Could You Be Due An HMRC Tax Refund? Check Your Payslip

Table of Contents

Understanding Your Payslip: Key Components for Tax Refund Identification

Understanding your payslip is the first step in identifying a potential HMRC tax refund. A thorough payslip analysis can reveal whether you've been overpaying tax. Key terms to focus on include:

- Gross Pay: Your total earnings before any deductions.

- Net Pay: Your take-home pay after all deductions (tax, National Insurance, etc.).

- Tax Code: A letter and number combination determining your tax-free allowance. Incorrect tax codes are a common reason for overpayment.

- Tax Deducted: The amount of income tax withheld from your gross pay.

- National Insurance Contributions (NICs): Contributions towards the National Insurance system.

Spotting Potential Overpayments:

- Unusually High Tax Deductions: Compare your current tax deductions to previous years. A significant increase without a corresponding increase in income could indicate an issue.

- Comparisons with Colleagues: Discuss tax deductions with colleagues in similar roles. Discrepancies might signal a tax code error.

- Changes in Circumstances: Marriage, having children, or starting a pension significantly impact your tax code and potential tax repayments. Ensure HMRC is aware of all changes.

Remember, regularly checking your payslip throughout the tax year is crucial for early identification of any potential overpayments. Don't wait until the end of the tax year to investigate!

Common Reasons for HMRC Tax Overpayments

Several factors can lead to an HMRC tax overpayment. Understanding these scenarios can help you determine if you're eligible for a tax refund check:

- Incorrect Tax Code: This is the most common reason for overpayment. An incorrect tax code results in too much tax being deducted.

- Emergency Tax: If your employer doesn't have enough information about your tax situation, they might apply emergency tax, which is a higher rate of tax.

- Changes in Circumstances: Failing to inform HMRC about changes like marriage, childbirth, or starting a new job can lead to an incorrect tax code and overpayment.

- Student Loan Repayments: Overestimated student loan repayments can also lead to overpayment.

- Pension Contributions: If your pension contributions aren't properly reported, it could result in an overpayment.

For more detailed information on each scenario and its impact on your tax calculations, visit the official HMRC website. [Link to relevant HMRC page].

How to Claim Your HMRC Tax Refund

Claiming your HMRC tax refund is generally straightforward. The most common method is through the HMRC online portal:

- Access your Government Gateway account: You'll need your Government Gateway User ID and password. If you don't have one, you'll need to create one.

- Navigate to the tax refund section: Follow the on-screen instructions to initiate a tax refund claim.

- Provide necessary information: You'll need details from your payslips and P60 (your end-of-year tax statement).

- Submit your claim: Once you've completed the process, submit your claim.

Alternative Methods:

While the online portal is the preferred method, you may be able to claim via post in some circumstances. Check the HMRC website for the most up-to-date information.

Complex Cases: If your situation is complex, consider seeking professional advice from a tax advisor.

You can typically expect to receive your refund within several weeks, though processing times can vary.

What to Do If Your Payslip Shows an Error

If you believe your payslip contains an error affecting your tax deductions, take the following steps:

- Contact your employer: Inform your employer about the potential error and provide them with any supporting evidence.

- Contact HMRC directly: If the issue can't be resolved with your employer, contact HMRC directly via their helpline or online query system.

- Request a tax code correction: If an incorrect tax code is the source of the problem, request a correction from HMRC.

- Dispute a tax assessment: If you disagree with a tax assessment, you can dispute it using the appropriate channels provided by HMRC.

You can find contact details and links to relevant HMRC pages for submitting queries on their website. [Link to relevant HMRC page].

Conclusion

Regularly reviewing your payslips is crucial to ensure accurate tax deductions and identify potential HMRC tax refunds. Understanding the key components of your payslip and the common reasons for overpayment can empower you to claim back money you're rightfully owed. Don't underestimate the potential value of a tax repayment; even a small amount can make a difference.

Don't delay! Check your payslips today and see if you're due an HMRC tax refund. Take control of your finances and claim what's yours! Start checking your payslips now for potential tax repayments.

Featured Posts

-

Top 5 Eurovision 2025 Finalists Who Will Win

May 20, 2025

Top 5 Eurovision 2025 Finalists Who Will Win

May 20, 2025 -

Tadic Fenerbahce Ye Geliyor Kuluep Tarihinin En Bueyuek Transferlerinden Biri

May 20, 2025

Tadic Fenerbahce Ye Geliyor Kuluep Tarihinin En Bueyuek Transferlerinden Biri

May 20, 2025 -

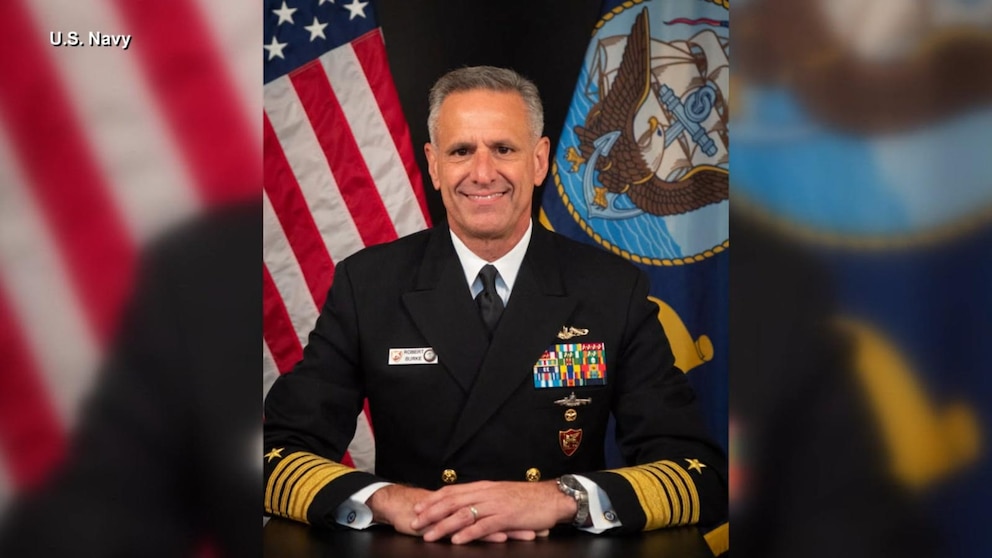

Navy Admiral Faces 30 Years For 500 000 Bribery Scheme

May 20, 2025

Navy Admiral Faces 30 Years For 500 000 Bribery Scheme

May 20, 2025 -

Fenerbahce De Sezonun Ilk Ayriligi Tadic Yeni Takimina Transfer Oldu

May 20, 2025

Fenerbahce De Sezonun Ilk Ayriligi Tadic Yeni Takimina Transfer Oldu

May 20, 2025 -

I Los Antzeles Kynigaei Ton Giakoymaki

May 20, 2025

I Los Antzeles Kynigaei Ton Giakoymaki

May 20, 2025