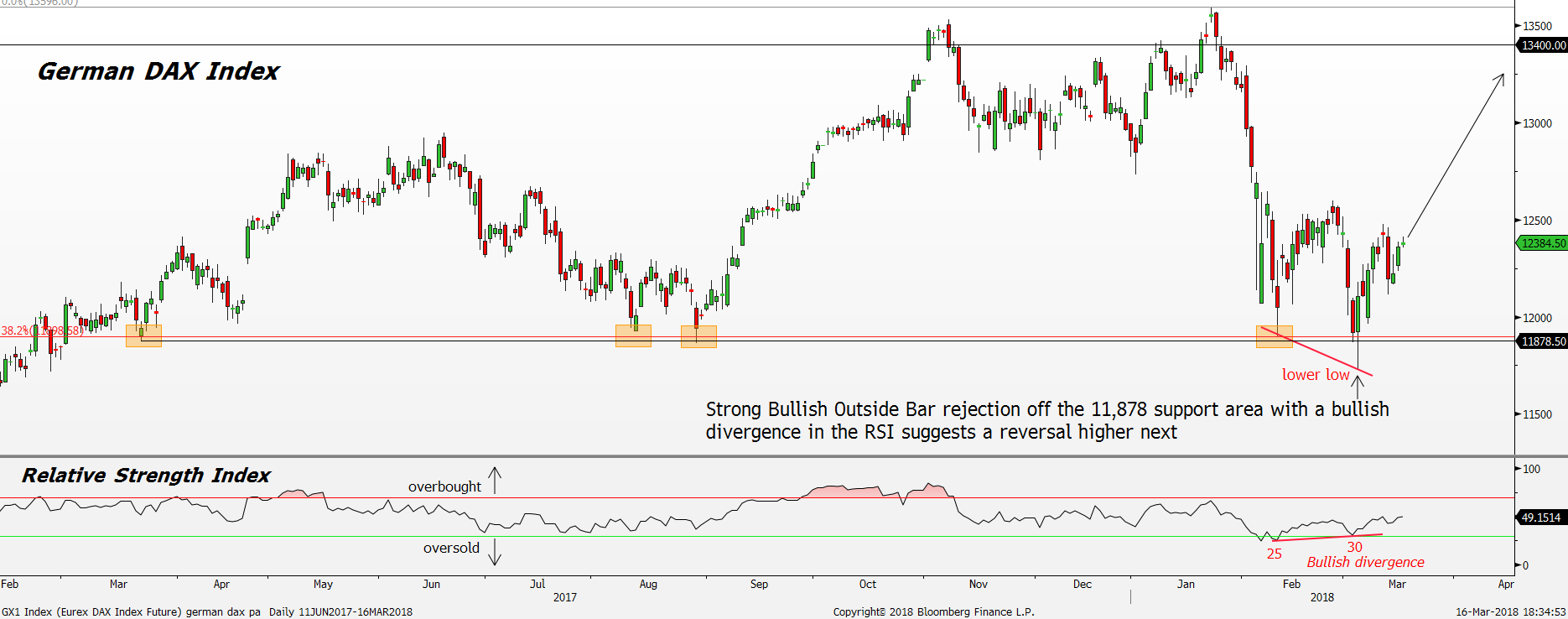

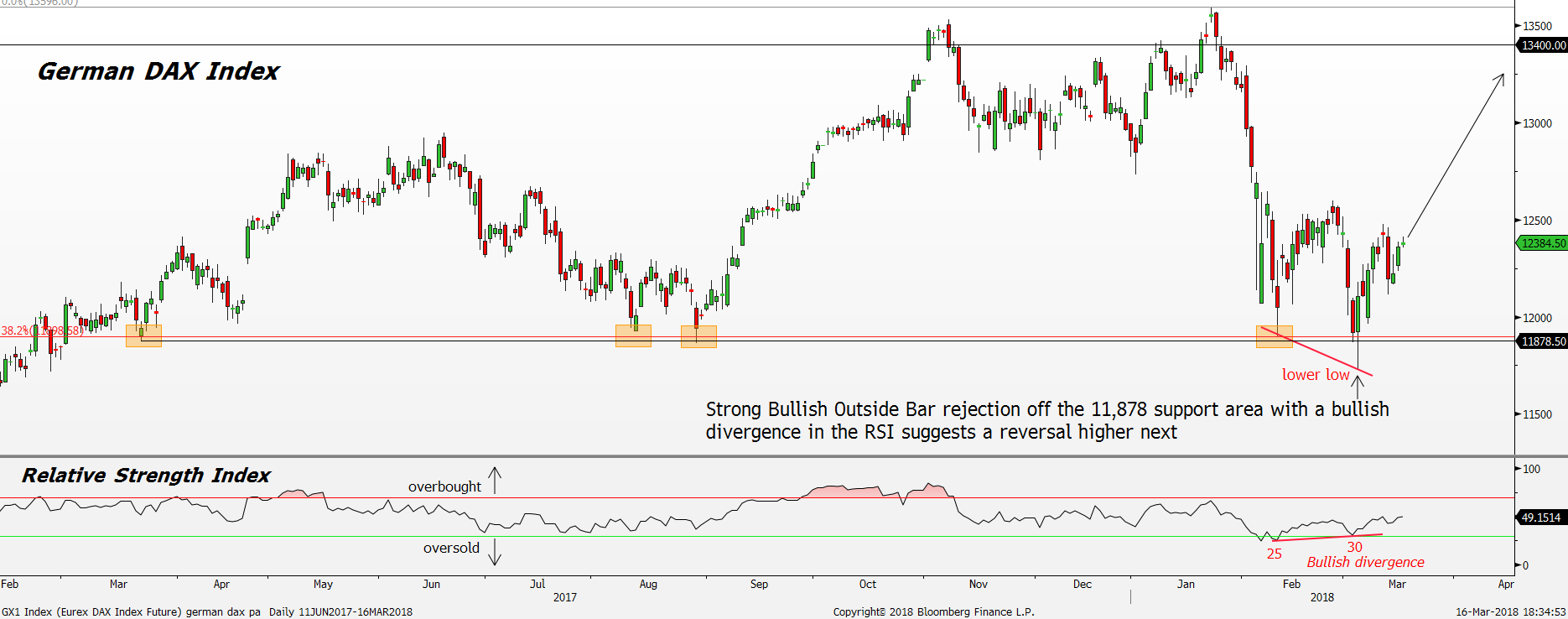

DAX Surge: Will A Wall Street Rebound Dampen German Market Gains?

Table of Contents

The DAX's Recent Rally: Understanding the Drivers

The impressive DAX surge can be attributed to several key factors. Let's delve into the primary drivers:

Strong Corporate Earnings:

Recent earnings reports from leading DAX companies have significantly boosted investor confidence. This positive performance has been a major catalyst for the current DAX surge.

- Key Performers: Companies like [Company A, sector, % increase], [Company B, sector, % increase], and [Company C, sector, % increase] have exceeded expectations, driving significant gains in their respective sectors.

- Sectoral Growth: The automotive and technology sectors, in particular, have displayed robust growth, contributing significantly to the overall DAX performance. [Insert data on sector performance].

Easing Inflation Concerns in Europe:

Easing inflation in Europe has played a crucial role in improving investor sentiment and fueling the DAX surge.

- Inflation Indicators: Recent data shows a decline in [mention specific inflation indicator, e.g., CPI] to [percentage], indicating a slowing rate of inflation.

- ECB Monetary Policy: The European Central Bank's (ECB) monetary policy decisions, while still focused on managing inflation, have shown signs of a more measured approach, lessening fears of overly aggressive rate hikes that could stifle economic growth.

Global Economic Outlook:

While global economic uncertainty persists, certain positive indicators have contributed to the DAX’s upward trajectory.

- Global Growth Forecasts: While global growth forecasts remain varied, projections for [mention region or sector] suggest continued expansion, indirectly supporting European markets.

- Geopolitical Risks and Energy Prices: While geopolitical risks and energy price volatility remain concerns, their impact has been less severe than initially feared, contributing to a more positive market sentiment.

Wall Street's Potential Rebound and its Impact on the DAX

The potential for a Wall Street rebound, or conversely, a downturn, significantly impacts the DAX. The two markets are deeply interconnected.

US Economic Indicators:

Key US economic indicators provide clues about the potential for a Wall Street rebound.

- GDP Growth: Forecasts for US GDP growth in [mention timeframe] suggest [mention projected growth percentage], indicating [positive or negative interpretation].

- Unemployment and Inflation: Unemployment figures and inflation rates in the US will play a crucial role in shaping the Federal Reserve's monetary policy and consequently, the direction of Wall Street.

Interdependence of Global Markets:

The DAX and Wall Street are inextricably linked. A strong Wall Street typically boosts global investor confidence, positively influencing the DAX. Conversely, a Wall Street downturn can trigger a sell-off in global markets, including the German market.

- Global Trade: The interconnected nature of global trade means that economic fluctuations in one major market quickly ripple across others.

- Investor Sentiment: Investor sentiment is a global phenomenon. Negative news from Wall Street can quickly dampen investor confidence worldwide.

Risk Factors for a Wall Street Correction:

Several factors could hinder a Wall Street rebound and negatively affect the DAX.

- High Interest Rates: Persistently high interest rates can curb economic activity and lead to a market correction.

- Geopolitical Instability: Geopolitical events can create uncertainty and trigger sell-offs in global markets.

- Recessionary Pressures: The risk of a recession in major economies poses a significant threat to global market stability.

Strategies for Navigating the DAX in a Volatile Market

Navigating the current market requires a proactive and informed approach.

Diversification Strategies:

Diversification is key to mitigating risk.

- Asset Class Diversification: Spread investments across different asset classes (stocks, bonds, real estate) to reduce the impact of market fluctuations.

- Geographic Diversification: Don't put all your eggs in one basket. Consider investing in markets beyond Germany.

Risk Management Techniques:

Effective risk management is crucial.

- Stop-Loss Orders: Set stop-loss orders to limit potential losses.

- Hedging: Employ hedging strategies to protect against adverse market movements.

- Position Sizing: Carefully manage position sizes to avoid excessive risk.

Staying Informed:

Staying up-to-date on market developments is paramount.

- Reliable News Sources: Follow reputable financial news sources for the latest updates.

- Analytical Tools: Utilize analytical tools to track economic indicators and market trends.

DAX Surge – A Long-Term Perspective

The recent DAX surge is a complex phenomenon driven by a confluence of factors, including strong corporate earnings, easing inflation concerns, and a relatively positive global outlook – though this positive outlook is intertwined with the potential for a Wall Street rebound or correction. The interconnectedness of the DAX and Wall Street cannot be overstated. A significant downturn on Wall Street could easily dampen the DAX surge.

To successfully navigate this volatile landscape, investors must monitor the DAX surge closely, analyze Wall Street's rebound potential, and understand the interplay between the German and US markets. Develop a robust DAX investment strategy that incorporates diversification, risk management techniques, and a commitment to staying informed. The long-term prospects of the DAX will depend on the unfolding economic situation both domestically and internationally. While the current surge is promising, maintaining a balanced perspective and a robust investment strategy is essential for navigating the complexities of the global market.

Featured Posts

-

Repression Chinoise En France Les Dissidents Dans Le Viseur

May 24, 2025

Repression Chinoise En France Les Dissidents Dans Le Viseur

May 24, 2025 -

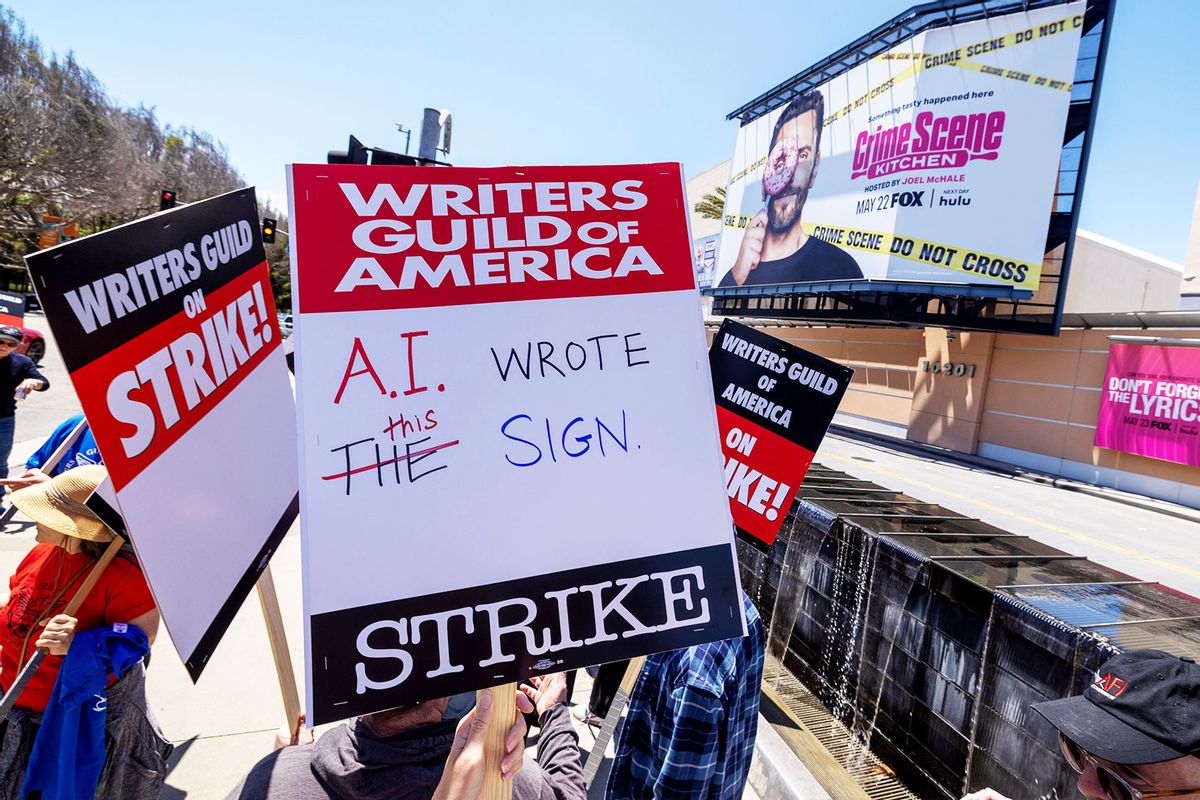

Actors And Writers Strike The Impact On Hollywood

May 24, 2025

Actors And Writers Strike The Impact On Hollywood

May 24, 2025 -

Semana Del 4 Al 10 De Marzo De 2025 Horoscopo Completo Para Cada Signo

May 24, 2025

Semana Del 4 Al 10 De Marzo De 2025 Horoscopo Completo Para Cada Signo

May 24, 2025 -

Hangi Burc 16 Mart Dogum Tarihi Ve Burc Yorumu

May 24, 2025

Hangi Burc 16 Mart Dogum Tarihi Ve Burc Yorumu

May 24, 2025 -

Memorial Day Lei Poster Contest Celebrating Keiki Artistic Talent In Hawaii

May 24, 2025

Memorial Day Lei Poster Contest Celebrating Keiki Artistic Talent In Hawaii

May 24, 2025