D-Wave Quantum (QBTS) Stock Jumped On Monday: What Investors Should Know

Table of Contents

Analyzing the Reasons Behind QBTS Stock's Monday Surge

Several factors likely contributed to the substantial increase in D-Wave Quantum's (QBTS) stock price on Monday. Let's examine the most probable causes:

Positive News and Announcements

While specific announcements need confirmation depending on the actual date of the stock jump, a sharp increase often follows positive news. This could include:

- New Partnerships or Collaborations: D-Wave Quantum might have announced a significant partnership with a major corporation or research institution, signaling increased adoption of its quantum computing technology. Such collaborations often translate into increased revenue streams and bolster investor confidence.

- Technological Breakthroughs: Successful advancements in D-Wave's quantum annealing technology or the release of improved software could significantly boost investor sentiment. A demonstration of increased processing power or problem-solving capabilities would be particularly impactful.

- Successful Product Launches or Upgrades: The introduction of new quantum computing products or significant updates to existing ones could attract new customers and showcase the company's continued innovation. This would send a strong signal to the market.

To fully understand the context, it's vital to refer to official press releases and financial news sources covering D-Wave Quantum on that specific Monday. [Insert links to relevant news articles and official press releases here].

Market Sentiment and Overall Quantum Computing Sector Growth

The rise in QBTS stock might also reflect the broader positive sentiment surrounding the quantum computing sector. Several factors could be at play:

- Increased Institutional Investment: Growing interest from institutional investors, such as venture capital firms and hedge funds, indicates a belief in the long-term potential of the quantum computing market.

- Government Funding and Support: Increased government funding for quantum computing research and development can create a positive ripple effect throughout the industry.

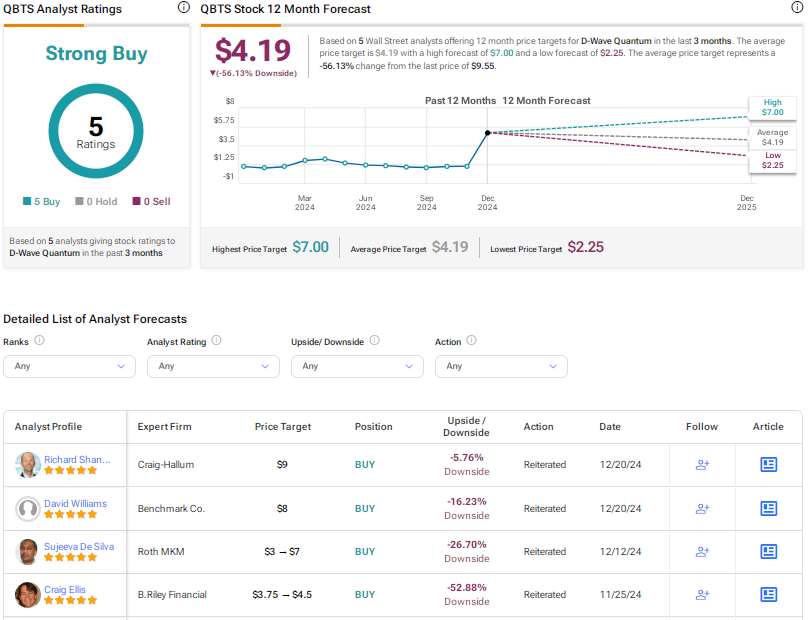

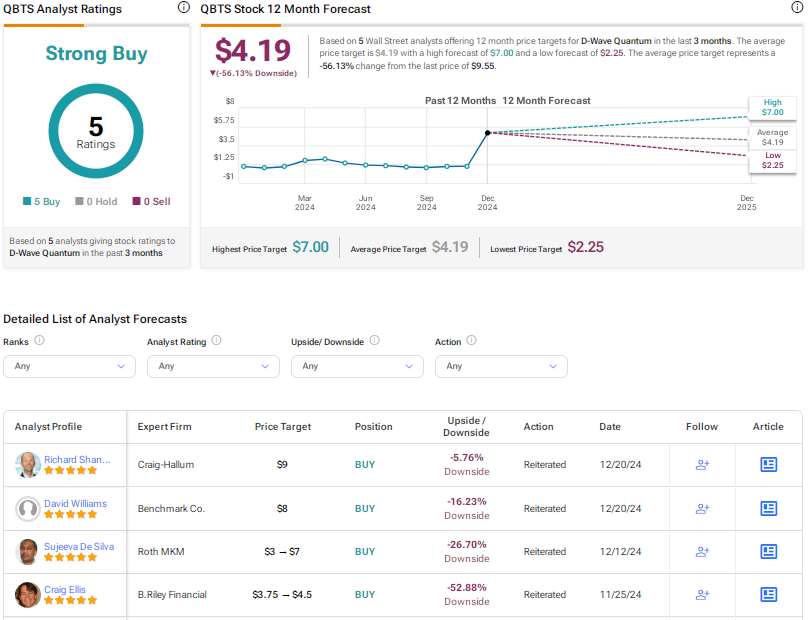

- Positive Analyst Reports: Favorable analyst reports and upgrades could significantly influence investor perception and drive up stock prices.

Comparing QBTS's performance to other leading quantum computing companies like IBM, Google, and IonQ on that day will provide further context. Analyzing relevant market indices focused on technology and the broader market sentiment will also offer valuable insights.

Short-Squeeze or Other Speculative Activity

It is crucial to consider whether speculative trading played a role in QBTS's price surge.

- Short Squeeze Explained: A short squeeze occurs when investors who bet against a stock (short selling) are forced to buy it back to limit their losses, driving up the price rapidly.

- Identifying Speculative Activity: Analyzing trading volume and short interest data can help determine if a short squeeze contributed to the price increase. An unusually high trading volume coupled with a significant decrease in short interest could suggest this scenario.

- Risk Assessment: While short squeezes can lead to rapid price appreciation, they are also inherently risky. These price jumps are often short-lived and can quickly reverse, potentially leading to substantial losses for investors.

What Investors Should Know About D-Wave Quantum (QBTS)

Before investing in D-Wave Quantum (QBTS), potential investors need to understand the company and its inherent risks.

Company Overview and Business Model

D-Wave Quantum is a leading developer of quantum computing systems based on quantum annealing technology. Key aspects of their business include:

- Quantum Annealing Focus: D-Wave's technology differs from other approaches like gate-based quantum computing, specializing in solving specific types of optimization problems.

- Target Markets: Their technology is currently being used in various fields, including logistics, materials science, and financial modeling.

- Competitive Landscape: The quantum computing market is highly competitive, with significant players like IBM, Google, and Rigetti. D-Wave’s differentiation lies in its focus on annealing.

Investment Risks and Considerations

Investing in QBTS involves significant risks, common to early-stage technology companies:

- Technological Hurdles: Quantum computing technology is still in its early stages of development. There are significant technological challenges to overcome before it reaches widespread adoption.

- Competition: The competitive landscape is intense, and D-Wave faces strong competition from larger companies with greater resources.

- Market Volatility: The stock price of early-stage technology companies is often highly volatile, and significant fluctuations are common.

Thorough due diligence is essential. Consider your risk tolerance and ensure proper diversification within your investment portfolio.

Long-Term Outlook for QBTS and the Quantum Computing Market

The long-term prospects for D-Wave Quantum and the broader quantum computing market are promising:

- Market Drivers: The potential applications of quantum computing across various industries are enormous, driving significant growth potential.

- Growth Opportunities: As the technology matures and becomes more accessible, the market is expected to expand rapidly.

- Challenges and Obstacles: Scaling quantum computers to a larger size while maintaining stability and reducing error rates remain key challenges.

While the long-term potential is significant, it's crucial to maintain a realistic perspective on the challenges and potential delays inherent in this emerging technology.

Conclusion

The recent surge in D-Wave Quantum (QBTS) stock price highlights the growing interest in the quantum computing sector. While positive news and overall market sentiment likely played a role, potential investors must carefully consider the reasons behind the price movement, including the possibility of speculative activity. Understanding D-Wave Quantum's business model, the competitive landscape, and the inherent risks associated with investing in early-stage technology is crucial. Learn more about D-Wave Quantum (QBTS) and conduct thorough research before investing. Understand the risks of quantum computing investments and stay informed on D-Wave Quantum's progress to make informed investment decisions. Research QBTS before investing to protect your capital.

Featured Posts

-

Affare Amazon Hercule Poirot Per Ps 5 A Meno Di 10 Euro

May 20, 2025

Affare Amazon Hercule Poirot Per Ps 5 A Meno Di 10 Euro

May 20, 2025 -

Pechalnaya Novost O Shumakhere Drug Rasskazal O Tyazhelom Sostoyanii

May 20, 2025

Pechalnaya Novost O Shumakhere Drug Rasskazal O Tyazhelom Sostoyanii

May 20, 2025 -

Il Gioco Di Hercule Poirot Ps 5 Offerta Amazon Sotto I 10 E

May 20, 2025

Il Gioco Di Hercule Poirot Ps 5 Offerta Amazon Sotto I 10 E

May 20, 2025 -

Slavni Na Premijeri Jutarnji List Ekskluzivno

May 20, 2025

Slavni Na Premijeri Jutarnji List Ekskluzivno

May 20, 2025 -

New Burnham And Highbridge History Photo Archive Opens Tomorrow

May 20, 2025

New Burnham And Highbridge History Photo Archive Opens Tomorrow

May 20, 2025