CoreWeave (CRWV) Stock Soars: Exploring The Contributing Factors

Table of Contents

CoreWeave's Competitive Advantage in the Cloud Computing Market

CoreWeave has rapidly established itself as a major player in the cloud computing landscape, particularly within the specialized niche of GPU-focused cloud services. This competitive advantage is built upon several key pillars.

Market Leadership in GPU-focused Cloud Computing

CoreWeave differentiates itself through several unique offerings:

- Specialized Hardware: The company leverages cutting-edge GPU technology, providing clients with unparalleled processing power for demanding applications. Their infrastructure is optimized for AI/ML workloads, offering superior performance compared to general-purpose cloud providers.

- Focus on AI/ML Workloads: CoreWeave caters specifically to the growing needs of the artificial intelligence and machine learning sectors, offering tailored solutions and expertise. This focus allows them to deeply understand and address the unique computational requirements of these rapidly expanding fields.

- Sustainable Infrastructure: CoreWeave is committed to environmentally responsible practices, utilizing energy-efficient hardware and infrastructure, a growing concern for environmentally conscious corporations and investors.

Unlike competitors like AWS, Google Cloud, and Azure, CoreWeave's laser focus on GPU-accelerated computing provides a significant advantage in the rapidly expanding AI/ML market. While these larger providers offer GPU services, CoreWeave's specialization allows for deeper optimization and superior performance for specific AI/ML tasks. Industry reports suggest CoreWeave holds a significant market share in this niche, further solidifying its competitive position.

Strategic Partnerships and Collaborations

CoreWeave's strategic partnerships play a vital role in its growth trajectory. Collaborations with major technology companies provide access to wider markets and enhance its service offerings. For instance, partnerships with [Insert Example Partnership Names Here] have significantly broadened CoreWeave's reach and solidified its position within the industry. These partnerships not only provide access to new clients but also contribute to the development of innovative solutions and unlock new revenue streams, positioning CoreWeave for continued expansion and growth.

Strong Financial Performance and Growth Projections

The surge in CoreWeave (CRWV) stock is closely linked to its impressive financial performance and promising growth projections.

Impressive Revenue Growth and Profitability

CoreWeave has demonstrated robust revenue growth in recent quarters, significantly exceeding industry averages. [Insert specific data points on revenue growth, profitability, and earnings per share]. This strong financial performance indicates a healthy business model and strong demand for its services. Analysts project continued growth, with [Insert specific growth projections from reliable sources] suggesting a positive outlook for the company's financial health.

Positive Analyst Ratings and Price Targets

Leading financial analysts have issued positive ratings and price targets for CoreWeave (CRWV) stock. [Cite specific analyst reports and their price targets]. This positive analyst sentiment reflects confidence in the company's future prospects and its ability to maintain its growth trajectory. The overall market sentiment towards CRWV stock is overwhelmingly positive, further fueling the price increase.

The Impact of Artificial Intelligence (AI) and Machine Learning (ML) Trends

CoreWeave is uniquely positioned to capitalize on the explosive growth of the AI/ML market. The increasing demand for powerful computing resources to train and deploy complex AI models directly benefits CoreWeave’s specialized GPU-based cloud services. The global AI/ML market is projected to experience [Insert market growth projections] in the coming years, providing a significant tailwind for CoreWeave's growth. GPU computing is a critical component of enabling these advancements, and CoreWeave's expertise in this area places them at the forefront of this transformative technological shift.

Investor Sentiment and Market Conditions

The recent surge in CoreWeave (CRWV) stock reflects a confluence of positive investor sentiment and favorable market conditions.

Increased Investor Interest and Demand

Several factors contribute to increased investor confidence in CoreWeave: strong financial performance, significant growth potential within the rapidly expanding AI/ML market, and a clear competitive advantage in the GPU-focused cloud computing sector. Increased trading volume and consistent upward price momentum further demonstrate the growing investor interest.

Favorable Macroeconomic Factors

While specific macroeconomic factors can influence the overall market, the positive outlook for the technology sector, particularly within cloud computing and AI/ML, is supportive of CoreWeave's growth. However, investors should be aware of potential risks associated with broader economic fluctuations and market volatility.

Conclusion: Investing in the Future of Cloud Computing with CoreWeave (CRWV) Stock

The substantial increase in CoreWeave (CRWV) stock price reflects a combination of strong financial performance, a clear competitive advantage in a rapidly growing market, and positive investor sentiment. The company's focus on GPU-accelerated computing for AI/ML workloads positions it for significant future growth. While past performance doesn't guarantee future success, the compelling factors driving CoreWeave (CRWV) stock's recent surge make it a stock worth further investigation for investors interested in the future of cloud computing. However, remember that all investments carry inherent risks, and it's crucial to conduct thorough due diligence before making any investment decisions.

Featured Posts

-

Exclusive Inside Ford And Nissans Collaborative Battery Plant

May 22, 2025

Exclusive Inside Ford And Nissans Collaborative Battery Plant

May 22, 2025 -

The Pittsburgh Steelers 2025 Season A Look At The Upcoming Schedule

May 22, 2025

The Pittsburgh Steelers 2025 Season A Look At The Upcoming Schedule

May 22, 2025 -

Ispovest Vanje Mijatovic O Razvodu Potpuna Istina

May 22, 2025

Ispovest Vanje Mijatovic O Razvodu Potpuna Istina

May 22, 2025 -

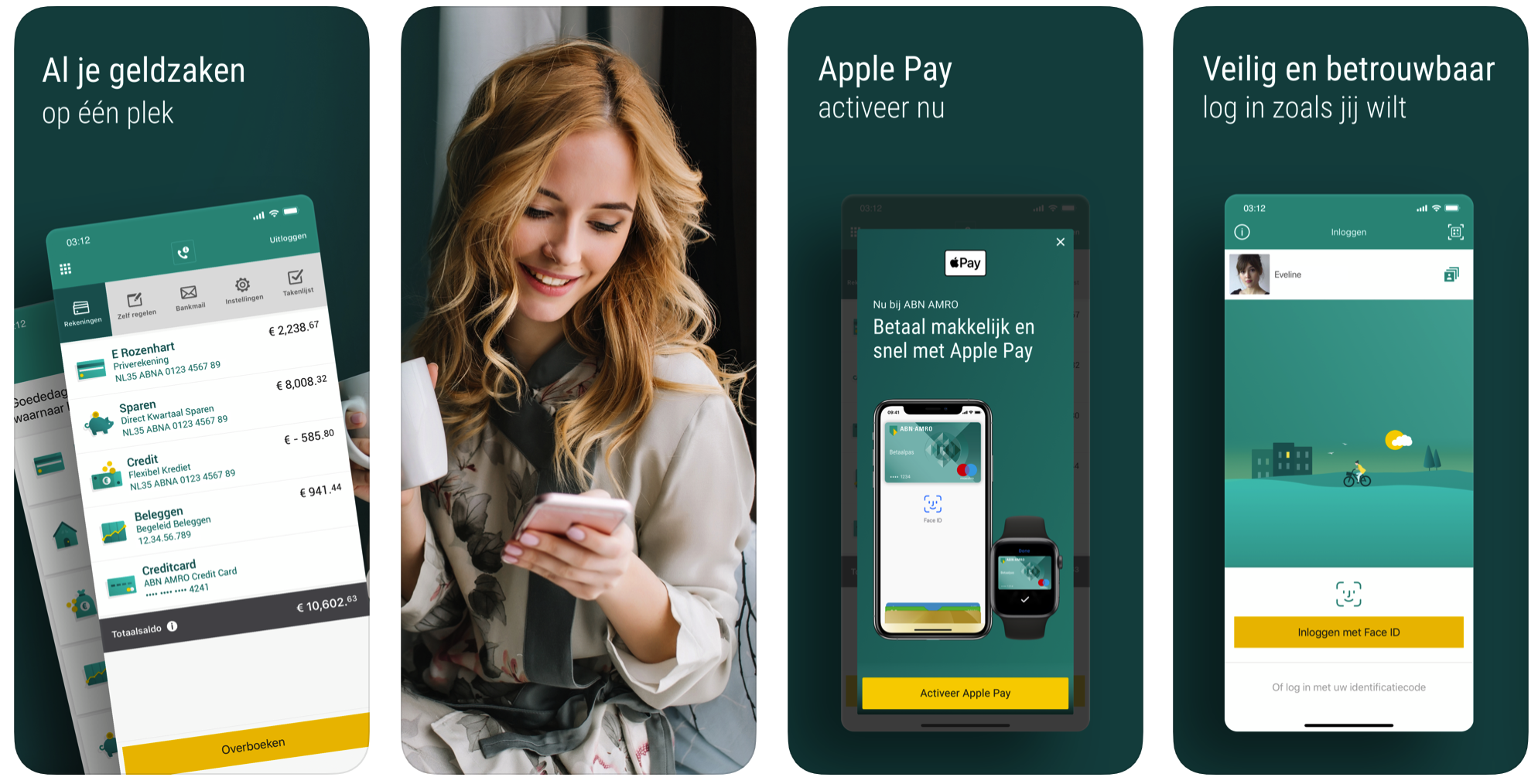

Problemen Met Online Betalen Bij Abn Amro Opslag

May 22, 2025

Problemen Met Online Betalen Bij Abn Amro Opslag

May 22, 2025 -

Virginia Gas Prices Drop Gas Buddy Reports Week Over Week Decline

May 22, 2025

Virginia Gas Prices Drop Gas Buddy Reports Week Over Week Decline

May 22, 2025