D-Wave Quantum (QBTS) Stock: Understanding The Thursday Price Movement

Table of Contents

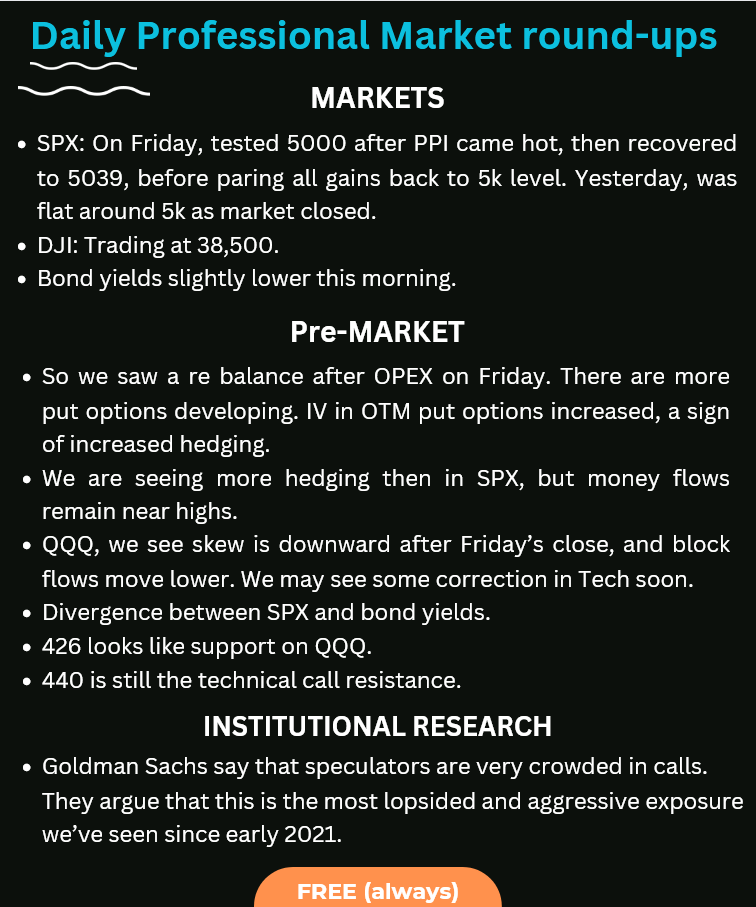

Market Sentiment and News Affecting QBTS Stock Price

Several factors related to market sentiment and news announcements significantly impacted the D-Wave Quantum (QBTS) stock price on Thursday.

Impact of Recent Press Releases or Announcements:

-

New Partnership Announcement: A potential partnership with a major technology company could have driven up the QBTS stock price, generating positive investor sentiment and increased trading volume. Such partnerships often signal increased market adoption and future revenue streams. The specifics of the partnership, including the partner's reputation and the scope of collaboration, greatly influence investor reaction.

-

Successful Product Launch: The successful launch of a new quantum computing product or service could have fueled investor optimism, leading to a price surge. Positive reviews and demonstrable progress in quantum computing technology are usually well-received by the market.

-

Financial Report Release: A better-than-expected financial report, showcasing strong revenue growth or improved profitability, could have positively impacted the QBTS stock price. Investors closely scrutinize financial performance indicators, and positive results usually translate to higher valuations. Conversely, disappointing results can lead to sharp declines.

-

Analyst Ratings and Upgrades: Positive analyst ratings and upgrades can significantly influence investor confidence and drive up the stock price. Analyst recommendations are often closely followed by institutional investors, leading to increased buying pressure. [Link to relevant financial news source reporting on analyst ratings]

Overall Market Trends and Their Correlation with QBTS:

The performance of the broader technology sector and the overall market significantly influences QBTS stock. A positive trend in the tech sector generally benefits companies like D-Wave Quantum. Conversely, a negative trend can lead to decreased investor interest and price declines. Macroeconomic factors, such as interest rate changes and inflation, also play a critical role. Higher interest rates often lead to reduced investment in riskier assets like QBTS, while inflation can erode investor purchasing power and negatively impact market sentiment.

Technical Analysis of QBTS Stock Chart on Thursday

Analyzing the QBTS stock chart from Thursday provides valuable insights into the price action.

Identifying Key Support and Resistance Levels:

Technical indicators such as moving averages (e.g., 50-day and 200-day), Relative Strength Index (RSI), and Moving Average Convergence Divergence (MACD) help identify key support and resistance levels. Support levels represent prices where buying pressure is expected to outweigh selling pressure, while resistance levels represent prices where selling pressure is expected to dominate. Breaks above resistance levels often signal bullish momentum, while breaks below support levels can trigger further declines. [Insert chart showing Thursday's QBTS price movement, highlighting support and resistance levels].

Volume Analysis and Trading Activity:

Analyzing trading volume helps understand the intensity of buying and selling pressure. High volume during price increases suggests strong conviction among buyers, while high volume during price decreases indicates strong selling pressure. Unusual volume spikes or dips can indicate significant shifts in market sentiment or the involvement of large institutional investors. For instance, a sudden surge in volume accompanied by a price increase could signal a large institutional buy-in.

Investor Behavior and Trading Strategies

Understanding investor behavior and trading strategies is crucial in analyzing QBTS stock price fluctuations.

Short-Term vs. Long-Term Investment Perspectives on QBTS:

Different investors employ diverse strategies. Day traders focus on short-term price movements, aiming for quick profits, while swing traders hold positions for a few days or weeks. Long-term investors, on the other hand, focus on the company's long-term growth potential. The interplay between these different strategies contributes to the overall price volatility. Short-term traders' actions can amplify short-term fluctuations, while long-term investors' decisions tend to be less sensitive to daily price swings.

Potential Impacts of Algorithmic Trading and High-Frequency Trading:

Algorithmic trading and high-frequency trading (HFT) can significantly influence short-term price movements. These automated trading systems react to market data in milliseconds, potentially amplifying volatility. HFT algorithms often exploit small price discrepancies, leading to rapid price fluctuations that may not necessarily reflect underlying market fundamentals.

Conclusion: Key Takeaways and Call to Action

The Thursday price movement in D-Wave Quantum (QBTS) stock was influenced by a complex interplay of market sentiment, news announcements, technical factors, and investor behavior. Understanding the impact of press releases, market trends, support and resistance levels, trading volume, and diverse investor strategies is crucial for analyzing QBTS price fluctuations. The role of algorithmic and high-frequency trading cannot be ignored, as these automated systems contribute to short-term volatility.

Understanding the intricacies of D-Wave Quantum (QBTS) stock requires continuous monitoring and in-depth analysis. Stay informed and make well-researched decisions regarding your QBTS investment. For further research, refer to the D-Wave Quantum website [link to D-Wave website] and reputable financial news sources. Remember to consult with a financial advisor before making any investment decisions.

Featured Posts

-

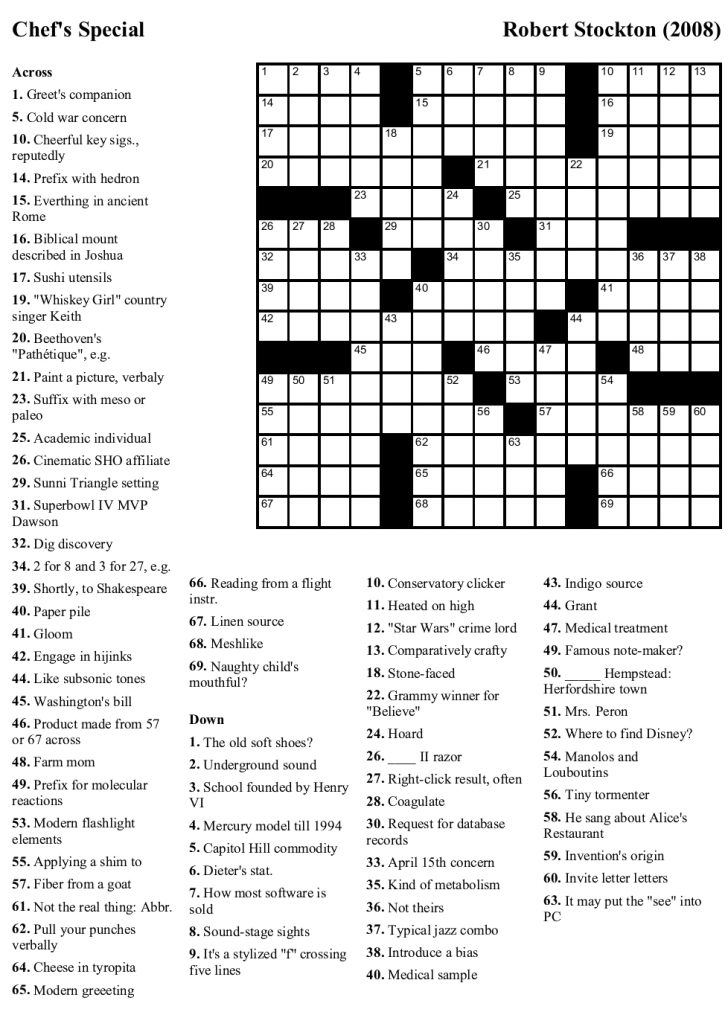

Solve The Nyt Mini Crossword Answers For March 13 2025

May 20, 2025

Solve The Nyt Mini Crossword Answers For March 13 2025

May 20, 2025 -

Popovnennya V Sim Yi Lourens Aktrisa Narodila Drugu Ditinu

May 20, 2025

Popovnennya V Sim Yi Lourens Aktrisa Narodila Drugu Ditinu

May 20, 2025 -

Aghatha Krysty Fy Esr Aldhkae Alastnaey Imkanyat Jdydt

May 20, 2025

Aghatha Krysty Fy Esr Aldhkae Alastnaey Imkanyat Jdydt

May 20, 2025 -

D Wave Quantum Inc Qbts Stock Drop On Thursday Reasons Explained

May 20, 2025

D Wave Quantum Inc Qbts Stock Drop On Thursday Reasons Explained

May 20, 2025 -

Taika Waititis Family Film Adds Mia Wasikowska To The Cast

May 20, 2025

Taika Waititis Family Film Adds Mia Wasikowska To The Cast

May 20, 2025