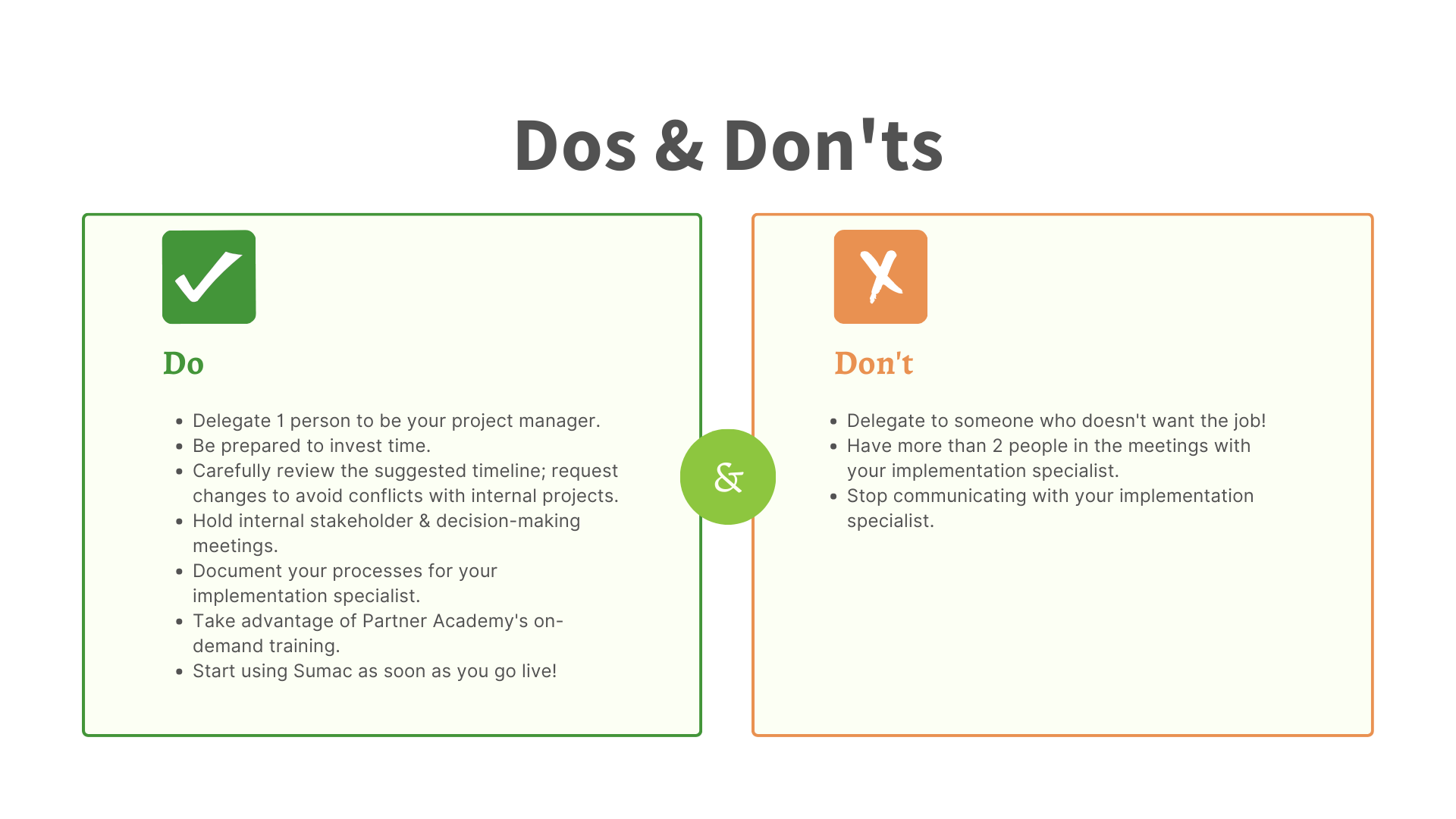

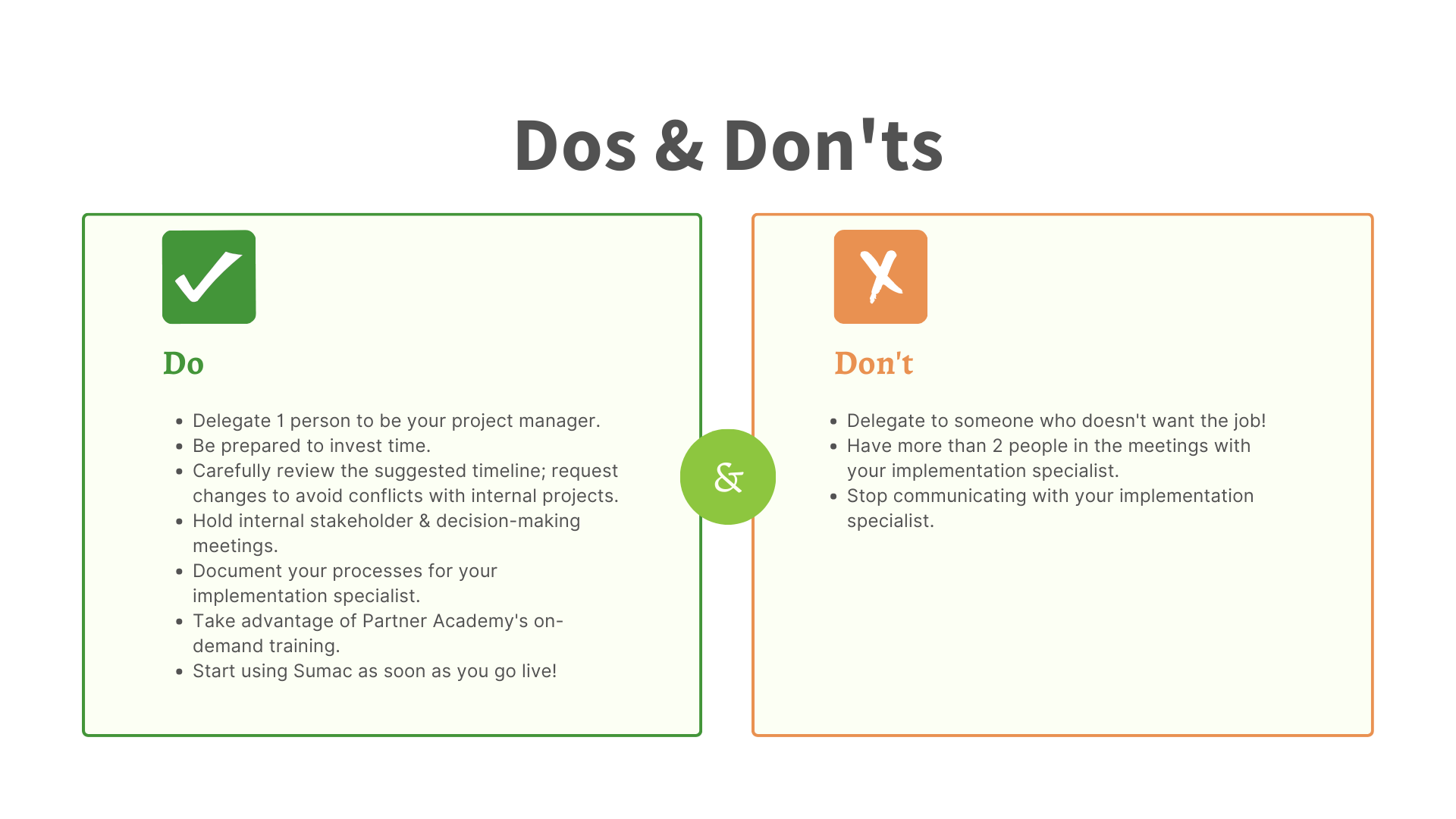

Crack The Code: 5 Dos And Don'ts For Private Credit Job Success

Table of Contents

Do: Master the Core Skills of Private Credit

The private credit industry demands a specific skill set. Demonstrating proficiency in these areas is crucial for private credit job success.

Financial Modeling Proficiency:

Proficiency in financial modeling is non-negotiable. Private credit professionals need to be comfortable building and interpreting complex models to evaluate investment opportunities.

- Proficiency in Excel (including advanced functions like VBA) is a must. Mastering shortcuts, pivot tables, and macros will significantly improve your efficiency.

- Experience with discounted cash flow (DCF) analysis, leveraged buyout (LBO) modeling, and comparable company analysis is crucial. These are fundamental tools used to value companies and assess investment risks.

- Showcase your ability to create clear, concise, and insightful financial reports. Your ability to communicate complex financial information effectively is key. Practice presenting your models and analyses clearly and confidently.

Credit Analysis Expertise:

A deep understanding of credit underwriting and risk assessment is paramount in private credit. You must be able to effectively evaluate a borrower's creditworthiness.

- Familiarity with various credit metrics (e.g., leverage ratios, interest coverage ratios) is essential. Understanding these metrics allows you to assess the financial health and risk profile of potential borrowers.

- Demonstrate your ability to assess the creditworthiness of borrowers and identify potential risks. This requires a thorough understanding of financial statements and the ability to identify red flags.

- Experience with different types of credit facilities (e.g., senior secured loans, subordinated debt) is beneficial. Knowledge of various financing structures will broaden your appeal to potential employers.

Industry Knowledge:

Staying abreast of current market trends and regulatory changes is vital for success in the dynamic private credit industry.

- Follow key industry publications and news sources. Stay informed about market movements, new regulations, and emerging trends. Publications like Private Equity International, Private Debt Investor, and industry-specific blogs are excellent resources.

- Network with professionals in the field to gain insights and perspectives. Networking events and conferences provide opportunities to learn from experienced professionals and build your network.

- Demonstrate your understanding of different private credit strategies (e.g., direct lending, fund investing). Understanding the nuances of different investment strategies will set you apart from other candidates.

Don't: Neglect Networking and Relationship Building

Networking is not just about collecting business cards; it's about building genuine relationships. This is crucial for private credit job success.

Importance of Networking:

Building a strong network within the private credit industry is incredibly valuable.

- Attend industry events and conferences. These events provide excellent opportunities to meet professionals, learn about new opportunities, and build your network.

- Connect with people on LinkedIn and other professional networking platforms. LinkedIn is a powerful tool for connecting with professionals in your field and staying updated on industry news. Actively engage with posts and participate in relevant groups.

- Informational interviews can provide invaluable insights and connections. Reach out to professionals in private credit for informational interviews to learn about their experiences and gain valuable advice.

Underestimating the Power of Referrals:

Referrals significantly increase your chances of landing an interview.

- Let your network know you're looking for a private credit job. Inform your contacts about your job search and the types of roles you're interested in.

- Follow up with your contacts regularly. Maintain consistent communication with your network to keep them updated on your progress.

- Express gratitude for any assistance provided. Show your appreciation for anyone who helps you in your job search.

Do: Prepare Thoroughly for Interviews

Thorough interview preparation is key to demonstrating your capabilities and securing your dream private credit role.

Behavioral Questions:

Behavioral questions assess your past experiences and how you've handled various situations.

- Prepare examples showcasing your problem-solving skills, teamwork abilities, and leadership qualities. Use the STAR method (Situation, Task, Action, Result) to structure your responses.

- Highlight your achievements and contributions in previous roles. Quantify your accomplishments whenever possible to demonstrate your impact.

- Demonstrate your ability to handle pressure and work under tight deadlines. Private credit often involves working under pressure; showcase your ability to manage this effectively.

Technical Questions:

Technical questions test your knowledge of financial modeling, credit analysis, and industry trends.

- Review key concepts and formulas. Brush up on your knowledge of DCF analysis, LBO modeling, and credit metrics.

- Practice solving case studies. Prepare for case studies by practicing similar examples and developing your analytical skills.

- Be prepared to discuss your experience with different software and tools. Demonstrate familiarity with relevant software, such as Excel, Bloomberg Terminal, and financial modeling platforms.

Don't: Undersell Your Experience and Achievements

Confidence and a clear presentation of your accomplishments are critical during the interview process.

Highlight Quantifiable Results:

Use data to support your claims and demonstrate your impact.

- Use metrics and data to showcase your contributions. Instead of saying "I improved efficiency," say "I improved efficiency by 15% by implementing X."

- Highlight successful projects and initiatives. Focus on projects where you made a significant contribution and quantify your results.

- Focus on the value you brought to your previous employers. Emphasize the positive impact you had on your previous organizations.

Lack Confidence:

Projecting confidence can significantly influence the hiring manager's perception.

- Maintain positive body language. Maintain eye contact, sit upright, and use open body language to convey confidence.

- Articulate your thoughts clearly and concisely. Practice your responses beforehand to ensure you can articulate your thoughts effectively.

- Show genuine interest in the opportunity. Demonstrate your enthusiasm for the role and the company.

Do: Follow Up After Interviews

Following up effectively demonstrates your continued interest and professionalism.

Importance of a Thank You Note:

Sending a thank-you note reinforces your interest and allows you to reiterate key points.

- Send a personalized thank-you note to each interviewer within 24 hours. Tailor each note to the specific interviewer and highlight key points from your conversation.

- Reiterate your interest in the position. Reaffirm your enthusiasm for the role and the company.

- Express your enthusiasm for the opportunity. Show genuine excitement about the potential of working for the company.

Follow-Up Communication:

Following up a week later shows persistent interest and professionalism.

- Follow up with the recruiter or hiring manager a week after the interview to reiterate your interest. A brief email is sufficient to check on the status of your application.

- Express your continued enthusiasm for the role. Reiterate your interest in the position and highlight your key qualifications.

- Maintain a professional and respectful tone. Ensure your communication remains professional and avoids being overly pushy or demanding.

Conclusion:

Securing a private credit job requires a strategic approach. By mastering core skills, actively networking, preparing thoroughly for interviews, showcasing your achievements confidently, and following up effectively, you can significantly increase your chances of private credit job success. Remember, cracking the code to private credit job success is a combination of hard work, strategic planning, and confident execution. Don't delay, start implementing these dos and don'ts today to unlock your potential in the exciting world of private credit!

Featured Posts

-

Chicago Bulls And The Nba Draft Lottery Cooper Flaggs Chances

May 13, 2025

Chicago Bulls And The Nba Draft Lottery Cooper Flaggs Chances

May 13, 2025 -

The Impact Of Reduced U S China Tariffs On The American Economy

May 13, 2025

The Impact Of Reduced U S China Tariffs On The American Economy

May 13, 2025 -

Nba Draft Lottery Okc Thunders Position Still Up In The Air

May 13, 2025

Nba Draft Lottery Okc Thunders Position Still Up In The Air

May 13, 2025 -

Salman Khan Box Office Flop Did Bhai Deliver A Disaster

May 13, 2025

Salman Khan Box Office Flop Did Bhai Deliver A Disaster

May 13, 2025 -

Scarlett Johansson And Chris Evans Hidden Comedy Gem On Netflix

May 13, 2025

Scarlett Johansson And Chris Evans Hidden Comedy Gem On Netflix

May 13, 2025