Credit Suisse Whistleblower Settlement: Up To $150 Million Awarded

Table of Contents

The Allegations Against Credit Suisse

The whistleblower's report detailed serious allegations of financial misconduct at Credit Suisse, encompassing a range of illegal activities that potentially violated numerous securities laws. These allegations significantly impacted investor confidence and raised concerns about the bank's internal controls and risk management practices.

-

Specific examples of alleged illegal activities: The report included allegations of money laundering, aiding and abetting tax evasion schemes for high-net-worth individuals, and potentially fraudulent securities transactions. These activities spanned several years and involved numerous internal and external parties.

-

The scale of the alleged fraud and its potential impact: The alleged misconduct involved substantial sums of money, potentially impacting thousands of investors and causing significant financial damage. The scale of the operation highlights systemic weaknesses within Credit Suisse’s compliance infrastructure.

-

The role of internal controls and compliance failures: The whistleblower’s report suggests significant failures in Credit Suisse’s internal controls and compliance programs, allowing the alleged illegal activities to continue undetected for an extended period. This points to a broader issue of corporate governance and oversight within the financial institution.

The Whistleblower's Role and the SEC's Investigation

The whistleblower played a crucial role in bringing these alleged activities to light. They bravely came forward, despite the significant personal risks involved, providing detailed information and evidence to the Securities and Exchange Commission (SEC). Their actions demonstrate the critical role individuals can play in exposing financial fraud and holding institutions accountable.

-

Timeline of events from initial report to settlement: The whistleblower initially contacted the SEC in [Insert Year, if available]. The SEC conducted a thorough investigation, gathering further evidence and corroborating the whistleblower's claims. The settlement was reached after [Insert timeframe, e.g., several years] of investigation and negotiation.

-

Evidence provided by the whistleblower: The whistleblower provided a significant amount of incriminating evidence, including internal documents, emails, and financial records that detailed the alleged scheme. This comprehensive evidence was vital in the SEC's successful investigation.

-

SEC's investigation methods and findings: The SEC employed a variety of investigative techniques, including interviews with employees, analysis of financial records, and forensic accounting methods. Their findings validated the whistleblower's allegations and led to the substantial settlement.

The $150 Million Settlement: A Record-Breaking Award

The $150 million settlement is a landmark achievement in the history of whistleblower rewards. It significantly surpasses previous awards, demonstrating the SEC's increasing commitment to rewarding those who expose significant financial fraud.

-

Comparison to previous largest whistleblower awards: This award is among the largest ever paid under the Dodd-Frank Act's whistleblower program, significantly exceeding previous high-profile cases. Its size reflects the severity and impact of the alleged misconduct.

-

Factors influencing the size of the award: Several factors likely contributed to the substantial payout, including the volume of evidence provided by the whistleblower, the significant financial harm caused by the alleged fraud, and the complexity of the SEC's investigation.

-

The potential deterrent effect on future illegal activities: The sheer size of the award serves as a powerful deterrent to future fraudulent activities, sending a clear message that financial misconduct will be severely punished. It underscores the significant financial risk associated with such actions.

The Importance of Whistleblower Protection

The Credit Suisse case underscores the vital importance of robust whistleblower protection. Laws like the Dodd-Frank Act protect individuals who report financial wrongdoing from retaliation and ensure confidentiality.

-

Specific laws protecting whistleblowers (e.g., Dodd-Frank Act): The Dodd-Frank Act provides significant protections for whistleblowers, including confidentiality, anti-retaliation provisions, and a reward system for providing information leading to successful enforcement actions.

-

Mechanisms for ensuring whistleblower anonymity and safety: The SEC employs various mechanisms to protect the identities and safety of whistleblowers, including secure reporting channels and confidential communication protocols.

-

The public benefit derived from whistleblowing: Whistleblowers play a critical role in safeguarding the integrity of the financial markets. Their actions protect investors, maintain public trust, and deter future misconduct.

Conclusion

The Credit Suisse whistleblower settlement underscores the critical role of whistleblowers in uncovering financial wrongdoing and the substantial rewards available for coming forward. The $150 million award is a testament to the SEC's commitment to enforcing financial regulations and protecting investors. This landmark case will likely influence future whistleblowing efforts and deter potential fraudulent activities.

Call to Action: Are you aware of financial misconduct within a company? Don't hesitate. Contact the SEC and consider reporting potential financial fraud. You could be eligible for a significant reward, similar to the Credit Suisse whistleblower settlement. Learn more about whistleblower protection and how to report potential violations securely. Protecting financial integrity starts with you.

Featured Posts

-

Could This Cryptocurrency Thrive Despite The Trade War

May 09, 2025

Could This Cryptocurrency Thrive Despite The Trade War

May 09, 2025 -

Market Volatility In Pakistan Stock Exchange Portal Experiences Outage

May 09, 2025

Market Volatility In Pakistan Stock Exchange Portal Experiences Outage

May 09, 2025 -

Fur Rondy Shorter Race Unwavering Spirit

May 09, 2025

Fur Rondy Shorter Race Unwavering Spirit

May 09, 2025 -

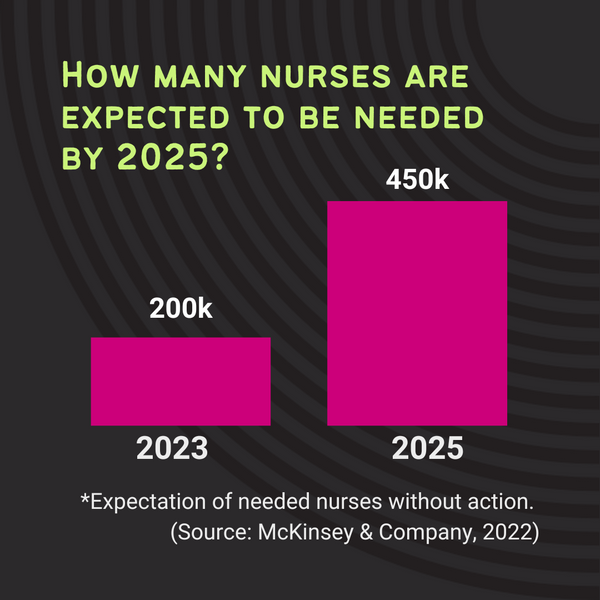

56 Million Boost For Community Colleges To Tackle Nursing Shortage

May 09, 2025

56 Million Boost For Community Colleges To Tackle Nursing Shortage

May 09, 2025 -

Persistent Tariffs Senator Warner On Trumps Trade Strategy

May 09, 2025

Persistent Tariffs Senator Warner On Trumps Trade Strategy

May 09, 2025

Latest Posts

-

Nhl Playoffs Oilers Vs Kings Game 1 Predictions And Betting Picks

May 09, 2025

Nhl Playoffs Oilers Vs Kings Game 1 Predictions And Betting Picks

May 09, 2025 -

Game 1 Prediction Oilers Vs Kings Nhl Playoffs Betting Odds

May 09, 2025

Game 1 Prediction Oilers Vs Kings Nhl Playoffs Betting Odds

May 09, 2025 -

Oilers Vs Kings Nhl Playoffs Game 1 Predictions Picks And Best Bets

May 09, 2025

Oilers Vs Kings Nhl Playoffs Game 1 Predictions Picks And Best Bets

May 09, 2025 -

Oilers Vs Kings Prediction Game 1 Playoffs Best Bets And Picks

May 09, 2025

Oilers Vs Kings Prediction Game 1 Playoffs Best Bets And Picks

May 09, 2025 -

Nhl Playoffs Oilers Vs Kings Prediction For Game 1 Tonight

May 09, 2025

Nhl Playoffs Oilers Vs Kings Prediction For Game 1 Tonight

May 09, 2025