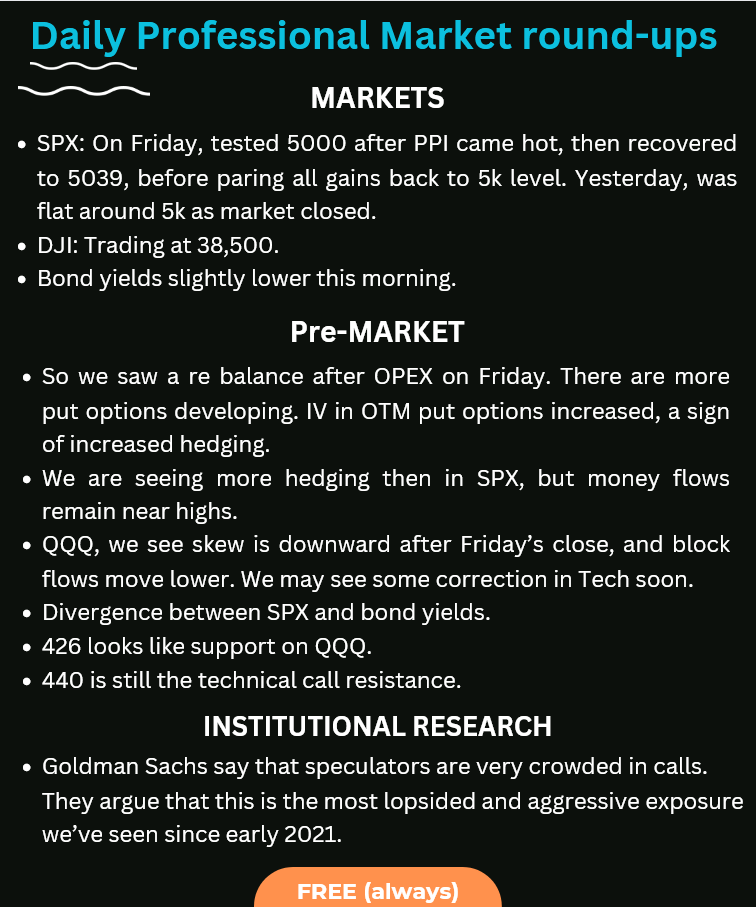

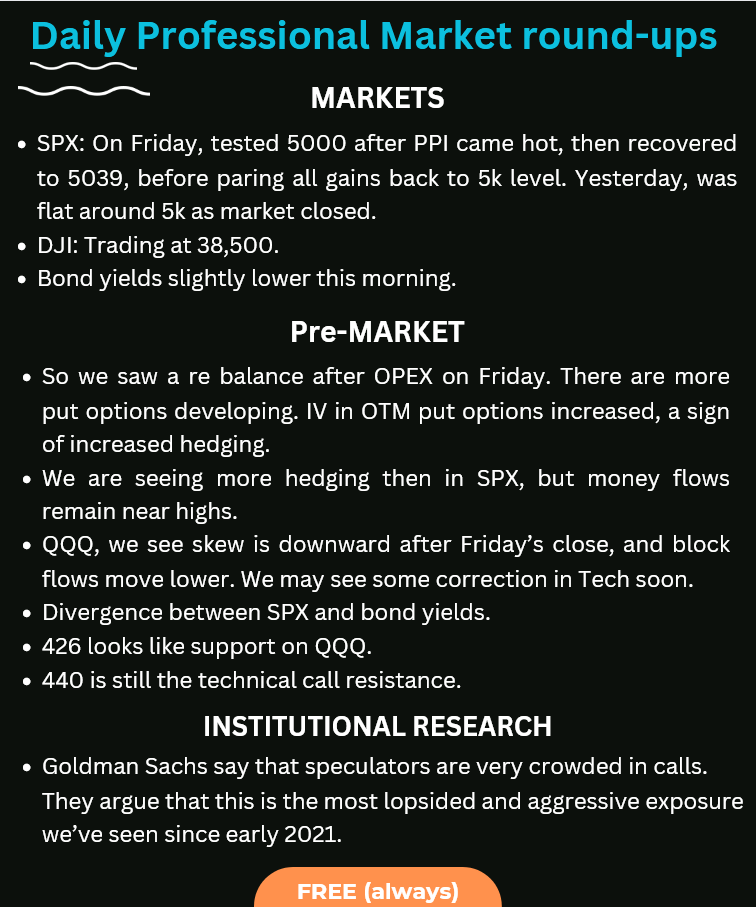

QBTS stock plunge, considering market analysis, the competitive landscape, and investor sentiment.

QBTS stock plunge, considering market analysis, the competitive landscape, and investor sentiment.

Several interconnected factors likely contributed to the significant drop in QBTS stock price on Thursday. Let's delve into the key areas that fueled this market reaction.

The primary catalyst for Thursday's QBTS stock plunge was undoubtedly the company's disappointing earnings report. The release revealed key performance indicators falling short of both internal projections and analyst expectations.

The broader market context also played a role in exacerbating the QBTS stock decline. The technology sector, as a whole, experienced a period of weakness on Thursday, with major indices like the Nasdaq experiencing a downturn. This negative market sentiment likely amplified the impact of D-Wave Quantum's disappointing earnings.

The quantum computing industry is rapidly evolving, with several companies vying for market share. Concerns about increasing competition and potential market saturation could have influenced investor decisions regarding QBTS stock.

The absence of robust near-term revenue projections or uncertainty about future revenue streams could have further contributed to the stock's decline. Investors often react negatively to a lack of clear visibility into a company's future financial performance.

The QBTS stock plunge had immediate and potentially long-term implications for D-Wave Quantum.

The immediate reaction to the news was a significant sell-off, evidenced by a sharp increase in trading volume.

The long-term consequences of this stock plunge for D-Wave Quantum remain to be seen, but several potential impacts are worth considering.

The QBTS stock plunge on Thursday was a result of several factors, including disappointing earnings, negative market sentiment, intensifying competition, and uncertainty about future revenue. These factors have raised concerns about the company's long-term prospects and its ability to navigate the competitive landscape of the quantum computing market. While the short-term outlook appears challenging, the long-term potential of quantum computing remains significant. To gain a clearer understanding of the situation and make informed investment decisions, it’s crucial to stay informed about QBTS stock and monitor the D-Wave Quantum investment landscape closely. Continue tracking the performance of QBTS and conduct thorough research before making any investment decisions in this dynamic sector. The quantum computing market is constantly evolving, and continuous monitoring is key to understanding future developments and potential opportunities.

Nea Stoixeia Fotizoyn Tampoy Peristatika Fonon

Nea Stoixeia Fotizoyn Tampoy Peristatika Fonon

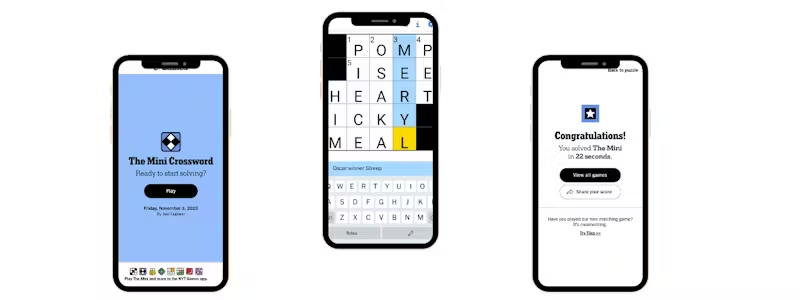

Todays Nyt Mini Crossword Solution March 13

Todays Nyt Mini Crossword Solution March 13

Reprise Du Bo Cafe A Biarritz De Nouveaux Gerants Aux Commandes

Reprise Du Bo Cafe A Biarritz De Nouveaux Gerants Aux Commandes

The Wayne Gretzky Loyalty Debate Analyzing The Impact Of Trump Tariffs And Statehood Discussions

The Wayne Gretzky Loyalty Debate Analyzing The Impact Of Trump Tariffs And Statehood Discussions

Dusan Tadic In Fenerbahce Deki Etkisi Tarihe Gecen Anlar

Dusan Tadic In Fenerbahce Deki Etkisi Tarihe Gecen Anlar