CoreWeave Stock (CRWV): Jim Cramer's Perspective And OpenAI's Role

Table of Contents

Jim Cramer's Take on CoreWeave (CRWV) Stock

Analyzing Cramer's Statements

Jim Cramer, the renowned host of CNBC's "Mad Money," has frequently discussed the burgeoning AI infrastructure sector. While specific, recent quotes directly referencing CoreWeave (CRWV) stock may be limited and require up-to-date research from reputable financial news sources, his general commentary on the AI sector can provide context. His opinions often reflect a bullish sentiment towards companies with strong fundamentals and significant growth potential in rapidly expanding markets like AI. By searching for "Jim Cramer CoreWeave" or "Cramer CRWV" on reputable financial news websites, you can find the most up-to-date information on his views.

- Specific quotes from Cramer (if available): [Insert direct quotes from reputable sources here, including links. If no direct quotes are available, state this clearly and focus on the general sentiment expressed towards similar companies in the AI sector.]

- Interpretation of Cramer's assessment (bullish, bearish, or neutral): [Based on available information, analyze Cramer's overall sentiment towards CoreWeave and the AI infrastructure market. Is he generally positive or cautious about the sector? ]

- Consideration of Cramer's track record and potential biases: It's crucial to remember that Cramer's opinions are just one perspective among many. His track record is mixed, and it's important to conduct your own due diligence before making any investment decisions.

OpenAI's Partnership and its Impact on CoreWeave's Value

The Significance of OpenAI's Relationship

CoreWeave's partnership with OpenAI is a significant driver of its value and growth prospects. OpenAI, a leading artificial intelligence research company, relies on CoreWeave's robust and scalable cloud infrastructure to train its large language models and power its AI services. This relationship provides CoreWeave with significant credibility and a substantial source of revenue.

- Specific services provided by CoreWeave to OpenAI: CoreWeave provides OpenAI with high-performance computing resources, including specialized GPUs and networking infrastructure, essential for the computationally intensive task of AI model training. This includes cloud computing solutions tailored to OpenAI's specific needs.

- Market share implications of this partnership: The association with OpenAI gives CoreWeave a significant competitive advantage, positioning it as a leading provider of AI infrastructure. This partnership boosts credibility and attracts other clients looking for reliable AI computing solutions.

- Potential future collaborations and growth opportunities: As OpenAI continues its innovation and expansion, the demand for CoreWeave's services is likely to increase, leading to further growth opportunities for both companies. This collaboration could lead to joint ventures and expansion into new AI-related areas. Keywords: OpenAI CoreWeave, CoreWeave OpenAI partnership, AI infrastructure provider, OpenAI cloud computing

CoreWeave's Business Model and Financial Performance

Revenue Streams and Growth Potential

CoreWeave operates primarily as a provider of high-performance cloud computing infrastructure, focusing on the rapidly growing AI and machine learning markets. Its revenue streams are generated through the provision of compute power, storage, and networking services to a range of clients.

- Key financial metrics (revenue, profit margins, etc.): [Insert relevant financial data from reputable sources like financial news websites or SEC filings. Analyze revenue growth, profit margins, and other key metrics to assess the company's financial health and performance.]

- Comparison to competitors in the AI infrastructure market: [Compare CoreWeave's performance and market share to key competitors in the AI infrastructure market. This will provide context for its growth potential and competitive positioning.]

- Analysis of future growth projections and potential risks: [Analyze future growth projections and identify potential risks, including competition, technological advancements, and market fluctuations. Keywords: CoreWeave financials, CRWV revenue, CoreWeave growth, AI infrastructure market

Investment Considerations and Risks

Weighing the Pros and Cons

Investing in CoreWeave (CRWV) stock presents both significant opportunities and risks. The company operates in a high-growth market, benefits from a strong partnership with OpenAI, and shows promising financial performance (based on available data). However, it also faces competition and inherent market risks.

- Potential upside and downside scenarios: [Outline potential scenarios for future growth and potential losses. Consider different market conditions and their impact on CRWV's stock price.]

- Risk factors (e.g., competition, market volatility, dependence on OpenAI): [Identify key risk factors, such as increasing competition in the AI infrastructure market, overall market volatility, and reliance on a single major client (OpenAI).]

- Comparison to similar companies in the sector: [Compare CoreWeave to similar companies in the AI infrastructure sector, considering their valuations, growth rates, and risk profiles.] Keywords: CoreWeave investment, CRWV risks, CoreWeave stock analysis, AI stock investment

Conclusion

Jim Cramer's (albeit potentially limited and requiring further research) comments on the AI sector, coupled with CoreWeave's strategic partnership with OpenAI and strong financial performance (based on available data), paint a picture of a company with significant growth potential. However, potential investors should carefully weigh the risks associated with the volatile tech sector and the inherent uncertainties of a relatively young company. Remember to conduct thorough due diligence, considering your own risk tolerance and investment goals. Considering your own research and risk tolerance, is CoreWeave (CRWV) stock the right investment for you? Learn more about CoreWeave (CRWV) and make an informed decision about this exciting opportunity in the AI infrastructure market. Keywords: CoreWeave stock outlook, CRWV future, invest in CoreWeave, AI stock investment decision.

Featured Posts

-

Vstuplenie Ukrainy V Nato Pozitsiya Evrokomissara I Perspektivy Peregovorov

May 22, 2025

Vstuplenie Ukrainy V Nato Pozitsiya Evrokomissara I Perspektivy Peregovorov

May 22, 2025 -

Abdelkebir Rabi Et Son Uvre Les Grands Fusains De Boulemane Au Book Club Le Matin

May 22, 2025

Abdelkebir Rabi Et Son Uvre Les Grands Fusains De Boulemane Au Book Club Le Matin

May 22, 2025 -

Vstup Ukrayini Do Nato Chi Zapobizhit Tse Podalshiy Rosiyskiy Agresiyi

May 22, 2025

Vstup Ukrayini Do Nato Chi Zapobizhit Tse Podalshiy Rosiyskiy Agresiyi

May 22, 2025 -

Core Weave Crwv Stock Soars On Thursday Reasons Behind The Rise

May 22, 2025

Core Weave Crwv Stock Soars On Thursday Reasons Behind The Rise

May 22, 2025 -

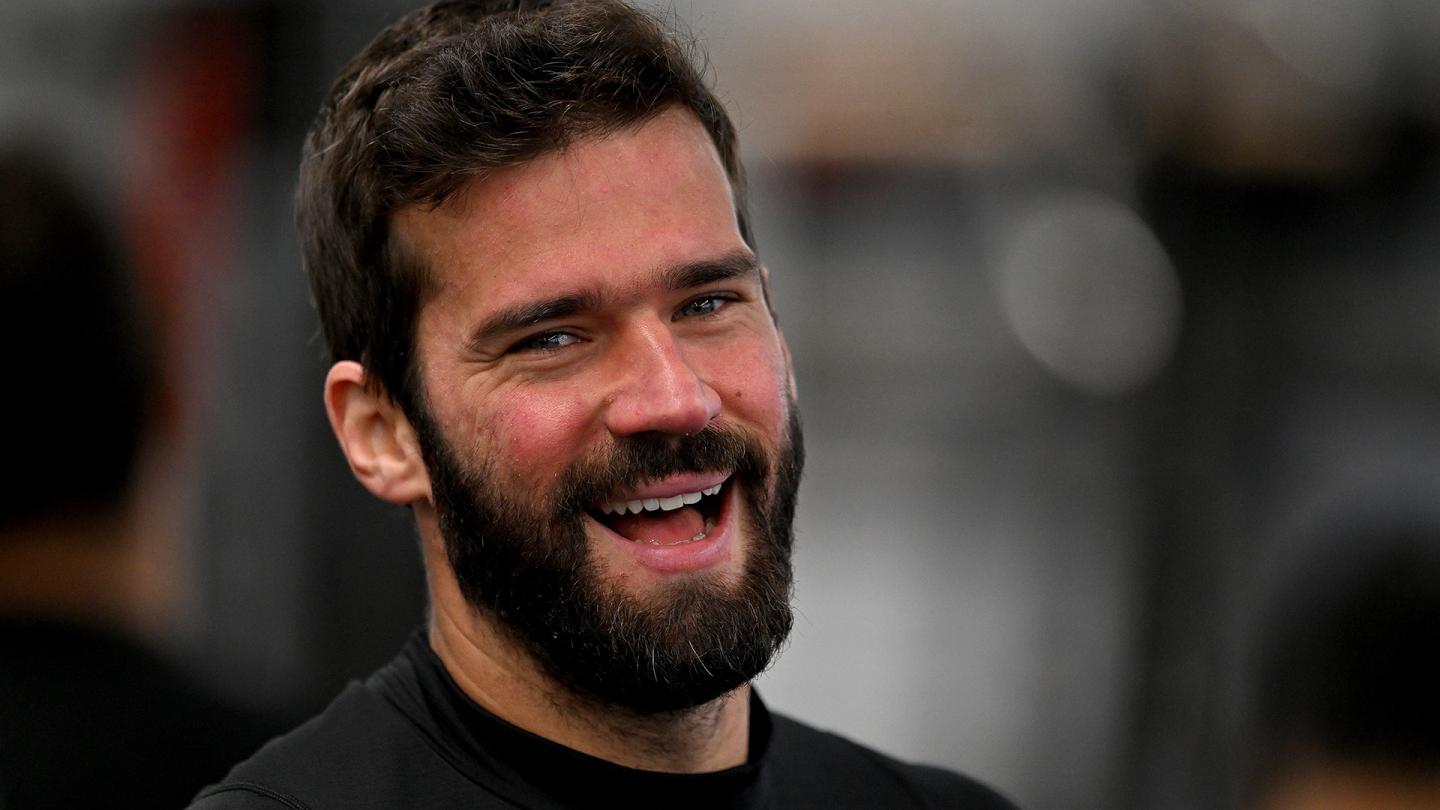

Slot And Enrique On Liverpool Luck Alisson And Post Match Analysis

May 22, 2025

Slot And Enrique On Liverpool Luck Alisson And Post Match Analysis

May 22, 2025