D-Wave Quantum Inc. (QBTS): Deconstructing The Recent Stock Market Rally

Table of Contents

Analyzing the Fundamentals of D-Wave Quantum Inc. (QBTS)

Understanding the recent D-Wave Quantum Inc. (QBTS) stock market rally requires a deep dive into the company's fundamentals. This involves examining its financial health and its technological advancements within the competitive quantum computing landscape.

Recent Financial Performance and Earnings Reports

Analyzing D-Wave's financial performance is crucial to understanding the stock's recent behavior. While specific numbers require accessing recent financial reports, investors should look for key indicators:

- Quarterly and Annual Earnings: Examine the trend in earnings per share (EPS) to understand profitability growth. Significant increases can positively impact stock price.

- Revenue Growth: Consistent revenue growth signals strong market demand for D-Wave's quantum computing solutions. Look for year-over-year (YOY) growth rates.

- Profitability: Assess profitability through metrics like gross margin and operating margin. Improving profitability indicates a healthier financial position.

- Partnerships and Contracts: Major partnerships with corporations or government agencies can inject significant revenue and boost investor confidence, impacting the QBTS stock price positively. Look for announcements of new collaborations.

- Key Financial Ratios: Analyze key ratios like the debt-to-equity ratio and current ratio to understand D-Wave's financial health and solvency.

Technological Advancements and Competitive Landscape

D-Wave's position within the quantum computing landscape is critical. The company's advancements in quantum annealing technology are key factors influencing investor sentiment:

- Technological Breakthroughs: Monitor announcements of improvements in qubit count, processing speed, or error correction capabilities. These advancements can attract further investment.

- Competitive Comparison: Assess D-Wave's technology against competitors using different quantum computing approaches (e.g., gate-based quantum computers). A competitive advantage can drive stock price appreciation.

- Market Share and Growth Potential: Analyze D-Wave's market share and the overall growth potential of the quantum computing industry. A large addressable market can support higher valuations.

Macroeconomic Factors Influencing QBTS Stock Price

The broader macroeconomic environment and investor sentiment significantly affect the QBTS stock price, independent of D-Wave's specific performance.

Overall Market Sentiment and Investor Confidence

The overall health of the stock market plays a vital role.

- Market Trends: A bullish market generally benefits technology stocks, including QBTS. Conversely, bearish market conditions can negatively impact the stock price regardless of D-Wave's fundamentals.

- Investor Sentiment towards Quantum Computing: Positive sentiment towards the quantum computing sector as a whole can push up stock prices for all companies in the field.

- Broader Economic Factors: Macroeconomic indicators such as interest rate hikes and inflation influence investor risk appetite, potentially affecting QBTS stock price.

Impact of Industry News and Analyst Ratings

News and analyst opinions heavily impact stock prices.

- News and Press Releases: Positive news, such as successful product launches or partnerships, can significantly boost the stock price. Negative news can have the opposite effect.

- Analyst Ratings and Price Targets: Follow analyst ratings (buy, hold, sell) and price targets. Positive analyst coverage can lead to increased investor interest.

- Industry Events: Significant industry events, conferences, or breakthroughs in the broader quantum computing field can influence investor sentiment towards QBTS.

Speculative Trading and Market Volatility

The D-Wave Quantum Inc. (QBTS) stock market rally is also influenced by speculative trading and market volatility.

Short-Term vs. Long-Term Investment Strategies

Investing in QBTS involves considering different time horizons.

- Short-Term Trading: Short-term trading is inherently riskier due to market volatility. Quick price fluctuations can lead to significant gains or losses.

- Long-Term Investing: A long-term investment strategy mitigates some risks, allowing investors to ride out short-term market fluctuations.

- Speculative Bubbles and Corrections: The potential for speculative bubbles and subsequent market corrections exists in rapidly growing sectors like quantum computing. Investors should be aware of this risk.

- Portfolio Diversification: Diversifying your investment portfolio is crucial to mitigate the risks associated with investing in a single, volatile stock.

Social Media Influence and Retail Investor Activity

Social media and retail investor activity can significantly impact stock prices.

- Social Media Sentiment: Positive or negative sentiment expressed on social media platforms can influence retail investor decisions and drive stock prices.

- Retail Investor Influence: Retail investors' buying or selling decisions can significantly impact stock prices, particularly in volatile markets.

- Social Media Trends: Pay attention to trending topics and discussions regarding QBTS on social media platforms.

Conclusion: Understanding the D-Wave Quantum Inc. (QBTS) Stock Rally

The recent D-Wave Quantum Inc. (QBTS) stock market rally is a complex phenomenon driven by a combination of factors. Technological advancements, positive investor sentiment, and overall market conditions all play a role. However, it's crucial to acknowledge the significant impact of speculative trading and the inherent volatility of the quantum computing sector. While positive financial reports and technological breakthroughs can contribute to price increases, understanding the balance between fundamental value and speculative activity is crucial when considering investing in QBTS.

Key Takeaways: Before investing in QBTS, carefully assess D-Wave's financial health, its technological competitiveness, and the overall market sentiment. Remember that short-term gains can be quickly reversed, and long-term strategies often offer better risk mitigation.

Call to Action: Before making any investment decisions related to D-Wave Quantum Inc. (QBTS), it's essential to conduct thorough due diligence and consult with a financial advisor. Stay informed on the latest developments in the quantum computing sector and the overall market conditions to make well-informed decisions regarding your QBTS stock investments.

Featured Posts

-

Cronin Appointed Head Coach At Highfield Rfc

May 20, 2025

Cronin Appointed Head Coach At Highfield Rfc

May 20, 2025 -

Weather Anchor Ginger Zee Addresses Negative Comments About Her Appearance

May 20, 2025

Weather Anchor Ginger Zee Addresses Negative Comments About Her Appearance

May 20, 2025 -

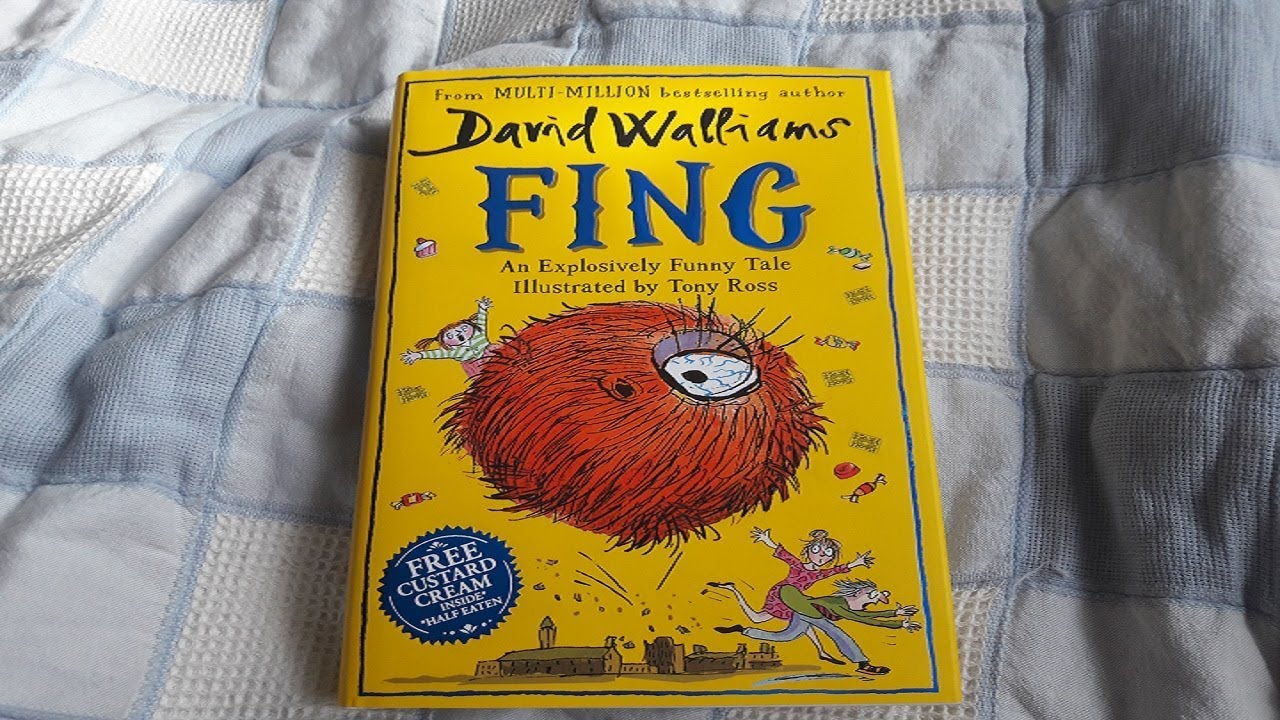

Stan Greenlights David Walliams Fantasy Project Fing

May 20, 2025

Stan Greenlights David Walliams Fantasy Project Fing

May 20, 2025 -

Post Brexit Challenges For Uk Luxury Exporters To The Eu

May 20, 2025

Post Brexit Challenges For Uk Luxury Exporters To The Eu

May 20, 2025 -

Zachary Cunhas New Role From Us Attorney To Private Practice

May 20, 2025

Zachary Cunhas New Role From Us Attorney To Private Practice

May 20, 2025