Decoding Uber's April Performance: A Double-Digit Rally Explained

Table of Contents

Stronger-Than-Expected Q1 Earnings Report

Uber's April stock rally was largely fueled by its stronger-than-expected Q1 2024 earnings report. The results significantly exceeded analyst predictions, boosting investor confidence and driving up the stock price.

Revenue Growth Surpasses Projections

Uber's Q1 revenue figures showcased impressive year-over-year growth, surpassing even the most optimistic analyst forecasts. This robust performance stemmed from several key areas:

- Ride-sharing resurgence: Post-pandemic recovery continued to drive strong growth in ride-sharing revenue, indicating increased consumer confidence and travel.

- Delivery dominance: Uber Eats maintained its position as a leading food delivery platform, contributing significantly to overall revenue. Increased demand and strategic partnerships further fueled this segment's growth.

- Freight expansion: Uber Freight's expansion into new markets and its effective use of technology contributed to solid revenue growth within this segment.

The overall revenue increase compared to the previous year was a remarkable X%, significantly outpacing market expectations of Y%. This demonstrates a strong recovery and growth trajectory for the company.

Improved Profitability Metrics

Beyond revenue growth, Uber showcased significant improvements in its profitability metrics, particularly its adjusted EBITDA. This key indicator of operational performance demonstrates the company's increasing efficiency and cost-cutting measures.

- Adjusted EBITDA improvement: Uber's adjusted EBITDA reached Z dollars, exceeding expectations and marking a substantial improvement compared to previous quarters.

- Cost optimization strategies: Successful cost-cutting initiatives, including streamlined operations and increased operational efficiency, contributed significantly to the improved profitability.

- Pricing adjustments: Strategic pricing adjustments, carefully balanced to maintain market competitiveness while improving margins, also played a key role.

This positive trend towards profitability is a crucial factor that fueled investor confidence and contributed to the double-digit rally in April.

Positive Market Sentiment and Investor Confidence

The April rally wasn't solely driven by Uber's Q1 earnings; positive market sentiment and increased investor confidence played a vital role.

Impact of Positive Industry Trends

Several broader industry trends contributed to the positive sentiment surrounding Uber:

- Post-pandemic recovery: The ongoing global economic recovery, coupled with increased consumer spending, positively impacted the ride-sharing and delivery sectors.

- Increased travel: A rise in leisure and business travel further boosted Uber's ride-sharing revenue.

- Growing delivery demand: The continued growth of the online food delivery market created favorable conditions for Uber Eats' expansion and profitability.

These positive market trends created a fertile ground for Uber's strong performance and bolstered investor confidence.

Successful Implementation of Strategic Initiatives

Uber's successful implementation of several strategic initiatives also contributed to the April rally.

- Targeted marketing campaigns: Effective marketing campaigns successfully increased brand awareness and user engagement across different segments.

- Technological advancements: Continuous improvements in Uber's technology, including enhanced user interfaces and improved logistical efficiency, helped optimize operations and enhance the customer experience.

- Strategic partnerships: Strategic partnerships with businesses and organizations strengthened Uber's market presence and expanded its reach.

These initiatives demonstrated Uber's proactive approach to innovation and market expansion, further solidifying investor confidence.

Analyzing the Stock Market Reaction and Future Outlook

Uber's stock price exhibited significant volatility throughout April, mirroring the market's reaction to the Q1 earnings report and subsequent analysis.

Stock Price Volatility and Analyst Predictions

The initial reaction to the earnings report was a sharp increase in the stock price, followed by some consolidation. Analyst predictions varied, with some forecasting further growth while others expressed caution.

- Stock price fluctuations: A chart illustrating the stock price movements throughout April would visually depict the volatility and overall positive trend.

- Analyst price targets: A range of analyst price targets reflected differing opinions on Uber's future prospects.

- Market sentiment shifts: Changes in market sentiment, driven by various economic factors and news events, also contributed to the stock price fluctuations.

Understanding these shifts is key to interpreting the market's reaction.

Potential Risks and Challenges

Despite the positive April performance, several risks and challenges could impact Uber's future performance:

- Intense competition: Competition from other ride-sharing and delivery services remains intense, requiring continuous innovation and adaptation.

- Regulatory hurdles: Ongoing regulatory changes and potential new regulations could pose challenges to Uber's operations.

- Economic uncertainty: Global economic uncertainty and inflationary pressures could negatively impact consumer spending and demand.

These factors need careful consideration when assessing Uber's long-term outlook.

Conclusion

Uber's April performance, highlighted by a substantial double-digit rally, resulted from a combination of strong Q1 earnings, positive market sentiment, and successful strategic initiatives. While challenges remain, the company's improved profitability and growth trajectory suggest a positive outlook. Understanding this "double-digit rally" requires a detailed analysis of Uber's financial performance and market dynamics. To stay updated on Uber's performance and future trends, continue following our analysis of Uber's performance and other market insights. Keep track of Uber's progress and further developments by regularly checking back for updates on their financial reports and market trends. Decoding Uber's future performance will require ongoing analysis of their strategic moves.

Featured Posts

-

Are Downtown Las Vegas Resort Fees Worth It A Cost Analysis

May 18, 2025

Are Downtown Las Vegas Resort Fees Worth It A Cost Analysis

May 18, 2025 -

9 11 Netflix Docuseries Captures Mans Terrifying Realization He Was On Fire

May 18, 2025

9 11 Netflix Docuseries Captures Mans Terrifying Realization He Was On Fire

May 18, 2025 -

Bowen Yang Lands A New Role A Blend Of Heart And Humor

May 18, 2025

Bowen Yang Lands A New Role A Blend Of Heart And Humor

May 18, 2025 -

The Enduring Legacy Of Emily Warren Roebling And The Brooklyn Bridge

May 18, 2025

The Enduring Legacy Of Emily Warren Roebling And The Brooklyn Bridge

May 18, 2025 -

Damiano David Maneskin Funny Little Fears Tracce Collaborazioni E Data Di Uscita Dell Album

May 18, 2025

Damiano David Maneskin Funny Little Fears Tracce Collaborazioni E Data Di Uscita Dell Album

May 18, 2025

Latest Posts

-

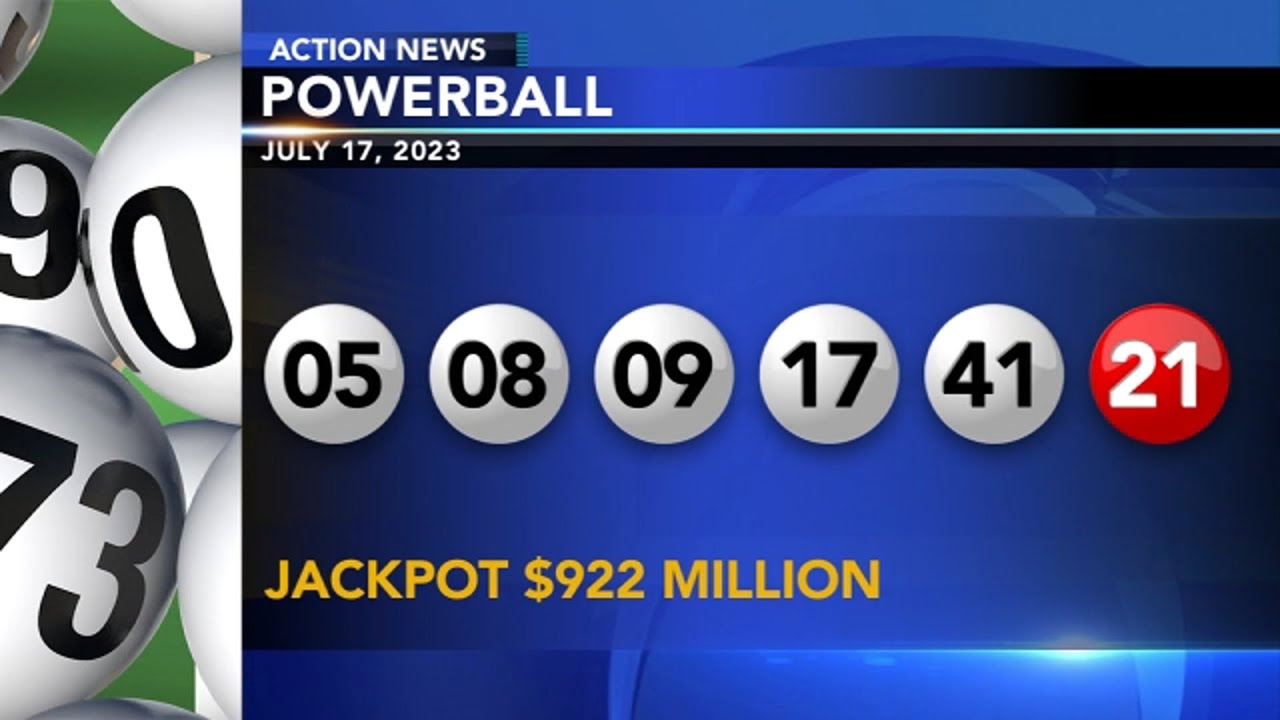

Daily Lotto Draw Results Tuesday 29th April 2025

May 18, 2025

Daily Lotto Draw Results Tuesday 29th April 2025

May 18, 2025 -

Find The Daily Lotto Results For Tuesday 29 April 2025

May 18, 2025

Find The Daily Lotto Results For Tuesday 29 April 2025

May 18, 2025 -

Tuesday 29 April 2025 Daily Lotto Results

May 18, 2025

Tuesday 29 April 2025 Daily Lotto Results

May 18, 2025 -

Daily Lotto Results Tuesday 29 April 2025 Check Winning Numbers

May 18, 2025

Daily Lotto Results Tuesday 29 April 2025 Check Winning Numbers

May 18, 2025 -

View The Daily Lotto Results For Friday April 25 2025

May 18, 2025

View The Daily Lotto Results For Friday April 25 2025

May 18, 2025