Deloitte's Economic Outlook: A Significant Slowdown Predicted For The US

Table of Contents

Key Factors Contributing to the Predicted Slowdown

Several interconnected factors contribute to Deloitte's prediction of a significant US economic slowdown. These include persistent inflation, aggressive interest rate hikes, weakening consumer spending, lingering supply chain issues, and geopolitical uncertainty. The interplay of these elements creates a complex and challenging economic environment.

-

Persistent Inflation: High inflation continues to erode purchasing power, forcing consumers to cut back on spending. This reduction in consumer spending directly impacts economic growth, as consumer spending accounts for a significant portion of the US GDP. The sustained elevated inflation rate is a key driver of the Deloitte economic forecast.

-

Aggressive Interest Rate Hikes: The Federal Reserve's aggressive interest rate hikes, aimed at curbing inflation, are having a chilling effect on economic activity. Higher interest rates increase borrowing costs for businesses and consumers, leading to reduced investment and decreased consumer spending. This is a crucial aspect of the Deloitte prediction for the US economic slowdown.

-

Weakening Consumer Spending: Faced with higher prices and increased borrowing costs, consumers are tightening their belts. This decrease in discretionary spending is impacting various sectors, from retail and consumer goods to hospitality and entertainment. The weakening consumer confidence further exacerbates this trend.

-

Lingering Supply Chain Issues: While supply chain disruptions have eased somewhat, ongoing challenges continue to impact production costs and timelines. This contributes to inflationary pressures and hampers economic growth. Supply chain inefficiencies remain a factor in the Deloitte economic outlook.

-

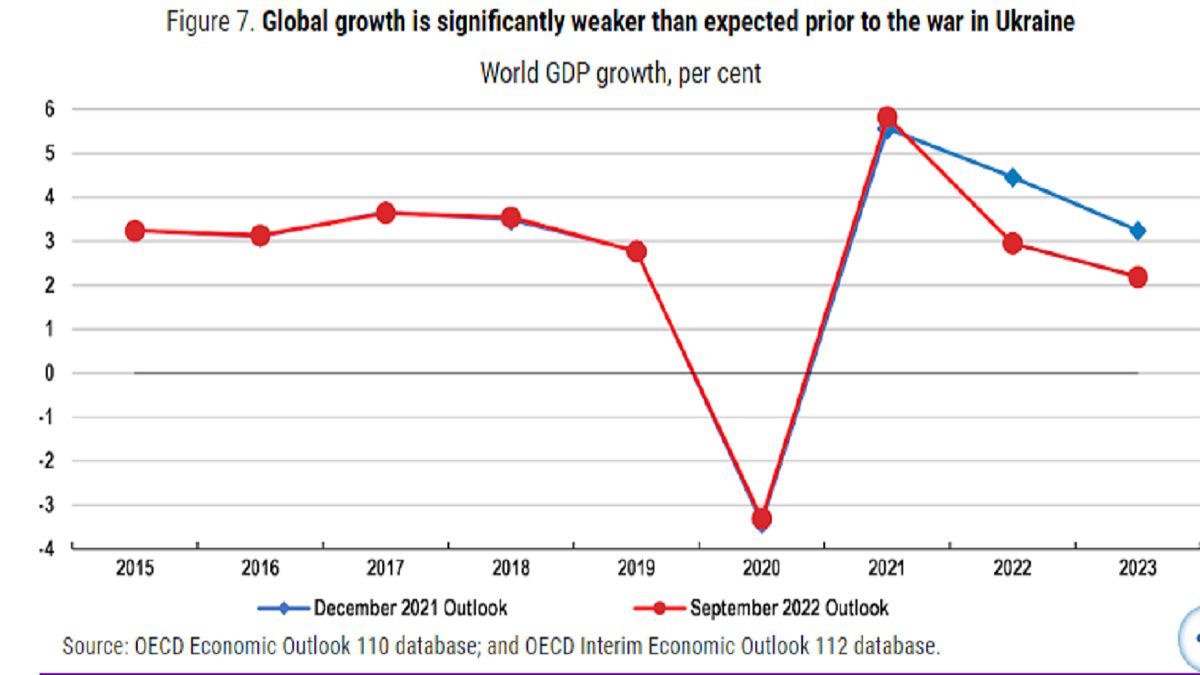

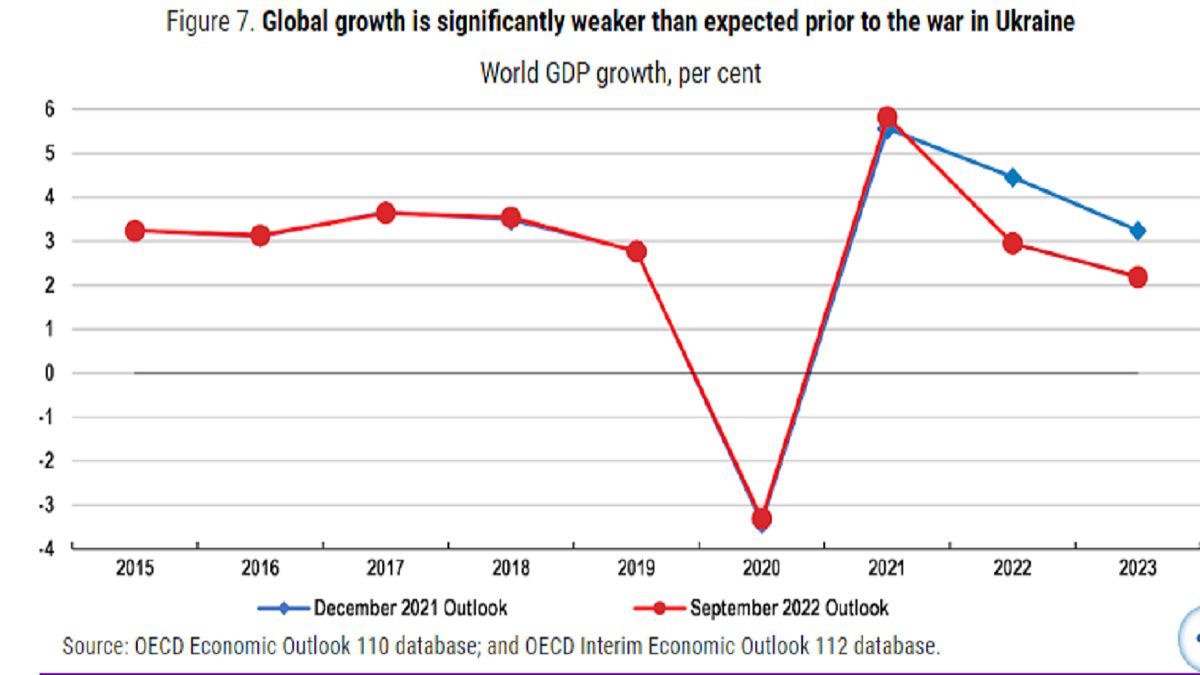

Geopolitical Uncertainty: The ongoing war in Ukraine and rising geopolitical tensions globally contribute to economic uncertainty. This uncertainty discourages investment and impacts global trade, further hindering US economic growth. This is a significant element of the broader economic analysis presented by Deloitte.

Projected Impact on Key Economic Indicators

Deloitte's report projects a substantial decline in key economic indicators. This slowdown will have far-reaching consequences for the US economy.

-

GDP Growth Forecast: Deloitte forecasts a significant decrease in GDP growth compared to previous years. While the precise figures vary depending on the specific report, the consensus points towards a notable slowdown. This decline in GDP growth is central to the Deloitte economic forecast.

-

Unemployment Rate Projections: The report anticipates a rise in the unemployment rate, although the extent of the increase remains uncertain. Specific sectors, such as those heavily reliant on consumer spending, are expected to be more vulnerable to job losses.

-

Inflation Rate Outlook: Deloitte's outlook suggests that while inflation might cool down eventually, it will likely remain elevated for a considerable period. The timeframe for a return to pre-inflationary levels remains uncertain.

-

Impact on Investment: Reduced consumer confidence and increased borrowing costs will likely lead to a decrease in both business and consumer investment. This will further dampen economic activity and prolong the slowdown.

-

Job Market Outlook: The predicted slowdown will inevitably impact the job market. Sectors heavily reliant on consumer spending are expected to be particularly vulnerable, leading to potential job losses across various industries.

Sector-Specific Impacts

The predicted economic slowdown will not affect all sectors equally. Deloitte's analysis highlights potential sector-specific impacts:

-

Real Estate Market: Higher interest rates will significantly impact the housing market, likely leading to a decrease in both home sales and construction activity.

-

Technology Sector: The tech sector, often sensitive to economic downturns, will likely experience reduced investment and potentially slower growth.

-

Manufacturing: The manufacturing sector will continue to face challenges due to supply chain disruptions and reduced consumer demand.

-

Retail and Consumer Goods: These sectors are especially vulnerable due to the anticipated decline in consumer spending.

Deloitte's Recommendations for Businesses

Deloitte offers crucial recommendations for businesses to navigate the challenging economic climate:

-

Strengthen Risk Management Strategies: Businesses should proactively identify and mitigate potential risks associated with the economic slowdown. This includes reviewing supply chains, reassessing pricing strategies, and diversifying revenue streams.

-

Adapt Financial Planning: Businesses need to adjust their financial plans to account for reduced growth and potentially lower revenues. This involves careful budgeting, cash flow management, and exploring cost-saving measures.

-

Foster Business Resilience: Building business resilience involves developing contingency plans, diversifying operations, and investing in technology to enhance efficiency and adaptability.

Conclusion

Deloitte's economic outlook presents a sobering picture of a significant US economic slowdown, driven by a confluence of interconnected factors. Understanding this Deloitte economic outlook and its projected impacts on various economic indicators and sectors is crucial for businesses and individuals to adapt and prepare. By implementing the recommended strategies, businesses can improve their chances of weathering the economic storm and emerging stronger. To gain a deeper understanding of Deloitte's [Year] US economic outlook and develop a robust strategic response, visit the Deloitte website and download the full report. Don't underestimate the implications of this US economic slowdown; proactive planning is essential for navigating this challenging period.

Featured Posts

-

Bencic Returns To Wta Final In Abu Dhabi

Apr 27, 2025

Bencic Returns To Wta Final In Abu Dhabi

Apr 27, 2025 -

Juliette Binoche Appointed Head Of Cannes Jury

Apr 27, 2025

Juliette Binoche Appointed Head Of Cannes Jury

Apr 27, 2025 -

How Many Horses Have Died At The Grand National A Pre 2025 Analysis

Apr 27, 2025

How Many Horses Have Died At The Grand National A Pre 2025 Analysis

Apr 27, 2025 -

Pne Group Two Wind Farms And Solar Plant Approved In Germany

Apr 27, 2025

Pne Group Two Wind Farms And Solar Plant Approved In Germany

Apr 27, 2025 -

Examining The Probability Of A Fifth Premier League Champions League Slot

Apr 27, 2025

Examining The Probability Of A Fifth Premier League Champions League Slot

Apr 27, 2025

Latest Posts

-

Alaska Adventure Ariana Biermanns Romantic Trip

Apr 27, 2025

Alaska Adventure Ariana Biermanns Romantic Trip

Apr 27, 2025 -

Ariana Biermanns Alaskan Trip A Couples Chill Adventure

Apr 27, 2025

Ariana Biermanns Alaskan Trip A Couples Chill Adventure

Apr 27, 2025 -

Ariana Biermann And Boyfriend Enjoy Alaskan Escape

Apr 27, 2025

Ariana Biermann And Boyfriend Enjoy Alaskan Escape

Apr 27, 2025 -

Ariana Biermanns Alaskan Adventure Romantic Getaway With Her Boyfriend

Apr 27, 2025

Ariana Biermanns Alaskan Adventure Romantic Getaway With Her Boyfriend

Apr 27, 2025 -

Buy Ariana Grande Lovenote Fragrance Set Online A Complete Guide To Pricing And Retailers

Apr 27, 2025

Buy Ariana Grande Lovenote Fragrance Set Online A Complete Guide To Pricing And Retailers

Apr 27, 2025