CoreWeave Stock Update: Current Performance And Future Outlook

Table of Contents

CoreWeave's Current Market Position and Performance

Recent Financial Results

Analyzing CoreWeave's financial performance requires careful consideration of publicly available information, as the company is privately held and doesn't release detailed financial reports like publicly traded companies. However, news articles and industry reports provide some insights. We need to rely on these sources for an understanding of CoreWeave's financial health.

- Revenue Growth: While precise figures are unavailable publicly, reports suggest significant revenue growth fueled by increasing demand for high-performance computing (HPC) and AI solutions. The company's focus on specialized cloud services for demanding workloads seems to be paying off.

- Profitability: Profitability data for CoreWeave is currently not publicly accessible. This is typical for privately held companies focused on rapid expansion. Future profitability will depend significantly on its ability to scale operations efficiently and manage costs.

- Significant Changes: The company has reportedly secured substantial funding rounds, indicating investor confidence in its growth trajectory and business model. This funding likely contributes to its aggressive expansion strategies.

Competitive Landscape and Market Share

CoreWeave operates in a fiercely competitive market dominated by giants like AWS, Google Cloud, and Microsoft Azure. However, CoreWeave carves a niche by focusing on a specialized segment: high-performance computing (HPC) and AI workloads.

- CoreWeave's Strengths: CoreWeave differentiates itself through its utilization of repurposed GPUs, providing cost-effective solutions for demanding compute tasks. This cost advantage coupled with a focus on high-performance computing provides a unique selling proposition (USP).

- CoreWeave's Weaknesses: The reliance on repurposed GPUs might present limitations in terms of scalability and the availability of consistent hardware. Furthermore, competing with established players with broader service offerings and extensive infrastructure requires significant investment and market penetration.

- Market Share: Precise market share data for CoreWeave is not publicly available. However, its rapid growth and substantial funding suggest a growing presence within the specialized HPC and AI cloud computing market.

Key Partnerships and Collaborations

Strategic partnerships are crucial for CoreWeave's growth and market penetration. These collaborations enhance its offerings and expand its reach within the cloud computing ecosystem.

- Key Partners: CoreWeave actively engages with various technology partners to offer comprehensive solutions, including software providers and hardware manufacturers. These relationships help it offer integrated and seamless services to its customers.

- Impact on Performance: Successful partnerships can dramatically improve CoreWeave's access to technology, customers, and resources. These collaborations are essential for the company's expansion into new markets and service offerings.

Future Outlook and Growth Potential for CoreWeave Stock

Growth Strategies and Expansion Plans

CoreWeave's growth strategy hinges on several key initiatives:

- Expansion into New Markets: The company likely plans to expand its geographical reach to tap into the growing global demand for high-performance computing and AI services. This global expansion is critical for future revenue growth.

- New Service Offerings: CoreWeave is expected to broaden its service portfolio by adding new capabilities and solutions catering to specific industry needs. This might include specialized software platforms or enhanced support services.

- Technological Advancements: Continuous innovation and investment in cutting-edge technologies are crucial for CoreWeave to maintain its competitive edge. Staying ahead of the curve in GPU technology and cloud infrastructure is vital for its long-term success.

Industry Trends and Their Impact on CoreWeave

The cloud computing industry is experiencing exponential growth, driven by increasing adoption of AI, machine learning, and other data-intensive applications.

- Positive Impacts: The surge in demand for high-performance computing directly benefits CoreWeave, which is well-positioned to capitalize on this trend due to its specialization.

- Potential Risks and Challenges: Increased competition from established players and potential economic downturns pose risks. Maintaining its technological leadership and adaptability to changing market demands is critical for continued success.

Potential Risks and Challenges

Investing in CoreWeave stock involves several potential risks:

- Competition: The intense competition from major cloud providers is a significant risk. Maintaining a competitive advantage requires continuous innovation and effective marketing.

- Economic Downturn: Economic instability can negatively impact demand for cloud computing services, potentially affecting CoreWeave's revenue and growth.

- Regulatory Changes: Changes in regulations related to data privacy and security can impact CoreWeave's operations and compliance costs.

Conclusion

CoreWeave operates in a dynamic and rapidly growing market, presenting significant opportunities for growth but also considerable risks. The company's focus on high-performance computing and its strategic partnerships are key strengths. However, intense competition and economic uncertainty remain significant challenges. While precise financial data is limited due to CoreWeave's private status, the available information points to a company with significant potential.

Stay informed about the latest developments in CoreWeave stock by regularly checking reputable financial news sources. Understanding the intricacies of CoreWeave stock and its position within the cloud computing market can be instrumental in making sound investment choices. Remember to conduct thorough due diligence and assess your own risk tolerance before making any investment decisions related to CoreWeave stock or any other investment opportunity.

Featured Posts

-

Activite Des Cordistes Face A La Multiplication Des Tours A Nantes

May 22, 2025

Activite Des Cordistes Face A La Multiplication Des Tours A Nantes

May 22, 2025 -

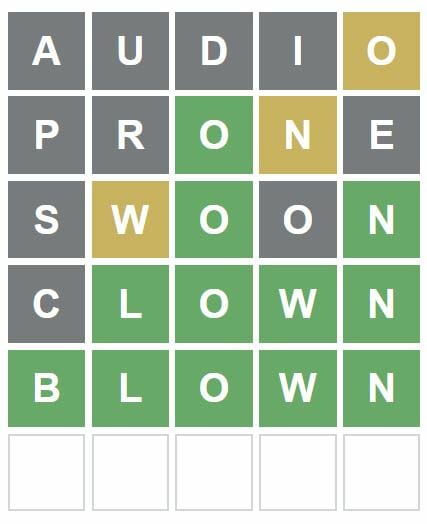

Wordle 363 Hints And Answer For March 13th

May 22, 2025

Wordle 363 Hints And Answer For March 13th

May 22, 2025 -

Canada Vs Mexico Los Memes Mas Divertidos De La Liga De Naciones Concacaf

May 22, 2025

Canada Vs Mexico Los Memes Mas Divertidos De La Liga De Naciones Concacaf

May 22, 2025 -

Potential Large Fine For Abn Amro Due To Bonus Issues

May 22, 2025

Potential Large Fine For Abn Amro Due To Bonus Issues

May 22, 2025 -

Gas Price Hike In Akron And Cleveland Ohio Gas Buddy Data Analysis

May 22, 2025

Gas Price Hike In Akron And Cleveland Ohio Gas Buddy Data Analysis

May 22, 2025