CoreWeave Stock (CRWV) Reacts To Nvidia's Strategic Investment

Table of Contents

Nvidia's Strategic Investment in CoreWeave: A Game Changer for Cloud Computing

Nvidia's investment in CoreWeave represents a substantial commitment to bolstering the capabilities of a leading provider of cloud-based AI infrastructure. While the exact financial terms haven't been fully disclosed, the investment signals a strong vote of confidence in CoreWeave's technology and market position. The strategic rationale behind Nvidia's decision is clear: a powerful synergy between Nvidia's high-performance GPUs (Graphics Processing Units) and CoreWeave's scalable cloud infrastructure.

- Amount of Investment: The exact figure remains undisclosed publicly, but reports suggest a significant sum reflecting Nvidia's belief in CoreWeave's future.

- Type of Investment: While the precise details are yet to be released, it is likely a combination of equity investment and potentially a strategic partnership agreement.

- Nvidia's Stated Reasons for the Investment: Nvidia likely recognizes CoreWeave's specialized infrastructure as an ideal platform to deploy and support its advanced GPU technology, enabling faster and more efficient AI processing for its clients. The investment allows Nvidia to expand its reach into the cloud computing market, tapping into CoreWeave's existing client base.

- Expected Synergies and Collaborations: The partnership promises enhanced GPU performance optimization within CoreWeave's infrastructure, leading to improved AI model training, inferencing, and overall efficiency for mutual customers. This collaboration should drive faster innovation and expansion for both companies.

Impact on CoreWeave Stock (CRWV): Immediate and Long-Term Effects

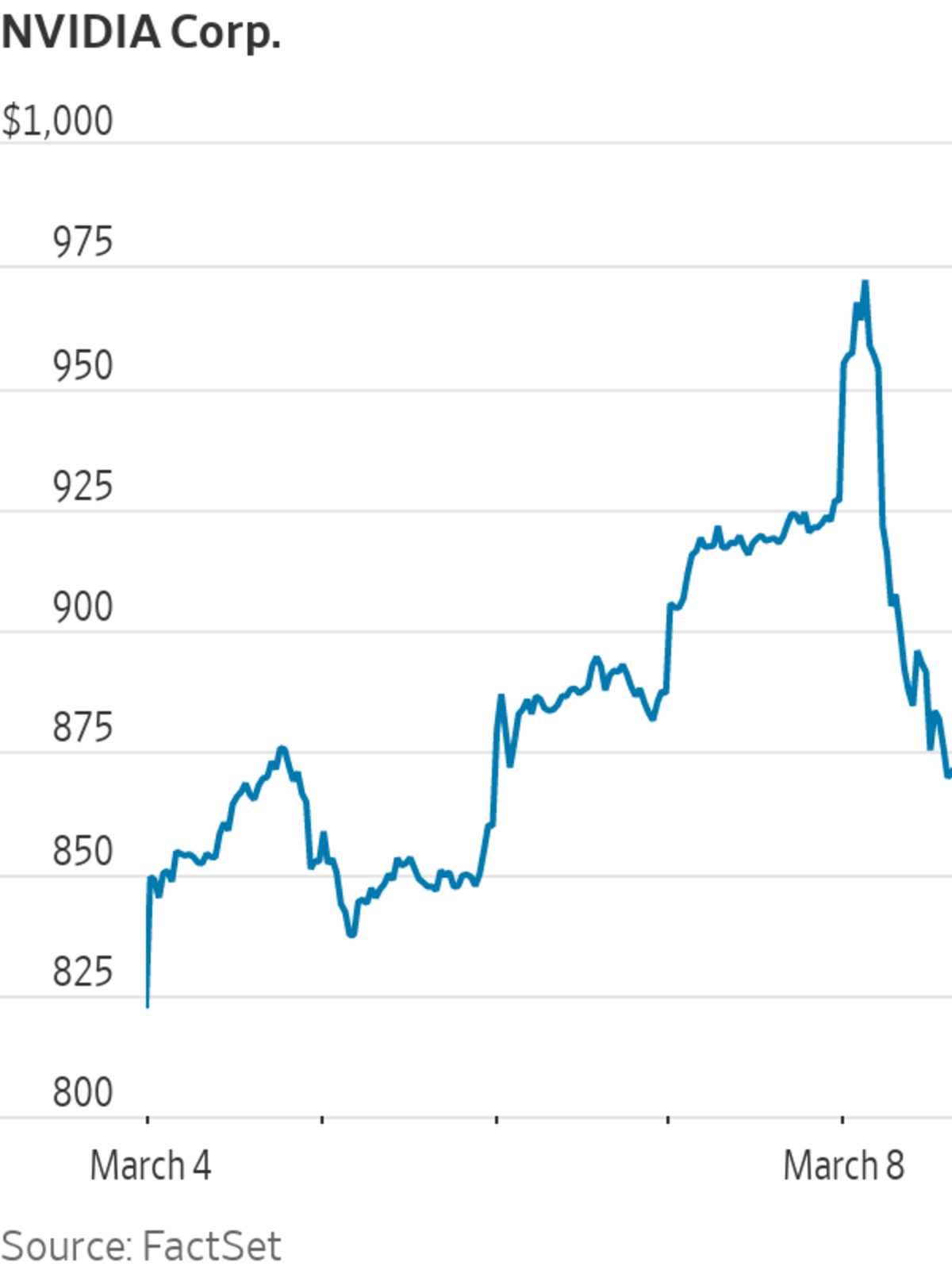

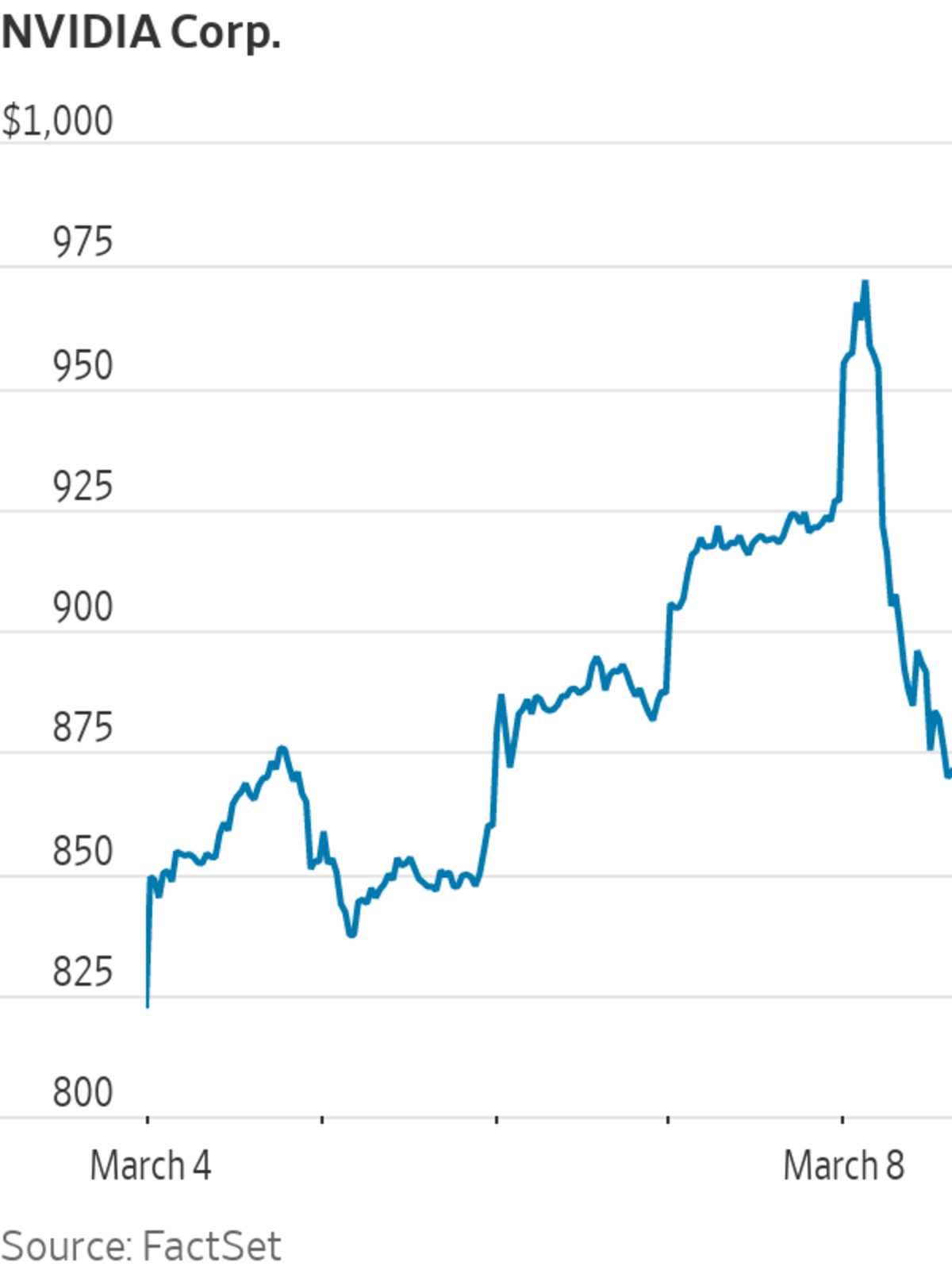

The market reacted swiftly and positively to the news of Nvidia's investment. The CRWV stock price experienced a significant jump immediately following the announcement, reflecting investor optimism about the partnership's potential.

- CRWV Stock Price Before the Announcement: The stock price prior to the announcement showed a steady, though not explosive, growth trajectory, suggesting underlying strength in CoreWeave's business model.

- CRWV Stock Price Change Immediately Following the Announcement: A substantial increase was observed, reflecting the market's positive assessment of the Nvidia deal.

- Analyst Predictions for Future Stock Performance: Analysts are generally bullish on CRWV's future, anticipating continued growth driven by the increased demand for AI infrastructure and the strengthened partnership with Nvidia. However, it's crucial to remember that these are projections, and market conditions can significantly influence actual performance.

- Potential Risks and Challenges: While the outlook is positive, risks remain. Competition in the cloud computing market is intense, and maintaining profitability while scaling operations will be a key challenge for CoreWeave. Geopolitical factors and economic downturns could also affect stock performance.

CoreWeave's Position in the Cloud Computing and AI Market

CoreWeave has established itself as a significant player in the rapidly growing cloud computing and AI infrastructure market. Its specialized infrastructure, tailored to high-performance computing needs, especially those related to AI workloads, positions it favorably amongst competitors.

- CoreWeave's Key Services and Offerings: CoreWeave offers specialized cloud services specifically designed for AI and machine learning applications, focusing on GPU-accelerated computing.

- CoreWeave's Target Market: The company targets businesses and researchers needing scalable, high-performance computing resources for AI development and deployment.

- Key Competitors in the Market: CoreWeave competes with major cloud providers like AWS, Google Cloud, and Azure, as well as other specialized AI infrastructure providers.

- CoreWeave's Competitive Advantages: CoreWeave's focus on specialized GPU-based infrastructure and its strategic partnership with Nvidia provide significant competitive advantages.

The Growing Demand for AI Infrastructure: A Booming Market

The demand for AI infrastructure is experiencing exponential growth, driven by the increasing adoption of AI across various industries. This demand is fueled by the need for powerful computing resources to train and deploy increasingly complex AI models.

- Market Size and Growth Projections for AI Infrastructure: The market is projected to grow at a considerable rate in the coming years, reflecting the widespread adoption of AI and machine learning technologies.

- Factors Driving the Demand for AI Infrastructure: The proliferation of large language models, advancements in generative AI, and the growing need for real-time AI processing are major drivers.

- CoreWeave's Role in Meeting This Demand: CoreWeave's specialized infrastructure and its collaboration with Nvidia position it strategically to capitalize on this burgeoning market.

Conclusion: Investing in the Future of AI Infrastructure with CoreWeave (CRWV)

Nvidia's strategic investment in CoreWeave represents a significant endorsement of the company's potential and its role in the rapidly evolving AI infrastructure landscape. The partnership is poised to drive substantial growth for CoreWeave, further strengthening its competitive position in the market. The immediate market reaction, along with analyst predictions, suggests a promising outlook for CRWV stock. However, potential investors should conduct thorough research and consider the inherent risks involved in any investment.

Learn more about CoreWeave stock (CRWV) and its potential by visiting a reputable financial news website or CoreWeave's investor relations page. Invest in the future of AI infrastructure, and stay updated on CRWV stock performance.

Featured Posts

-

Oh Jun Sungs Thrilling Wtt Star Contender Chennai Victory

May 22, 2025

Oh Jun Sungs Thrilling Wtt Star Contender Chennai Victory

May 22, 2025 -

The Risky Business Of Ceo Relationships A Case Study

May 22, 2025

The Risky Business Of Ceo Relationships A Case Study

May 22, 2025 -

El Regreso De Javier Baez Salud Y Rendimiento

May 22, 2025

El Regreso De Javier Baez Salud Y Rendimiento

May 22, 2025 -

Hell City Votre Qg Pour Le Hellfest A Clisson

May 22, 2025

Hell City Votre Qg Pour Le Hellfest A Clisson

May 22, 2025 -

Columbus Gas Prices Fluctuate A 48 Cent Gap

May 22, 2025

Columbus Gas Prices Fluctuate A 48 Cent Gap

May 22, 2025