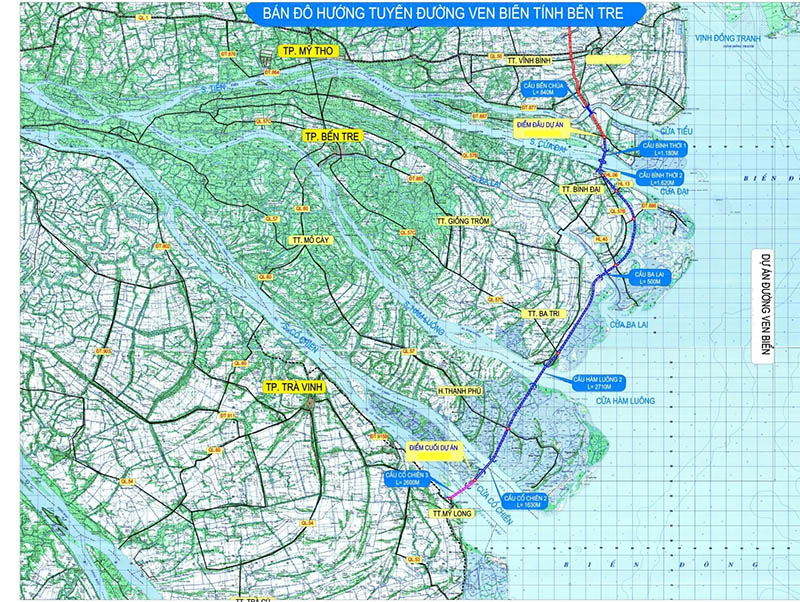

7 Du An Ket Noi Giao Thong Tp Hcm Long An Uu Tien Phat Trien

May 22, 2025

7 Du An Ket Noi Giao Thong Tp Hcm Long An Uu Tien Phat Trien

May 22, 2025 -

Columbus Ohio Exploring The Gas Price Discrepancy

May 22, 2025

Columbus Ohio Exploring The Gas Price Discrepancy

May 22, 2025 -

Fastest Across Australia On Foot A New Record

May 22, 2025

Fastest Across Australia On Foot A New Record

May 22, 2025 -

L Espace Julien Les Novelistes Avant Le Hellfest

May 22, 2025

L Espace Julien Les Novelistes Avant Le Hellfest

May 22, 2025