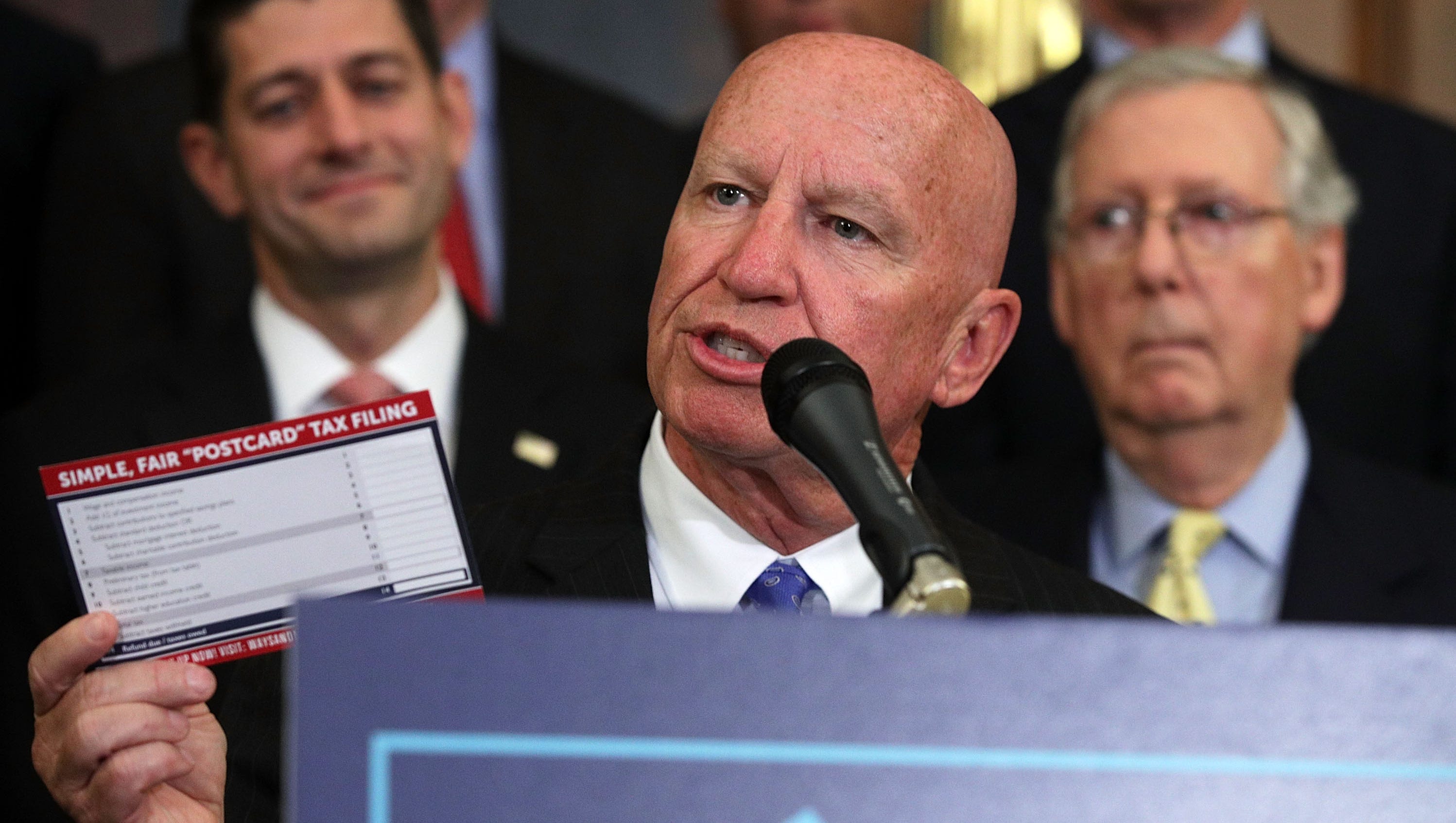

Detailed Look At The House GOP's Trump Tax Cut Plan

Table of Contents

The House GOP is actively pursuing a tax cut plan reminiscent of the Trump-era tax cuts. This detailed analysis explores the key features of this proposed legislation, examining its potential effects on the economy, individuals, and businesses. We'll dissect the plan's core provisions, weigh its projected benefits and drawbacks, and analyze its long-term implications for the national debt. Understanding this plan is crucial for anyone interested in fiscal policy and its impact on American taxpayers.

Core Provisions of the House GOP Tax Cut Plan

The proposed House GOP tax cut plan aims to significantly reduce tax burdens for individuals and corporations, echoing many aspects of the 2017 Tax Cuts and Jobs Act. Let's examine its key components:

Individual Income Tax Changes

The plan proposes several changes to individual income taxes, potentially impacting taxpayers across various income brackets.

- Tax Brackets and Rates: Specific details are still emerging, but the plan reportedly aims to lower tax rates across the board, potentially simplifying the tax code. This could lead to increased disposable income for many taxpayers.

- Standard Deduction and Itemized Deductions: Changes to the standard deduction and itemized deductions are likely. Increased standard deductions could simplify tax filing for many, while adjustments to itemized deductions might affect high-income earners differently.

- Child Tax Credit and Other Individual Tax Credits: Modifications to the Child Tax Credit and other individual tax credits are anticipated. These changes could significantly impact families with children and those eligible for other tax credits.

- Impact on Different Income Groups: The plan's effects on various income groups remain a subject of debate. While lower rates generally benefit all taxpayers, the degree of benefit will likely vary depending on income level and family structure. High-income earners may receive proportionately larger tax cuts, potentially exacerbating income inequality.

- High-income earners: Could see significant reductions in their overall tax liability.

- Middle class: May experience moderate tax relief, but the extent will depend on the specific provisions.

- Low-income families: The impact is less certain and largely hinges on adjustments to the Child Tax Credit and other targeted credits.

Corporate Tax Rate Reductions

A central tenet of the plan is a substantial reduction in the corporate income tax rate. This reduction aims to boost business investment and job creation.

- Proposed Reduction: The proposed rate reduction could bring the corporate tax rate closer to levels seen in other developed countries.

- Impact on Investment and Job Creation: Proponents argue the reduction will incentivize businesses to invest more in expansion, leading to increased job creation. Opponents, however, contend that the benefits may primarily accrue to shareholders and executives.

- Comparison with Current Rates and Historical Precedents: A comparison with the current corporate tax rate and those of previous administrations will help contextualize the proposed changes and assess their potential long-term effects.

- Increased Corporate Profits and Shareholder Returns: Reduced corporate tax rates are likely to translate into higher after-tax profits, potentially leading to increased shareholder returns through dividends and stock buybacks.

- Increased Inequality: Critics argue that such reductions could worsen income inequality, benefiting large corporations and wealthy shareholders disproportionately.

Tax Cuts for Small Businesses

The plan also includes provisions aimed at providing tax relief for small businesses and entrepreneurs.

- Specific Tax Breaks: This may include deductions, credits, or simplifications to the tax code designed to encourage growth and job creation among small businesses. Examples could include increased expensing of equipment or enhanced tax credits for research and development.

- Impact on Small Business Growth: The effectiveness of these tax cuts in stimulating small business growth will be a key factor in evaluating the overall success of the plan.

- Comparison to Previous Incentives: Comparing the proposed incentives with past small business tax initiatives provides historical context and allows for analysis of their relative effectiveness.

- Potential Unintended Consequences: Careful analysis is needed to identify potential unintended consequences, such as the creation of loopholes that favor certain businesses over others.

- Data-Driven Analysis: Reliable data and statistics will be crucial in assessing the impact of these measures on small business growth and job creation.

Economic Impact of the House GOP Tax Cut Plan

Analyzing the potential economic ramifications of the House GOP's proposed plan is crucial. This includes examining its impact on growth, the national debt, and income distribution.

Projected Economic Growth

The plan’s proponents argue that it will stimulate economic growth through increased investment and consumer spending.

- GDP Growth Projections: Analyzing projected GDP growth under the proposed plan requires sophisticated economic modeling and careful consideration of various factors.

- Independent Economic Forecasts: Comparing these projections with forecasts from independent economic institutions provides a more balanced perspective.

- Multiplier Effects: The potential multiplier effects on the economy need to be considered—how initial increases in investment and spending ripple throughout the economy.

- Data and Model Support: The claims regarding economic growth must be supported by robust economic models and reliable data.

Impact on the National Debt

A critical concern is the potential impact on the federal budget deficit and the national debt.

- Budget Deficit Analysis: A detailed analysis of the plan’s impact on the federal budget deficit is essential. This analysis requires projecting revenue changes and government spending.

- Long-Term Implications: The long-term implications for the national debt must be carefully evaluated.

- Alternative Fiscal Scenarios: Comparing projected debt under the proposed plan with projections under alternative fiscal scenarios provides context.

- Budget Data and Projections: The analysis must rely on reliable budget data and projections from reputable sources.

Distributional Effects of the Tax Cuts

Understanding how the tax cuts would affect different income groups is essential.

- Income Group Analysis: Analyzing the distributional effects requires detailed modeling of the tax code's impact on various income groups.

- Income Inequality: The potential for increased income inequality due to disproportionate benefits for high-income earners must be examined.

- Comparison to Previous Tax Cuts: Comparing the distributional effects of this plan to those of past tax cuts provides valuable insights.

- Data-Driven Claims: All claims about distributional effects must be rigorously supported by economic models and data.

Comparison with the Trump Tax Cuts

Comparing the proposed plan with the 2017 Trump tax cuts reveals similarities, differences, and potential lessons learned.

- Similarities and Differences: A detailed comparison will highlight the key similarities and differences in their provisions and intended effects.

- Effectiveness of Trump Tax Cuts: Evaluating the economic performance following the 2017 tax cuts provides insights into the potential effectiveness of the new plan.

- Lessons Learned: Analyzing what worked and what didn't work in the Trump tax cuts is crucial for informing the current proposal.

- Data and Policy Analysis: This comparison must rely on robust data and relevant policy analysis to support conclusions.

Conclusion

This analysis has explored the intricacies of the House GOP's proposed Trump-inspired tax cut plan, examining its core provisions, potential economic impact, and comparison with the 2017 tax cuts. We've analyzed its projected effects on various income groups, the national debt, and economic growth, highlighting both potential benefits and drawbacks.

Call to Action: Understanding the implications of the House GOP's Trump tax cut plan is critical for informed civic engagement. Stay informed about further developments and continue researching the House GOP’s Trump tax cut plan to make your voice heard on this vital issue affecting American taxpayers.

Featured Posts

-

2024 Protest Features Performance Of Hit The Road Drax

May 13, 2025

2024 Protest Features Performance Of Hit The Road Drax

May 13, 2025 -

Sabalenka Defeats Paolini Reaches Porsche Grand Prix Final

May 13, 2025

Sabalenka Defeats Paolini Reaches Porsche Grand Prix Final

May 13, 2025 -

Epic City Development Halted Gov Abbotts Intervention And Developer Response

May 13, 2025

Epic City Development Halted Gov Abbotts Intervention And Developer Response

May 13, 2025 -

Nba Draft 2025 Which Teams Have The Best Shot At Cooper Flagg

May 13, 2025

Nba Draft 2025 Which Teams Have The Best Shot At Cooper Flagg

May 13, 2025 -

Was Vittoria Ceretti Leonardo Di Caprios Secret Date At The Met Gala

May 13, 2025

Was Vittoria Ceretti Leonardo Di Caprios Secret Date At The Met Gala

May 13, 2025