Could Driverless Uber Pay Off? Exploring Relevant ETFs

Table of Contents

The Potential Profitability of Driverless Uber

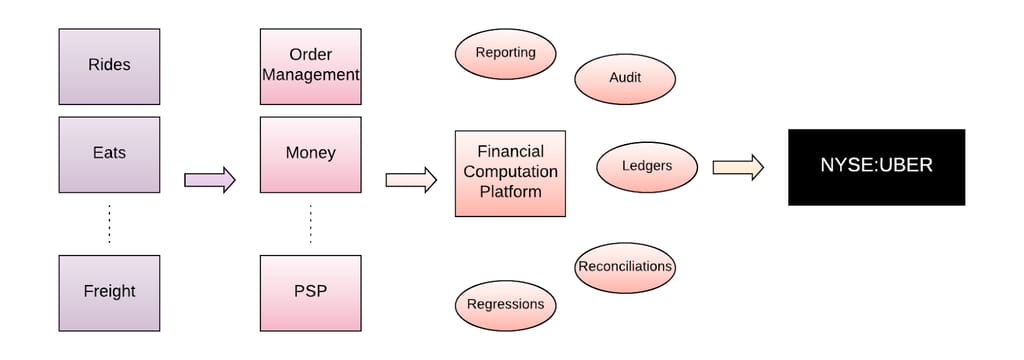

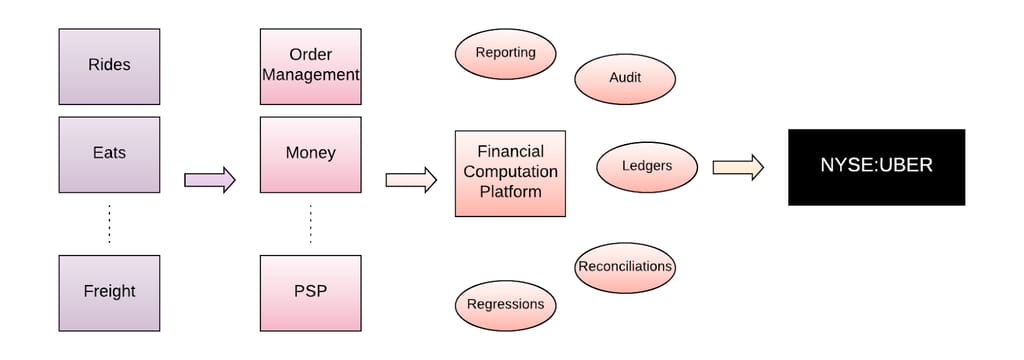

The shift towards autonomous vehicles presents a compelling case for significant profitability in the ride-sharing industry, particularly for companies like Uber. The potential for increased efficiency and revenue generation is immense, though considerable challenges remain.

Reduced Operational Costs

The most immediate benefit of driverless technology lies in drastically reduced operational costs. Eliminating the need for human drivers translates to substantial savings across multiple areas.

- Lower Labor Costs: Driver salaries and benefits represent a huge portion of current ride-sharing operational costs. Autonomous vehicles could potentially reduce these costs by 70-80%.

- Reduced Insurance Premiums: Insurance costs for self-driving cars are projected to decrease significantly as accident rates are expected to fall with improved safety systems.

- Increased Vehicle Utilization: Autonomous vehicles can operate for longer periods without breaks, maximizing their utilization and generating more revenue per vehicle. Current human-driven vehicles are limited by driver shift schedules and rest periods.

This enhanced efficiency and reduced downtime contribute significantly to the bottom line, potentially transforming the economics of the ride-sharing business model.

Increased Revenue Streams

Driverless technology opens the door to innovative revenue streams currently unavailable to traditional ride-sharing services.

- Expanded Service Areas: Autonomous vehicles could expand service into underserved or remote areas, where a lack of drivers currently limits operations.

- On-Demand Delivery Services: The same technology enabling passenger transport can easily be adapted to deliver goods, creating a lucrative new market for driverless fleets.

- Subscription Models: Companies might offer subscription-based services, providing unlimited rides within a specified area for a monthly fee.

These diverse revenue streams are critical in offsetting the substantial initial investment required for autonomous vehicle development and deployment.

Challenges and Risks

Despite the alluring potential, several significant challenges and risks could hinder the widespread adoption of driverless Uber and similar services.

- Technological Challenges: Achieving fully autonomous driving in all conditions, particularly in complex urban environments, remains a significant technological hurdle.

- Regulatory Hurdles: The regulatory landscape surrounding autonomous vehicles is constantly evolving, with varying regulations across different jurisdictions creating complexity and uncertainty.

- Public Acceptance: Public trust and acceptance of self-driving technology are crucial for widespread adoption. Concerns about safety and job displacement need to be addressed effectively.

- Cybersecurity Risks: Autonomous vehicles are vulnerable to hacking and cyberattacks, posing significant safety and security concerns.

Addressing these challenges requires continuous innovation, robust safety protocols, and transparent communication to build public confidence.

Identifying Relevant ETFs for Driverless Uber Investment

Investing in the driverless revolution requires careful consideration of various ETFs offering exposure to this emerging sector.

Technology ETFs

Several ETFs focus on companies developing and deploying autonomous vehicle technology, artificial intelligence (AI), and related advancements.

- Example 1: [Insert ETF ticker and link to fact sheet - e.g., Global X Robotics & Artificial Intelligence ETF (BOTZ)] – This ETF invests in companies involved in robotics, AI, and automation, including those contributing to autonomous driving technology.

- Example 2: [Insert ETF ticker and link to fact sheet - e.g., iShares Autonomous Driving Technology ETF (SELF)] - This ETF provides focused exposure to companies developing autonomous driving technologies.

These ETFs offer direct exposure to companies driving innovation in the self-driving car sector.

Transportation ETFs

Broader transportation ETFs offer indirect exposure to the driverless technology revolution by investing in companies involved in ride-sharing, logistics, and automotive manufacturing.

- Example 1: [Insert ETF ticker and link to fact sheet - e.g., Invesco Dynamic Transportation ETF (DRV)] - This ETF invests in a range of transportation companies, some of which could benefit from the adoption of autonomous driving technology.

- Example 2: [Insert ETF ticker and link to fact sheet - e.g., First Trust Nasdaq Transportation ETF (FTXR)] - Similar to DRV, this ETF provides exposure to various transportation businesses potentially influenced by the driverless car revolution.

Investing in these ETFs provides a more diversified approach to capitalizing on the wider impact of autonomous vehicles.

Considerations for ETF Selection

Choosing the right ETFs requires careful consideration of several factors.

- Expense Ratios: Lower expense ratios translate to greater returns over the long term.

- Diversification: A well-diversified ETF reduces risk by spreading investments across multiple companies.

- Investment Goals: Select ETFs aligned with your investment horizon and risk tolerance.

Thorough research and due diligence are crucial before making any investment decisions. Align your ETF selection with your personal risk tolerance and financial objectives.

Investing in the Future of Ride-Sharing with Driverless Uber ETFs

The potential profitability of driverless Uber is significant, driven by reduced operational costs and new revenue streams. However, technological, regulatory, and public acceptance challenges must be considered. Several ETFs offer investors exposure to this transformative technology, allowing participation in the potential growth of this exciting market.

Key takeaways include the immense cost-saving potential of driverless technology, the emergence of new revenue streams, and the inherent risks associated with this innovative sector. Understanding these aspects is crucial for making informed investment decisions.

Don't miss out on the driverless revolution – research driverless Uber related ETFs now! Start your journey into the future of transportation and explore the potential of driverless Uber ETFs today!

Featured Posts

-

Is Jackbit The Best Crypto Casino For Instant Withdrawals A Review

May 18, 2025

Is Jackbit The Best Crypto Casino For Instant Withdrawals A Review

May 18, 2025 -

Safe And Secure Bitcoin And Crypto Casinos 2025 Edition

May 18, 2025

Safe And Secure Bitcoin And Crypto Casinos 2025 Edition

May 18, 2025 -

Los Angeles Angels Win 1 0 Jose Sorianos Stellar Performance

May 18, 2025

Los Angeles Angels Win 1 0 Jose Sorianos Stellar Performance

May 18, 2025 -

Taylor Swift Kendrick Lamar And Simone Biles Webby Awards Triumph

May 18, 2025

Taylor Swift Kendrick Lamar And Simone Biles Webby Awards Triumph

May 18, 2025 -

Exclusive Unpacking The Taylor Swift Blake Lively Connection In The It Ends With Us Fallout

May 18, 2025

Exclusive Unpacking The Taylor Swift Blake Lively Connection In The It Ends With Us Fallout

May 18, 2025

Latest Posts

-

28 April 2025 Daily Lotto Results Winning Numbers Announced

May 18, 2025

28 April 2025 Daily Lotto Results Winning Numbers Announced

May 18, 2025 -

Check Daily Lotto Results For Monday April 28 2025

May 18, 2025

Check Daily Lotto Results For Monday April 28 2025

May 18, 2025 -

29 April 2025 Daily Lotto Results Winning Numbers Announced

May 18, 2025

29 April 2025 Daily Lotto Results Winning Numbers Announced

May 18, 2025 -

Daily Lotto 29 April 2025 Results

May 18, 2025

Daily Lotto 29 April 2025 Results

May 18, 2025 -

Daily Lotto Monday 28 April 2025 Results

May 18, 2025

Daily Lotto Monday 28 April 2025 Results

May 18, 2025