Delaying ECB Rate Cuts: Economists Issue Warning

Table of Contents

The Persistent Threat of Inflation

The primary concern driving economists' warnings is the persistent threat of inflation. While headline inflation may be showing signs of easing in some areas, a closer look reveals a more worrying picture.

Core Inflation Remains Stubbornly High

Despite headline inflation easing slightly, core inflation – which excludes volatile food and energy prices – remains stubbornly high across much of the Eurozone. This indicates that underlying inflationary pressures persist and are not simply a result of temporary shocks.

- Sticky wage growth: Strong wage growth, driven partly by labor shortages and increased bargaining power for workers, contributes significantly to persistent core inflation.

- Supply chain disruptions: Though easing, lingering supply chain disruptions continue to impact prices, particularly in certain sectors.

- Strong consumer demand: Robust consumer demand, fueled by pent-up savings and a relatively strong labor market in some areas, continues to fuel inflationary pressures.

Risks of Inflation Becoming Entrenched

The ECB's primary fear is that high inflation could become ingrained in the economy, leading to a wage-price spiral. This scenario, where rising prices lead to higher wages, which in turn further fuel price increases, could make inflation extremely difficult to control in the long term. This necessitates a more cautious approach to rate cuts.

- Inflation expectations: The ECB closely monitors inflation expectations – what consumers and businesses believe future inflation will be. If these expectations become entrenched at high levels, it becomes a self-fulfilling prophecy.

- Entrenched inflation and aggressive monetary policy: Tackling entrenched inflation typically requires more aggressive and prolonged monetary policy tightening, potentially causing deeper economic pain.

- Wage-price spiral: The risk of a wage-price spiral necessitates careful management of wage growth and price pressures to prevent a more serious inflationary crisis.

The Looming Recessionary Threat

The second major concern revolves around the looming threat of a deeper recession caused by the prolonged period of high interest rates.

High Interest Rates Squeeze Businesses and Consumers

Prolonged high interest rates significantly increase borrowing costs for businesses and consumers, leading to a contraction in investment and spending. This dampening effect can trigger a significant slowdown in economic growth and even a recession.

- Declining investment: Businesses are postponing or canceling investments in new projects due to higher borrowing costs, impacting long-term economic growth.

- Weakening consumer spending: Increased borrowing costs for mortgages, loans, and credit cards are reducing consumer spending, affecting vital sectors like retail and hospitality.

- Falling business confidence: Uncertainty around future economic conditions and rising interest rates are causing a fall in business confidence, further stifling investment and growth.

The Fragility of the Eurozone Economy

The Eurozone economy is already facing numerous headwinds, including the ongoing energy crisis, geopolitical uncertainties, and varying levels of economic strength across member states. Delaying ECB rate cuts could exacerbate these existing vulnerabilities and lead to a more severe and prolonged economic downturn.

- Asymmetric shocks: Different countries within the Eurozone experience economic shocks differently, with some nations more susceptible than others to rising interest rates.

- Energy crisis impact: The energy crisis has disproportionately impacted certain Eurozone economies, making them particularly vulnerable to further economic contraction.

- Geopolitical instability: Ongoing geopolitical instability adds a layer of uncertainty, making economic forecasting difficult and further complicating policy decisions.

Alternative Policy Options and Their Limitations

While raising interest rates is the ECB's primary tool, some economists suggest exploring alternative policy options to address inflation without exacerbating the recessionary risks.

Targeted Measures to Combat Inflation

Instead of relying solely on broad-based interest rate hikes, economists suggest exploring more targeted measures to combat specific inflationary pressures.

- Supply-side interventions: Government intervention to address supply chain bottlenecks and other supply-side constraints could help ease price pressures without the need for aggressive interest rate increases.

- Targeted fiscal policies: Fiscal policies focused on mitigating the impact of high prices on vulnerable groups could help maintain consumer demand without fueling inflation.

- Nuanced monetary policy: A more nuanced approach to monetary policy, considering the diverse economic situations of Eurozone member states, might be necessary.

The Difficulty of Balancing Inflation and Growth

The ECB faces the unenviable task of balancing the need to control inflation with the need to avoid a deep recession. There is no easy solution, and the optimal path forward is a subject of intense debate among economists.

- Premature easing risks: Premature easing of monetary policy risks reigniting inflation, potentially necessitating even more aggressive action later.

- Overly tight policy risks: Conversely, overly tight monetary policy risks causing a severe recession, with long-lasting negative consequences.

- Finding the right balance: The key lies in finding the right balance between inflation control and supporting economic growth – a delicate act with significant consequences for the entire Eurozone.

Conclusion

The debate surrounding the timing of ECB rate cuts highlights the complex and precarious situation facing the European Central Bank. Economists' warnings underscore the substantial risks associated with delaying interest rate reductions, particularly the potential for a deeper recession and the entrenchment of inflation. While controlling inflation remains paramount, policymakers must carefully weigh the broader economic implications of their actions. Finding the optimal balance between inflation control and supporting sustainable economic growth will be crucial for navigating the current economic turbulence. Staying informed on further developments regarding ECB rate cuts and the evolving economic outlook is vital for businesses and individuals alike. Understanding the nuances of European Central Bank monetary policy is key to effective economic planning. Keep a close watch on updates on interest rates and their impact on your financial future.

Featured Posts

-

Ais Limitations Why Learning Is A Misnomer And How To Use Ai Ethically

May 31, 2025

Ais Limitations Why Learning Is A Misnomer And How To Use Ai Ethically

May 31, 2025 -

Banksys Art Debuts In Dubai A World News Exclusive

May 31, 2025

Banksys Art Debuts In Dubai A World News Exclusive

May 31, 2025 -

Canadian Red Cross Manitoba Wildfire Evacuee Support How You Can Help

May 31, 2025

Canadian Red Cross Manitoba Wildfire Evacuee Support How You Can Help

May 31, 2025 -

The Versatile Uses Of Rosemary And Thyme From Garden To Plate

May 31, 2025

The Versatile Uses Of Rosemary And Thyme From Garden To Plate

May 31, 2025 -

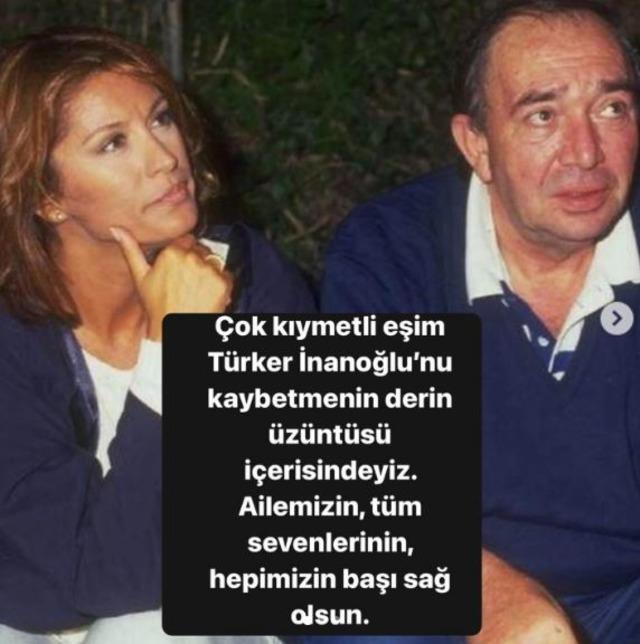

Tuerker Inanoglu Nu Kaybeden Guelsen Bubikoglu Nun Duygusal Anilari

May 31, 2025

Tuerker Inanoglu Nu Kaybeden Guelsen Bubikoglu Nun Duygusal Anilari

May 31, 2025