Decoding The Bank Of Canada's Pause: Insights From Financial Experts

Table of Contents

Reasons Behind the Bank of Canada's Pause

The Bank of Canada's decision to pause wasn't arbitrary; it stemmed from a careful consideration of several crucial economic indicators.

Inflation Slowdown

Recent data from Statistics Canada shows a slowdown in inflation rates. While still above the Bank of Canada's target of 2%, the decrease in the Consumer Price Index (CPI) suggests that the aggressive interest rate hikes implemented earlier are starting to have the desired effect. Core inflation, which excludes volatile items like food and energy, also showed a moderation. However, this deceleration is influenced by global factors, including easing supply chain pressures and lower energy prices, which may not be entirely sustainable.

- CPI decline: Statistics Canada's recent reports indicate a [Insert specific percentage decrease in CPI].

- Core inflation moderation: Core inflation has decreased by [Insert specific percentage decrease], demonstrating a less intense price pressure across a broader range of goods and services.

- Global factors: The decrease in inflation is partially attributable to global factors such as reduced energy costs and improved supply chain efficiency.

Economic Slowdown Concerns

The Bank of Canada is also mindful of the potential for an economic slowdown or even a recession. Raising interest rates too aggressively risks stifling economic growth and increasing unemployment. The current slowdown in the Canadian housing market is a key indicator of this risk. Higher interest rates make borrowing more expensive, impacting housing affordability and consequently reducing demand.

- Recession risk: Financial experts are divided on the probability of a recession, with some projecting a mild slowdown while others raise concerns about a more significant downturn.

- Housing market impact: The slowdown in the housing market is reflecting the impact of increased interest rates on affordability.

- Interest rates and economic growth: There is an inverse relationship between interest rates and economic growth; higher rates can curb economic activity, while lower rates can stimulate it.

Uncertain Global Economic Outlook

The global economic landscape remains uncertain, with geopolitical risks and ongoing supply chain disruptions contributing to volatility. These factors add complexity to the Bank of Canada's decision-making process, prompting a cautious approach to further interest rate adjustments.

- Geopolitical risks: The war in Ukraine, tensions between the US and China, and other global conflicts contribute to economic uncertainty.

- Supply chain disruptions: Although easing, lingering supply chain issues continue to affect inflation and overall economic stability.

- Interest rate outlook globally: Central banks worldwide are navigating similar challenges, leading to a complex and interconnected global interest rate outlook.

Potential Future Scenarios and Their Implications

The Bank of Canada's pause doesn't signify a definitive end to interest rate adjustments. Several scenarios remain possible.

Further Rate Hikes

If inflation remains stubbornly high or core inflation shows signs of reacceleration, the Bank of Canada may resume interest rate hikes. Such a move would likely lead to higher borrowing costs for consumers and businesses, potentially slowing economic growth further.

- Inflation persistence: A resurgence in inflation, particularly in core inflation, could trigger further rate hikes.

- Monetary policy tightening: Further increases would represent a continuation of the Bank of Canada’s monetary policy tightening strategy.

- Impact on borrowing: Increased interest rates will make mortgages, loans, and other forms of credit more expensive.

Maintaining the Pause

The Bank may maintain the current interest rate if inflation continues to decline at a satisfactory pace and economic growth remains stable. This pause would provide time to assess the full impact of previous rate increases.

- Inflation control: Continued deceleration of inflation towards the Bank of Canada’s target of 2% is essential for maintaining the pause.

- Economic stability: Stable economic growth without inflationary pressure would support a prolonged pause.

- Data-driven approach: The Bank will likely monitor key economic indicators before deciding on further action.

Potential Rate Cuts

If the economy weakens significantly, or if inflation falls below the Bank of Canada's target, rate cuts become a possibility. This would represent a stimulative monetary policy intended to boost economic activity.

- Economic downturn: A substantial economic downturn could prompt the Bank of Canada to reduce interest rates to stimulate the economy.

- Stimulative monetary policy: Rate cuts would aim to lower borrowing costs and encourage investment and spending.

- Impact on investment: Lower interest rates can make borrowing cheaper, potentially stimulating investment and economic growth.

How the Bank of Canada's Pause Affects You

The Bank of Canada's actions directly impact various aspects of your personal finances.

Impact on Mortgages and Loans

The pause in interest rate hikes offers some relief to those with existing mortgages and loans, preventing further increases in their monthly payments. However, prospective borrowers might still face relatively high borrowing costs compared to previous years.

- Mortgage rates: Existing mortgage holders will see no immediate increase in their payments, while new borrowers may still face high rates.

- Personal loans: Similar to mortgages, interest rates on personal loans will remain at the current relatively high levels for now.

- Borrowing costs: While the pause provides temporary relief, borrowing costs remain elevated compared to pre-pandemic levels.

Impact on Savings and Investments

The pause might affect savings rates and investment returns. Lower interest rates (in a future scenario) generally lead to lower returns on savings accounts but can potentially boost investment returns in certain asset classes.

- Savings rates: Savings account interest rates are likely to remain somewhat stable in the short term.

- Investment returns: The impact on investment returns is complex and depends on various factors and market conditions.

- Financial planning: The uncertain economic landscape necessitates careful financial planning and diversification of investments.

Conclusion

The Bank of Canada's decision to pause interest rate hikes is a complex response to a dynamic economic landscape. Understanding the interplay of inflation, economic growth, and global uncertainty is crucial for navigating your personal finances. Whether you're considering a mortgage, planning for retirement, or managing your investments, staying informed about the Bank of Canada's actions is vital. Continue to monitor the Bank of Canada's announcements and expert analyses to effectively navigate the evolving economic landscape. Learn more about the implications of the Bank of Canada's pause by [link to related resource].

Featured Posts

-

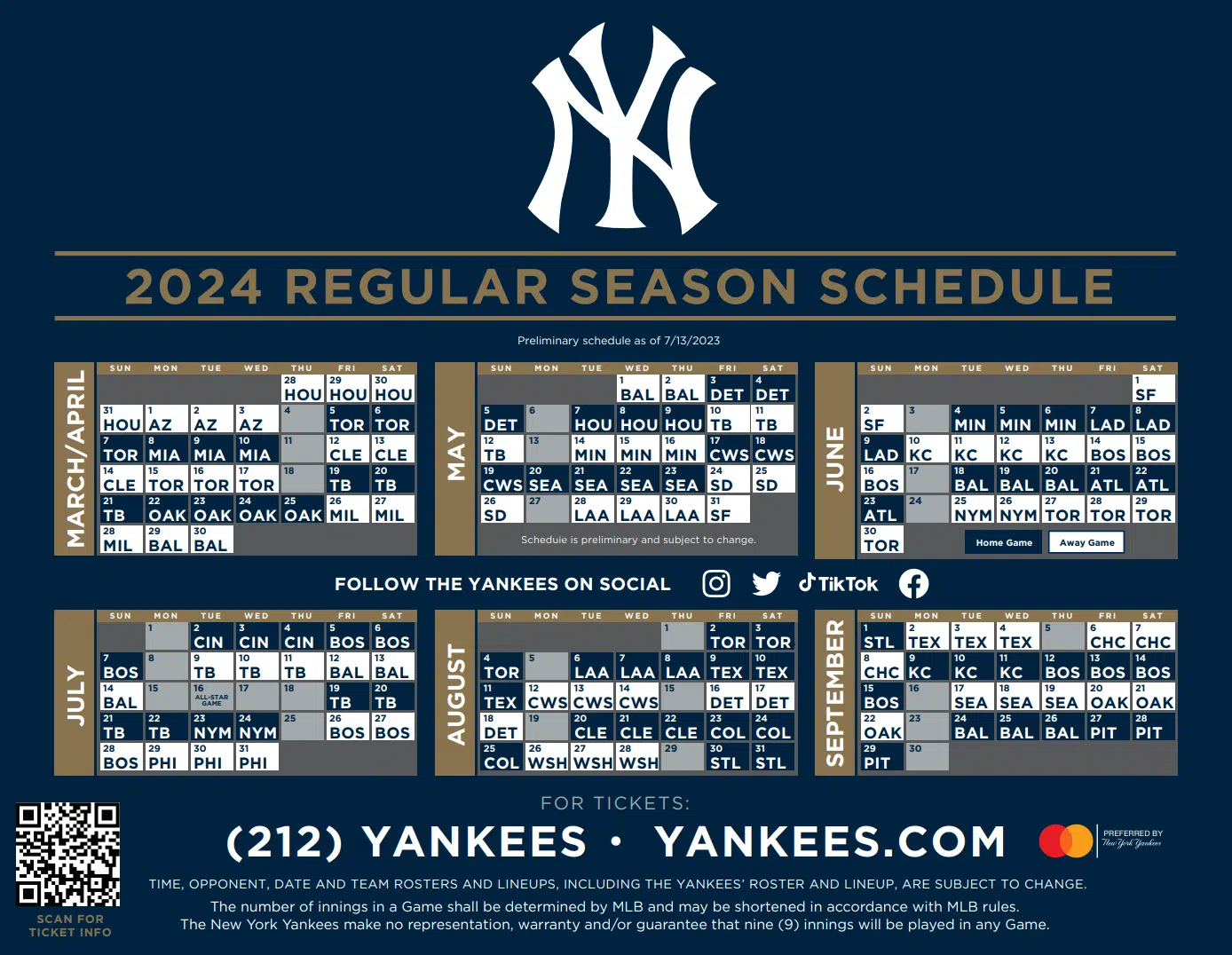

Yankees Opening Day Win A Winning Formula Revealed

Apr 23, 2025

Yankees Opening Day Win A Winning Formula Revealed

Apr 23, 2025 -

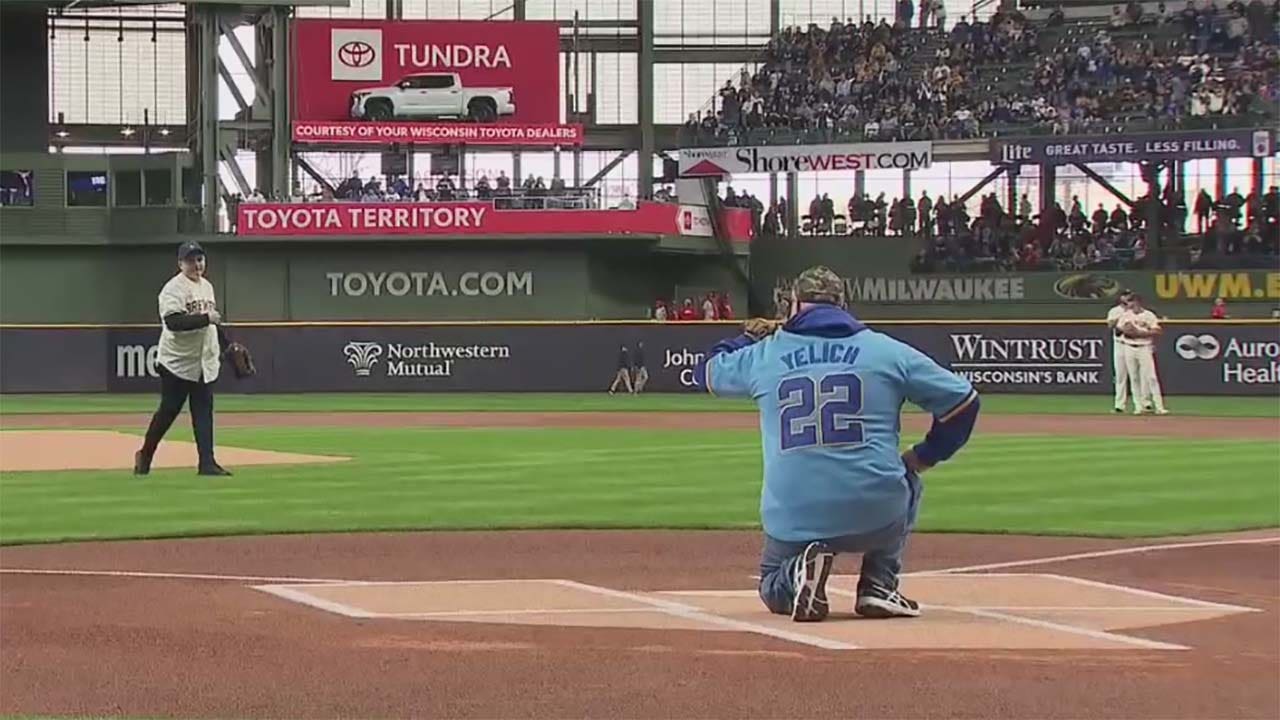

3 1 Win For Athletics Key Moments Against Brewers

Apr 23, 2025

3 1 Win For Athletics Key Moments Against Brewers

Apr 23, 2025 -

The Blue Origin Debacle A Deeper Dive Than Katy Perrys Controversies

Apr 23, 2025

The Blue Origin Debacle A Deeper Dive Than Katy Perrys Controversies

Apr 23, 2025 -

Record Setting 9 Home Runs Yankees Dominate In 2025 Season Opener

Apr 23, 2025

Record Setting 9 Home Runs Yankees Dominate In 2025 Season Opener

Apr 23, 2025 -

Royals Crush Brewers 11 1 In Home Opener

Apr 23, 2025

Royals Crush Brewers 11 1 In Home Opener

Apr 23, 2025

Latest Posts

-

Chinas Steel Production Cuts Impact On Iron Ore Prices And Global Supply

May 10, 2025

Chinas Steel Production Cuts Impact On Iron Ore Prices And Global Supply

May 10, 2025 -

Improving Company Performance Through Effective Middle Management

May 10, 2025

Improving Company Performance Through Effective Middle Management

May 10, 2025 -

The Complexities Of The Chinese Auto Market Case Study Bmw And Porsche

May 10, 2025

The Complexities Of The Chinese Auto Market Case Study Bmw And Porsche

May 10, 2025 -

A Data Driven Analysis Of New Business Hotspots Across The Country

May 10, 2025

A Data Driven Analysis Of New Business Hotspots Across The Country

May 10, 2025 -

Iron Ore Falls As China Curbs Steel Output Impact On Global Markets

May 10, 2025

Iron Ore Falls As China Curbs Steel Output Impact On Global Markets

May 10, 2025