Cost-Cutting Measures Surge As U.S. Companies Face Tariff Challenges

Table of Contents

The Devastating Impact of Tariffs on U.S. Businesses

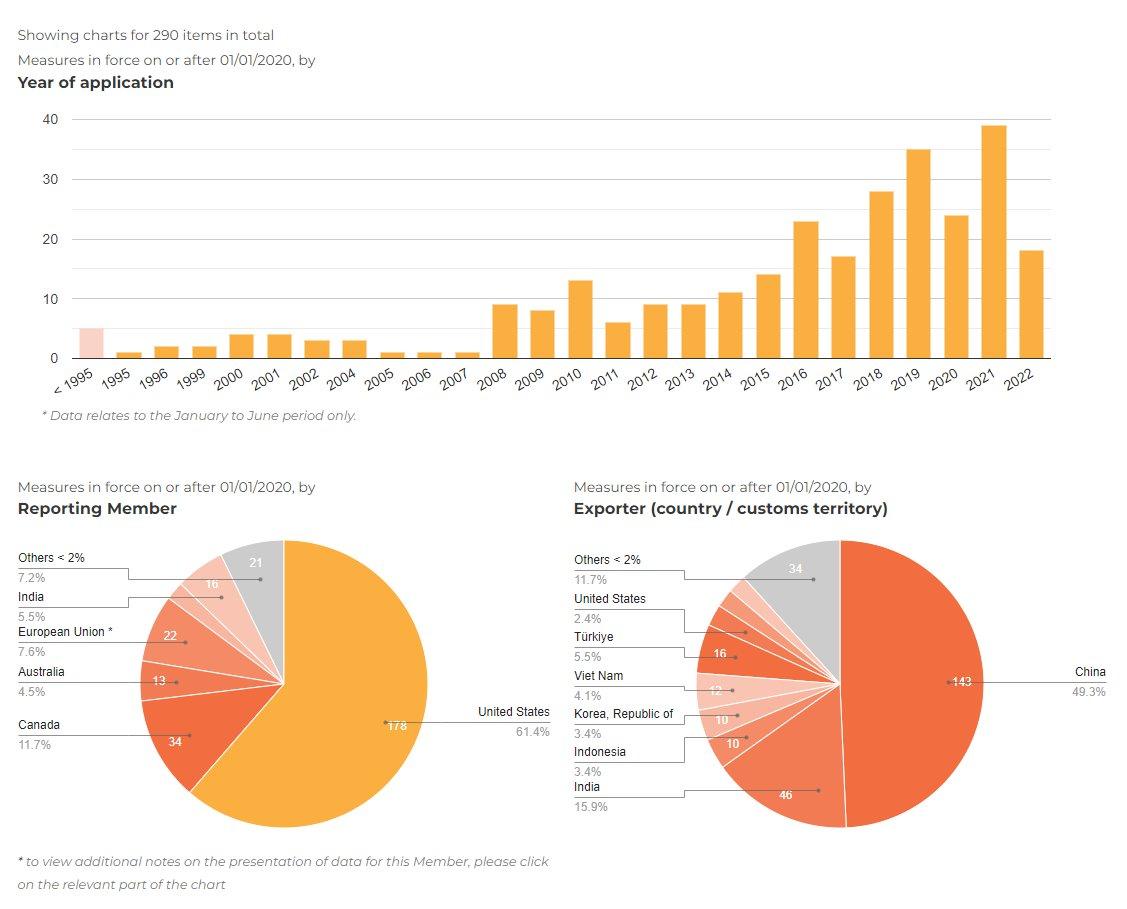

Tariffs, essentially taxes on imported goods, have created a ripple effect throughout the U.S. economy, significantly impacting businesses across various sectors.

Increased Production Costs

Tariffs directly increase the cost of imported goods and raw materials. Industries reliant on international supply chains, such as manufacturing and agriculture, are particularly hard-hit. For example, the tariffs on steel and aluminum have increased production costs for countless U.S. manufacturers, leading to a 15-20% price increase in certain products. This added cost is ultimately passed on to consumers, leading to higher prices at the retail level.

- Impact on Manufacturing: Increased costs of imported steel and components lead to higher prices for finished goods.

- Impact on Agriculture: Tariffs on imported fertilizers and machinery raise farming costs, impacting food prices.

- Ripple Effect: Higher production costs lead to reduced consumer purchasing power and decreased overall economic activity.

Reduced Profit Margins and Revenue

Higher production costs directly translate into squeezed profit margins. Many businesses find themselves operating with significantly lower profits or even losses. Furthermore, the increased prices of goods can lead to decreased sales as consumers cut back on spending.

- Lower Profit Margins: Increased input costs reduce profitability, forcing businesses to make tough choices.

- Decreased Sales: Higher prices for consumer goods result in reduced demand and lower revenue for businesses.

- Examples: Several retailers have reported declining sales figures directly attributed to increased prices caused by tariffs.

Supply Chain Disruptions

Tariffs introduce uncertainty and delays into already complex supply chains. Businesses face challenges finding alternative suppliers, leading to increased logistical costs and production delays. The search for alternative sources often involves higher transportation expenses and increased lead times.

- Supplier Uncertainty: Tariffs make it difficult to predict the cost of imported goods, creating uncertainty for businesses.

- Alternative Supplier Search: Finding reliable alternative suppliers outside of tariff-affected regions is time-consuming and expensive.

- Increased Logistical Costs: Shipping costs increase as businesses seek alternative suppliers further away geographically.

Cost-Cutting Strategies Adopted by U.S. Companies

Faced with these challenges, U.S. companies are resorting to various cost-cutting strategies, some more drastic than others.

Automation and Technology Investments

Many companies are investing heavily in automation and technology to reduce labor costs and improve efficiency. This includes adopting AI-powered systems, robotics, and advanced manufacturing techniques.

- Automation Investments: Businesses are investing in robotic process automation (RPA) and other technologies to streamline operations.

- AI and Efficiency: Artificial intelligence is used to optimize processes, predict demand, and improve resource allocation.

- Examples: Companies in the manufacturing and logistics sectors are leading the way in automation adoption.

Restructuring and Workforce Reductions

A painful but common response to tariff-induced pressures is restructuring and workforce reductions, including layoffs and downsizing. While necessary for survival in some cases, these measures have significant ethical considerations and potential negative long-term impacts.

- Layoffs and Downsizing: Cost-cutting measures often include reducing staff to control labor costs.

- Rationale: Businesses justify these actions as necessary to maintain profitability in the face of increased costs.

- Ethical Considerations: The impact on employees and communities needs careful consideration and often requires robust support programs.

Sourcing and Supply Chain Optimization

Businesses are actively diversifying their sourcing strategies, seeking alternative, lower-cost suppliers both domestically and internationally. This involves optimizing supply chain logistics to minimize transportation costs and improve efficiency.

- Diversification: Businesses are exploring new suppliers in regions not affected by tariffs.

- Supply Chain Efficiency: Improved logistics and inventory management are vital to controlling costs.

- Challenges: Finding reliable, high-quality suppliers outside of established networks can be difficult.

Renegotiating Contracts and Reducing Expenses

Companies are renegotiating contracts with suppliers and vendors to secure better pricing. Simultaneously, efforts are focused on reducing operational expenses, such as energy consumption and administrative costs.

- Contract Renegotiation: Businesses are leveraging their bargaining power to secure lower prices from suppliers.

- Operational Efficiency: Companies are streamlining processes and reducing waste to lower operational costs.

- Examples: Implementing energy-saving measures, reducing office space, and optimizing material usage are common strategies.

Long-Term Implications and Potential Risks of Aggressive Cost-Cutting

While immediate cost-cutting is necessary for survival, aggressive measures can carry significant long-term risks.

Impact on Innovation and Competitiveness

Cost-cutting often translates into reduced investment in research and development, potentially hindering innovation and long-term growth. This can lead to a loss of market share to more innovative competitors.

- Reduced R&D: Cutting R&D budgets can stifle innovation and future growth opportunities.

- Loss of Competitiveness: Companies that fail to innovate may lose market share to more agile competitors.

- Balance: A balanced approach that includes strategic investment alongside cost-cutting is vital for long-term success.

Employee Morale and Productivity

Aggressive cost-cutting measures, particularly layoffs, can significantly impact employee morale and productivity. A negative work environment can lead to decreased efficiency and increased turnover.

- Decreased Morale: Layoffs and salary cuts can create a climate of fear and uncertainty among remaining employees.

- Reduced Productivity: Stress, anxiety, and uncertainty can negatively impact employee performance.

- Maintaining a Positive Environment: Open communication, transparency, and employee support are crucial during challenging times.

Reputational Damage and Consumer Perception

Aggressive cost-cutting measures, especially those perceived as unfair or unethical, can damage a company's reputation and negatively impact consumer perception. This can lead to loss of customer trust and brand loyalty.

- Negative Publicity: Layoffs and cost-cutting measures can attract negative media attention, harming brand reputation.

- Consumer Backlash: Consumers may boycott companies perceived as acting unethically or prioritizing profits over employees.

- Long-Term Impact: Reputational damage can have lasting consequences, affecting a company's ability to attract customers and talent.

Conclusion: Navigating the Challenges of Tariffs and Implementing Effective Cost-Cutting Measures

The surge in cost-cutting measures reflects the significant challenges U.S. businesses face in navigating the complexities of tariffs. While short-term cost reductions are often necessary, a strategic and balanced approach is crucial for long-term sustainability. Ignoring the potential long-term implications of aggressive cost-cutting can lead to decreased innovation, damaged employee morale, and reputational harm. Effective cost-cutting strategies require careful planning, prioritizing investments in innovation and employee well-being, and focusing on sustainable operational efficiencies. Learn more about navigating tariff challenges and implementing successful cost-cutting strategies for your business. Download our free guide on "Strategic Cost Reduction in a Tariff-Affected Market" today!

Featured Posts

-

Get Capital Summertime Ball 2025 Tickets The Official Guide

Apr 29, 2025

Get Capital Summertime Ball 2025 Tickets The Official Guide

Apr 29, 2025 -

Papal Conclave Debate Over Convicted Cardinals Voting Rights

Apr 29, 2025

Papal Conclave Debate Over Convicted Cardinals Voting Rights

Apr 29, 2025 -

Cleveland Indians Fan Removed After Targeting Jarren Duran Following Suicide Revelation

Apr 29, 2025

Cleveland Indians Fan Removed After Targeting Jarren Duran Following Suicide Revelation

Apr 29, 2025 -

Black Hawk Collision Near Dc Report Details Pilot Error

Apr 29, 2025

Black Hawk Collision Near Dc Report Details Pilot Error

Apr 29, 2025 -

Austin City Limits Celebrating Willie Nelson And Familys Legacy

Apr 29, 2025

Austin City Limits Celebrating Willie Nelson And Familys Legacy

Apr 29, 2025

Latest Posts

-

Skoleprestasjoner Og Adhd Medisin Hva Viser Fhi Studien

Apr 29, 2025

Skoleprestasjoner Og Adhd Medisin Hva Viser Fhi Studien

Apr 29, 2025 -

Adhd In Adults With Autism And Intellectual Disability A New Study

Apr 29, 2025

Adhd In Adults With Autism And Intellectual Disability A New Study

Apr 29, 2025 -

Study Reveals Higher Adhd Rates In Adults With Autism And Intellectual Disability

Apr 29, 2025

Study Reveals Higher Adhd Rates In Adults With Autism And Intellectual Disability

Apr 29, 2025 -

Adhd Medisin Og Skoleprestasjoner En Fhi Rapport

Apr 29, 2025

Adhd Medisin Og Skoleprestasjoner En Fhi Rapport

Apr 29, 2025 -

Tik Toks Impact On Adhd Awareness And Misdiagnosis

Apr 29, 2025

Tik Toks Impact On Adhd Awareness And Misdiagnosis

Apr 29, 2025