D-Wave Quantum (QBTS) Stock: A Quantum Leap For Investors?

Table of Contents

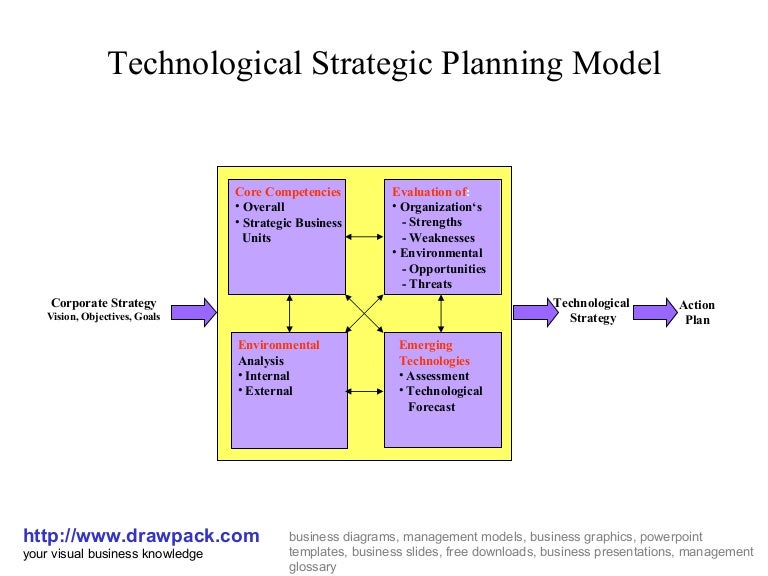

Understanding D-Wave Quantum and its Technology

What is D-Wave's Quantum Annealing Technology?

D-Wave's technology centers around quantum annealing, a specialized type of quantum computing designed to solve specific optimization problems. Unlike gate-based quantum computing, which aims to build a universal quantum computer, quantum annealing focuses on finding the lowest energy state of a system, providing solutions to complex optimization challenges much faster than classical computers. This makes it particularly well-suited for applications requiring the processing of vast amounts of data to find optimal solutions. While highly effective for its niche applications, quantum annealing is not a general-purpose quantum computing solution and has limitations compared to gate-based approaches.

- Practical Applications: D-Wave's quantum annealers are already being used in various industries, including logistics, materials science, and financial modeling, to optimize supply chains, design new materials, and improve portfolio management.

- Key Clients and Partnerships: D-Wave boasts a growing list of clients, including prominent names in the tech and finance industries, further demonstrating market traction and validating its technology. Strategic partnerships with leading research institutions and technology companies also bolster its position.

- Scalability and Limitations: D-Wave continues to improve the scalability of its quantum processors, increasing the number of qubits (quantum bits) in each generation. However, current processors still have limitations in terms of qubit connectivity and error rates compared to theoretical possibilities.

Analyzing D-Wave Quantum (QBTS) Stock Performance

Historical Stock Performance and Volatility

Analyzing the historical performance of QBTS stock requires careful consideration of its relatively recent entry into the public market. Charts and graphs depicting price trends since its initial public offering (IPO) should be included here to illustrate volatility and growth patterns. Investors should look for trends in the stock's price and its correlation with market fluctuations. [Insert relevant chart/graph here].

Key Financial Indicators

Evaluating the financial health of D-Wave Quantum requires a review of its key financial indicators. This includes an examination of the company's revenue streams, profitability (or lack thereof), operational expenses, and overall debt levels. A comparison of these metrics to industry averages and competitors provides valuable context for assessing the company's financial position. This analysis helps investors assess whether the company is financially viable and has the potential for sustainable growth.

- Financial Health and Growth Prospects: Investors need to assess whether D-Wave is demonstrating growth in revenue and reducing operational losses. Future projections and the company's strategic plans play a critical role in evaluating its long-term prospects.

- Comparison to Competitors: While direct comparisons to competitors in the quantum computing space can be challenging due to the nascent nature of the field, benchmarking against similar technology companies can offer valuable insights.

- Factors Influencing Volatility: The volatility of QBTS stock is heavily influenced by several factors, including broader market trends, technological advancements (or setbacks), and the overall investor sentiment towards the quantum computing sector.

Investment Risks and Opportunities in D-Wave Quantum (QBTS) Stock

Assessing the Risks

Investing in D-Wave Quantum (QBTS) stock involves several inherent risks:

- Market Volatility: The stock market, especially for emerging technology companies, is inherently volatile. QBTS stock price can fluctuate significantly based on various market factors.

- Technological Challenges: The quantum computing field is still in its early stages. Technological hurdles and unexpected delays in development could impact the company's progress and profitability.

- Competition: The quantum computing sector is becoming increasingly competitive, with both established tech giants and new startups vying for market share.

Evaluating the Opportunities

Despite the risks, investing in D-Wave Quantum (QBTS) presents significant opportunities:

- Long-Term Growth Potential: The quantum computing market is projected to experience substantial growth in the coming years. As quantum computers become more powerful and versatile, their applications across numerous industries will expand exponentially.

- Competitive Advantages: D-Wave's early-mover advantage and established client base provide it with a significant competitive edge. Continued technological advancements could further solidify its position.

- Impact of Breakthroughs and Regulation: Major technological breakthroughs and supportive regulatory environments could significantly boost D-Wave's growth trajectory.

Conclusion

Investing in D-Wave Quantum (QBTS) stock involves weighing considerable risks against substantial potential rewards. While the company faces challenges in a competitive landscape and the quantum computing sector is still in its nascent stages, the long-term growth prospects are undeniable. The analysis of D-Wave's unique quantum annealing technology, coupled with a thorough assessment of its financial health and the inherent market risks, should form the basis of any investment decision. While investing in D-Wave Quantum (QBTS) stock carries inherent risks, the potential rewards in this burgeoning field of quantum computing are significant. Conduct your own due diligence before making any investment decisions, but don't dismiss the potential of D-Wave Quantum (QBTS) stock as a part of your long-term investment strategy. Remember to consult with a financial advisor before making any investment decisions.

Featured Posts

-

Activite Portuaire D Abidjan Croissance Stable En 2022

May 20, 2025

Activite Portuaire D Abidjan Croissance Stable En 2022

May 20, 2025 -

Politique Camerounaise Macron Et L Election Presidentielle De 2032

May 20, 2025

Politique Camerounaise Macron Et L Election Presidentielle De 2032

May 20, 2025 -

Bangladeshinfo Com Your Comprehensive Guide To Bangladesh

May 20, 2025

Bangladeshinfo Com Your Comprehensive Guide To Bangladesh

May 20, 2025 -

Quick Facts About Wayne Gretzkys Legendary Career

May 20, 2025

Quick Facts About Wayne Gretzkys Legendary Career

May 20, 2025 -

Chinas Space Supercomputer A Technological And Strategic Overview

May 20, 2025

Chinas Space Supercomputer A Technological And Strategic Overview

May 20, 2025