David Dodge On Canada: A Year Of Ultra-Low Economic Growth Predicted

Table of Contents

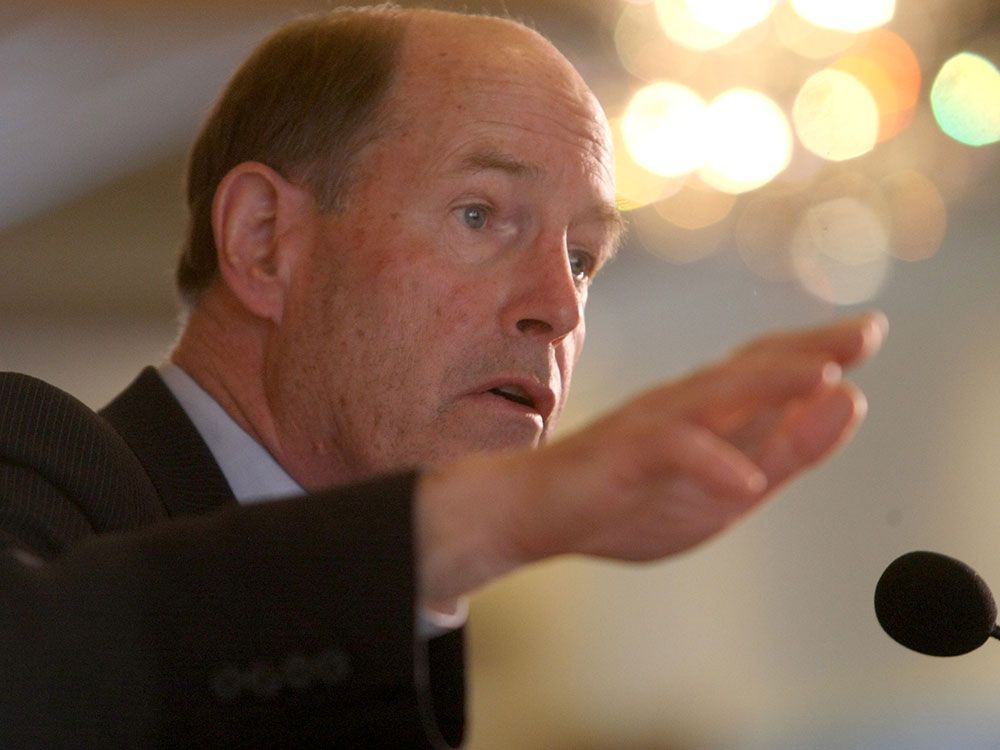

David Dodge's Prediction: A Year of Ultra-Low Growth in Canada

David Dodge, a former Governor of the Bank of Canada, has forecast a period of exceptionally slow economic growth for Canada. While the precise source and specific percentage may vary depending on the interview or publication, his warnings consistently point towards ultra-low growth, potentially near stagnation. This prediction often focuses on the upcoming fiscal year.

- Timeframe: The prediction typically covers the next 12-18 months, a crucial period for economic planning and policy adjustments.

- Affected Sectors: While the impact will be widespread, Dodge's analysis may highlight specific vulnerability in sectors like real estate, heavily reliant on consumer confidence and borrowing.

- Significance of "Ultra-Low" Growth: "Ultra-low" growth signifies a significant departure from historical trends of stronger economic expansion. This sluggish growth rate contrasts sharply with periods of robust expansion Canada has experienced in the past, highlighting the severity of the predicted slowdown.

Factors Contributing to Slow Canadian Economic Growth According to Dodge

Dodge's prediction isn't based on mere speculation. He cites several key economic factors contributing to this anticipated slowdown:

- Global Economic Slowdown: The current global economic climate, marked by high inflation and potential recession in major economies, significantly impacts Canada's export-oriented sectors and overall investor confidence. The ripple effect of global uncertainty directly affects Canadian economic performance. [Link to credible source on global economic slowdown]

- High Interest Rates in Canada: The Bank of Canada's aggressive interest rate hikes, aimed at curbing inflation, have increased borrowing costs for businesses and consumers. This inevitably dampens investment, spending, and overall economic activity. The impact of these interest rate hikes on "inflation Canada" remains a key concern. [Link to credible source on Canadian interest rates]

- Persistent Inflation in Canada: High and persistent inflation erodes purchasing power, reducing consumer spending and impacting business profitability. Controlling "inflation Canada" is crucial for stimulating economic growth and stabilizing the economy. [Link to credible source on Canadian inflation]

Implications of Ultra-Low Economic Growth for Canadian Businesses

Ultra-low economic growth poses considerable challenges for Canadian businesses of all sizes.

- Reduced Investment: Businesses are likely to postpone or reduce capital investments due to economic uncertainty and higher borrowing costs. This directly affects job creation and future growth potential.

- Hiring Freezes and Potential Job Losses: Companies may implement hiring freezes or even resort to layoffs to reduce costs and navigate the challenging economic conditions. Small businesses, often lacking the financial reserves of larger corporations, are particularly vulnerable.

- Strategies for Business Resilience: To mitigate the negative impacts, businesses need to focus on cost optimization, diversification, and enhancing operational efficiency. Developing robust "business resilience" strategies is paramount for survival and future growth during an "economic downturn Canada."

Impact on Canadian Consumers and Households

The predicted economic slowdown directly impacts Canadian consumers and households:

- Increased Cost of Living: High inflation continues to drive up the "cost of living Canada," squeezing household budgets and reducing disposable income. This impacts consumer spending across various sectors.

- Reduced Consumer Spending: Facing rising costs and economic uncertainty, consumers are likely to reduce spending on non-essential goods and services, further impacting business revenue and overall economic activity. Understanding "Canadian consumer spending" trends is vital.

- Job Insecurity and Decreased Consumer Confidence: The potential for job losses and reduced economic opportunities contribute to decreased consumer confidence, leading to a downward spiral in spending and economic activity. High "household debt Canada" further exacerbates the situation for many families.

Government Response and Potential Policy Adjustments

The Canadian government will likely need to implement policy adjustments to address the predicted economic slowdown.

- Fiscal Stimulus: The government might consider fiscal stimulus measures, such as increased government spending or tax cuts, to boost economic activity and stimulate demand.

- Monetary Policy Adjustments: While interest rate hikes have been used to combat inflation, the Bank of Canada may need to adjust its monetary policy depending on the evolving economic situation. Careful consideration of "monetary policy Canada" is essential.

- Effectiveness and Political Implications: The effectiveness of these interventions will depend on various factors, including their timing, scale, and the overall global economic climate. These policy decisions also have significant political implications, influencing public perception and electoral outcomes related to "Canadian government economic policy" and "fiscal policy Canada."

Conclusion

David Dodge's prediction of ultra-low economic growth in Canada underscores the challenges facing the nation. Factors such as global economic slowdown, high interest rates, and persistent inflation contribute to this concerning outlook. The implications are far-reaching, impacting businesses through reduced investment and potential job losses, and affecting consumers through increased cost of living and reduced spending. The government's response will be crucial in mitigating the negative impacts and guiding Canada through this period of economic uncertainty. Stay informed about the evolving economic landscape in Canada. Follow the latest news and analysis on David Dodge's predictions and their potential impact on Canadian economic growth. Understanding the forecast for David Dodge Canada economic growth is crucial for navigating the coming year.

Featured Posts

-

The 1 Million Question Michael Sheen And The Backlash Against His Documentary

May 02, 2025

The 1 Million Question Michael Sheen And The Backlash Against His Documentary

May 02, 2025 -

Dallas Icon Passes Away Daughter Amy Irving Shares Heartfelt Tribute

May 02, 2025

Dallas Icon Passes Away Daughter Amy Irving Shares Heartfelt Tribute

May 02, 2025 -

Understanding Xrp Functionality Use Cases And Future Potential

May 02, 2025

Understanding Xrp Functionality Use Cases And Future Potential

May 02, 2025 -

Optimale Laadtijden Met Enexis In Noord Nederland Vermijd Piekuren

May 02, 2025

Optimale Laadtijden Met Enexis In Noord Nederland Vermijd Piekuren

May 02, 2025 -

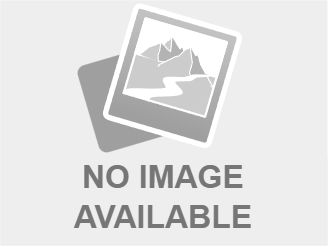

The Geography And Politics Of This Country

May 02, 2025

The Geography And Politics Of This Country

May 02, 2025