D-Wave Quantum (QBTS) Stock Price Drop: Impact Of Negative Valuation Report

Table of Contents

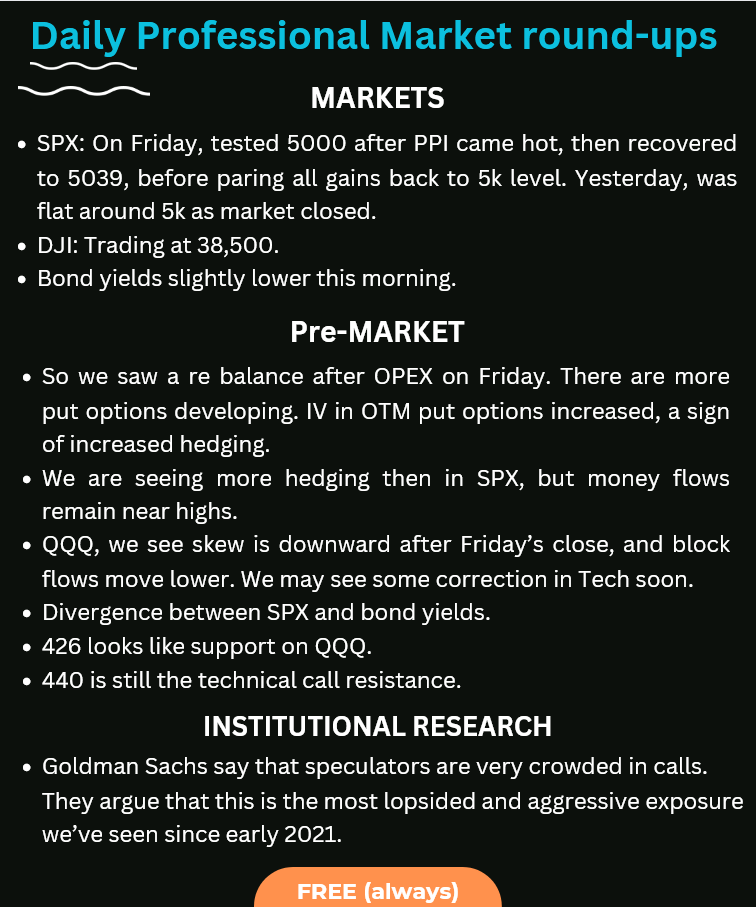

The Negative Valuation Report: A Deep Dive

A critical factor contributing to the D-Wave Quantum (QBTS) stock price drop was a recently released negative valuation report. This report cast doubt on several key aspects of the company's prospects, leading to a significant sell-off.

Key Findings of the Report

The report highlighted several crucial concerns that fueled the decline in the QBTS stock price:

- Profitability Concerns: The report questioned D-Wave Quantum's path to profitability, citing high operating costs and slow adoption of its quantum computing technology. Specific concerns included projected revenue shortfalls compared to initial forecasts.

- Intense Market Competition: The report emphasized the increasing competition in the quantum computing field, suggesting that D-Wave Quantum may struggle to maintain its market share against larger, better-funded competitors. It cited the advancements of companies like IBM and Google as major threats.

- Technological Challenges: The report raised concerns about the technological challenges D-Wave Quantum faces in scaling its quantum annealing technology and achieving wider applicability for its systems. It pointed out limitations in comparison to other quantum computing approaches.

The methodology used in the report, while not publicly detailed in all instances, appeared to be based on a comprehensive financial analysis, including revenue projections, market share analysis, and technological assessments. The report's credibility within the financial community is currently being debated, with some analysts questioning its methodology and others citing its alignment with general market concerns.

Analyst Reactions and Market Sentiment

Following the release of the negative valuation report, several financial analysts downgraded their ratings on D-Wave Quantum (QBTS) stock. Analyst X, for example, lowered their price target significantly, citing concerns about the company's long-term viability. This negative sentiment was reflected in the market, with investors initiating significant sell-offs and a substantial decrease in trading volume for QBTS. The overall market reaction signaled a loss of investor confidence in the company's short-term prospects.

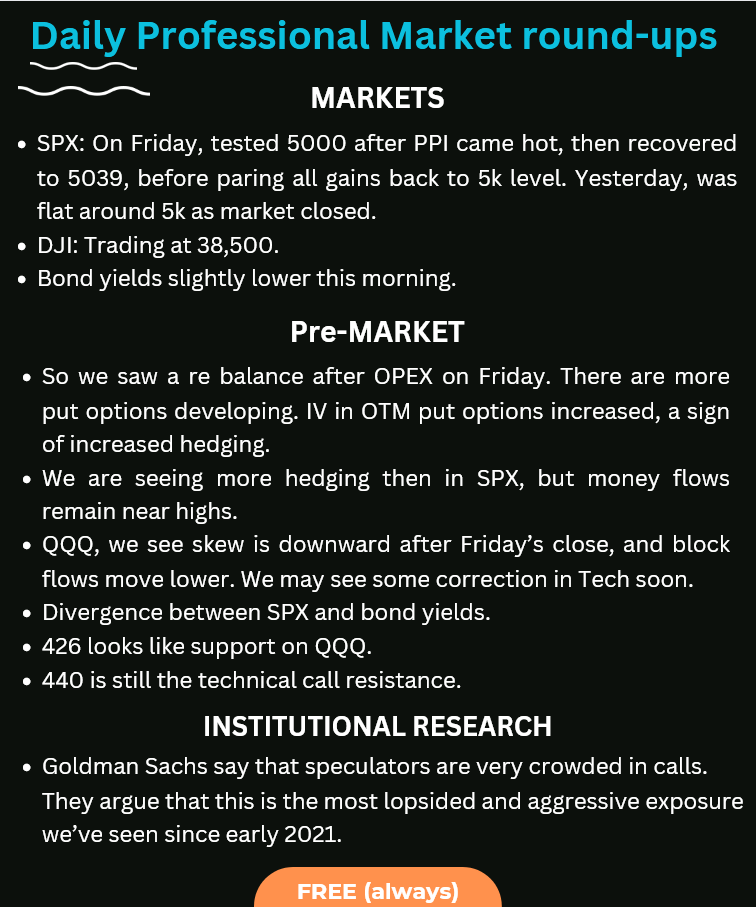

Factors Contributing to the D-Wave Quantum (QBTS) Stock Price Drop Beyond the Report

While the negative valuation report was a significant catalyst, other factors contributed to the D-Wave Quantum (QBTS) stock price drop.

Macroeconomic Factors

Several macroeconomic conditions exacerbated the negative impact of the report on the QBTS stock price:

- Overall Market Downturn: A broader market downturn reduced investor appetite for riskier assets, including those in the nascent quantum computing sector.

- Interest Rate Hikes: Rising interest rates increased borrowing costs for companies, potentially hindering D-Wave Quantum's growth and investment plans.

- Sector-Specific Challenges: The report also highlighted challenges specific to the quantum computing sector, including the high capital expenditures required for research and development and the extended timeframe for commercial applications.

Company-Specific Factors

Beyond macroeconomic influences, certain internal factors within D-Wave Quantum might have contributed to the negative valuation and subsequent QBTS stock price decline:

- Delays in Product Development: Potential delays in the development and launch of new products could have raised concerns about the company's ability to compete effectively.

- Management Changes: Any recent management changes or restructuring within the company could have further unsettled investors.

- Financial Performance Issues: Concerns regarding the company's financial performance, especially profitability and cash flow, likely played a role in the negative assessment.

Assessing the Long-Term Impact on D-Wave Quantum (QBTS)

Despite the recent setbacks, the long-term impact on D-Wave Quantum remains uncertain.

Potential for Recovery

D-Wave Quantum still possesses the potential for recovery:

- Future Partnerships: Strategic partnerships with major technology companies or research institutions could provide crucial resources and market access.

- Technological Breakthroughs: Significant advancements in quantum annealing technology or the development of new applications could revitalize investor confidence.

- Market Shifts: Changes in market dynamics, such as increased government funding or growing demand for quantum computing solutions, could positively impact QBTS.

Investment Strategies in the Wake of the Price Drop

Investing in QBTS after the price drop involves considerable risk. Investors should carefully consider their risk tolerance and diversify their portfolios. Potential strategies include:

- Buy-and-Hold: Maintaining a long-term investment approach, believing in the eventual success of the company.

- Dollar-Cost Averaging: Investing a fixed amount of money at regular intervals to mitigate the impact of price fluctuations.

Disclaimer: Investing in the quantum computing sector, including D-Wave Quantum (QBTS), is highly speculative. There's no guarantee of profit, and significant losses are possible.

Conclusion: Navigating the D-Wave Quantum (QBTS) Stock Price Volatility

The recent D-Wave Quantum (QBTS) stock price drop, largely attributed to a negative valuation report and various contributing factors, highlights the volatility inherent in investing in the quantum computing sector. The report's key findings, along with broader market conditions and company-specific issues, created a perfect storm leading to a significant decline in the QBTS stock price. While the future remains uncertain, the potential for recovery exists through strategic partnerships, technological breakthroughs, and favorable market shifts. Investors must proceed with caution, conducting thorough due diligence and assessing their risk tolerance before investing in QBTS or any other quantum computing stock. Stay informed about D-Wave Quantum (QBTS) stock price movements, news, and future developments in the quantum computing field by regularly monitoring financial news and analyst reports related to the D-Wave Quantum (QBTS) stock price and the broader quantum computing sector.

Featured Posts

-

Druga Vagitnist Dzhennifer Lourens Pidtverdzhennya Vid Predstavnikiv Aktrisi

May 20, 2025

Druga Vagitnist Dzhennifer Lourens Pidtverdzhennya Vid Predstavnikiv Aktrisi

May 20, 2025 -

Nagelsmann Names Goretzka For Germanys Nations League Squad

May 20, 2025

Nagelsmann Names Goretzka For Germanys Nations League Squad

May 20, 2025 -

Pro D2 Biarritz Asbh Victoire Depend Du Mental

May 20, 2025

Pro D2 Biarritz Asbh Victoire Depend Du Mental

May 20, 2025 -

K Sepernontas Ta Tampoy I Istoria Tis Marthas Kai Toy Gamoy Tis

May 20, 2025

K Sepernontas Ta Tampoy I Istoria Tis Marthas Kai Toy Gamoy Tis

May 20, 2025 -

Should Investors Worry About Current Stock Market Valuations A Bof A Analysis

May 20, 2025

Should Investors Worry About Current Stock Market Valuations A Bof A Analysis

May 20, 2025