Details Emerge: House Republicans Outline Trump's Tax Proposals

Table of Contents

Key Tax Cuts Proposed in Trump's Tax Proposals

Trump's tax proposals centered around significant reductions in both individual and corporate tax rates. Let's examine the specifics:

Individual Income Tax Rate Reductions

The proposed changes to individual income tax brackets aimed to simplify the tax system and lower the tax burden for many Americans. However, the impact varied significantly depending on income level.

- Proposed Bracket Changes: While the exact numbers varied across different versions of the proposals, they generally involved consolidating tax brackets and reducing the top marginal rates. For instance, some proposals suggested lowering the highest bracket from 37% to a lower percentage, potentially even as low as 33%.

- Impact on Different Income Levels: Middle-class families could have seen modest tax savings through increased standard deductions or reduced tax rates in lower brackets. High-income earners, however, stood to benefit disproportionately from the proposed reductions in the top marginal rates.

- Changes to Standard Deductions and Exemptions: Many proposals included increases in the standard deduction, potentially eliminating the need for itemized deductions for many taxpayers. This simplification could have made tax filing easier but may have also reduced the tax benefits for charitable contributions or other itemized deductions.

Corporate Tax Rate Cuts

A cornerstone of Trump's tax proposals was a dramatic reduction in the corporate tax rate.

- Proposed Corporate Tax Rate Reduction: The most significant proposal was to lower the corporate tax rate from 35% to 21%. Proponents argued this would boost economic growth by encouraging investment and job creation.

- Projected Economic Effects: Supporters predicted increased business investment, leading to higher wages and job growth. The "trickle-down" effect was frequently cited as a key benefit. However, critics questioned the efficacy of this approach.

- Drawbacks and Criticisms: Concerns were raised about the potential impact on the national debt and the fairness of providing significant tax breaks to large corporations. Some argued that the benefits primarily accrued to shareholders and did not translate into widespread wage increases or job creation.

Impact on Specific Demographics under Trump's Tax Proposals

The distributional effects of Trump's tax proposals were a major point of contention.

Impact on High-Income Earners

High-income earners would have experienced the most significant tax cuts under these proposals.

- Disproportionate Benefits: The reduction in the top marginal tax rates and potential capital gains tax cuts disproportionately benefited the wealthiest Americans.

- Income Inequality: Critics argued that these tax cuts exacerbated income inequality, further widening the gap between the rich and the poor. Data illustrating the concentration of wealth among the top 1% was often cited in these criticisms.

Impact on Middle-Class Families

The impact on middle-class families was more nuanced and varied depending on specific proposals.

- Potential Benefits and Drawbacks: While some proposals offered modest tax savings through increased standard deductions, others argued that the benefits were outweighed by other factors, like cuts to certain tax credits that disproportionately benefited middle and lower income families.

- Examples of Impact: Analyzing specific tax scenarios for a typical middle-class family, considering income, deductions, and potential tax credits, would be needed to determine a precise impact.

Impact on Low-Income Individuals

Low-income individuals may have experienced a mixed impact from Trump's tax proposals.

- Tax Credits and Deductions: The proposals' impact on low-income individuals depended heavily on whether existing tax credits and deductions were maintained or altered.

- Potential Consequences: The net effect could have been positive or negative, depending on the specific changes made and individual circumstances. Careful analysis would be required to determine this impact accurately.

Potential Economic Consequences of Trump's Tax Proposals

The long-term economic consequences of Trump's tax proposals were debated extensively.

Effects on the National Debt

The significant tax cuts were projected to increase the national debt substantially.

- Projected Increase in National Debt: Economic forecasts varied, but most predicted a considerable increase in the federal deficit and national debt over the long term as a result of these tax cuts.

- Long-Term Consequences: A growing national debt could lead to higher interest rates, reduced government spending in other areas, and potential long-term economic instability.

Effects on Economic Growth

The impact on economic growth was a central point of contention.

- Trickle-Down Economics: Proponents argued that tax cuts would stimulate investment and job creation through the "trickle-down" effect.

- Economic Models and Predictions: Various economic models produced differing predictions, with some showing modest growth and others predicting little or negative effects.

International Comparisons

Comparing the proposed tax cuts to those in other developed nations reveals potential impacts on global competitiveness.

- Global Competitiveness: The corporate tax rate reduction aimed to make the US more competitive internationally, attracting foreign investment and bolstering domestic businesses. However, the effectiveness of this approach was debated extensively.

Conclusion

The House Republicans' outline of Trump's tax proposals represents a significant attempt to reshape the US tax code. Understanding the intricacies of these proposals—from the individual and corporate tax rate reductions to their potential impact on different income groups and the national debt—is essential for informed civic engagement. The potential economic consequences are far-reaching and require careful consideration. To stay abreast of the latest developments and detailed analyses of Trump's tax proposals, continue to follow reputable news sources and economic analyses. Stay informed about the ongoing debate surrounding Trump's tax proposals and their potential impact on your financial future.

Featured Posts

-

Mdah Tam Krwz Ke Jwtwn Pr Chrh Gyy Haly Wwd Astar Ka Rdeml Wayrl

May 16, 2025

Mdah Tam Krwz Ke Jwtwn Pr Chrh Gyy Haly Wwd Astar Ka Rdeml Wayrl

May 16, 2025 -

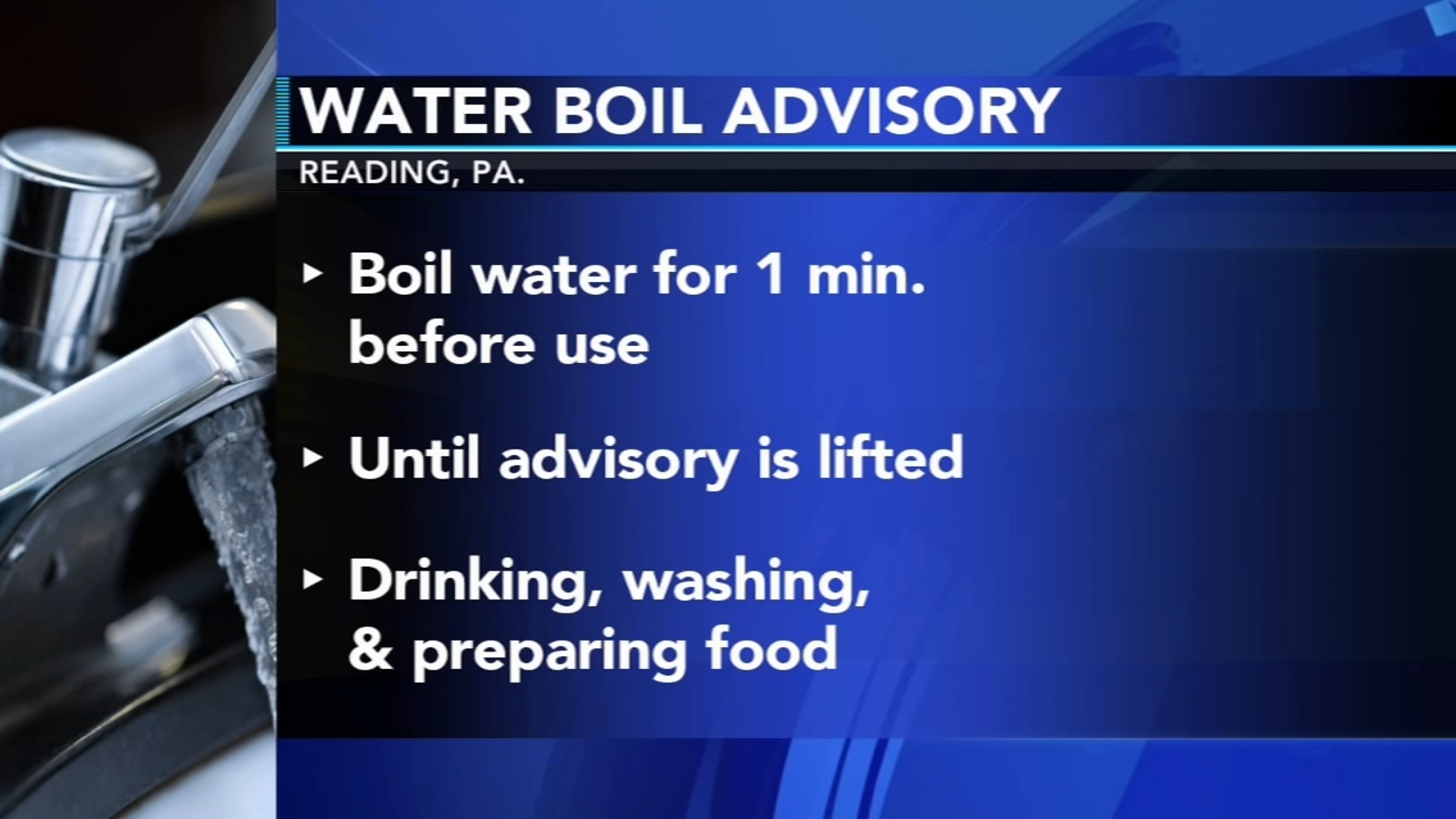

Pulaski Boil Water Advisory Extended To Saturday

May 16, 2025

Pulaski Boil Water Advisory Extended To Saturday

May 16, 2025 -

Quakes Epicenter Your San Jose Earthquakes Game Preview

May 16, 2025

Quakes Epicenter Your San Jose Earthquakes Game Preview

May 16, 2025 -

Foot Locker Signs Lease For New Global Headquarters In Florida

May 16, 2025

Foot Locker Signs Lease For New Global Headquarters In Florida

May 16, 2025 -

Cody Poteet Conquers Abs Challenge In Chicago Cubs Spring Training

May 16, 2025

Cody Poteet Conquers Abs Challenge In Chicago Cubs Spring Training

May 16, 2025