DAX Rally: Potential For A Wall Street-Driven Correction?

Table of Contents

Factors Fueling the Recent DAX Rally

Several factors have contributed to the recent surge in the DAX index. Understanding these underlying forces is crucial for evaluating the sustainability of this rally and the potential for a future downturn.

Strong German Economic Fundamentals

Germany's robust economic performance has played a key role in supporting the DAX rally. Several indicators point to a strong foundation:

- Robust export performance: German companies continue to demonstrate strong export capabilities, driving economic growth and bolstering corporate earnings. This is particularly true in sectors like automotive and machinery.

- Positive industrial production data: Industrial production figures have shown consistent growth, reflecting increased manufacturing activity and investment. This signals ongoing strength within the German industrial sector.

- Resilient consumer spending: Despite inflationary pressures, German consumer spending remains relatively resilient, indicating sustained domestic demand. This consumer confidence supports overall economic activity.

These positive economic indicators contribute to a more optimistic outlook for German companies, thereby supporting the DAX's upward trajectory. However, it's essential to monitor these indicators closely for any signs of weakening.

Global Economic Recovery (and its limitations)

The global economic recovery, while uneven, has also played a part in the DAX rally. However, it's crucial to acknowledge significant limitations:

- Easing inflation in some regions: A slowdown in inflation in certain regions has eased concerns about aggressive interest rate hikes, creating a more favorable environment for stock markets.

- Continued strength in certain sectors: The technology sector, for example, continues to exhibit resilience, driving global market sentiment. This positive spillover effect benefits other sectors, including those represented in the DAX.

- However, persistent geopolitical risks and inflation remain major concerns: The war in Ukraine, ongoing trade tensions, and persistent inflationary pressures in many parts of the world pose significant risks and could easily disrupt the global recovery. These uncertainties could quickly reverse the current positive market sentiment.

Impact of Monetary Policy

The European Central Bank's (ECB) monetary policy decisions have significantly impacted the DAX. A comparison with the US Federal Reserve's (FED) policies highlights potential divergences:

- European Central Bank (ECB) interest rate decisions and their effect on the DAX: The ECB's interest rate decisions, while aiming to combat inflation, also influence borrowing costs for businesses and affect investor sentiment. The pace and magnitude of these decisions directly influence the DAX.

- Comparison to US Federal Reserve (FED) policies and potential divergence: Differences in monetary policy between the ECB and the FED can lead to capital flows between the Eurozone and the US, potentially impacting the DAX. A divergence in policy can create either supportive or adverse conditions for the German market.

Potential Triggers for a Wall Street-Driven Correction

The interconnected nature of global financial markets means that events on Wall Street can significantly influence the DAX. Several potential triggers warrant attention:

Negative Sentiment on Wall Street

Negative sentiment on Wall Street can quickly spread globally, impacting even robust markets like the DAX:

- Impact of US economic data releases on global markets: Significant negative surprises in US economic data releases often trigger sell-offs across global markets, including the DAX.

- Influence of major US tech companies' performance on investor sentiment: The performance of major US tech companies strongly influences overall investor sentiment. Negative performance can lead to a global risk-off sentiment, affecting the DAX.

Rising Interest Rates in the US

Higher US interest rates can exert significant pressure on the DAX:

- Impact of higher US interest rates on global capital flows: Higher US interest rates can attract capital away from Europe, potentially leading to a decline in the DAX.

- Potential for capital repatriation to the US from Europe: Investors may repatriate capital from Europe to the US to take advantage of higher returns, creating downward pressure on the DAX.

Geopolitical Instability

Geopolitical instability continues to be a significant threat to global markets:

- Ongoing conflicts and their potential to negatively impact global markets: Ongoing geopolitical conflicts create uncertainty and risk aversion, potentially leading to a market correction.

- Uncertainty surrounding energy prices and supply chains: Uncertainty in energy markets and potential supply chain disruptions can significantly impact economic activity and investor sentiment.

Assessing the Risk of a Correction

Analyzing the DAX requires a multifaceted approach using both technical and fundamental analysis:

Technical Analysis of the DAX

Technical analysis provides insights into potential market movements:

- Examination of key technical indicators (e.g., RSI, MACD): Studying technical indicators like RSI (Relative Strength Index) and MACD (Moving Average Convergence Divergence) can help identify potential overbought or oversold conditions.

- Identification of potential support and resistance levels: Identifying key support and resistance levels on the DAX chart can offer insights into potential price reversal points.

Fundamental Analysis of the DAX Companies

Analyzing the fundamentals of DAX companies is essential for a comprehensive assessment:

- Evaluation of the financial health of major DAX companies: A thorough assessment of the financial health of major DAX companies, including their earnings, debt levels, and profitability, is crucial.

- Assessment of their vulnerability to a market downturn: Identifying which companies are most vulnerable to a potential market downturn allows investors to make informed decisions.

Conclusion

The recent DAX rally presents a compelling investment opportunity, but it also carries significant risk. The interconnectedness of global markets, coupled with potential triggers like negative Wall Street sentiment, rising US interest rates, and geopolitical instability, suggests a real possibility of a correction. Therefore, a robust investment strategy necessitates a careful assessment of both technical and fundamental indicators. By understanding the potential for a Wall Street-driven DAX correction, investors can better manage their risk and make informed decisions. Stay informed on DAX and global market developments to navigate this volatile period effectively. Develop a strong understanding of DAX rally dynamics and implement a comprehensive risk management plan to safeguard your investments.

Featured Posts

-

Did Woody Allen Abuse Dylan Farrow Sean Penn Casts Doubt

May 24, 2025

Did Woody Allen Abuse Dylan Farrow Sean Penn Casts Doubt

May 24, 2025 -

A Practical Guide To Obtaining Bbc Big Weekend 2025 Sefton Park Tickets

May 24, 2025

A Practical Guide To Obtaining Bbc Big Weekend 2025 Sefton Park Tickets

May 24, 2025 -

Kharkovschina 40 Svadeb Za Odin Den Data Stala Samoy Populyarnoy Dlya Brakosochetaniy Foto

May 24, 2025

Kharkovschina 40 Svadeb Za Odin Den Data Stala Samoy Populyarnoy Dlya Brakosochetaniy Foto

May 24, 2025 -

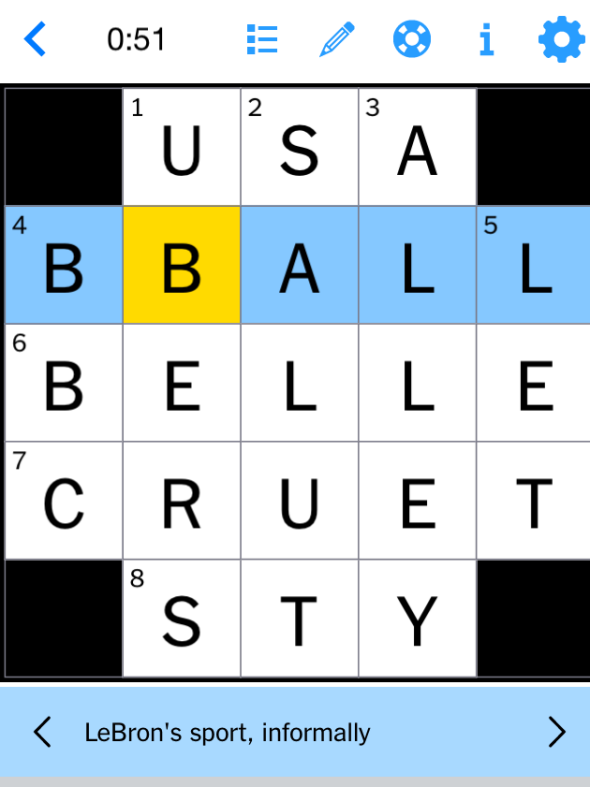

Nyt Mini Sunday Crossword April 6 2025 Solutions

May 24, 2025

Nyt Mini Sunday Crossword April 6 2025 Solutions

May 24, 2025 -

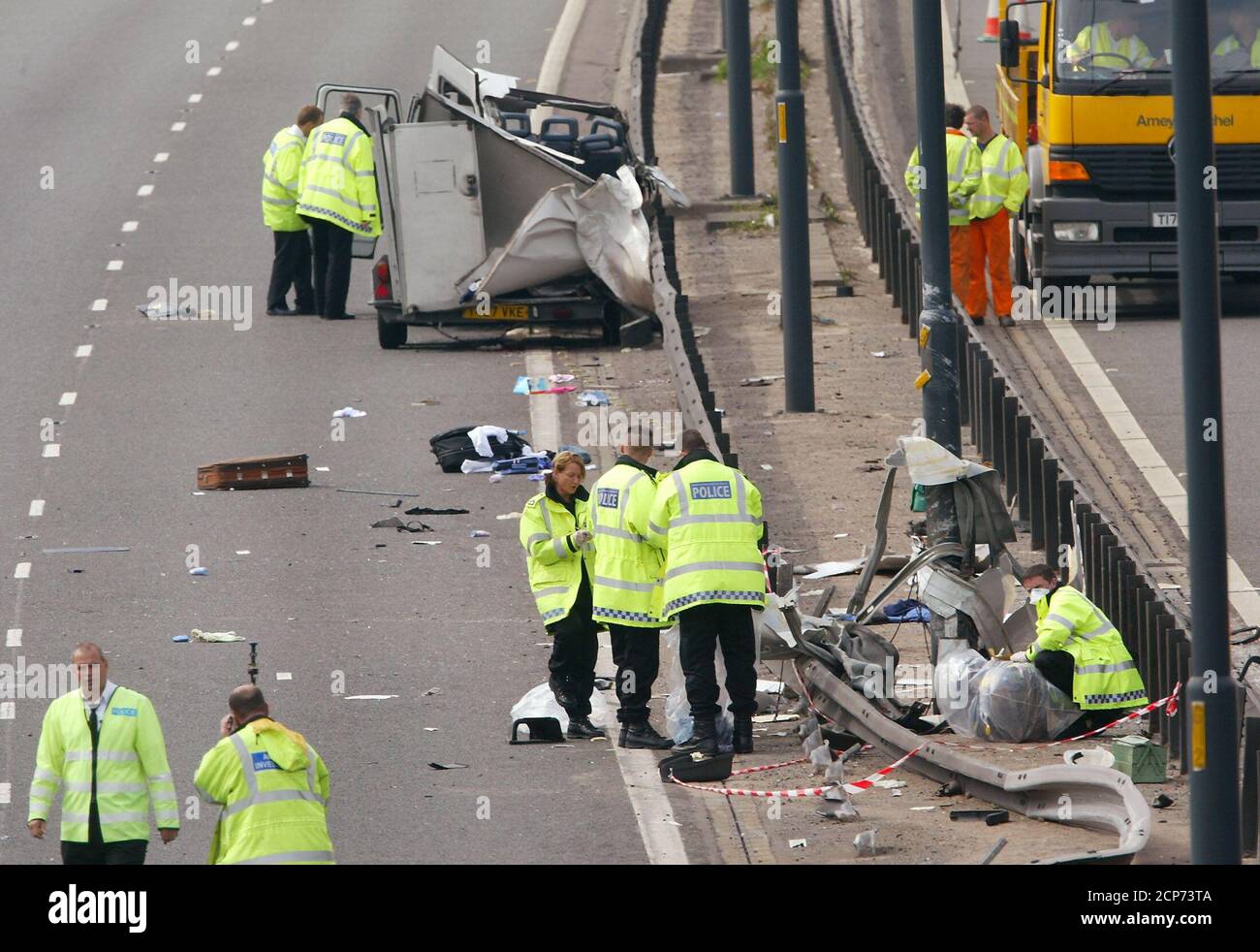

Car Overturns On M56 Motorway Crash Update Casualty Care

May 24, 2025

Car Overturns On M56 Motorway Crash Update Casualty Care

May 24, 2025