Deutsche Bank And FinaXai Partner On Tokenized Fund Servicing

Table of Contents

Revolutionizing Fund Administration with Blockchain Technology

Blockchain technology is revolutionizing fund administration, offering unprecedented levels of efficiency, security, and transparency. This partnership leverages blockchain's inherent strengths to create a superior tokenized fund servicing solution.

- Enhanced Security and Transparency: The immutable nature of the blockchain eliminates the risk of data manipulation and ensures complete transparency throughout the fund lifecycle. Every transaction is recorded and verifiable, fostering trust among all stakeholders.

- Significant Cost Reduction and Faster Processing: Automation through blockchain technology drastically reduces operational costs associated with traditional fund administration. Processing times are significantly shortened, leading to faster settlements and improved liquidity.

- Improved Auditability and Regulatory Compliance: The transparent and auditable nature of the blockchain simplifies compliance with regulatory requirements. This reduces the burden on fund managers and enhances investor confidence.

- Enhanced Investor Access and Reporting: Investors gain improved access to real-time information regarding their investments, fostering better decision-making and greater control. Reporting becomes more efficient and accurate.

The finaXai Platform and its Integration with Deutsche Bank's Infrastructure

finaXai's platform is at the heart of this innovative solution. Its core functionalities, specifically designed for tokenized fund servicing, integrate seamlessly with Deutsche Bank's robust and secure infrastructure.

- finaXai Platform Capabilities: The platform offers a comprehensive suite of tools for tokenization, issuance, and management of fund assets. It handles complex transactions with speed and accuracy.

- Seamless Integration: The integration leverages APIs for streamlined data exchange between finaXai's platform and Deutsche Bank's existing systems. This ensures smooth operation and minimizes disruption.

- Scalability and Security: The combined solution is built for scalability, capable of handling the increasing demands of a growing number of institutional investors and asset classes. Robust security measures are in place to protect sensitive data.

- API-Driven Efficiency: The use of APIs enables seamless data exchange and automation, further enhancing efficiency and reducing manual intervention.

Benefits for Institutional Investors and Asset Managers

This partnership offers numerous benefits to institutional investors and asset managers, significantly enhancing their fund management operations.

- Faster Settlement Times and Reduced Costs: The automated processes enabled by tokenized fund servicing result in significantly faster settlement times, reducing operational costs and freeing up capital.

- Improved Transparency and Auditability: The enhanced transparency offered by blockchain technology fosters trust and confidence amongst investors and regulators. Auditing becomes simpler and more efficient.

- Simplified Regulatory Compliance: The immutable record-keeping inherent in blockchain technology simplifies compliance with various regulatory requirements, reducing the administrative burden.

- Increased Efficiency and Reduced Administrative Burden: Automation streamlines many manual processes, freeing up staff to focus on strategic initiatives and enhancing overall efficiency.

Specific Use Cases of Tokenized Fund Servicing

Tokenized fund servicing finds applications across various asset classes, offering numerous benefits:

- Private Equity: Tokenization allows for fractional ownership of private equity investments, making them more accessible to a wider range of investors.

- Hedge Funds: Improved liquidity and transparency through tokenization enhance the appeal of hedge fund investments.

- Real Estate Funds: Tokenization facilitates fractional ownership of real estate assets, simplifying investment and improving liquidity.

- Other Asset Classes: The potential applications extend beyond these examples, offering opportunities for tokenizing various other asset classes and further enhancing market efficiency.

Conclusion

The partnership between Deutsche Bank and finaXai signifies a pivotal moment in the evolution of fund servicing. By leveraging the power of tokenization, this collaboration offers institutional investors and asset managers significant benefits, including increased efficiency, reduced costs, enhanced transparency, and improved regulatory compliance. The use of blockchain technology in tokenized fund servicing promises to reshape the landscape of the financial industry.

Learn more about how tokenized fund servicing can transform your fund management operations. Contact Deutsche Bank or finaXai today to explore the possibilities.

Featured Posts

-

Elon Musk Denies Fathering Amber Heards Twins A Timeline Of Events

May 30, 2025

Elon Musk Denies Fathering Amber Heards Twins A Timeline Of Events

May 30, 2025 -

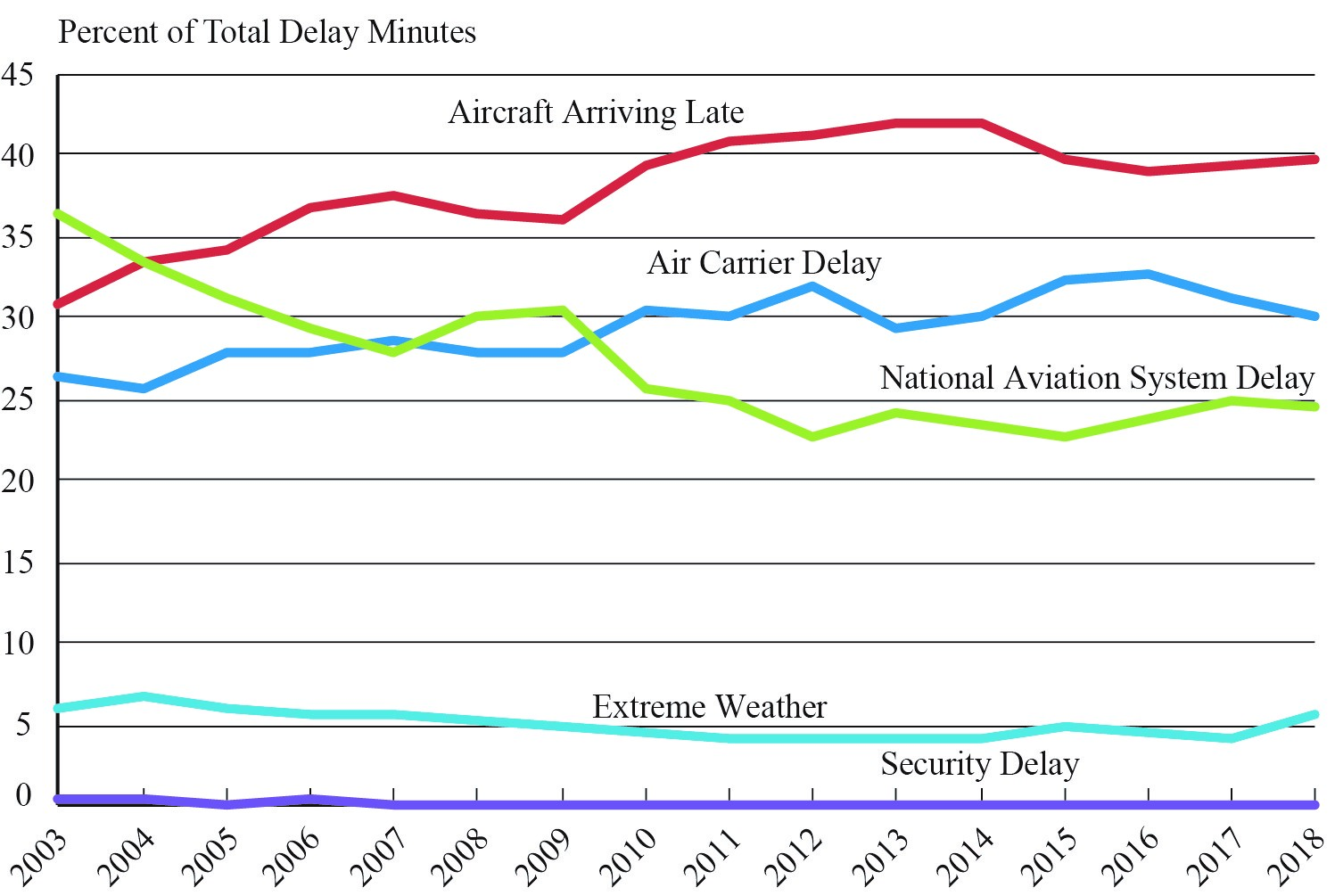

Understanding San Diego Airport Flight Delays Causes And Solutions

May 30, 2025

Understanding San Diego Airport Flight Delays Causes And Solutions

May 30, 2025 -

Whidbey Clam Research Citizen Scientists Contribute To Discovery

May 30, 2025

Whidbey Clam Research Citizen Scientists Contribute To Discovery

May 30, 2025 -

Impact Of Social Media Censorship Us Announces Visa Changes

May 30, 2025

Impact Of Social Media Censorship Us Announces Visa Changes

May 30, 2025 -

Us Imposes Visa Curbs Over Social Media Censorship Concerns

May 30, 2025

Us Imposes Visa Curbs Over Social Media Censorship Concerns

May 30, 2025