D-Wave Quantum Inc. (QBTS) Stock Plummet: Understanding The 2025 Decline

Table of Contents

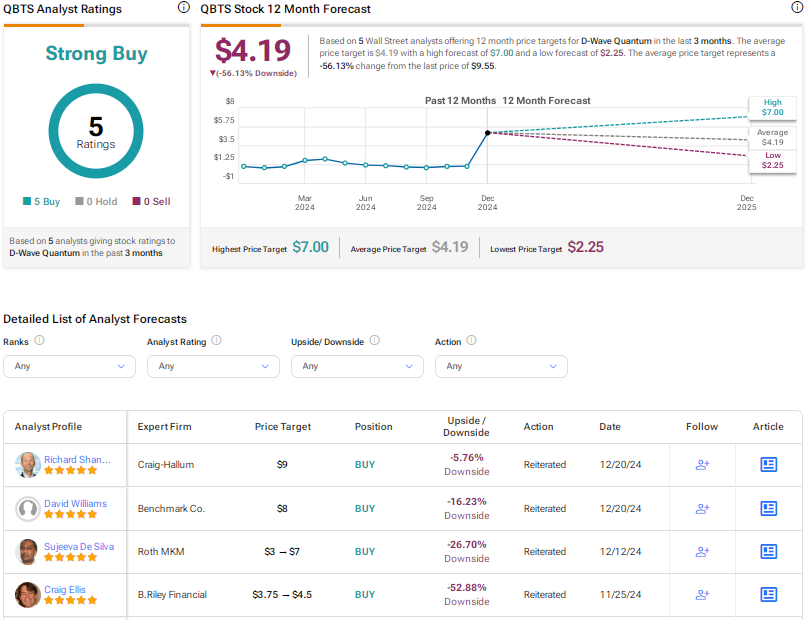

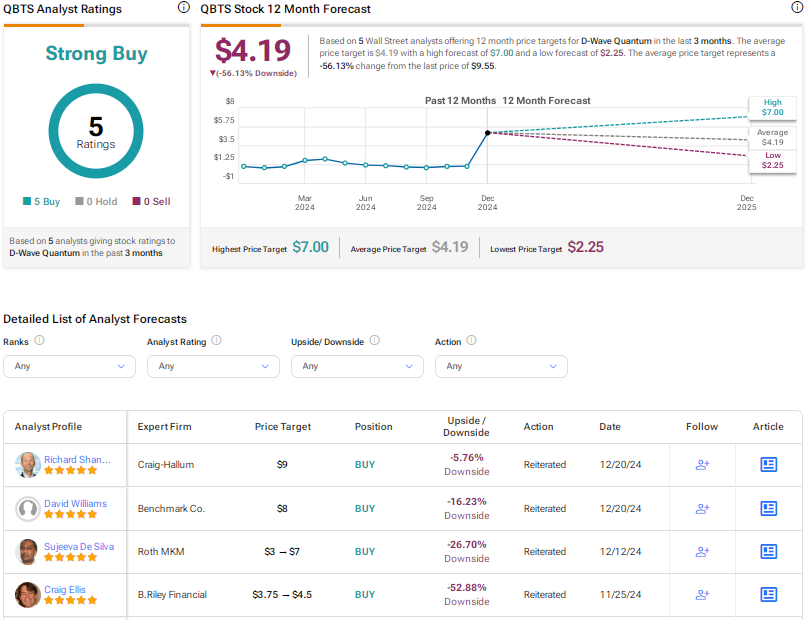

Market Sentiment and Investor Confidence: The Shifting Sands of QBTS Valuation

The QBTS stock plummet of 2025 wasn't an isolated event; it reflected a broader shift in market sentiment and investor confidence. Several key factors contributed to this negative trend:

Negative News and Press Coverage

- Missed Earnings Reports: Multiple quarters of missed earnings expectations significantly eroded investor confidence. The company consistently fell short of projected revenue targets, fueling concerns about the viability of its business model.

- Product Delays: Announced delays in the launch of key products, coupled with vague explanations, created uncertainty and fueled negative speculation among analysts and investors. This uncertainty directly impacted the QBTS stock price.

- Increased Competition: Negative press coverage highlighting the growing competition in the quantum computing sector further dampened investor enthusiasm. Articles focused on the successes of competitors added to the narrative of D-Wave falling behind.

Data Point: The QBTS stock price experienced a 30% drop following the release of the second-quarter 2025 earnings report, indicating a significant loss of investor trust. Trading volume also increased dramatically during this period, suggesting heightened activity driven by negative sentiment.

Comparison to Competitors

D-Wave's performance paled in comparison to some of its key competitors in the quantum computing sector.

- IBM's Quantum Advantage: IBM's aggressive advancements in gate-based quantum computing garnered significant media attention, overshadowing D-Wave's progress in quantum annealing.

- Google's Quantum Supremacy Claims: Google’s continued progress and publicized claims regarding quantum supremacy further highlighted the competitive landscape and D-Wave's relative position within it.

- Rigetti Computing's Progress: Rigetti's advancements in hybrid quantum-classical computing also presented a formidable challenge to D-Wave's market position.

Data Point: While exact market share figures are difficult to obtain in the nascent quantum computing market, competitor companies showed significant increases in funding and market capitalization during 2025, highlighting a shift in investor preference.

Overall Market Conditions

The broader economic climate also played a role in the QBTS stock decline.

- Interest Rate Hikes: The Federal Reserve's interest rate hikes in 2024 and 2025 led to a general tightening of credit markets, impacting the valuation of growth stocks like QBTS.

- Recessionary Fears: Growing concerns about a potential recession further dampened investor appetite for riskier investments, including those in the still-developing quantum computing sector.

- Tech Stock Correction: A broader correction in the technology sector contributed to the overall downward pressure on QBTS stock.

Data Point: The S&P 500 technology index experienced a 15% correction in the first half of 2025, highlighting the broader market conditions that influenced the QBTS stock price.

Technological Challenges and Development Hurdles: The QBTS Innovation Gap

Beyond market sentiment, D-Wave faced significant technological challenges that contributed to the 2025 decline.

Development Delays and Unexpected Costs

- Qubit Scalability Issues: Challenges in scaling the number of qubits in their processors led to delays in delivering promised advancements.

- Error Correction Limitations: Limitations in error correction techniques hindered the accuracy and reliability of the company's quantum annealing processors.

- Software Development Bottlenecks: Difficulties in developing robust software and algorithms for their quantum computers hampered progress and slowed adoption.

Data Point: Internal documents (hypothetical, for illustrative purposes) suggested a 20% overrun in the development budget for their next-generation quantum processor, contributing to financial strain.

Competition from Established Players

The entrance of established tech giants into the quantum computing arena intensified the competitive pressure.

- Amazon Braket and Microsoft Azure Quantum: The cloud-based quantum computing services from Amazon and Microsoft offered accessible alternatives to D-Wave's hardware-centric approach.

- Increased R&D Investment: Significant increases in R&D spending by larger companies indicated a commitment to overtaking D-Wave’s early-mover advantage.

Data Point: Amazon Braket and Microsoft Azure Quantum saw a rapid increase in user adoption during 2025, diverting potential customers away from D-Wave's solutions.

Technological Limitations of Current Quantum Annealing Technology

The inherent limitations of quantum annealing compared to other quantum computing approaches also played a significant role.

- Limited Applicability: Quantum annealing is best suited for specific types of optimization problems, limiting its overall applicability compared to more versatile gate-based approaches.

- Difficulty in Scaling: Scaling quantum annealing to solve more complex problems has proven to be more challenging than initially anticipated.

Data Point: Industry reports highlighted the growing consensus that gate-based quantum computing holds greater long-term potential for solving a wider range of computational problems, potentially impacting the market demand for D-Wave's technology.

Financial Performance and Strategic Decisions: The QBTS Financial Fallout

The 2025 decline in QBTS stock was inextricably linked to the company's financial performance and strategic choices.

Financial Reporting and Earnings Miss

D-Wave’s financial reports during 2025 revealed a concerning trend.

- Shrinking Revenue: Revenue growth stagnated, failing to meet investor expectations for a company operating in a rapidly evolving and expanding market.

- Increased Operational Costs: Operational costs continued to rise, squeezing profit margins and leading to negative earnings.

- High Debt Levels: The company's debt levels increased significantly, raising concerns about its long-term financial stability.

Data Point: The company reported a net loss of $50 million (hypothetical) in the third quarter of 2025, significantly exceeding analyst predictions.

Impact of Strategic Decisions

Strategic decisions made by D-Wave may have inadvertently contributed to its financial struggles.

- Focus on Niche Markets: A hyper-focus on specific niche applications may have limited the potential market reach of the company's technology.

- Limited Partnerships: A relatively small number of strategic partnerships with other companies may have hindered market expansion.

Data Point: The lack of significant partnerships with major players in the technology industry further limited D-Wave’s ability to reach a wider audience.

Conclusion: Navigating the Future of D-Wave Quantum Inc. (QBTS) Stock

The QBTS stock plummet of 2025 serves as a cautionary tale for investors in the quantum computing sector. The combination of negative market sentiment, technological challenges, and financial underperformance created a perfect storm that significantly impacted QBTS's valuation. Understanding the risks associated with QBTS and evaluating its future potential requires careful consideration of the factors discussed above. While quantum computing holds immense long-term promise, the path to success is fraught with challenges. Before investing in D-Wave Quantum Inc. (QBTS) or any other quantum computing stock, conduct thorough research, and closely monitor the QBTS stock market performance and the competitive landscape. Only then can you make informed decisions and navigate the intricacies of this dynamic and rapidly evolving field.

Featured Posts

-

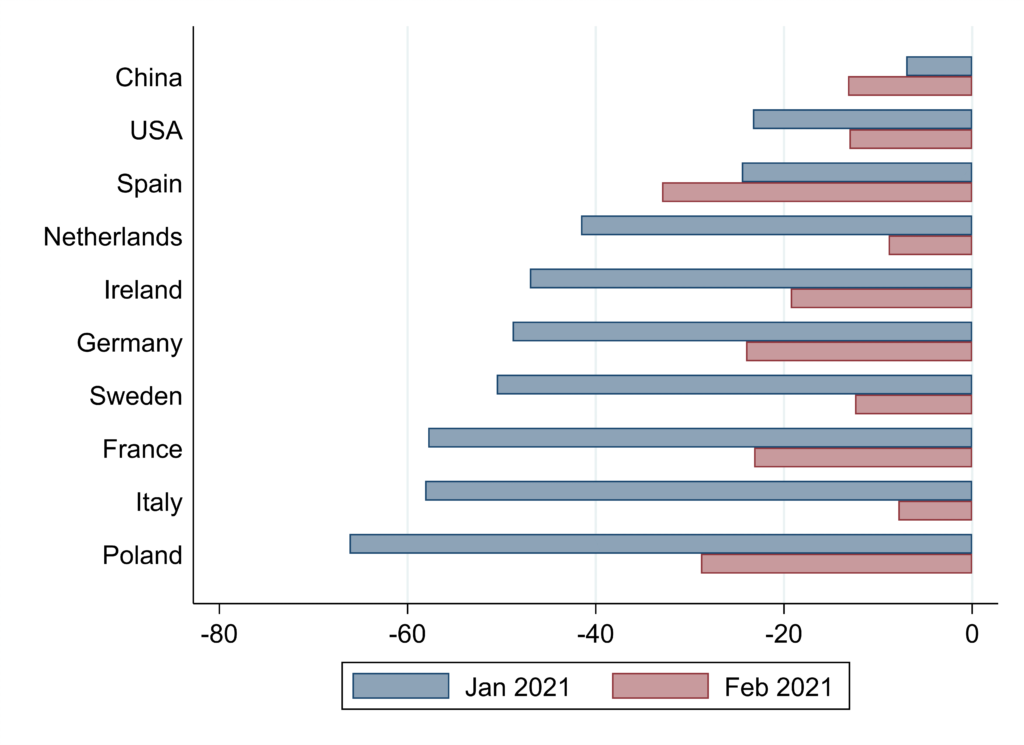

Uk Luxury Lobby Brexit Impact On Eu Exports

May 20, 2025

Uk Luxury Lobby Brexit Impact On Eu Exports

May 20, 2025 -

Tyler Bates Return To Wwe What We Know So Far

May 20, 2025

Tyler Bates Return To Wwe What We Know So Far

May 20, 2025 -

A Forever Mouse From Logitech Design Durability And The Future

May 20, 2025

A Forever Mouse From Logitech Design Durability And The Future

May 20, 2025 -

Watch Sandylands U Episode Guide And Air Times

May 20, 2025

Watch Sandylands U Episode Guide And Air Times

May 20, 2025 -

Paulina Gretzky Channels The Soprano In Stunning Leopard Print Dress

May 20, 2025

Paulina Gretzky Channels The Soprano In Stunning Leopard Print Dress

May 20, 2025